Hi, I'm Sam Morton, and I believe trading can be simple and accessible for anyone willing to learn. Ticks & Trades is all about sharing what I’ve learned to become a highly effective E-mini S&P 500 futures trader – so you can do the same. My philosophy is Simplified Trading for Everyone. Trading can be a great way to earn extra income if you know what you’re doing, and it can even be fun.

A Journey to Mastery – No Shortcuts, Just Discipline

If you’re looking for magical “get rich quick” shortcuts, you won’t find them here. The Ticks & Trades approach to trading the E-mini futures is about transformation, not tricks. The trading world is full of hype about secret formulas and overnight success, but chasing those fantasies usually leads to disappointment. I learned that the hard way. The only real secret is a solid process and the discipline to stick to it – taking the bad days with the good.

I know how it feels to struggle in the market. When I started out, I was just like many of you: a regular guy with a day job (and a family and a dog or two) trying to pull in some extra money by day trading. I had some early wins, but I also made every mistake in the book – I even nearly blew up two trading accounts when I first began. It took years of trial and error, education, and paying “tuition” to the school of hard knocks for me to finally develop a consistently successful trading strategy.

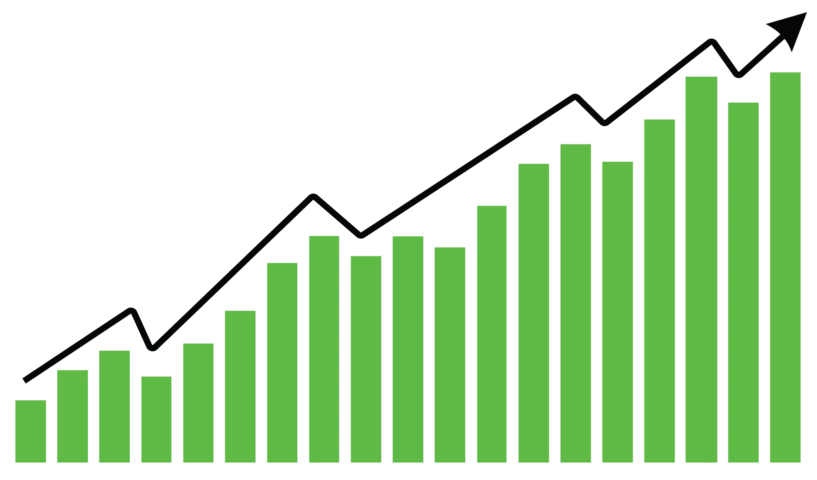

But once I established a repeatable, rules-based process that worked, trading became not only more profitable but actually enjoyable. I became a disciplined, confident trader who could make better decisions in real time because I understood why the market was moving and how to respond. That transformation – from struggling amateur to self-assured trader – is what I want for you as well.

And remember, learning to trade effectively isn’t just about the money – it’s about freedom. When you master a skill you can use in any market, you’re essentially buying back your time and gaining the freedom to live on your own terms. (The bonus is that pulling dollars out of the market can be pretty fun, too.)

Ticks & Trades exists to fast-track that transformation for you. I created this site to share the exact process that changed my trading life, so you don’t have to make the same costly mistakes I did. Consider it a roadmap to trading mastery – one that can save you years of frustration.

So, this is not a “set-and-forget” passive income scheme. My trading approach requires active engagement, especially during the first couple of hours of the regular market session each day. I’ll show you how to fit this strategy into your daily routine – even if you have a day job or other responsibilities – but you must be able to dedicate time during those key morning hours. If your 9-to-5 schedule doesn’t allow you to focus on the market for a while after the opening bell, then this may not be the right fit (unless you can carve out that time).

The good news is, by following a clear set of rules and a solid game plan, you won’t need to stare at charts all day. Do the work in those prime hours, execute the strategy, and then you can step away and focus on your other priorities. In short: you get out what you put in. This strategy can work alongside your life, but it isn’t hands-off – you have to show up when it counts.

Daily Levels + E‑mini Trading 101: Your Complete Trading System

To make your journey easier, I’ve put together a complete system that gives you everything you need to trade the E-mini with an edge. When you subscribe to the Daily Levels – Game Plan, you now get full access to my E‑mini Trading 101 course included at no additional cost (this course alone is a $299 value). Together, the Daily Levels and the course provide the what, why, and how of successful day trading:

- Daily Levels – Your Morning Game Plan (The What): Each trading day before the market opens, I publish the exact price levels of interest for the E-mini session. These are key support and resistance zones in the S&P (SPY) that I’ve identified using my proven methodology. Think of them as your roadmap for the day – highlighting where high-probability trade opportunities may arise. With these Daily Levels in hand, you’ll know what areas to focus on as the market moves, instead of guessing or chasing random trades.

- E‑mini Trading 101 Course (The Why and How): Understanding the context and execution is crucial. That’s why every Daily Levels subscription comes with full access to the comprehensive E‑mini Trading 101 online course. In this self-paced course, I teach you the foundational skills, market context, and specific rules behind the Ticks & Trades strategy. You’ll learn why those key levels matter – how to read charts, interpret what you’re seeing in real time, and identify the patterns that give you a true edge. More importantly, you’ll learn how to execute trades around those levels with discipline: when to enter, when to stay out, and how to manage risk like a pro. By the end of the course, you’ll have a firm grasp of my strategy and the confidence to apply it on your own.

Together, these two resources give you a complete trading game plan. Every morning, you’ll start your day with a clear “what to do” – a set of battle-tested levels to watch – and the knowledge of why those levels matter and how to trade them. It’s a one-two punch that takes much of the guesswork and emotion out of trading. Instead of reacting impulsively, you’ll be prepared to act decisively when the market reaches your pre-defined zones. In short, you get a proven system and the know-how to use it effectively.

I’ll never promise you overnight riches – what I offer is far more valuable: the chance to master a skill that can serve you for a lifetime. With the Daily Levels and E-mini 101 course, you’re not just getting trade alerts; you’re gaining insight into how the market works and how a successful trader thinks. The true value is in the transformation you’ll undergo: from hoping for lucky wins to executing a plan with confidence and consistency.

If you’re ready to break out of the boom-and-bust cycle and approach trading as a disciplined process, Ticks & Trades can help get you there. My own friends and family have seen the difference this strategy made in my life – in fact, they were the ones who encouraged me to offer an online course. I’ve traded this way for several years, staying consistently profitable and in control, and now I’m excited to share the same method with you.

Imagine starting each trading day knowing exactly what your game plan is, and finishing the day knowing you followed a strategy you trust. That’s what I want every subscriber to experience. No more second-guessing, no more emotional rollercoasters – just a clear path forward and continuous improvement in your trading.

Meet Sam - A Trader Who's Probably a Lot Like You

- I haven’t spent decades on a trading floor. In fact, I set foot on an actual trading floor only once, as a visitor at the Chicago Mercantile Exchange many years ago when meeting a trader friend for lunch.

- I struggled a lot in the beginning. I (almost) blew up two trading accounts early on by making emotional, impulsive trades. I know exactly how it feels to watch a trade go horribly wrong and wipe out a big chunk of your account.

- I turned things around by committing to a rules-based strategy and serious study. After those early failures, I took courses, read countless trading books, and gradually developed the strategy that became Ticks & Trades. Once I treated trading like a business – with a plan and strict rules – my results completely changed.

*(Interested in the full backstory of how I developed this strategy? Read on for “The Long Version” of my trading journey and the lessons I learned along the way.)

For those who love details, here’s how I learned the hard way and why I’m so confident in the Ticks & Trades strategy: