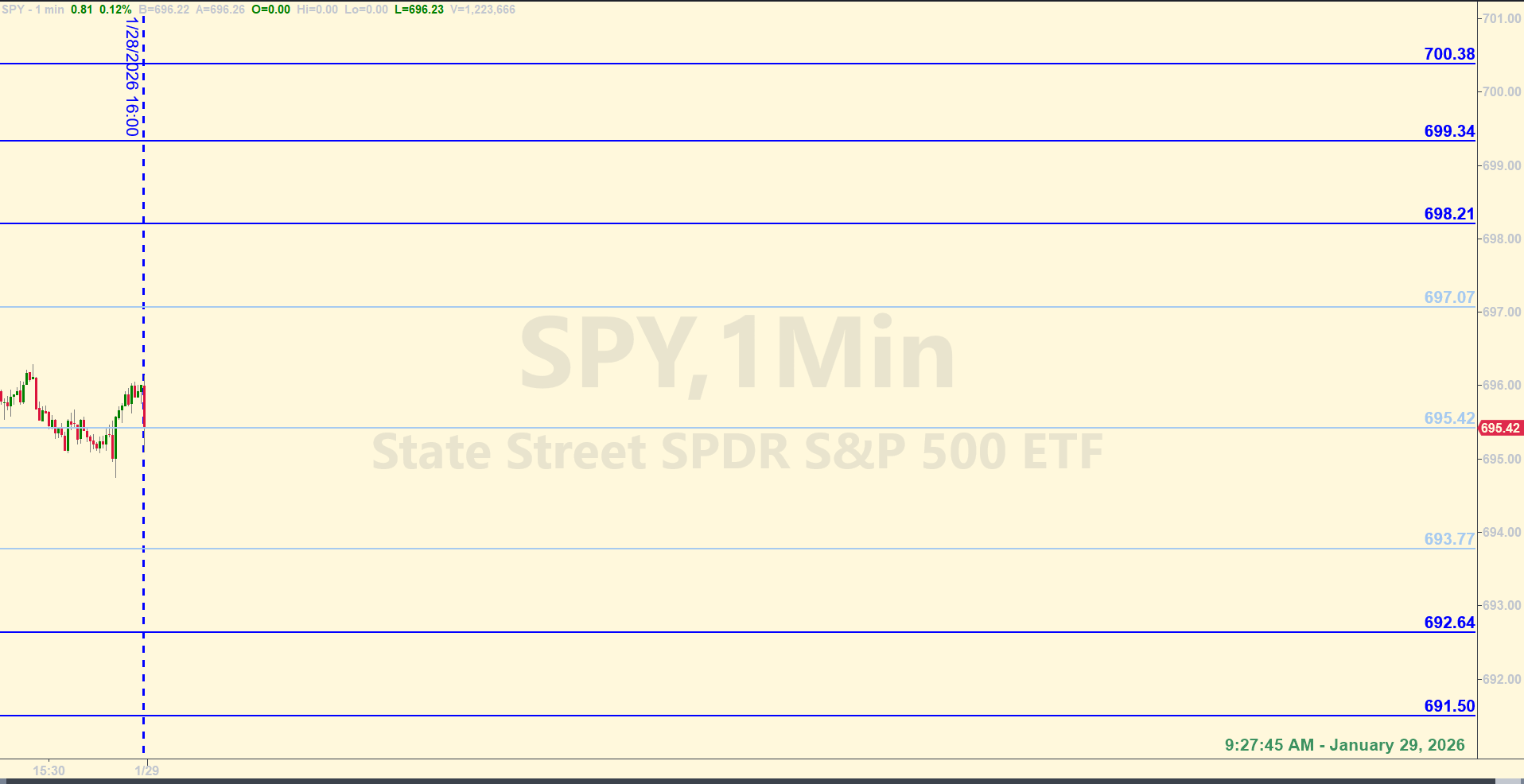

SPY Levels & Game Plan

Thursday, January 29, 2026

9:27 am Eastern - We got some movement after the Fed announcement yesterday. Overall though, price is in the same area. They found a new high yesterday, pulled back and closed the day slightly under Tuesday's close. The close of yesterday was 695.42 and that is probably a doorway now for the bears to try to pull price down a little if they can. I'm not sure I would trade against 695.42 unless there were other good signals in real time that could validate its importance as support or resistance.

The bigger doorway for the bears to get more selling going on is 693.77. That is the bear axis for today. Right now though, with about 15 minutes until market open, price is trying to get above 697.07. That is the bull axis for today. Getting above and closing hourly candles above 697.07 puts the bulls in a better position to drive price higher if they can. The SPX opened above 7,000 yesterday and promptly fell for most of the day. It wasn't a lot in the big picture, but it's clear that 7,000 was a target and there were some sellers up there. And a couple other indexes that are typically market leading indicators also had a down day. And those other indexes weren't at all time highs.

So either the SPY is resetting for a new attempt at 700, or they are getting a little weak and need a bigger break. There's just a lot of back and forth in an area with several trendlines that are constraining price. Spiking the highs and then coming back down multiple times like they've been doing will eventually turn into another leg higher - where they build up enough energy to move above the trendlines. Or they finally start dripping lower and get a bigger move in the downward direction. They won't move sideways forever. As always, be aware of what the larger timeframe charts are saying before trading against the levels. Trade well today.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

Interesting day. The day after a Fed announcement often tends to be more volatile than usual. Today was no exception. Right after the open. price shot up to 697.07, got to a high of 697.06 and started falling. Important level, wouldn't you say? Your first trade though was after the close of the 9:45 am Eastern candle. No long trade at 692.64 because of a Near Miss bounce in front of the level. Then a couple minutes later, a short at 693.77 netted your first Base Hit. Price continued to fall and went right through 691.50 like it wasn't there. The long trade you entered at 691.50 hit the max loss limit before a Fumble Signal materialized. So no reversal. But when price finally found support and climbed again, the Recycle trade at 691.50 handed over a Base Hit. After that, there were no more official trades. The former levels hit in the way up were not traded for Recycles because of the time of day - both were hit within 30-minutes of the closing bell, and we don't enter new trades within 30 minutes of the closing bell.

Here's a little hint: when price ignores a level and there is no reaction - like when 691.50 was hit on the way down the first time at 10:00am. Well, the Recycle trade of those levels - the ones where price does not respect the level the first time - are almost always great trades on the other side. That's why you took the Recycle of 691.50 at 12:38 pm. Hopefully, you pulled more than just a Base Hit on that nice pullback.

Per the rules, a total of -12 ES points for the day.

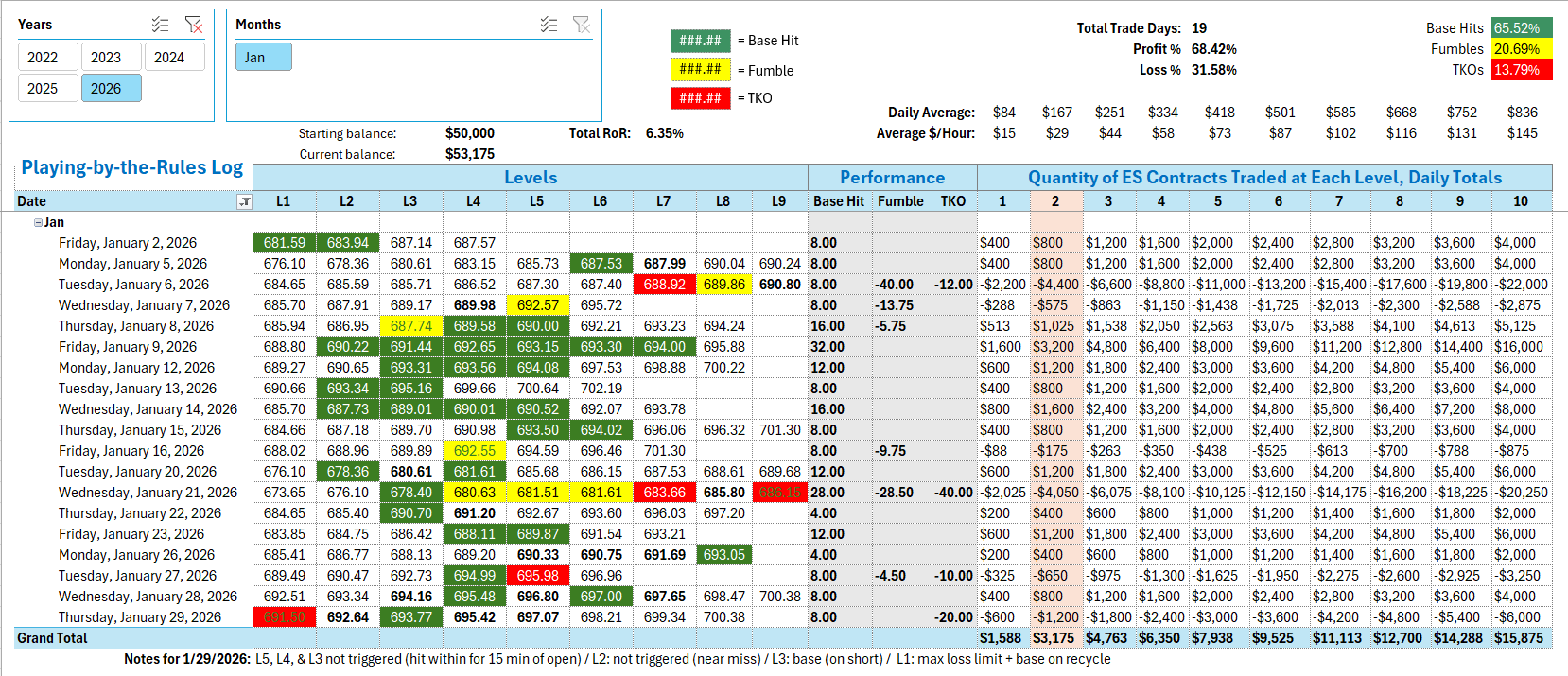

Tracking log to-date for 2026: