SPY Levels & Game Plan

Friday, January 30, 2026

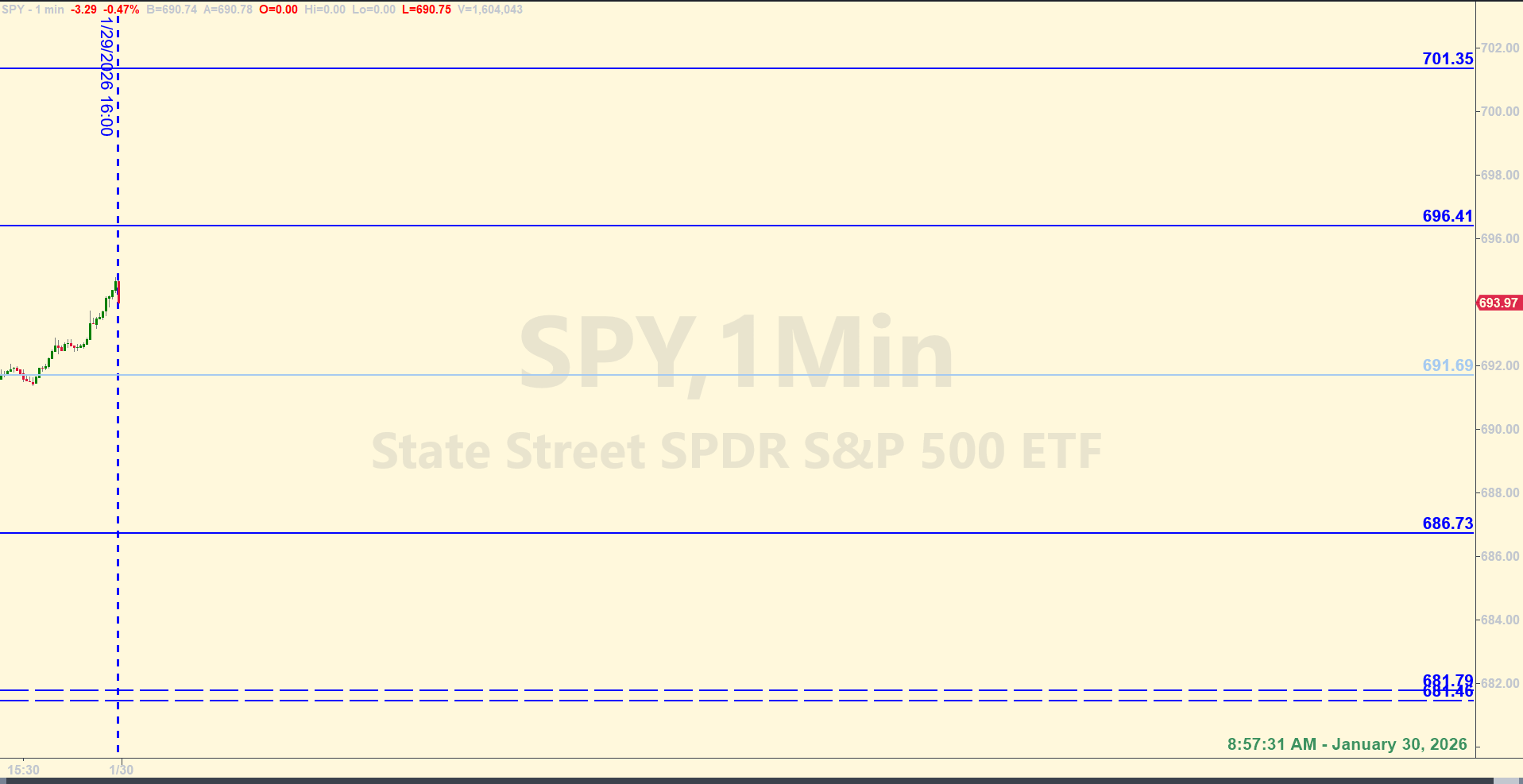

8:57 am Eastern - Big picture is that the SPY is still bullish. There's nothing bearish about the monthly, weekly, or daily charts. Since today is the last trading day of January, it's good to consider where price might close today. After yesterday's whipsaw down and back up as the SPY settled in after the post-Fed decision on interest rates on Wednesday, it puts price back more in the middle of stuff. There was a level on the board yesterday at 691.50 that didn't do anything to price the first time price hit it - they fell right through it. But the level was and still is important. Once price stabilized by the end of the regular session, price was back up above 691.50. Then, in the premarket this morning, price is once again messing around with 691.50 and the area around it. Check out yesterday's Recap here.

We have a level on the board for today that is slightly higher, at 691.69 that is our axis level for the day. Above 691.69 with good closes - like hourly closes - is better for the bulls, below is better for the bears. Price has been fighting back and forth in a zone of about one dollar spread of either side of 691.69 for the past couple hours. So this area should be important during the regular session too. With this axis level and all the other levels on the board for today, they will likely need more wiggle room than is typically needed. Increased volatility is likely.

There are probably other levels of support and resistance in between the levels that we do have on the board for today, but the ones we're using are necessarily far a part. We saw what happened yesterday. If we get big swings again today, it is safer to not include too many levels to trade against. A lot today will depend on price interactions with indicators on larger timeframes. Yesterday, price found a bottom at the convergence of several important levels. They weren't on the board as official levels for the day, yesterday - but then again, it wasn't like we anticipated a 120+ point swing in one day either. If price gets above or below the extremes of the levels for today, we'll need to look for other places of high-probability support and resistance in real time. There has already been a PPI data release at 8:30 am. And there could be some movement with some PMI news that comes out at 9:45 am. Be careful and trade well today.

After the closing bell...

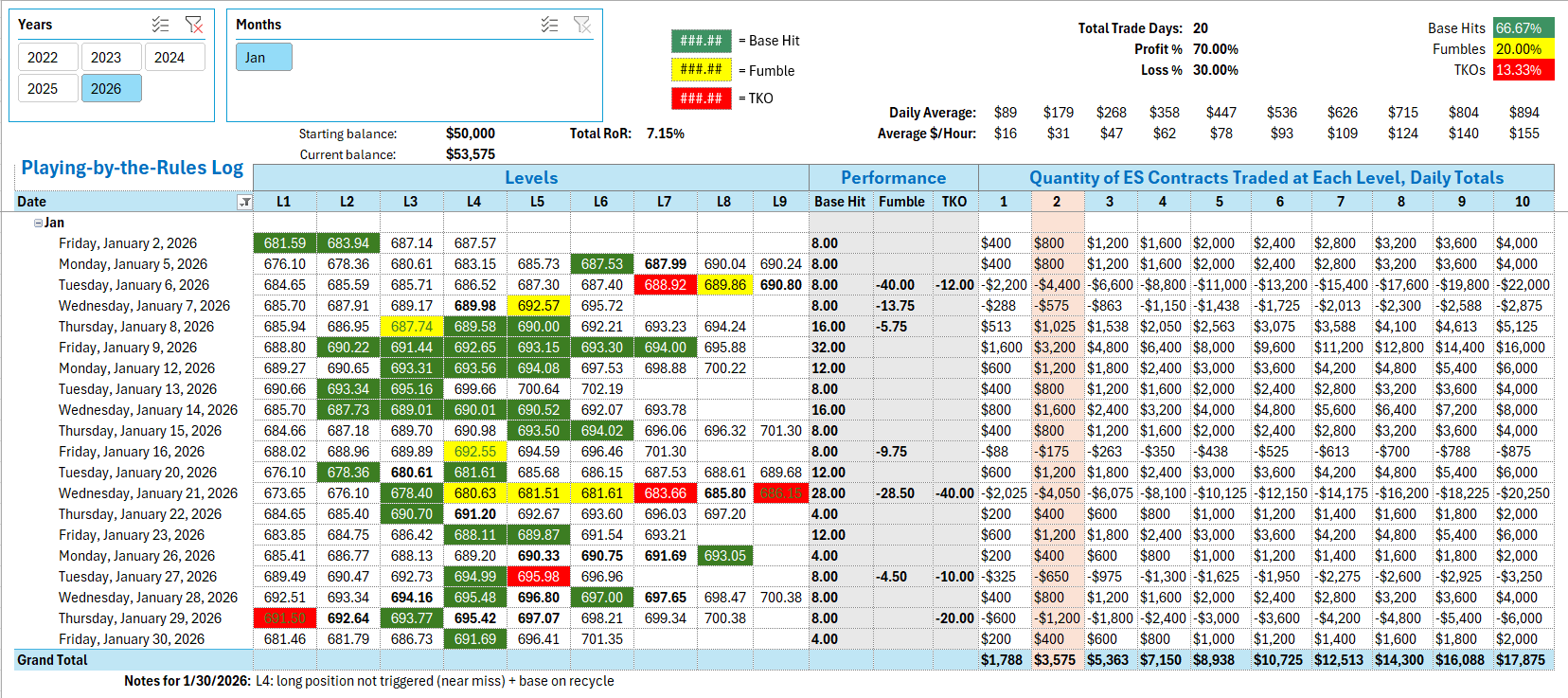

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

As we suspected, 691.69 was important today. Price couldn't leave it alone. Since it was the axis level for today, where the bulls would want to stay above and the bears would want to stay below, it makes sense that they fought this level all day. It put the close of the day near the open, and now we have a nice doji candle on the daily chart. Pretty decent swings - about 70 points from high to low and yet they closed within pennies from where they opened. Not sure this means a whole lot yet, but it does signify some indecision in the SPY - at least for now.

After the first 15-minute candle closed, price was above 691.69. They came down and bounced before hitting the level, so that's a Near Miss. The level was clearly important, because price bounced there multiple times before getting under the level. They retested the level from below the first time too soon to take a Recycle Trade, and the next time price came up into 691.69 from below at about 12:33 pm, the came close and fell away before hitting the level. That's another Near Miss. We talked this morning in the Game Plan about the levels needing more wiggle room to pull in trades, and this is why I mentioned that. The 5-cent buffer wasn't enough to trigger the trades, but 10 or 15-cents would have worked. These aren't Base Hit trades per the rules, even though the level worked very well for many different hits. As I'll explain below, with the way price behaved at two of the levels today, you should have been able to pull at least one Base Hit. So, I'm considering the Recycle Trade the one where you would have pulled some points relatively easy.

When price got down to 686.73, they came up close again and started to bounce. The didn't get within 10 cents of the operating level and the way they bounced and climbed fast was bullish. There were a lot of buyers on top of the level - which was an important level - and the buying was strong enough to get a good rally going. Those facts, along with a couple good signals on some longer timeframe charts were telling us that the bulls were getting back in gear to push price back up. So, while the level at 686.73 was not hit precisely, the area was important support and there were clear signals on other timeframes, so this was where you should have been able to pull some dollars from the market. The bounce in front of 686.73 is where I took my only trade of the day. When price started to bounce, I got on board with a few contracts and pulled 17 points. If I can do that at an obvious place of support, then you should have been able to pull at least a 4-point Base Hit at some point today. Both 691.69 and 686.73 were important today, and you knew that before the market even opened, courtesy of the Game Plan.

Per the rules, a total of 4 ES points for the day.

Tracking log to-date for 2026: