SPY Levels & Game Plan

Friday, January 16, 2026

9:00 AM - SPY did pull back a little yesterday, but in the big picture, it was just a test of the 38.2% retracement - spiked it a little, but didn't make it all the way down to the 50%. They bounced there between those retracement levels and that has a bullish feel to it. At least in the interim. All these attempts to break out into new highs has resulted in relatively sharp pull backs. So the bulls still have their work cut out to break out and stay above the highs if they want the next leg in the SPY to be in the upward direction. Basically, right now, price is in the upper-middle area of "stuff". We're still doing the back and forth thing we talked about in the last couple Game Plans.

The axis level for today is 692.55. Staying above and closing above is good for the bulls. Price can dip below the axis and that probably wouldn't be a problem for the bulls - unless we get multiple closes of significant timeframes under it. Like hourly closes. If that happens, the bears would have an easier time pulling price down some more. And trading against 692.55 at the precise level could be tricky if you don't see any other signals that would lend more credence to the level's importance as support and/or resistance in real time. Right now, I would consider the axis level at 692.55 to be a gauge for near-term potential market bias.

If the bulls can get back above 694.00 - that area is still important - they can try to tag 694.59 again. They've already been hanging out under 694.59 in the premarket and have hit it a couple times. So this consolidation under 694.59 could be looked at as bullish. Currently in the premarket, as of 8:50 AM Eastern as I write this, price is above the axis level and below the 694.00. There will be some movement today which will challenge these axis areas.

There are still trendlines in play today - most are above current price. They are likely to hit at least one of them again. If the bulls can break through them, it reinforces the bull case. It could be that we'll get a slow grind under the tariff hearing situation gets finalized.

As always, if the market starts acting out of character - like if something spooks the market increases volatility, be extra-aware of other indicators that might be present in real time around the levels as price comes into them. Trade well today.

After the closing bell...

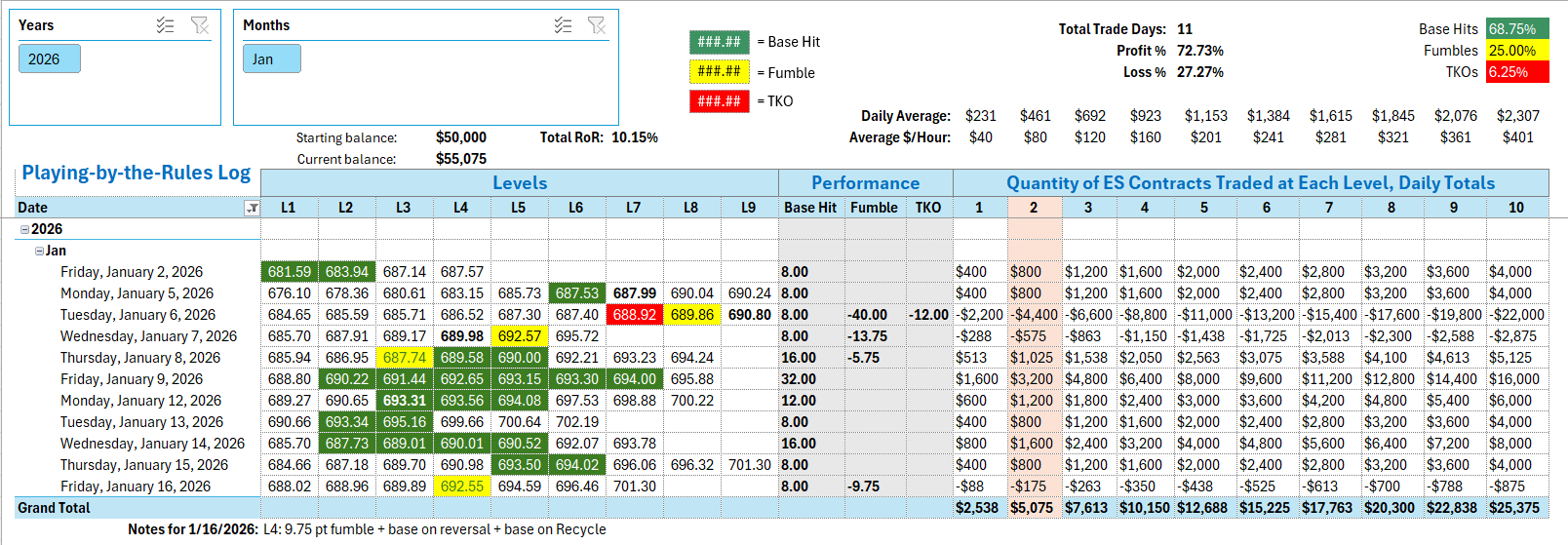

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

The only level hit was the axis level of 692.55. Price came down into and hit the operating level the first time at 9:56 AM. That long trade resulted in a 9.75 point Fumble, and 4 points (at a minimum) for a Base Hit on the reversal as price continued lower. The bears weren't able to tag 689.89 and support was found in front of that level. So price climbed back up to 692.55, and by the retest at 11:11 AM, the time was right for a Recycle trade at 692.55, this time on the short side. That trade pulled in a Base Hit quickly. After that, no more trades, because 692.55 was done for the day - traded on both on the short and long sides.

Per the rules, a total of -1.75 ES points for the day.

Tracking log to-date for 2026: