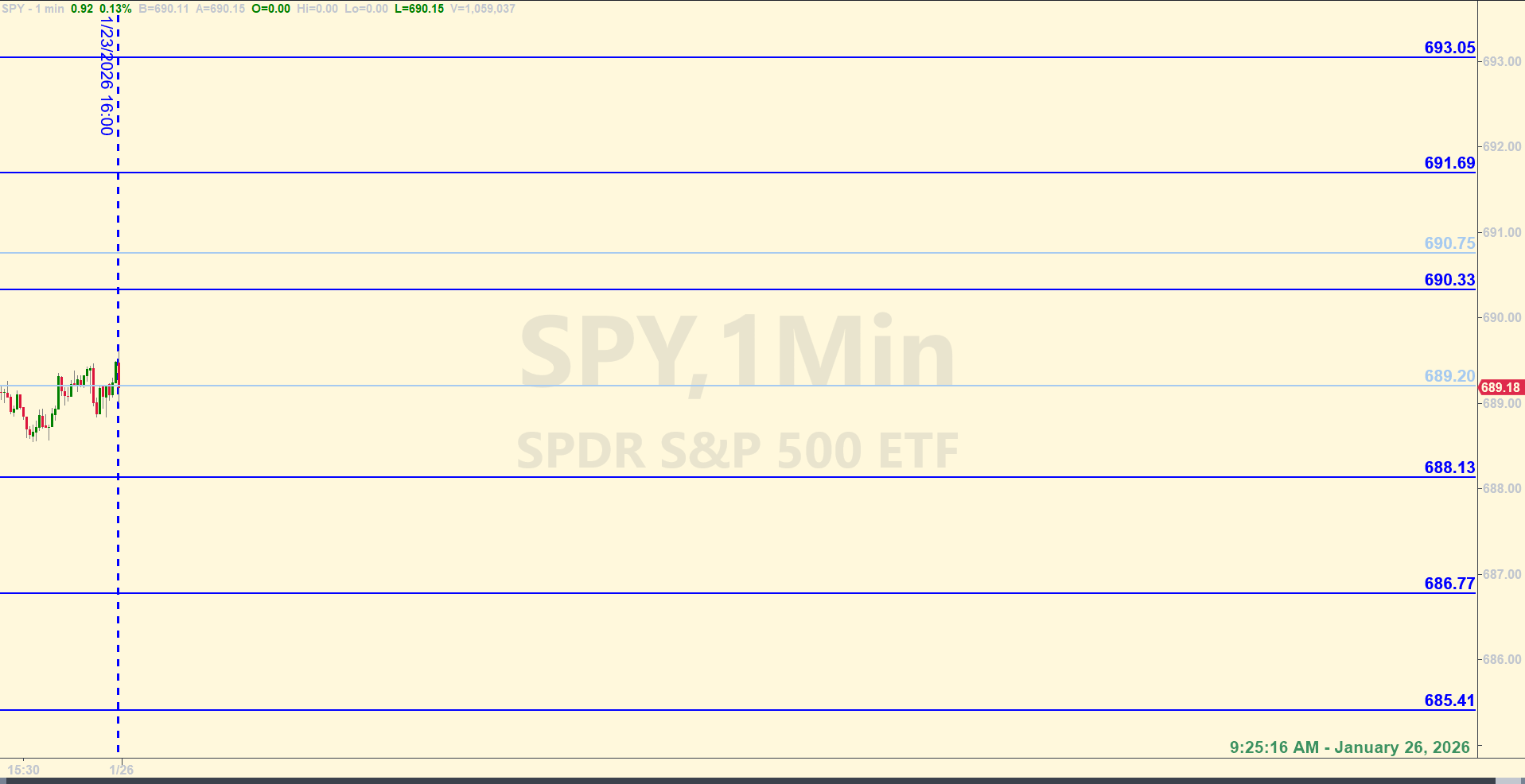

SPY Levels & Game Plan

Monday, January 26, 2026

9:25 am Eastern - We're at the last week of January and it's an FOMC week. Interest rate decisions will be on the docket at the culmination of the Wednesday Fed meeting. This means things will likely slow down a little leading up to 2:00 pm Eastern on Wednesday, the 28th. And then Wednesday afternoon, action will pick up. As of right now, about 20 minutes before the market open on Monday, price in the SPY is still in the middle of stuff. I realize that's not exactly helpful information - except to underline the fact that the bulls and bears probably have more-or-less equal footing until price gets above or below this middle area where they're at right now. In the big picture, like on the weekly and monthly charts, things are still bullish. When you get down to some smaller timeframes, price is fighting to stay above some important moving averages. And also there are trendlines converging at some areas around and above price which could present a challenge to the bulls.

For things to be in the bulls court, they'll need to keep price above 689.20 on hourly closes. That is the bear axis for today, although getting below isn't necessary a problem for the bulls unless we get closes of longer term candles under that area. I'm not sure I would want to trade against 689.20 unless I saw other compelling reasons to do so in real time - if/when price interacts with that level.

The level at 690.75 and slightly above is an area the bulls will need to fight to get out of what has the potential of being a longer-term bearish consolidation. Breaking above 690.75 and closing at least a couple hourly candle closes above is the first step in removing the bearish consolidation from the table. Like the bear axis down at 689.20, I'm not sure I'd be willing to trade against 690.75 unless there are other good reasons that validate that level's importance in real time.

The other levels on the board for today are designed for base hit trades in a "normal" market. Understand the big picture, look for signals on longer timeframe charts, and trade well today.

After the closing bell...

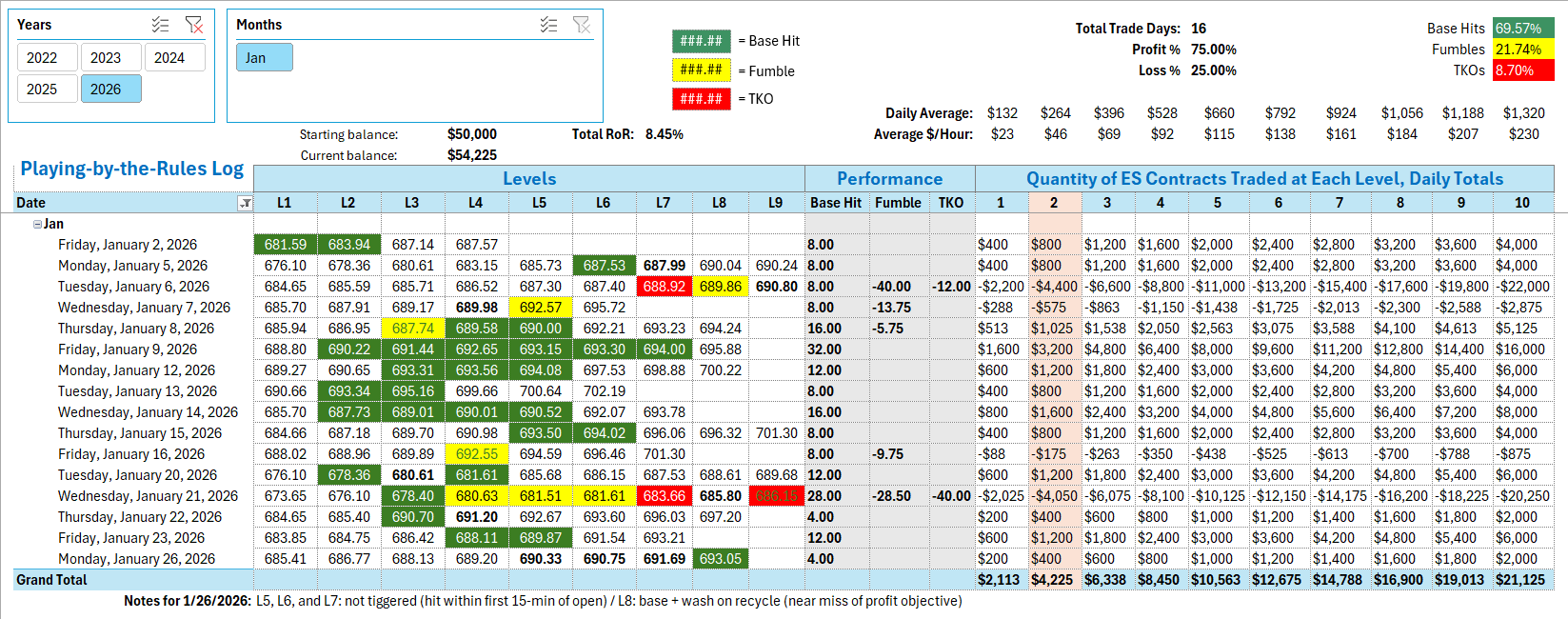

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

There were buyers at the open that made price get above the bull axis of 690.75 pretty quickly, and by the time the 9:45 am Eastern candle closed, price was already above the next level in the sequence at 691.69. This meant you were either buying ES contracts if SPY came back down and tagged 691.69, or selling ES contracts if SPY continued higher and tagged 693.05. You know we add a 5-cent buffer toward price at each of the levels to help ward off front-runners. So you would buy at SPY 691.74, to be precise. SPY got down to a low of 691.75 at 10:11 am and bounced decisively from there - much more than a Base Hit's worth of points. That was a penny shy of triggering the trade and therefore a Near Miss. We would consider the bounce the trade - even if we weren't along for the ride. So we can't count the bounce from the 691.69 level at 10:11 am as an official Base Hit trade today.

Price went up to 693.05 - triggering a short trade in the E-minis when the SPY hit 693.00. That produced a nice Base Hit within a few minutes. Then price got above the level around 12:01 pm. When price came back down into the operating level of 693.10 at 12:50 pm, you went long in the ES. The bounce a couple minutes later came within a certain threshold of the profit objective of 4 ES points, and quickly came back down to your entry point. This is a near miss of the profit objective and the trade was closed out at a wash. Managing these kinds of trades like this is the prudent way to do it because with that kind of market behavior, the odds are increased the the level won't hold for a Base Hit on the long side now. But as you can see, price did find sufficient support there after about 28 minutes, and it continued higher for afterward. Only one official Base Hit though, treating the whole thing as the process.

Per the rules, a total of 4ES points for the day.

Tracking log to-date for 2026: