SPY Levels & Game Plan

Tuesday, January 13, 2026

9:15 AM - We’ve got some interesting things going on this morning. First, after launching off 690.65 (a level from yesterday) right after the opening bell yesterday, price didn’t slow down until the trendline zone that started at 693.31. Once price got above the overall axis area above 694.08, the bulls were able to run. And all that was spelled out in the Game Plan from yesterday. The levels worked as designed. So that left the day with at least a couple good signals for a pull back this morning – which would have looked very similar to the pullback in the premarket yesterday.

However, an 8:30 AM Eastern data release has elevated price, and as of right now, a few minutes before the opening bell, they are fighting yesterday’s close at 695.16. So the bulls are certainly trying to use this surge to their advantage – perhaps to try to target SPY 700. But they’ll need at least one hourly close above yesterday’s high to be in the clear to try for 700. Yesterday’s high was 696.09. That’s not on the board for today as an official level, but keep that area in mind if/when price gets up there again. Above is good for the bulls, but the first order of business for the bulls is to stay above the bulls axis at 695.16 today.

The zone up at 699.66 to 700.64 is wider than usual, but if the bulls can get up there and finally hit 700, either front-runners will be able to pull price down ahead of the precise level of 700 – or there will be a spike as the buy-the-breakout traders buy up there expecting a surge. There may be a surge and 700 gets spiked, but I’ve never been a fan of buying at the highs – or what I perceive to be a probable high. There are likely many algos and traders targeting 700 as an exit point to take profits. Under normal market conditions, big areas like this tend to be pivot points. At least for the interim.

The bear axis is 693.34. Hourly closes below that area is better for the bears, and they may be able to make the reversal signals from yesterday come to fruition. But there are trendlines all over the map today – mostly below price. So there is a good chance of bull/bear battles at these places. I intentionally do not have many levels on the board for today just to be safe. No other data releases scheduled during the regular session, but be aware of unusual activity anyway. Trade well today.

After the closing bell...

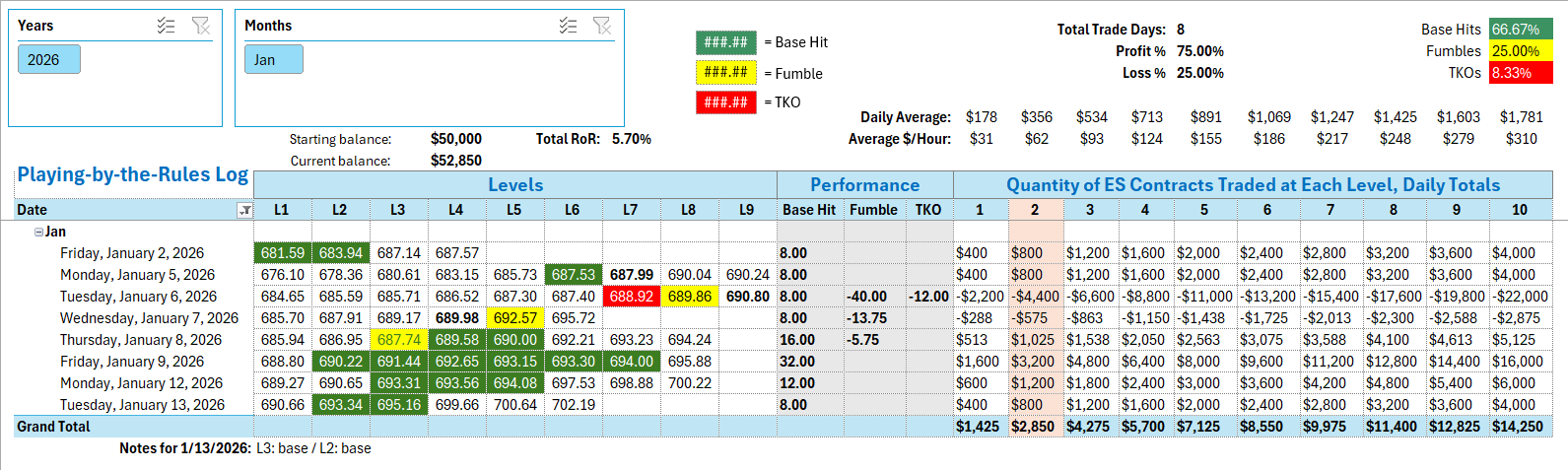

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

At the close of the 9:45 AM candle, price was one penny under 695.16. Going short in the E-minis at the market as soon as that 15-minute window opened gave you your first Base Hit. Price fell into 693.34, and going long there netted you Base Hit number two. There was not enough time between when price got under 693.34 at 10:16 AM and when they came back up into it from the underside at 10:34 AM to allow for a Recycle trade, although you can see the level did provide overhead resistance. Price went back up to 695.16 and while there was great resistance up there, going short again at the level was not in line with the rules. It had already been traded on the short side earlier and therefore it was off the table, per the rules. As always, the first hit is the best hit.

Per the rules, a total of 8 ES points for the day.

Tracking log to-date for 2026: