SPY Levels & Game Plan

Tuesday, January 27, 2026

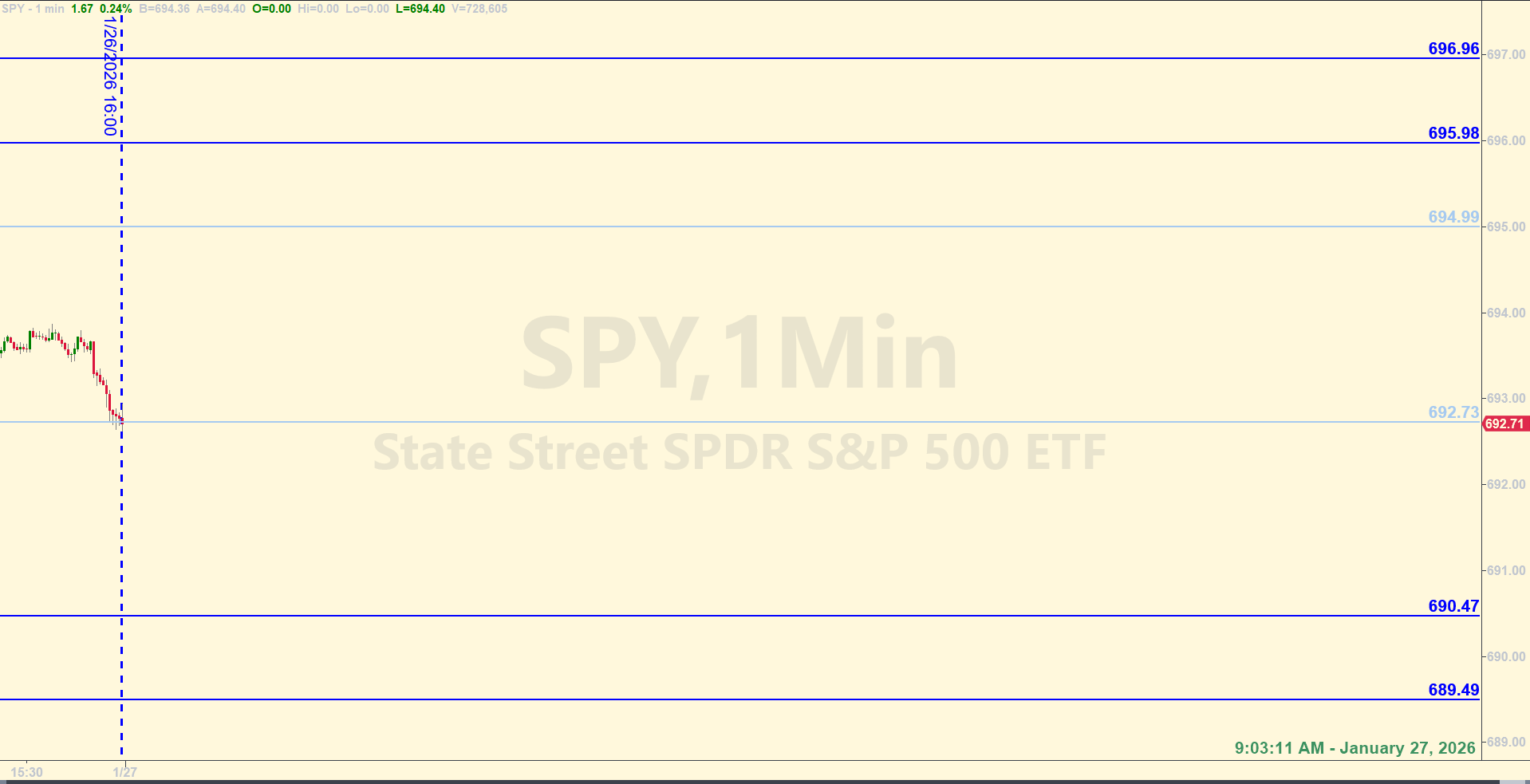

9:03 am Eastern - Price in the SPY is getting a little boost in the premarket this morning. The bulls are nudging up to a trendline that they'll need to break above to continue a grind higher. If price gets above and starts closing above 694.99, that would put the bulls in a better position to target the former all-time highs and possibly break above. They'll have their work cut out, but it's very possible price will find itself at a pivotal point by the time the FOMC news is released tomorrow at 2:00 pm. This kind of thing tends to happen a lot leading up to FOMC announcements. So decisions will need to be made, and the next mid-to-long-term direction in the market could start to take place. If nothing comes out of the news tomorrow, the big picture is likely to continue to look like a big, slow rollover. Remember, the big picture is bullish - nothing has happened yet to negate that. But being so far "extended" gives price room to reset a little - move back down into longer-term support, while the overall market remains bullish. It would be good to keep this in mind until the next obvious leg in the market becomes apparent.

Usually, the Tuesday before the FOMC data drop is slow. And usually, the path of least resistance is up in a slow, low-volume market. But be aware that there are areas above current price that the bears won't give up without some kind of fight. In the past few months, we've seen price get near the highs, then meet strong overhead resistance and fall back down a not insignificant amount of points in a short amount of time. Right now, price is up in the same neighborhood where they keep meeting resistance.

The question is - will this be the time the bulls can break out? With the upcoming news tomorrow and considering where price is in time and space, either can happen this week - either price gets to the highs and the bulls try to break above and establish a foothold where they might be able to get the next leg in the market going in the upward direction. Or, the bears come back out and start another sell program and trip up the bulls. Both scenarios are equally possible. Don't forget that several attempts by the bulls to get daily closes above former highs have been thwarted by the bears. Each time, price falls again.

One clue we might get that lower prices are possible - at least in the interim - is if price gets below yesterday's close at 692.73 and we see hourly closes under that area. It may not be much, but it could be a start of something bigger. It would be better for the bulls if they can stay above 692.73, and better still if they can get above and stay above the 695.00 area.

There is a consumer confidence data release coming out at 10:00 am Eastern today. It might be a non-factor, but it would be good to be aware of your surroundings at that time nonetheless. Trade well today.

After the closing bell...

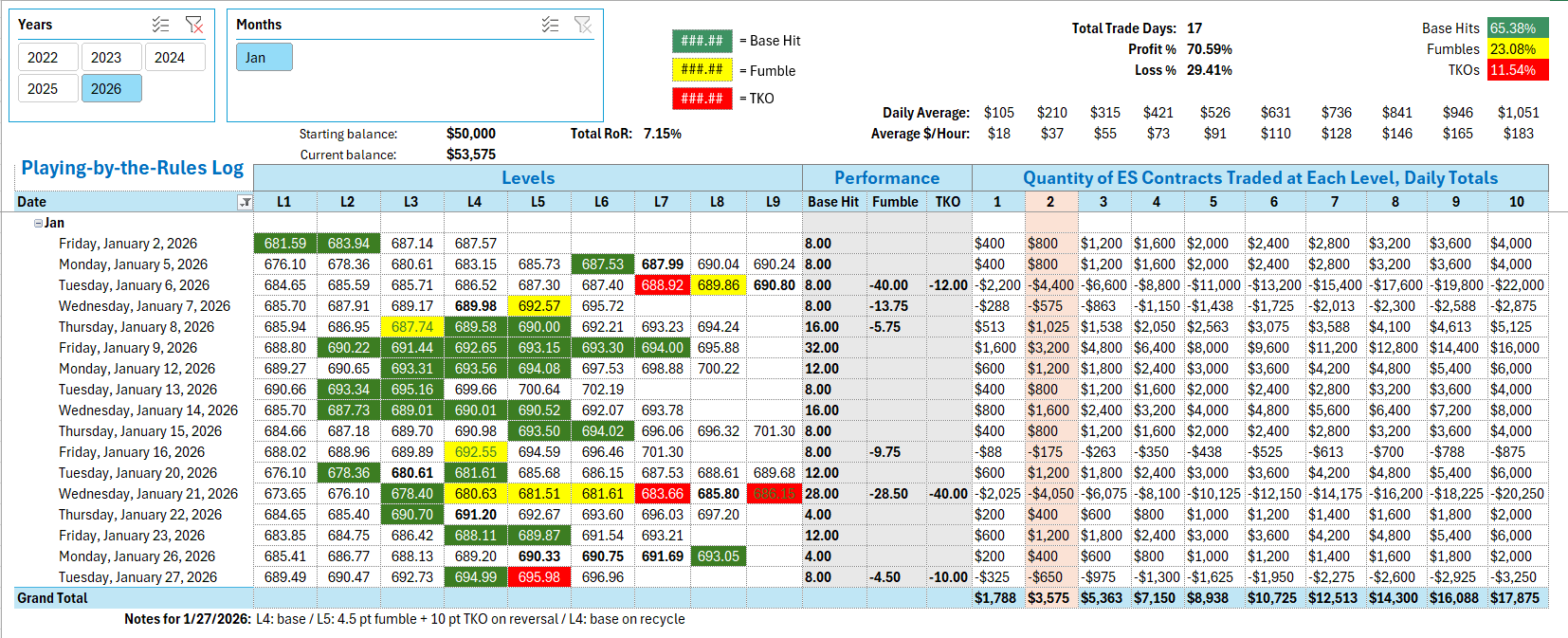

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

Like yesterday, there were some buyers at the open, keeping the bullish thing intact. It didn't take them long to get above the bull axis of 694.99. The first trade was a short at 694.99, giving the bears a chance to defend the level. They did exactly that and the pull back netted a Base Hit. Price got above that level and went straight up into 695.98. There was a little pull back initially , but bullish momentum kept price rising until they had broken the former all time high of 696.09. Sticking to the rules, there was a Fumble signal where you reversed the trade at a 4.5 point loss. By that point, there were clues on larger timeframes that price might be hitting resistance, if given some more time. But treating this systematically, reversing the position would have put you on the wrong side of the level and the second Fumble signal occurred at 10 points out of the money. Two Fumbles in a row is called a TKO - a technical knockout - and the trade is closed out. No need to reverse again - just get out of the fight and regroup. As I said earlier, there were clues that price would probably pull back from the 695.98 area if given some more time. As it stood with our rules though, there were two Fumbles there and that's what we're calling it. The next trade was a long at 694.99, as price bounced as expected. This was the Recycle trade at 694.99. Price got back up to 695.98 again, but you didn't trade it again. It had already been shorted. As far as we knew, this next attempt at the level could have been the time the bulls would break out and test the next level up. But they basically petered out and fell back below the level at the close of the regular session.

Per the rules, a total of -6.5 ES points for the day.

Tracking log to-date for 2026: