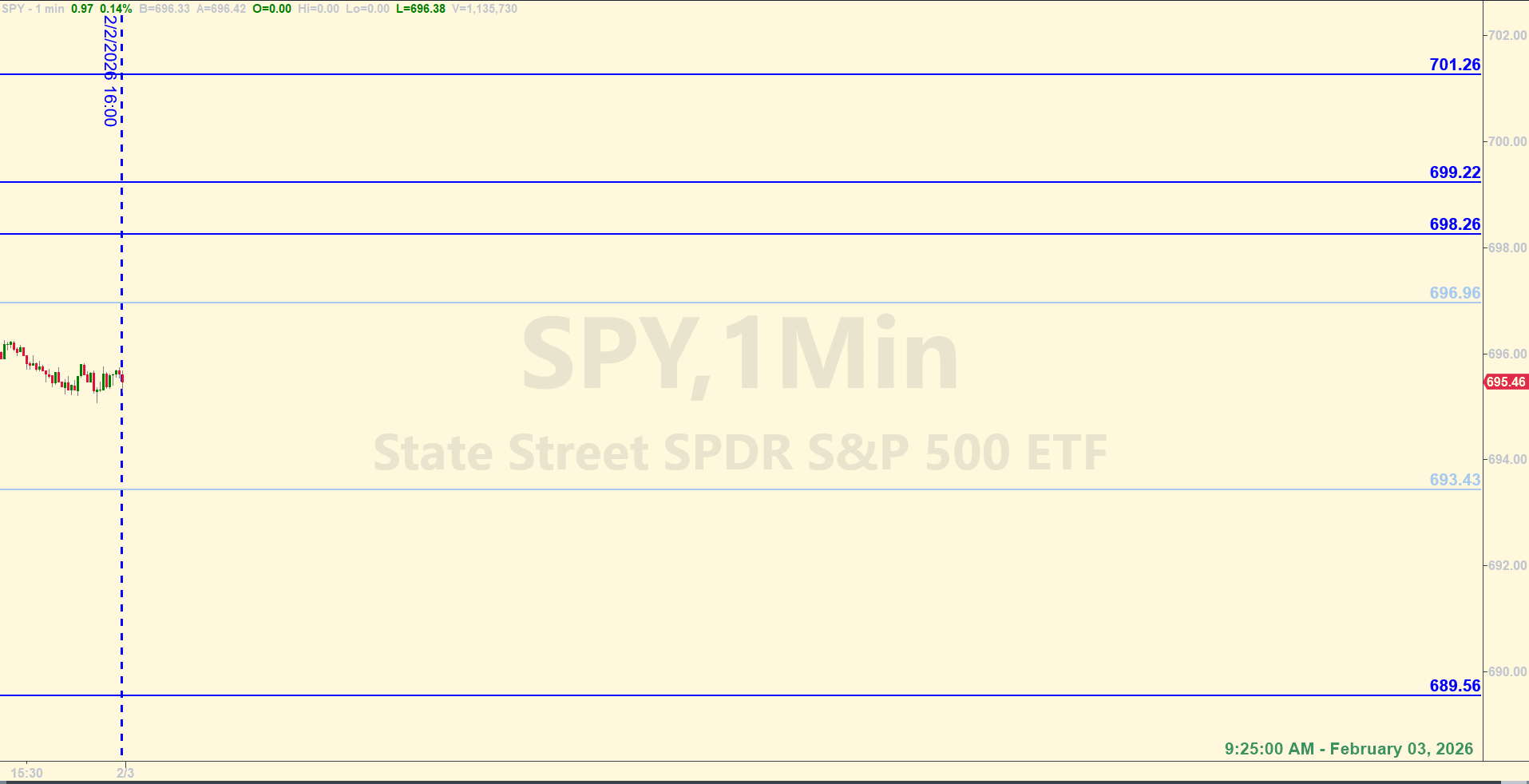

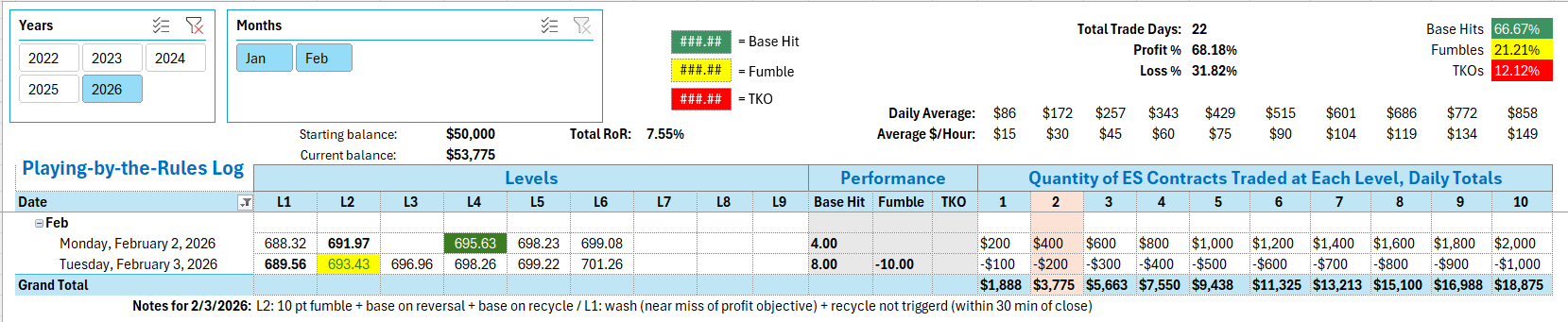

SPY Levels & Game PlanTuesday, February 3, 20269:25 am Eastern – The SPY is still targeting 700 and if the bulls can break above some important areas – including a longer-term trendline – then 700 is within range. The level at 696.96 is the bull axis. Staying above is good for the bulls. Getting a 2-hour

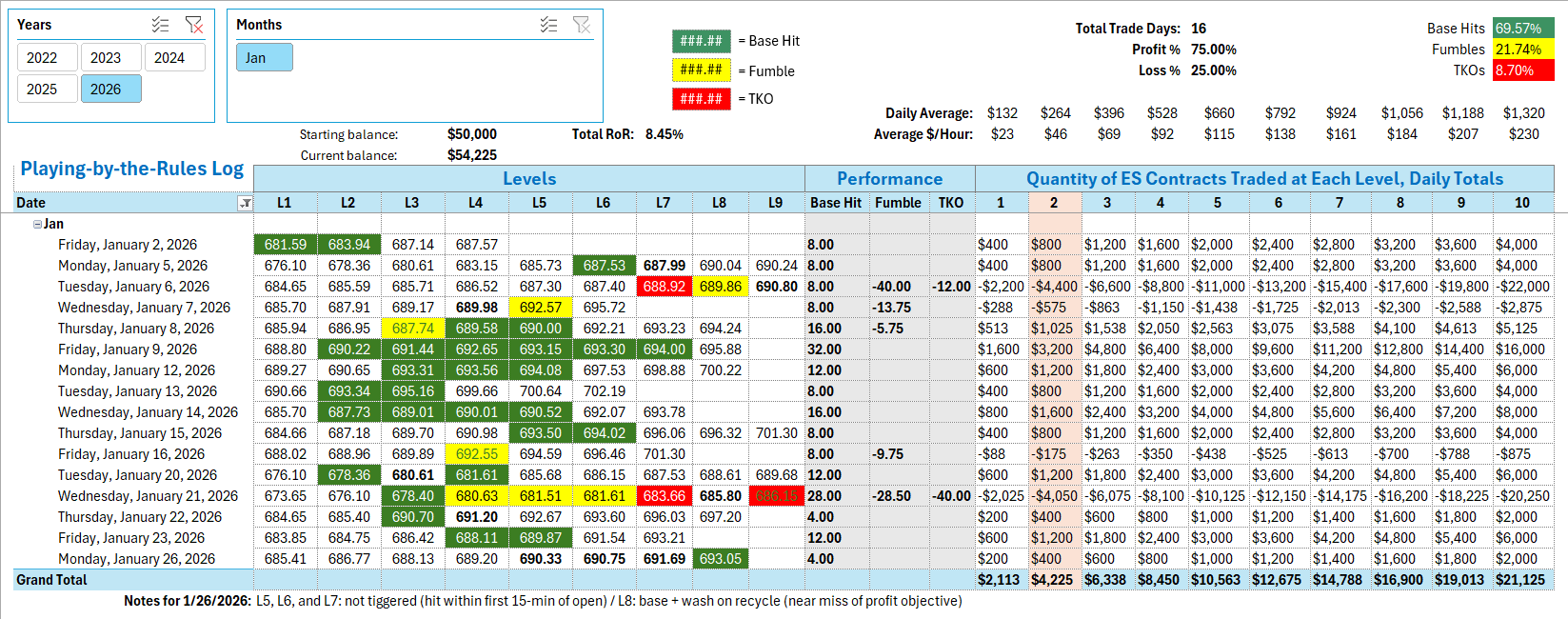

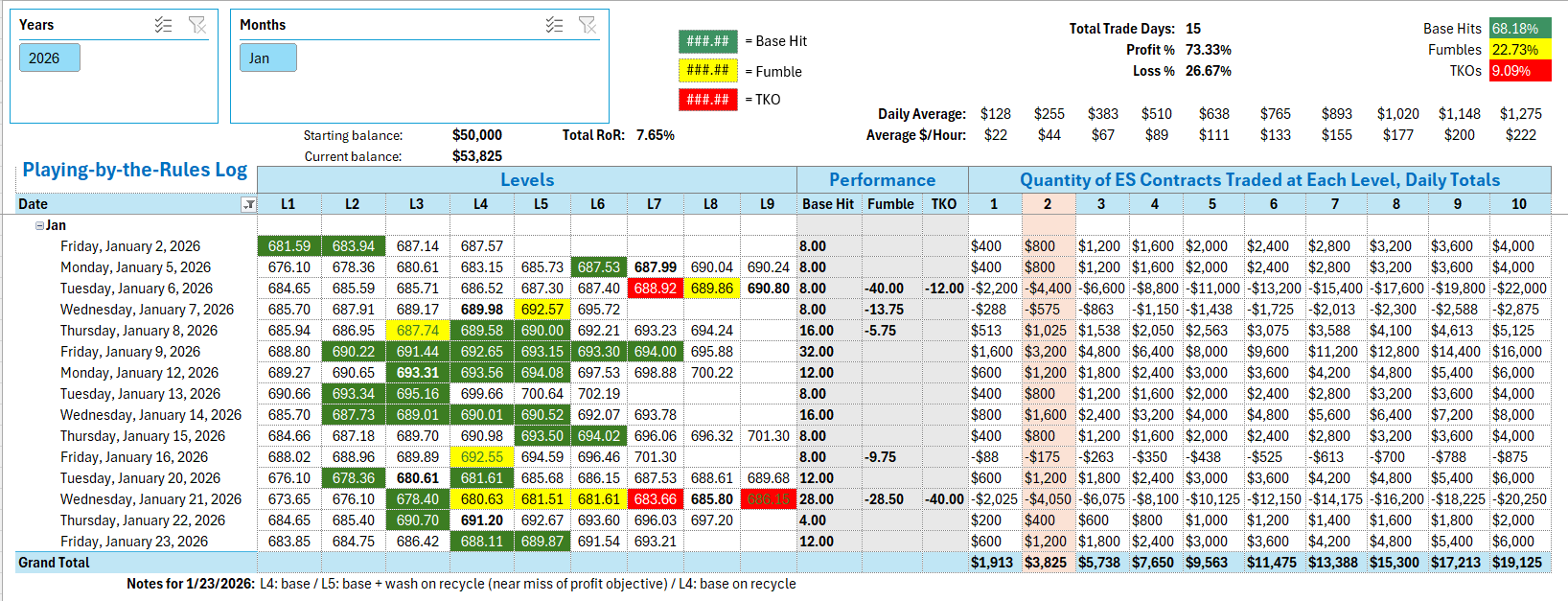

Browse the Daily Levels and Game Plans Market Recaps below. Each day's trading performance is dissected after the market closes. You'll be able to see exactly what subscribers to the Daily Levels received before the market opened that morning - and how the levels worked throughout the regular trading session. The previous 20 trading days are posted below. To see older Recaps, click on one post and you'll be able to navigate to legacy Recaps from the other page.

These Daily Recap posts start at November 4, 2025 and continue through to present day. To see the Daily Recaps from before November 4, 2025, visit the Ticks & Trades YouTube channel to see several years worth of daily data in video format:

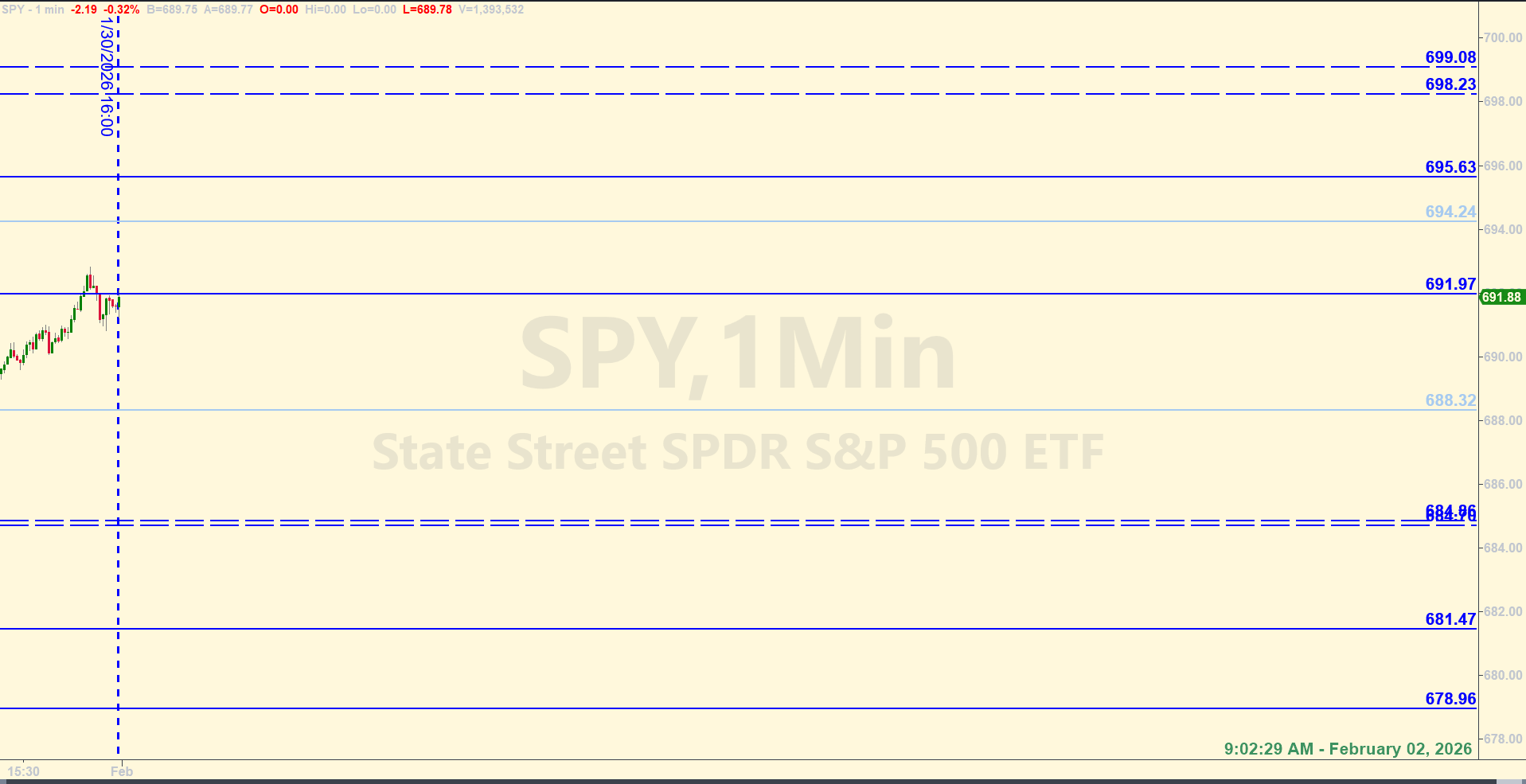

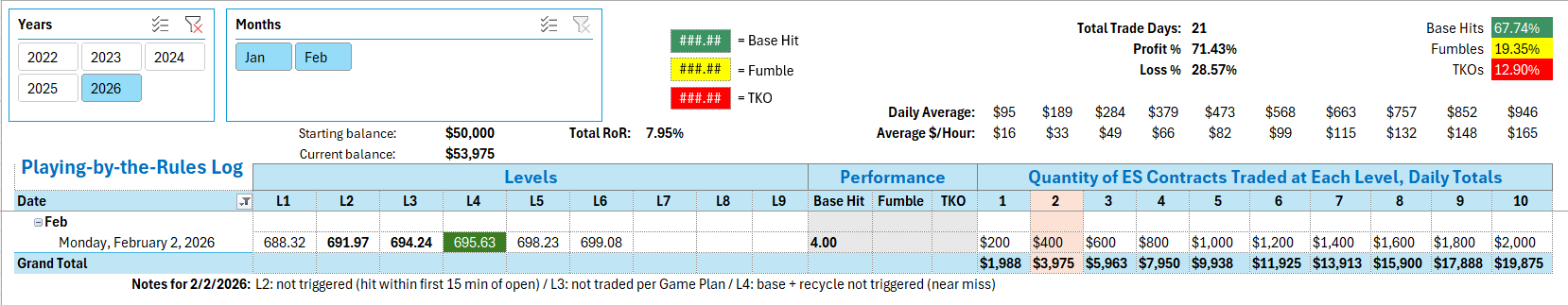

SPY Levels & Game PlanMonday, February 2, 20269:02 am Eastern – We’re into February now, and things could get interesting. In the big picture, starting with the monthly chart of the SPY, things are still bullish. Same with the weekly and daily charts. When we get down to the 4-hour charts and pretty much all

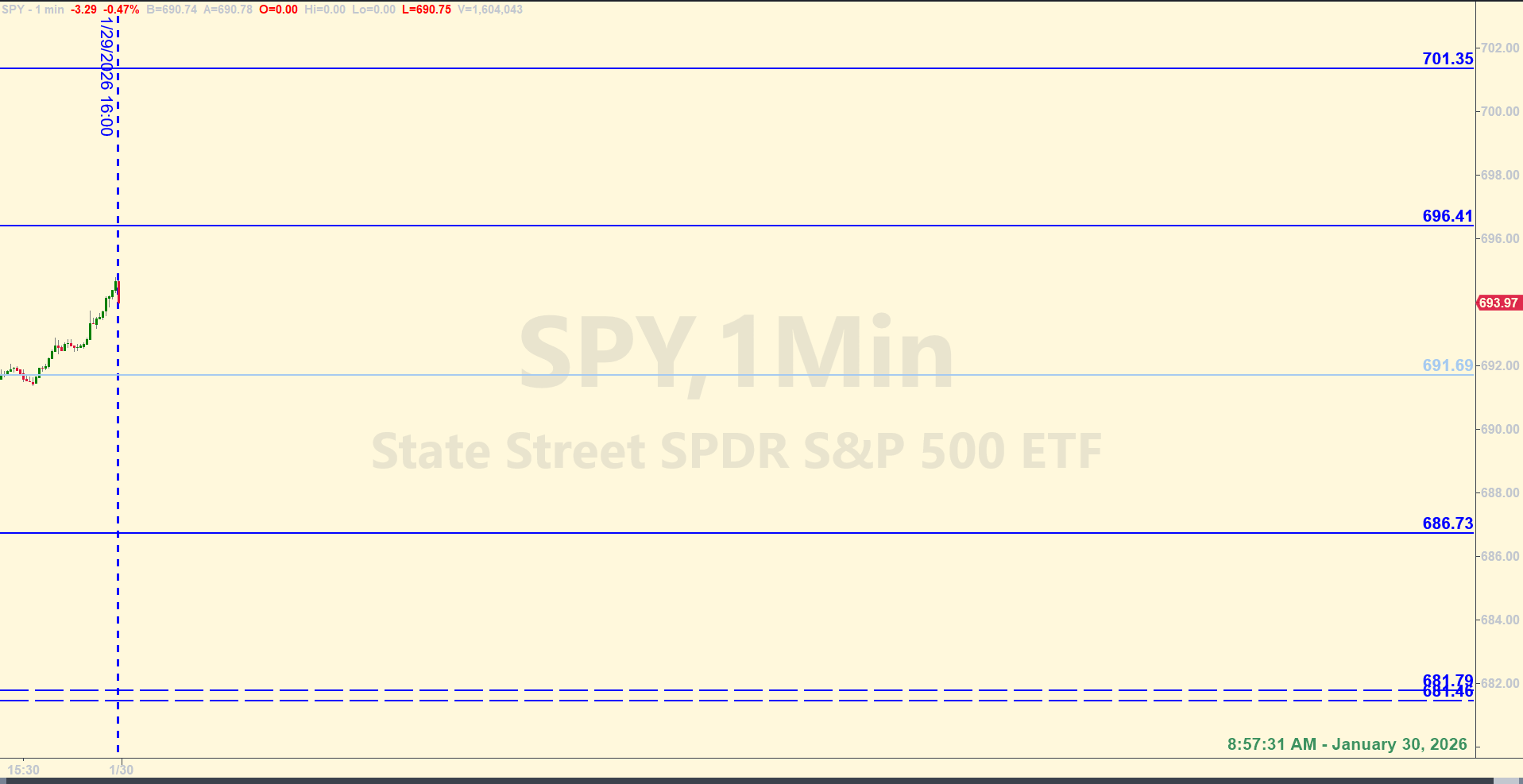

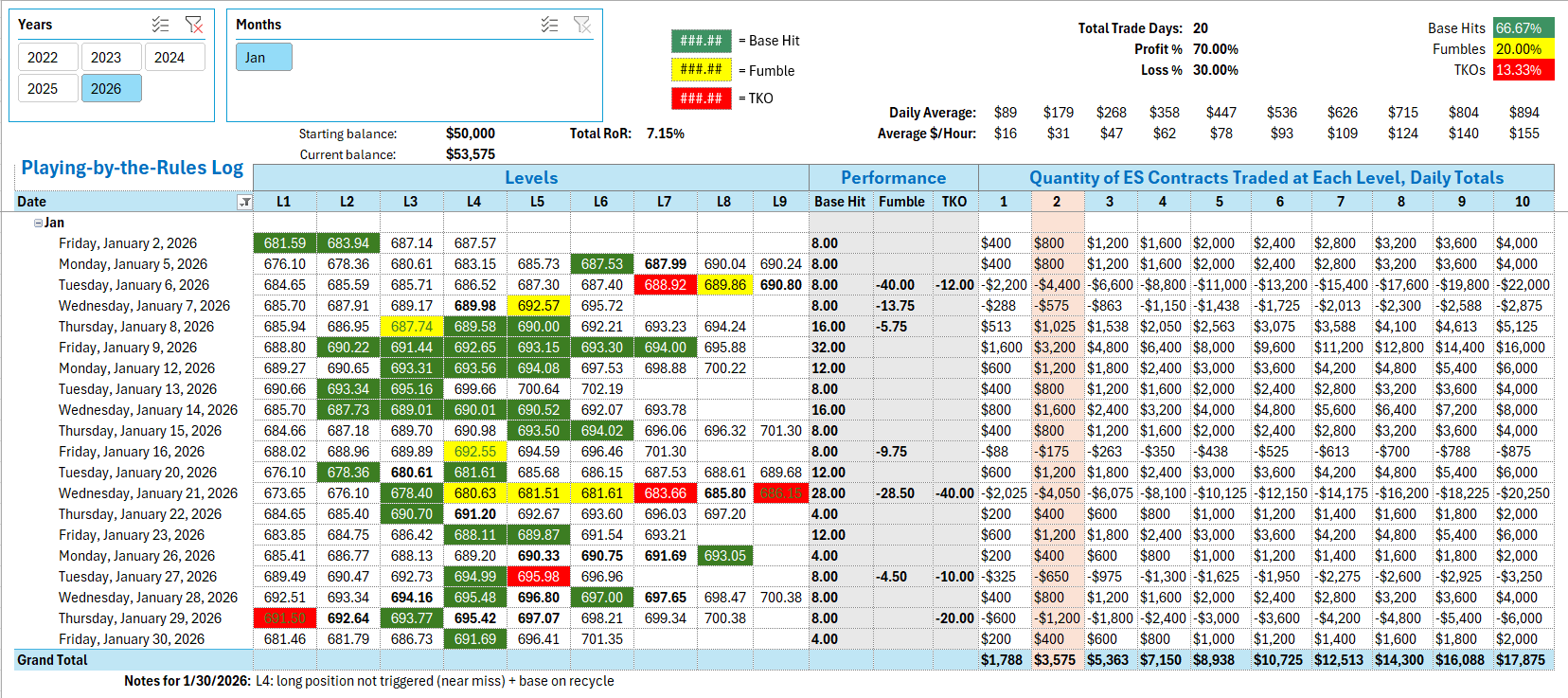

SPY Levels & Game PlanFriday, January 30, 2026 8:57 am Eastern – Big picture is that the SPY is still bullish. There’s nothing bearish about the monthly, weekly, or daily charts. Since today is the last trading day of January, it’s good to consider where price might close today. After yesterday’s whipsaw down and back

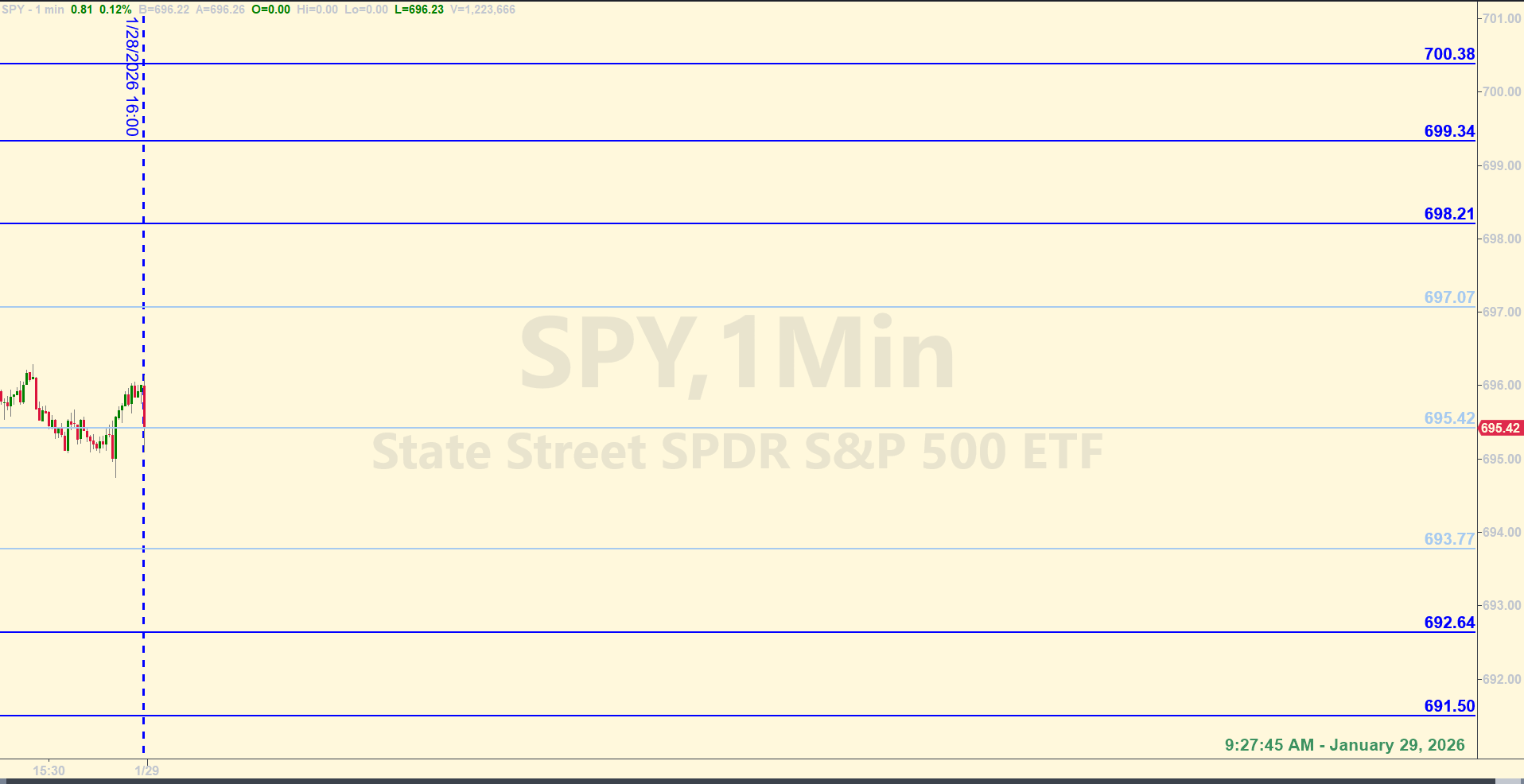

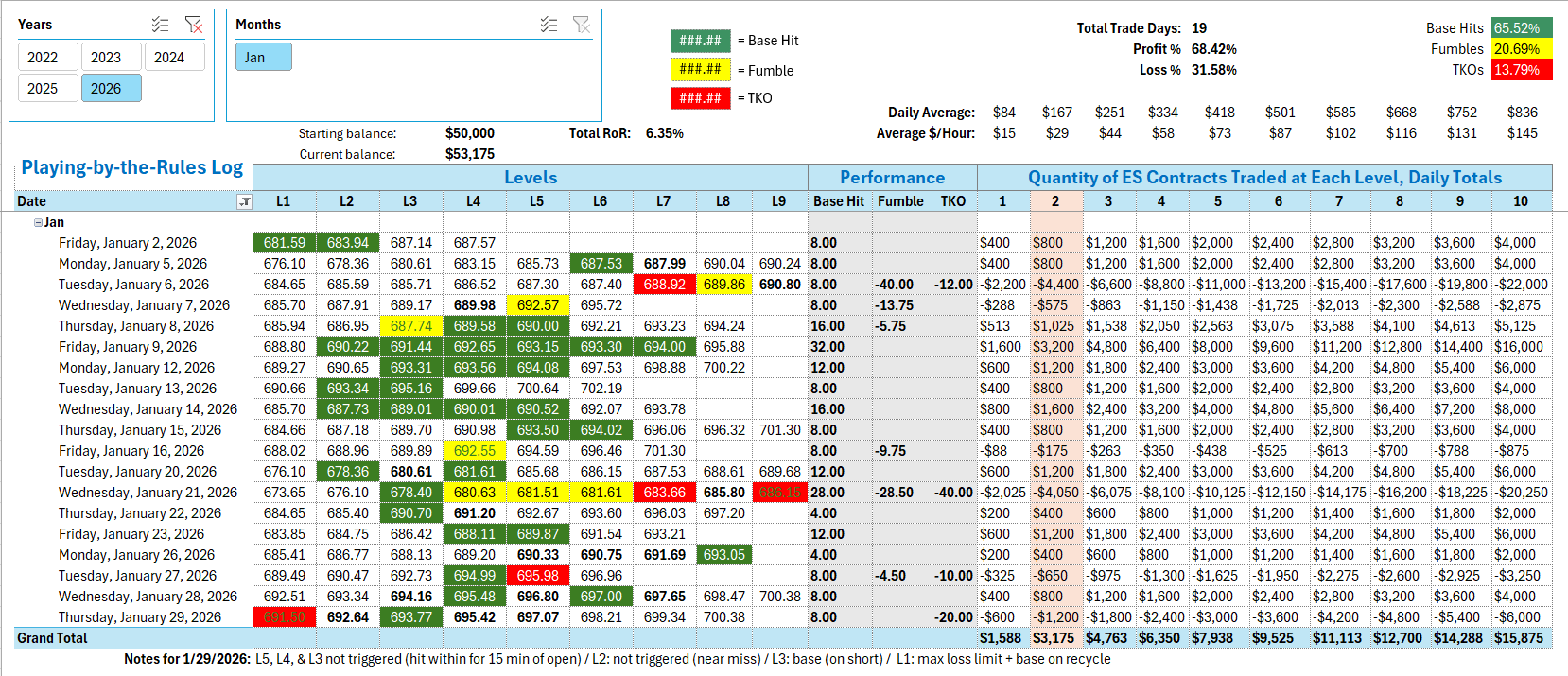

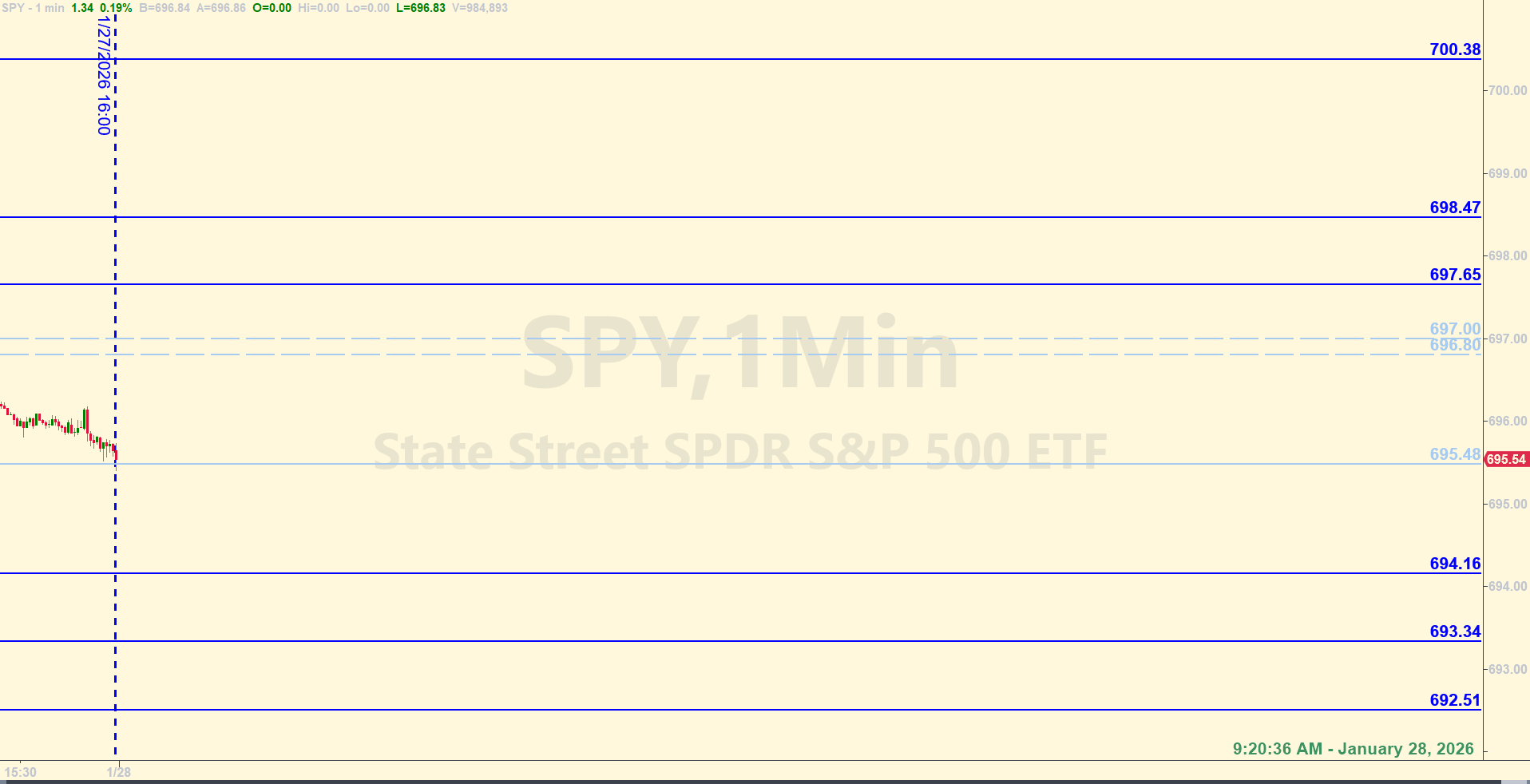

SPY Levels & Game PlanThursday, January 29, 2026 9:27 am Eastern – We got some movement after the Fed announcement yesterday. Overall though, price is in the same area. They found a new high yesterday, pulled back and closed the day slightly under Tuesday’s close. The close of yesterday was 695.42 and that is probably

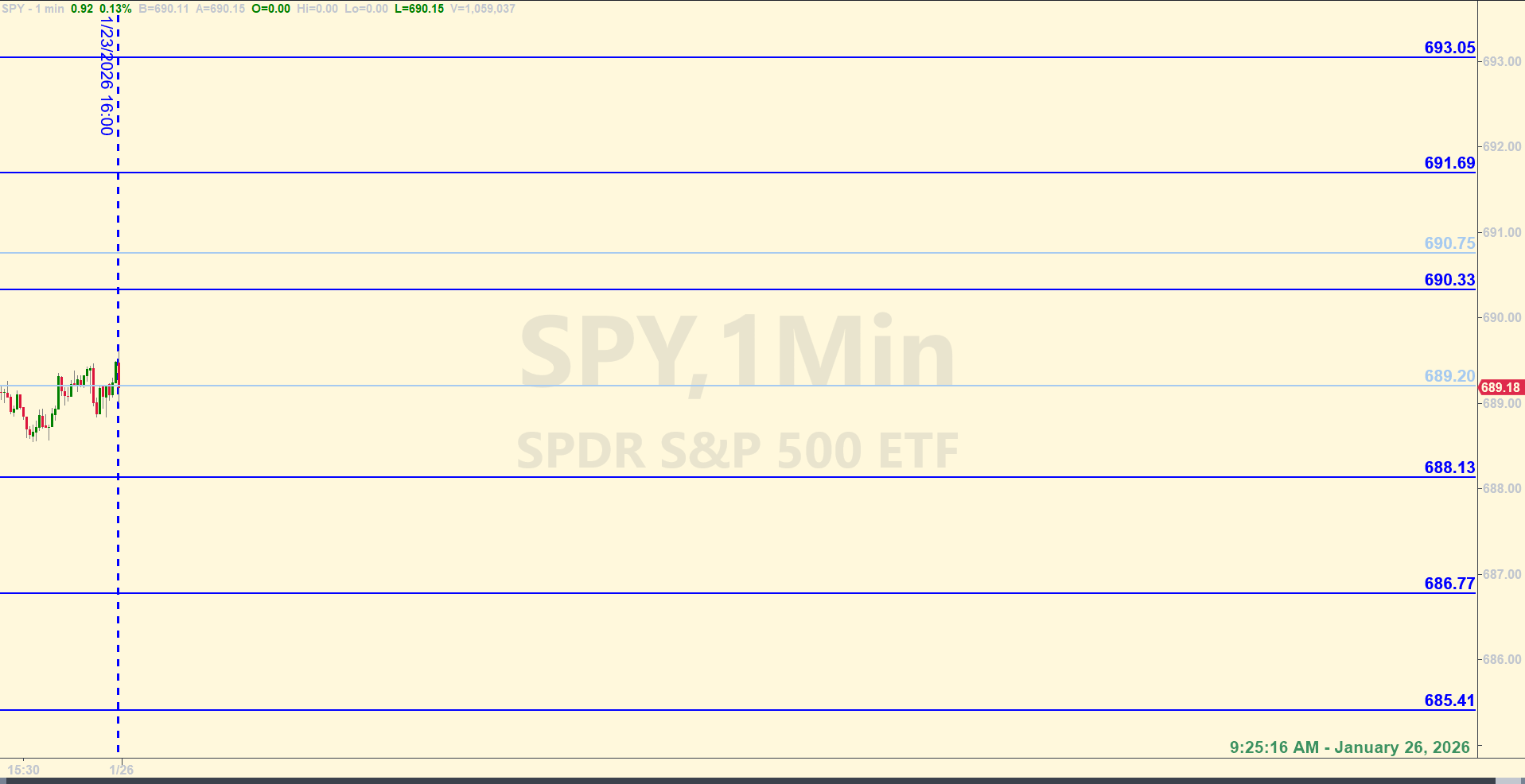

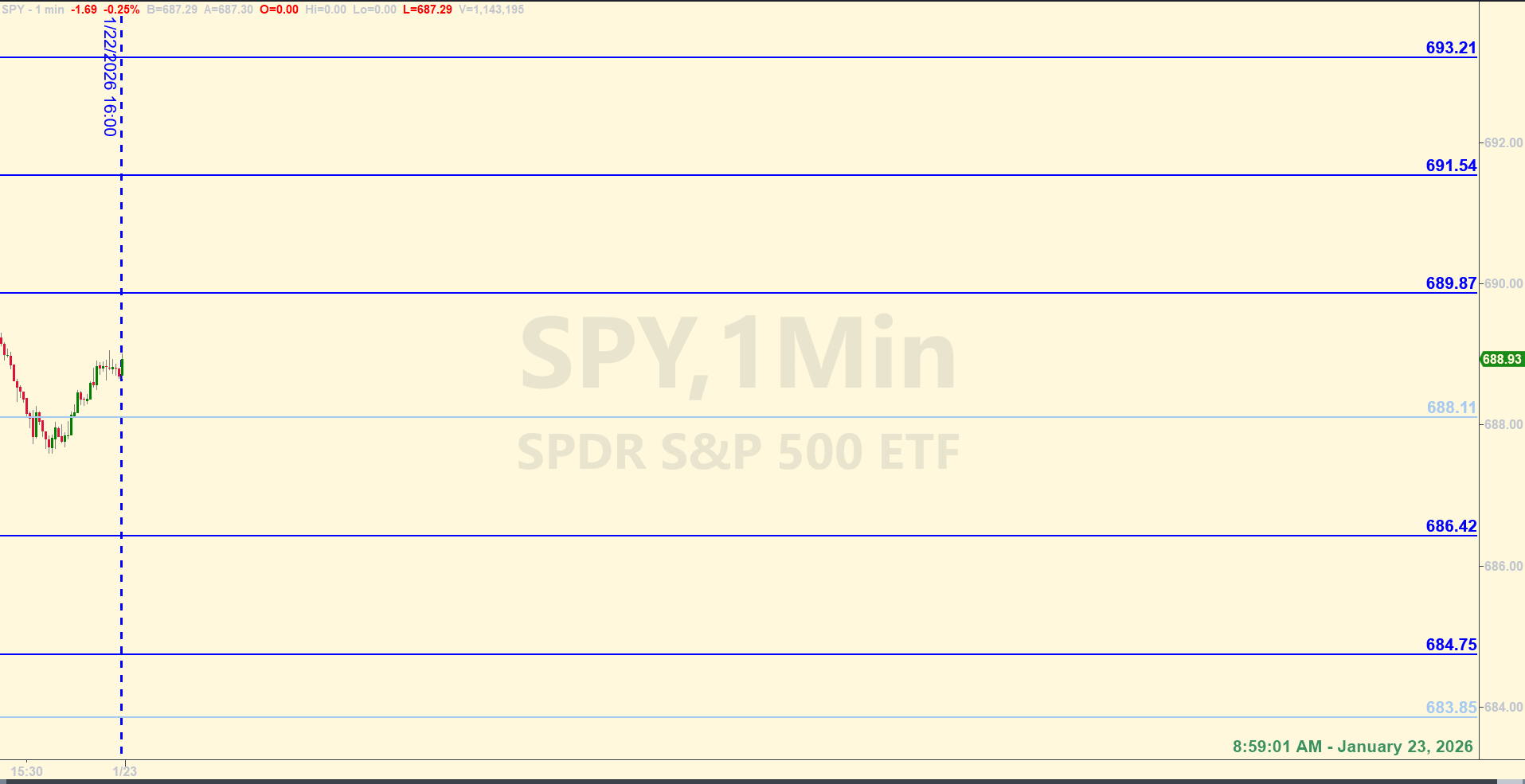

SPY Levels & Game PlanFriday, January 23, 2026 8:59 am Eastern – Nothing has been gained in the overnight and premarket session so far. Right now, with about 40 minutes until the opening bell, price is under where they closed yesterday. The level at 688.11 is an area they’re fighting. This is our axis level

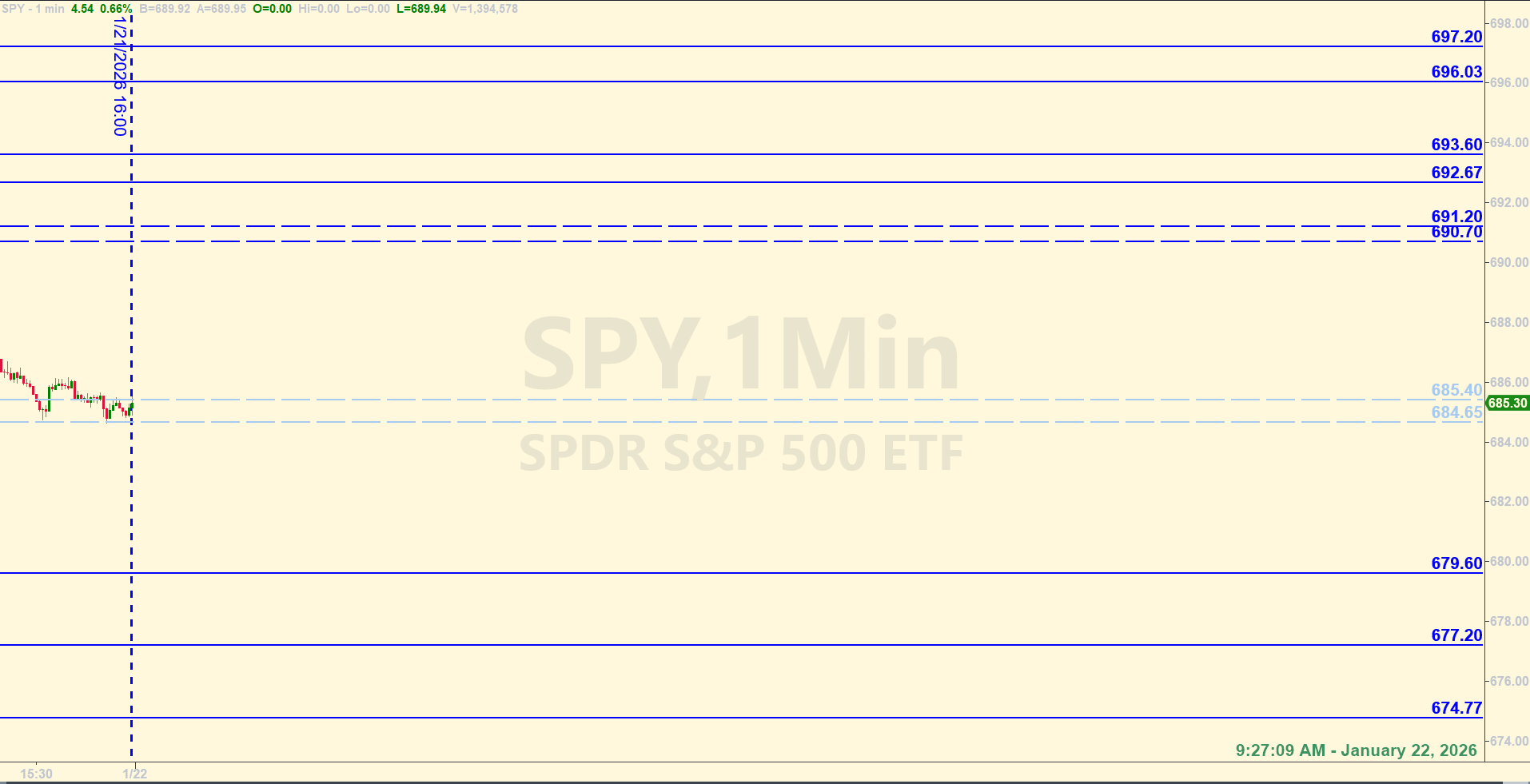

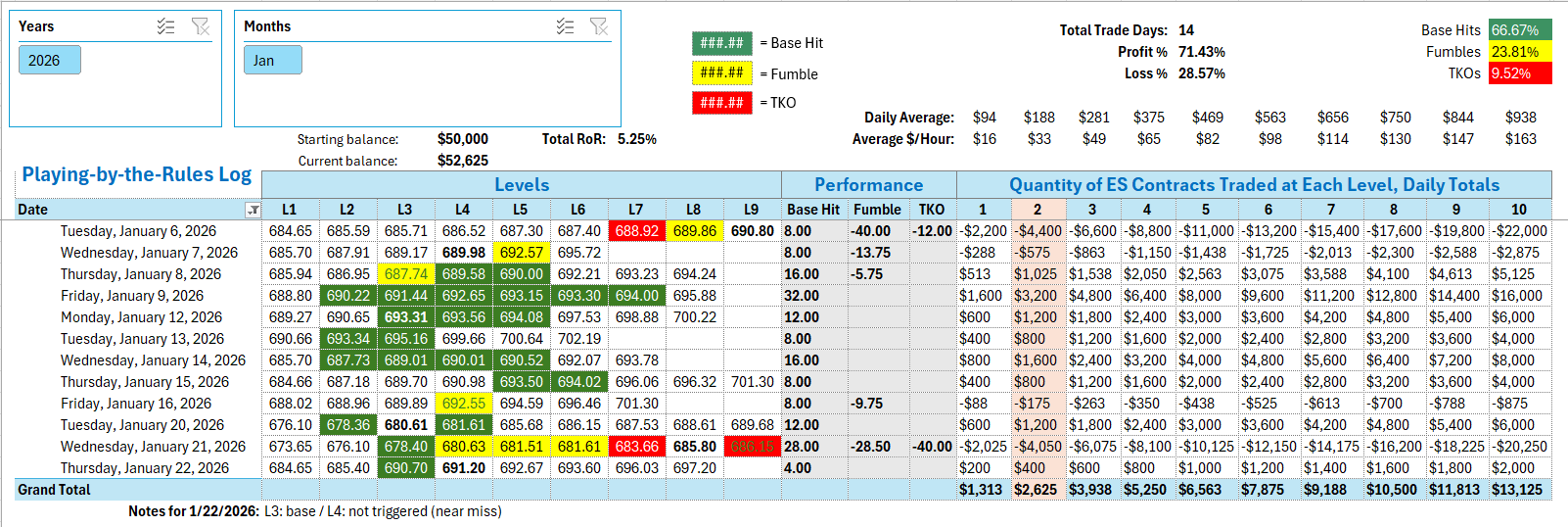

SPY Levels & Game PlanThursday, January 22, 2026 9:27 am Eastern – The bulls are doing a good job making up for lost ground. In the premarket, price is up almost 50 S&P points from where they closed yesterday. Wider than usual swings and increased volatility is still a good possibility today. One thing that

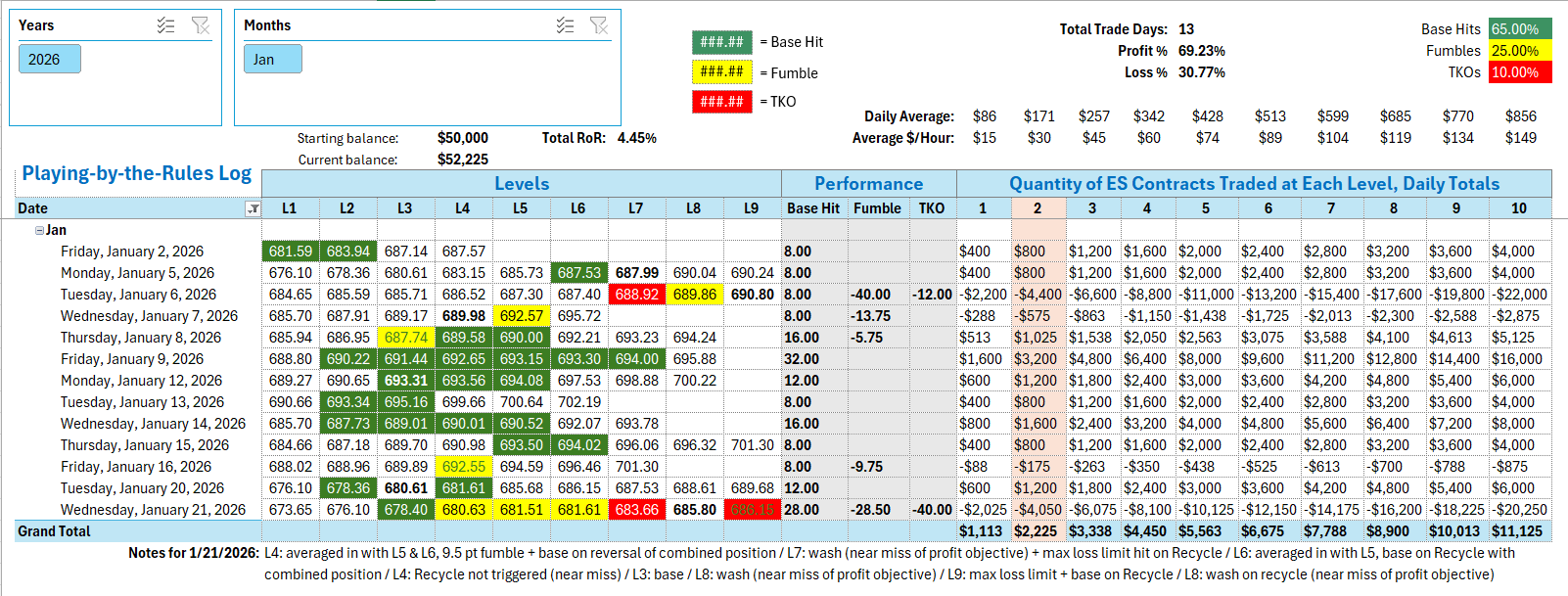

SPY Levels & Game PlanWednesday, January 21, 2026 9:17 am Eastern – There’s a good chance of increased volatility today. Welcome to Wacky Wednesday. On the board yesterday was a level at 676.10. It was not hit during the regular session, but at about 7:00 AM Eastern this morning in the premarket, price got down there

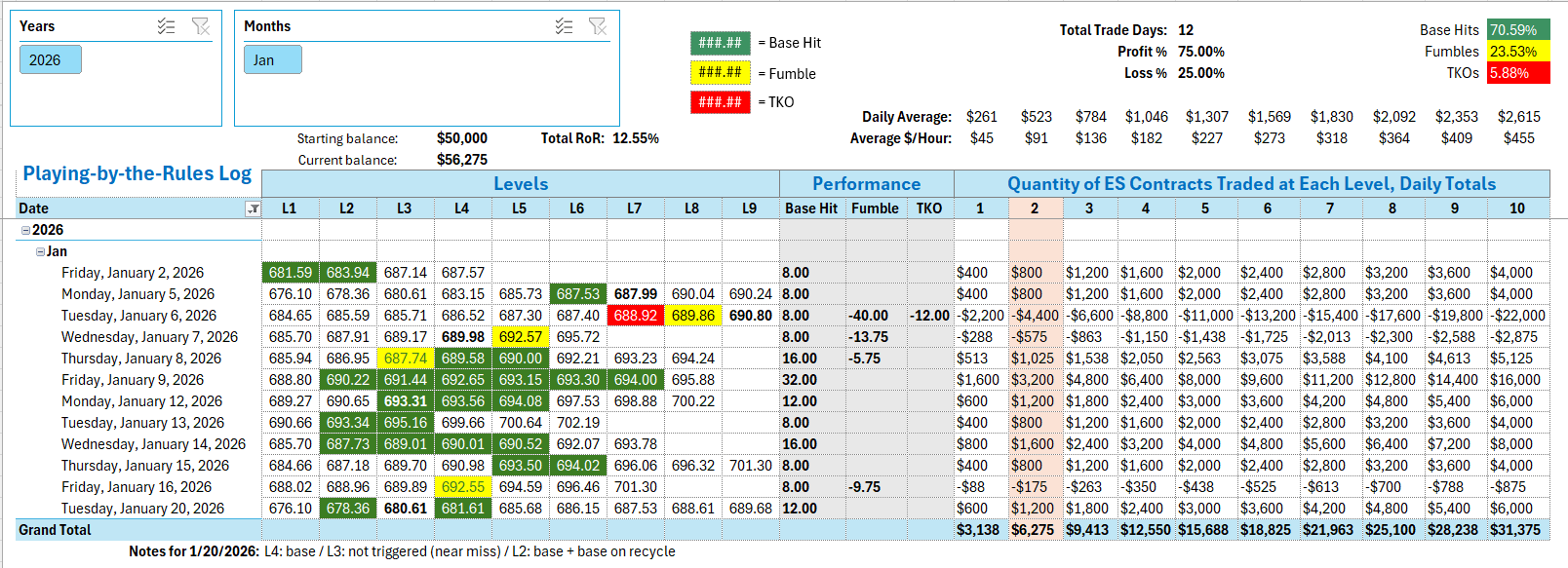

SPY Levels & Game PlanTuesday, January 20, 2026 9:17 AM – The news is all about Trump, Greenland, and tariffs and this has affected price in the premarket. The futures have pulled price down below the cluster of trendlines that have informed many trades over the past few weeks. Now that price is down relatively

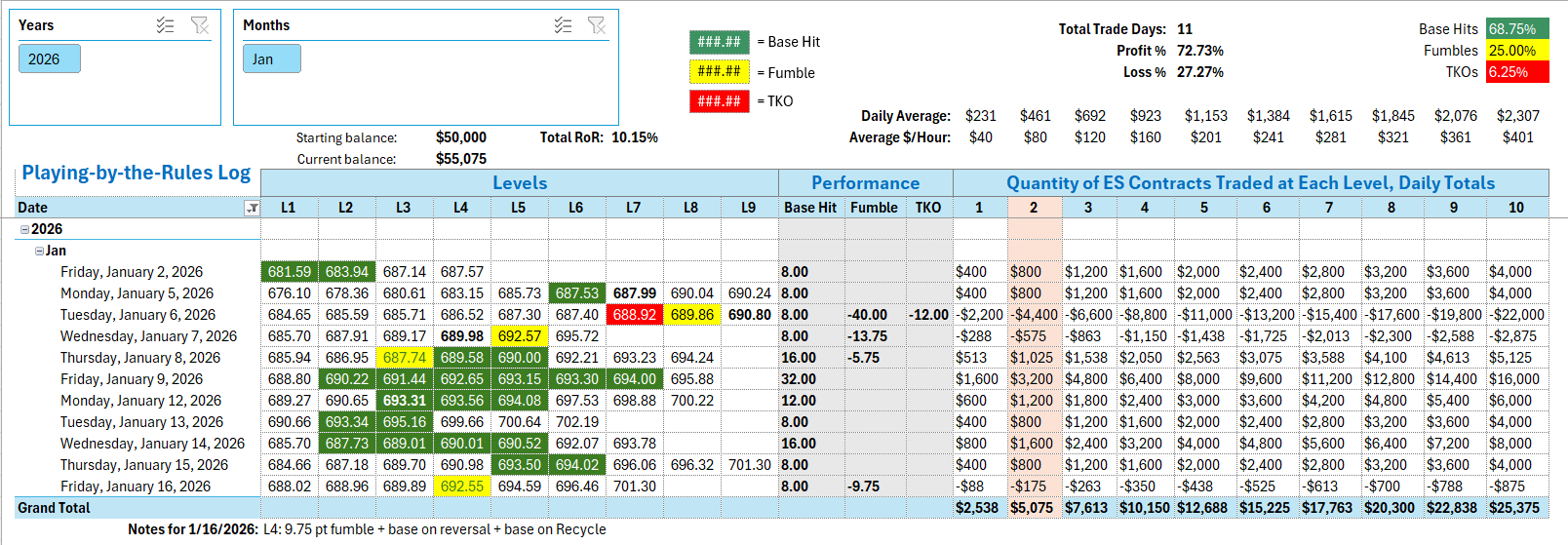

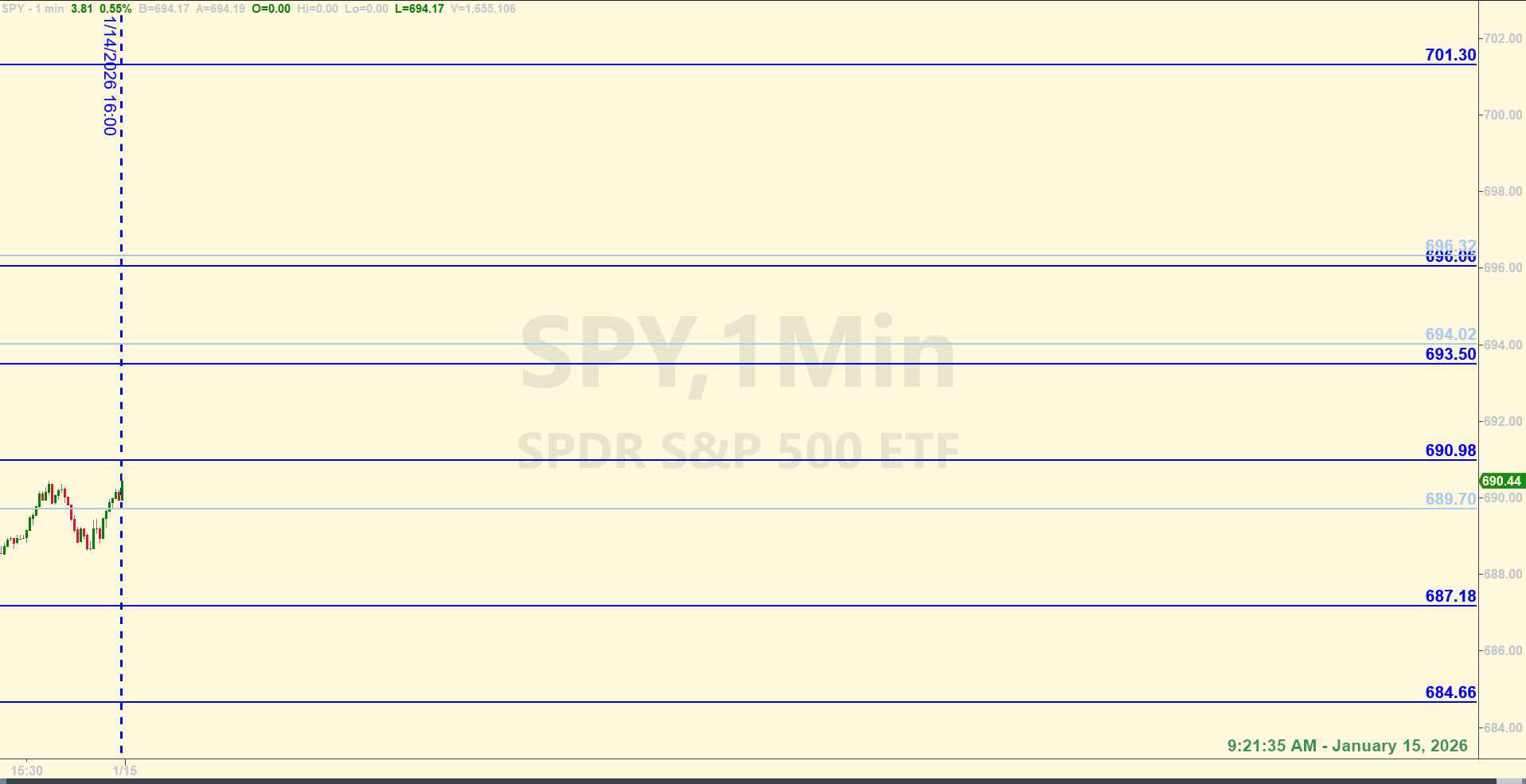

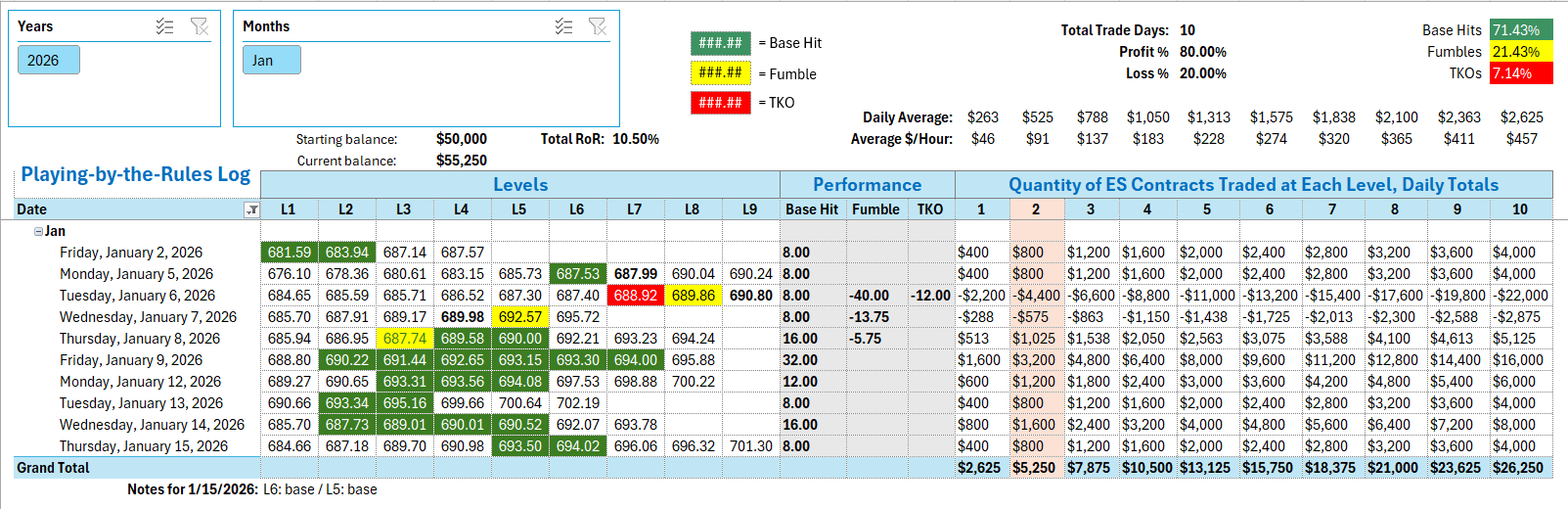

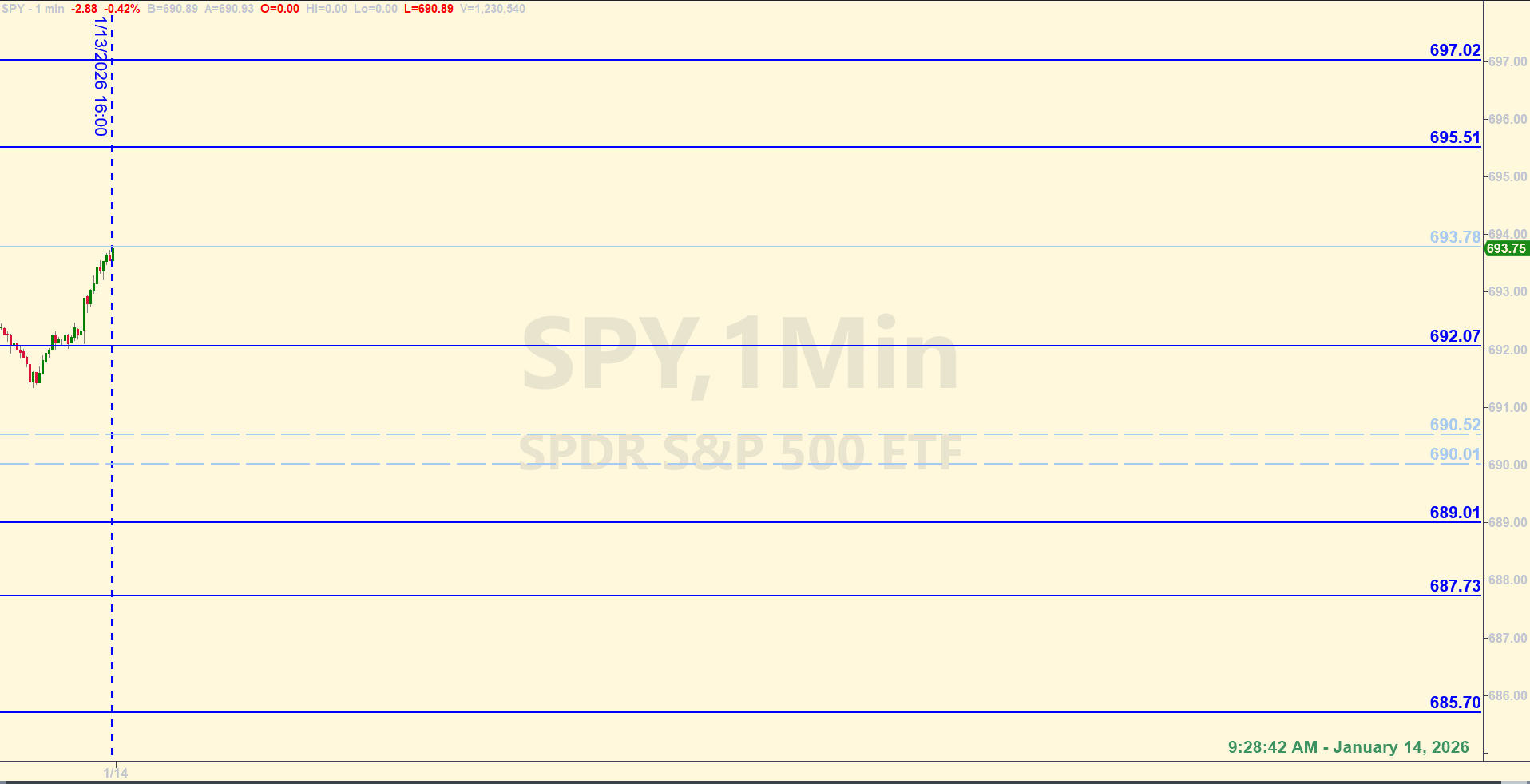

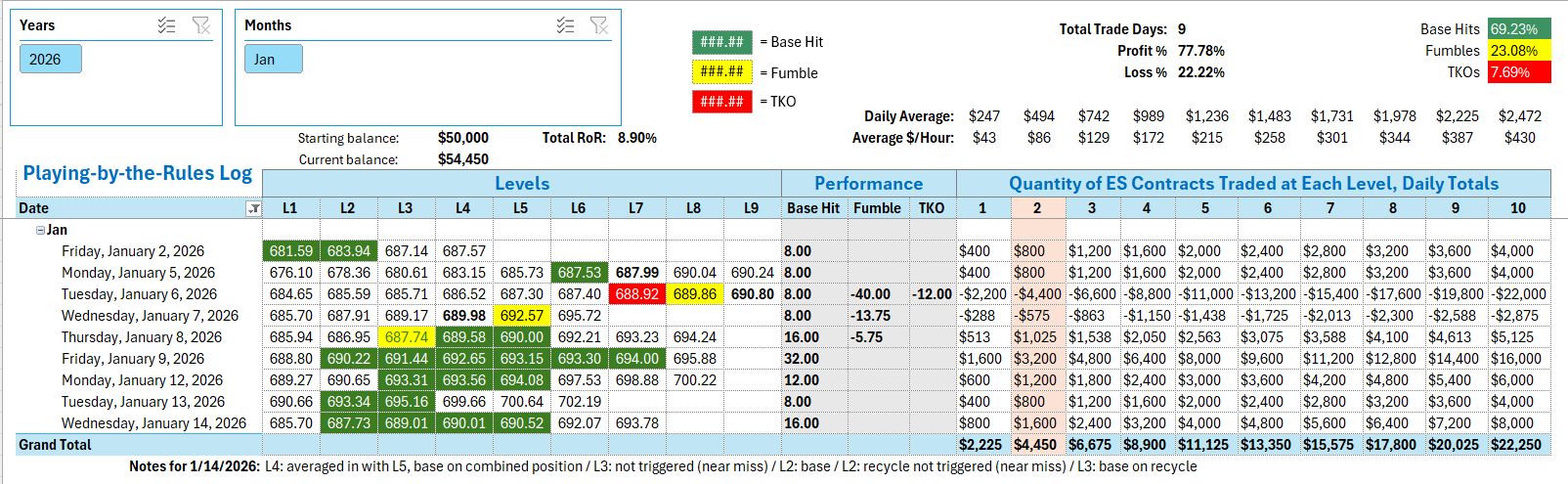

SPY Levels & Game PlanWednesday, January 14, 2026 9:28 AM – Quick recap of yesterday’s activity: the signals we talked about that pointed to a pull back did come to fruition. The bulls couldn’t stay above 695.16, let alone close an hour above it, so the reversal signal on the hourly chart from Monday played

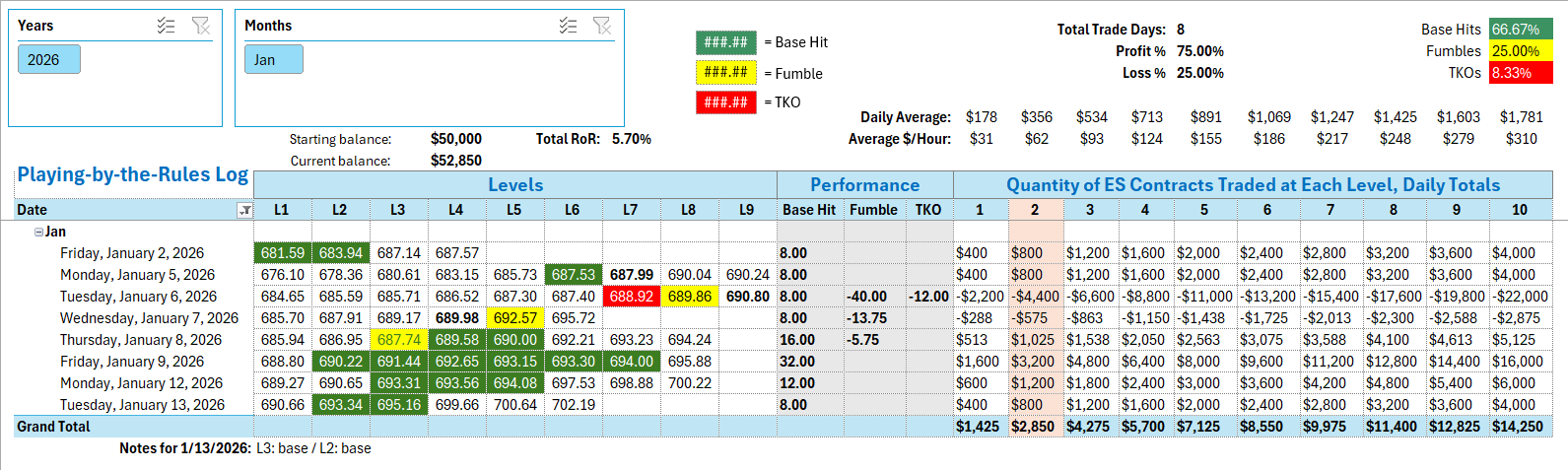

SPY Levels & Game PlanTuesday, January 13, 2026 9:15 AM – We’ve got some interesting things going on this morning. First, after launching off 690.65 (a level from yesterday) right after the opening bell yesterday, price didn’t slow down until the trendline zone that started at 693.31. Once price got above the overall axis area above

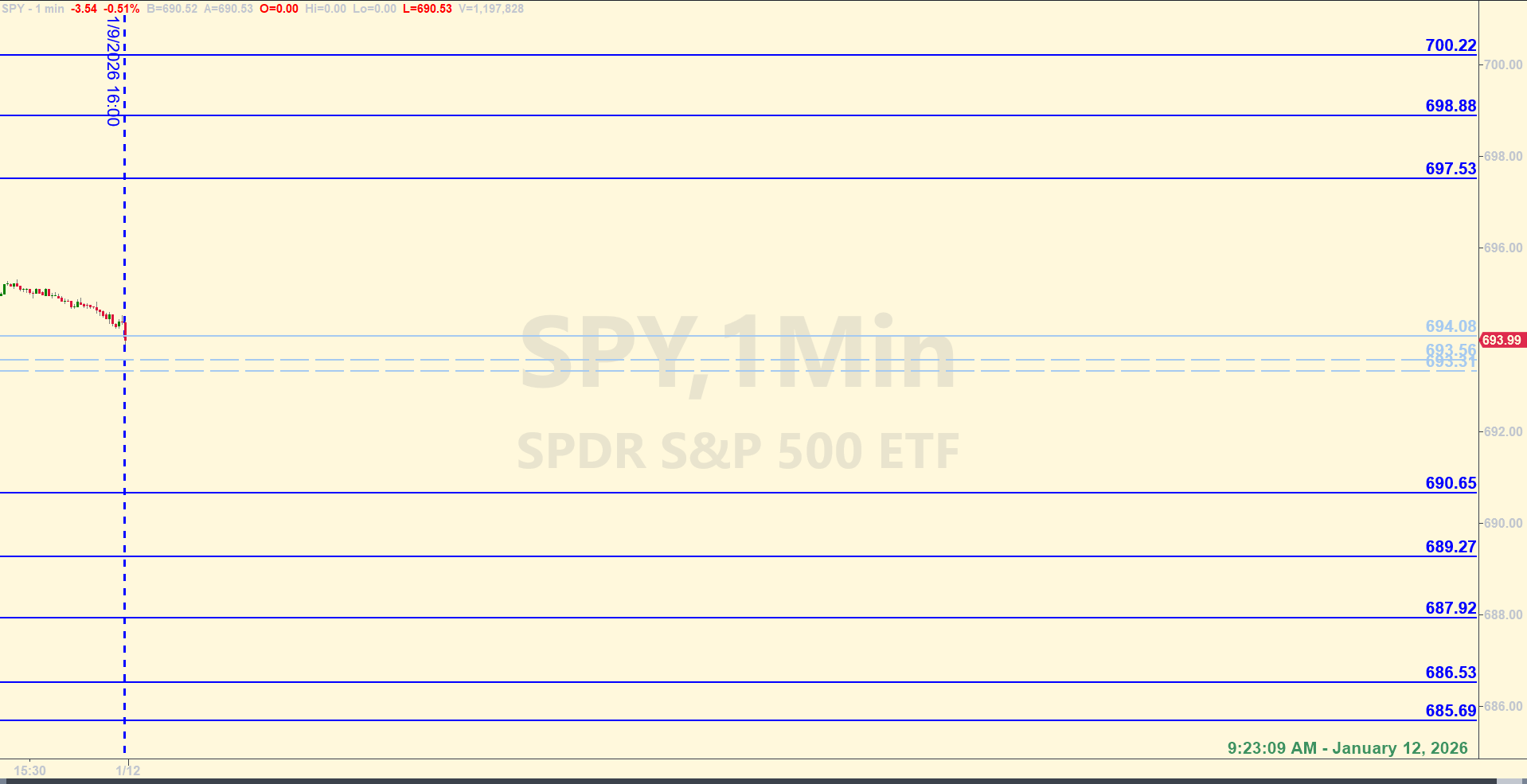

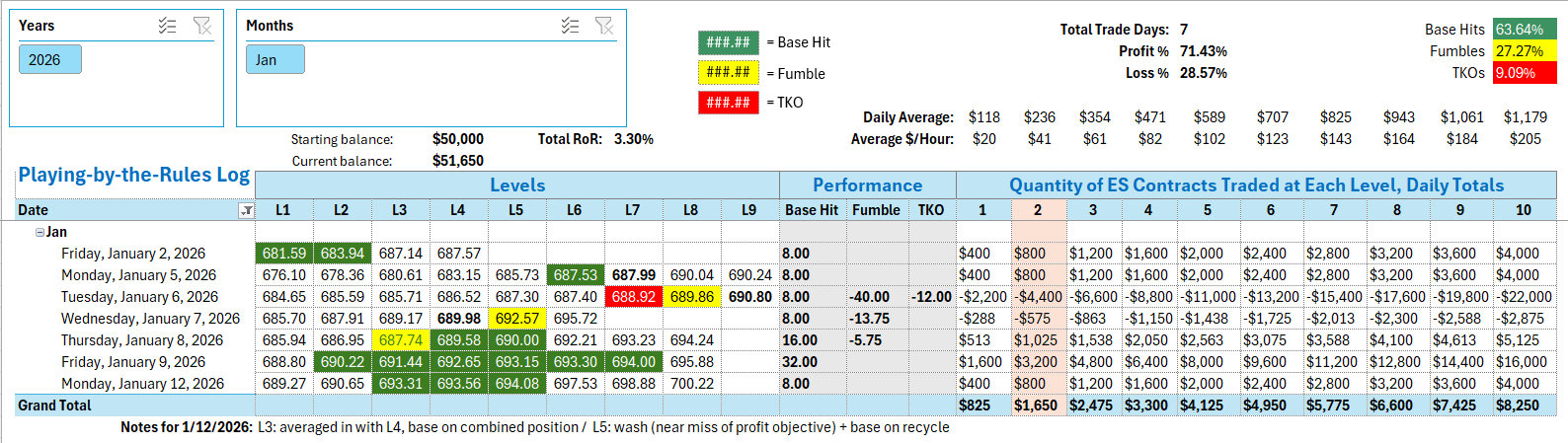

SPY Levels & Game PlanMonday, January 12, 2026 9:23 AM – The level at 694.00 from Friday turned out to be strong overhead resistance. After the closing bell and throughout the premarket session, the futures pulled price down a good amount – around a 50 S&P point drop so far. Right now, as of 9:04 AM

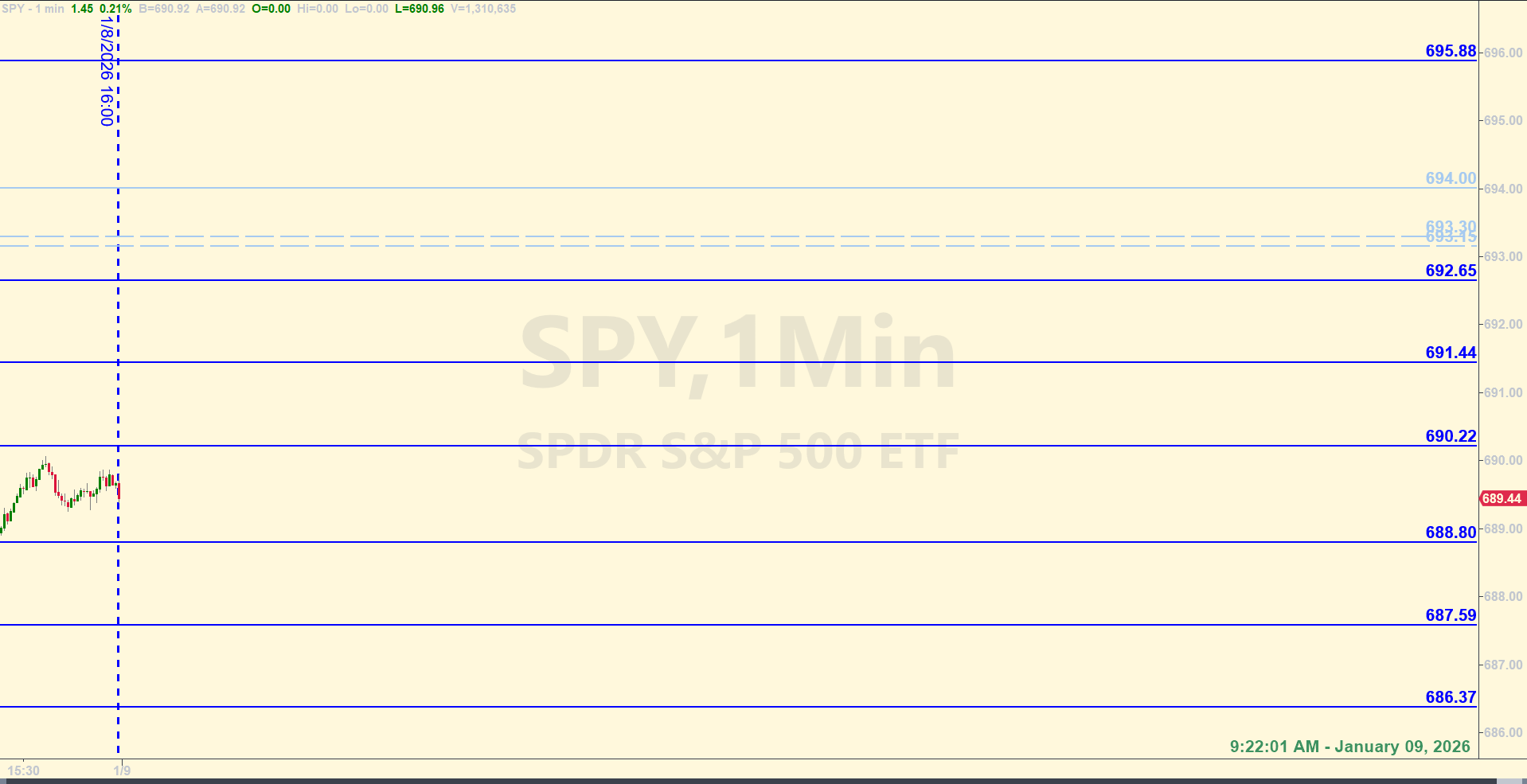

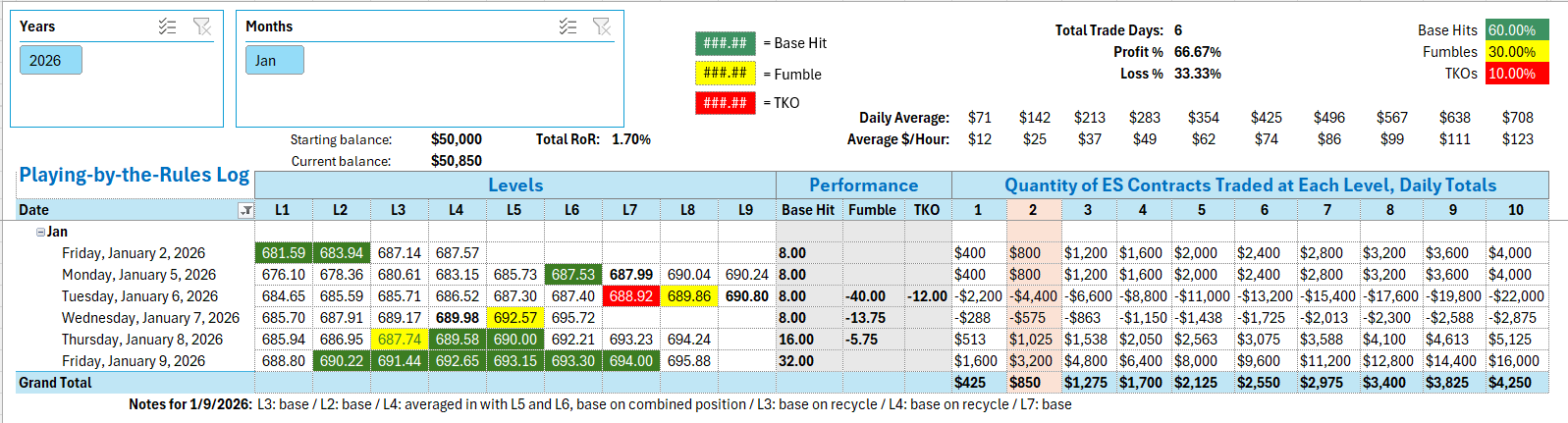

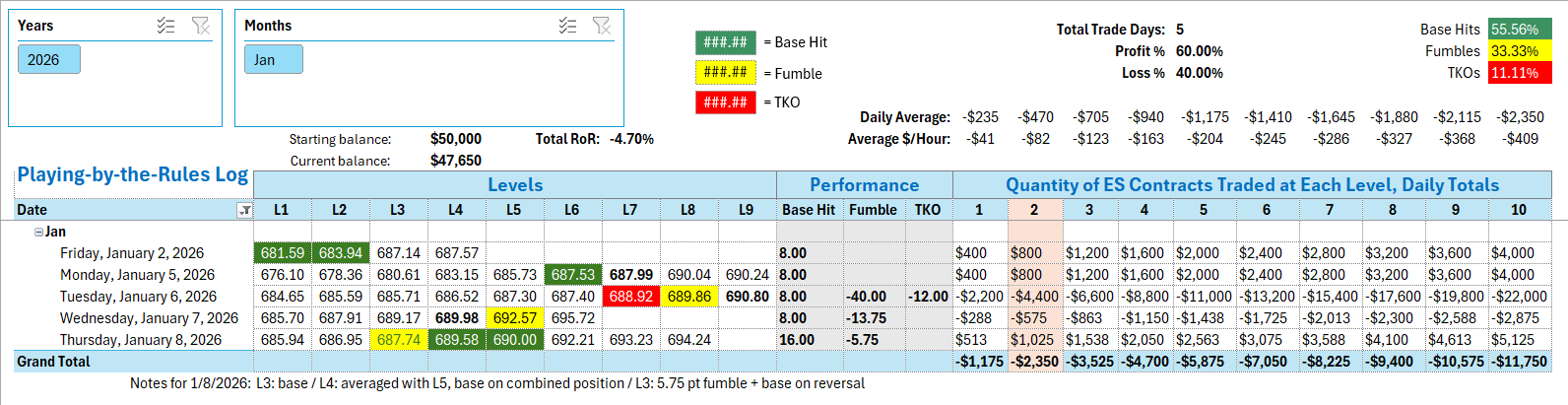

SPY Levels & Game PlanFriday, January 9, 2026 9:22 AM – We’ve got some interesting activity going on in the SPY. Some data releases at 8:30 AM jolted the premarket and price shot up to some overhead resistance areas. At 10:00 AM, there are more data releases that will probably affect price too. I’ve been looking

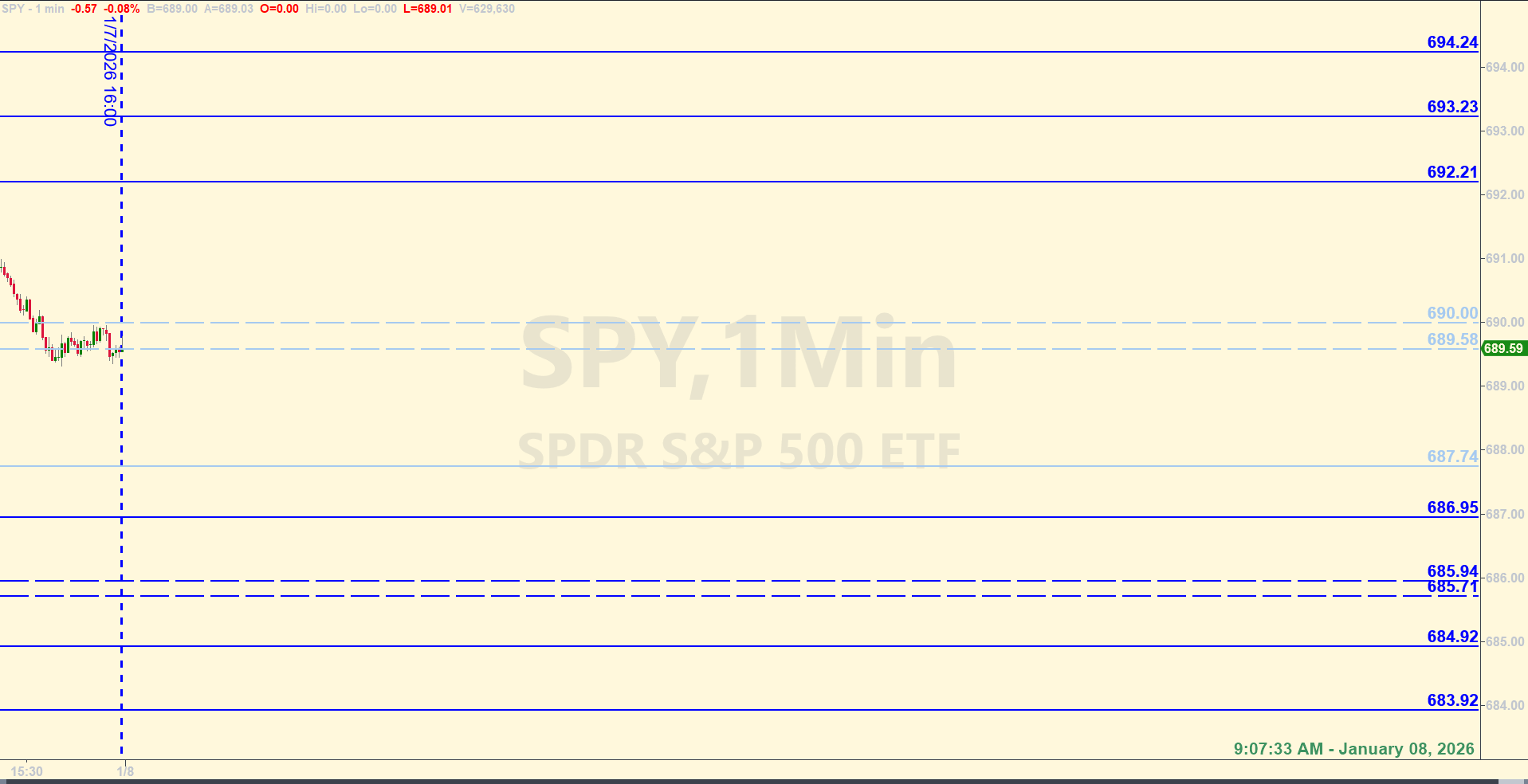

SPY Levels & Game PlanThursday, January 8, 2026 9:07 AM – Yesterday morning we said that the bulls would be in good shape if they could keep price above 692 and especially a trendline area above that level (which was identified with precise levels) and continue to close hourly above that area. It would keep the

SPY Levels & Game PlanWednesday, January 7, 2026 9:19 AM – The SPY hit a new high yesterday. They stalled out right above 692 though and stayed in that general area in the post market. Then in the overnight and premarket session, price dipped and the bulls are currently trying to get back above 692.

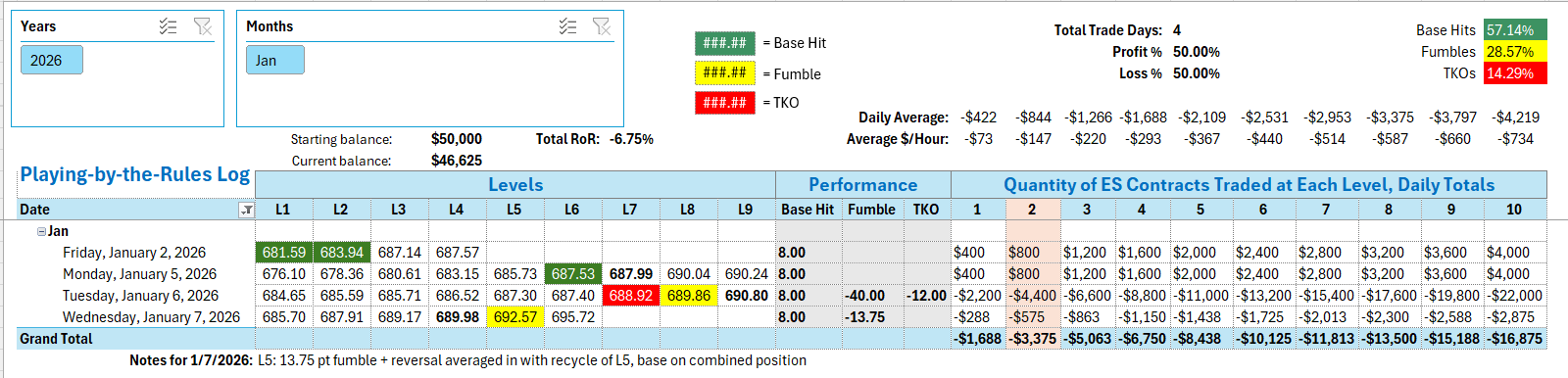

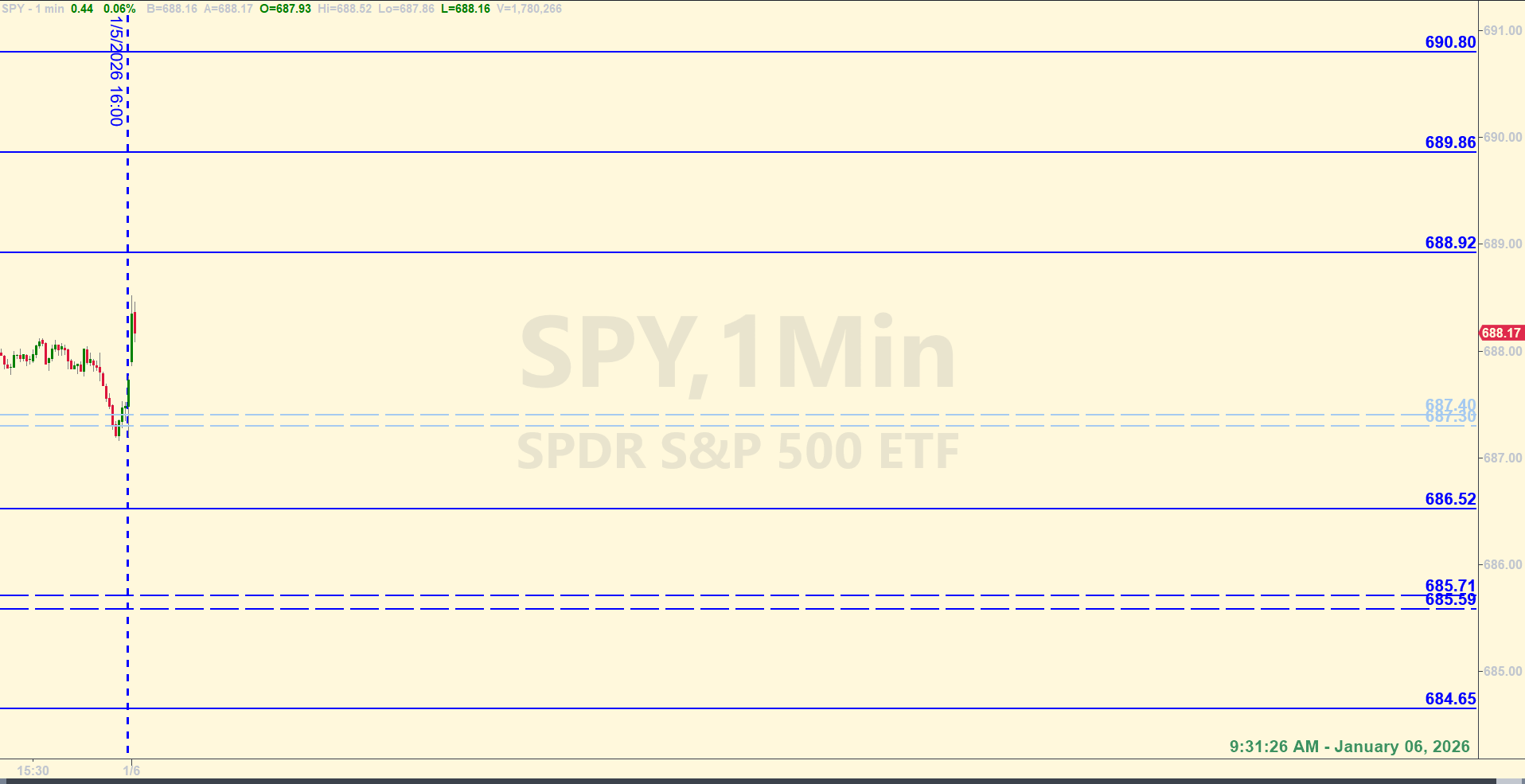

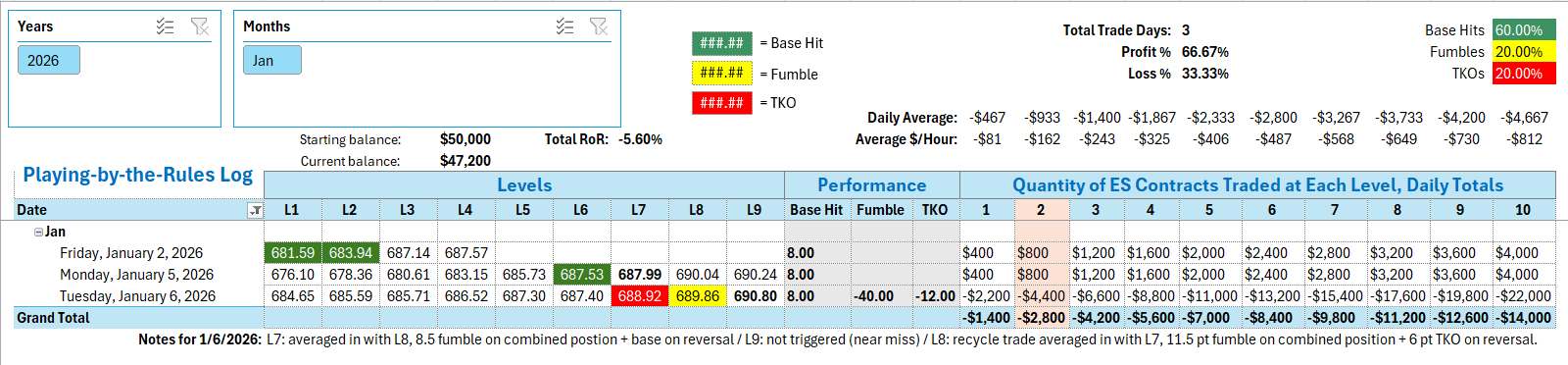

SPY Levels & Game PlanTuesday, January 6, 2026 Take note of the levels for today – see list above – and keep refreshing this page. The Game Plan should be ready to publish around the opening bell… The trendline that the bulls and bears have been fighting is around the axis zone between 687.40 and 687.30