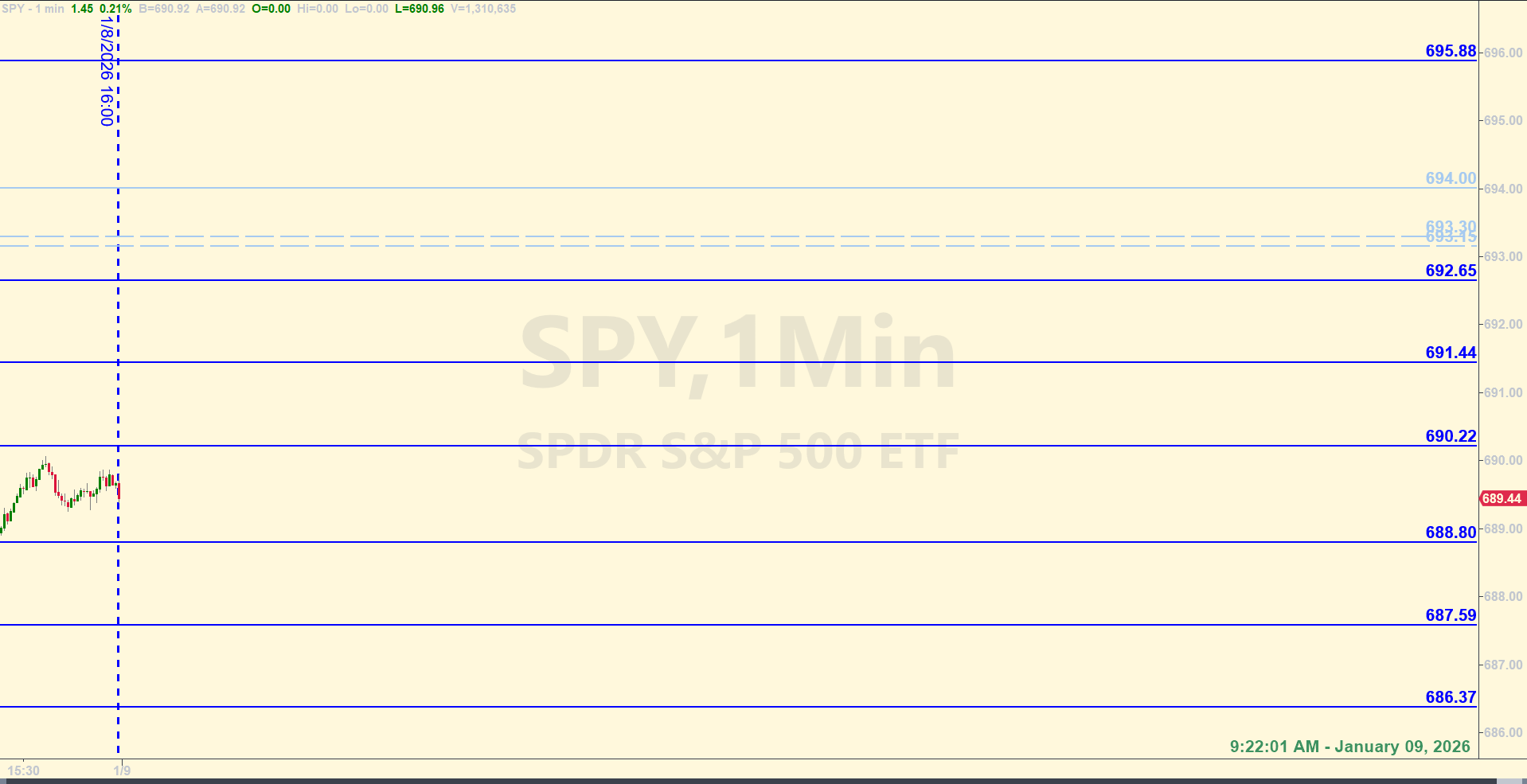

SPY Levels & Game Plan

Friday, January 9, 2026

9:22 AM - We’ve got some interesting activity going on in the SPY. Some data releases at 8:30 AM jolted the premarket and price shot up to some overhead resistance areas. At 10:00 AM, there are more data releases that will probably affect price too. I’ve been looking at the SPY and missed the fact that the ES already tagged 7,000. It’s the cash index, the SPX that is close to, but hasn’t hit 700. And of course 700 in the SPY would be significant too. The pull back on Wednesday and the waiting period yesterday (Thursday), where the market was mostly flat, has apparently built up enough energy to attempt another rally. Price in the SPY has already hit and reacted away from the 75% retracement from Wednesday’s high.

The bulls need to get above and close hourly above the trendline, which is between 693.15 and 693.30 today. If they can do that, they’ll target the highs from Wednesday and try to establish closes above 694. That would put price back into uncharted territory again – although I do have a level of possible resistance at 695.88. I’m not sure I would trade against 694 unless I see other compelling reasons to do so in real time.

Staying below the trendline area means price will likely visit the support areas below current price. The levels are good for base hits in the ES if price approaches the levels the right way. If volatility picks up – and it’s very possible that it will today – than there is no shame in sitting back and observing and letting the dust settle. The levels might work, but in an overly-active market, they may need more wiggle room and time to develop. And sometimes, it’s not feasible to wait out an active trade when all you’re looking for is a relatively small base hit. The best trades (in my opinion), are the quick and precise trades that occur within pennies of the levels.

Be aware of your surroundings leading up to 10:00 AM. We could see increased volatility around then. Trade well today.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

There were Base Hits all over the place today. Number one was a short at 691.44 as soon as the 9:45 AM candle closed. Then price came down into 690.22 and bounced. That was Base Hit number two. The third, forth and fifth Base Hits came when the short position entered at 692.55 at about 10:26 AM was doubled, and then tripled when price continued up to the zone at the levels 693.15 and 693.30. The pull back from with that combined position in tow gave plenty of room to pull the desired points as price fell. Where did they fall to? Right into 691.44, which was ready for a Recycle trade and that long trade was Base Hit number six. No short trades as price hit the next three levels up because those levels had already been satisfied on the short side. But price retested 692.65 from above and the timing was right for a Recycle trade there, so that long trade on the retest at 692.65 at 11:33 AM was Base Hit number seven. The final Base Hit - for an impressive eight total for the day happened on the short trade taken up at 694.00. You'll notice that price almost hit the operating level at 693.30 on the retest making the Recycle Trade of that level almost give us the ninth Base Hit. But eight 4-point Base Hits using the levels and the rules is a good day.

Per the rules, a total of 32 ES points for the day.

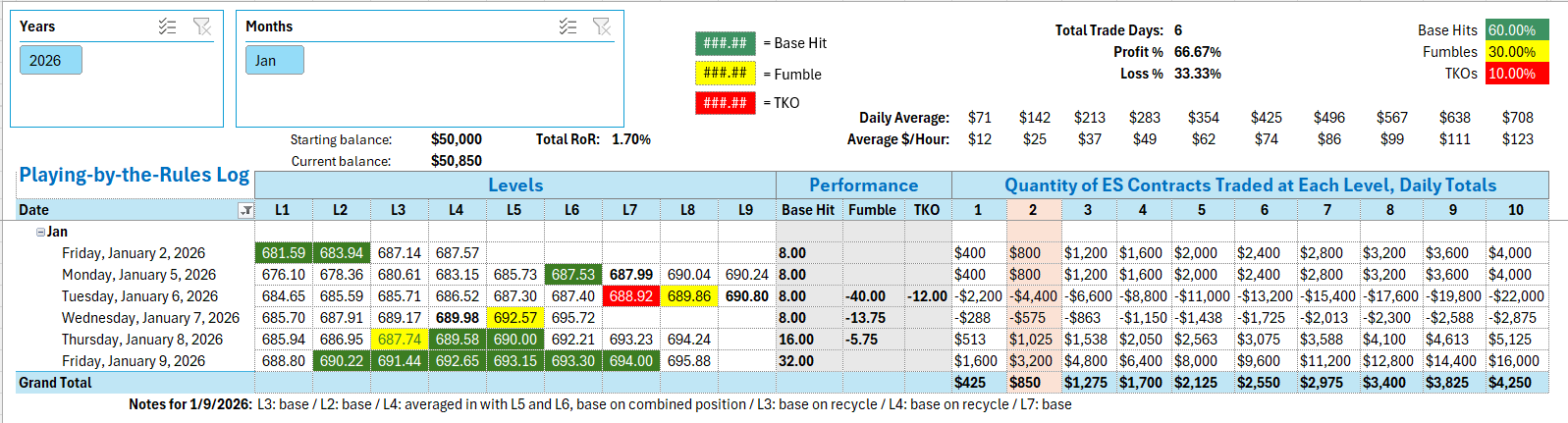

Tracking log to-date for 2026: