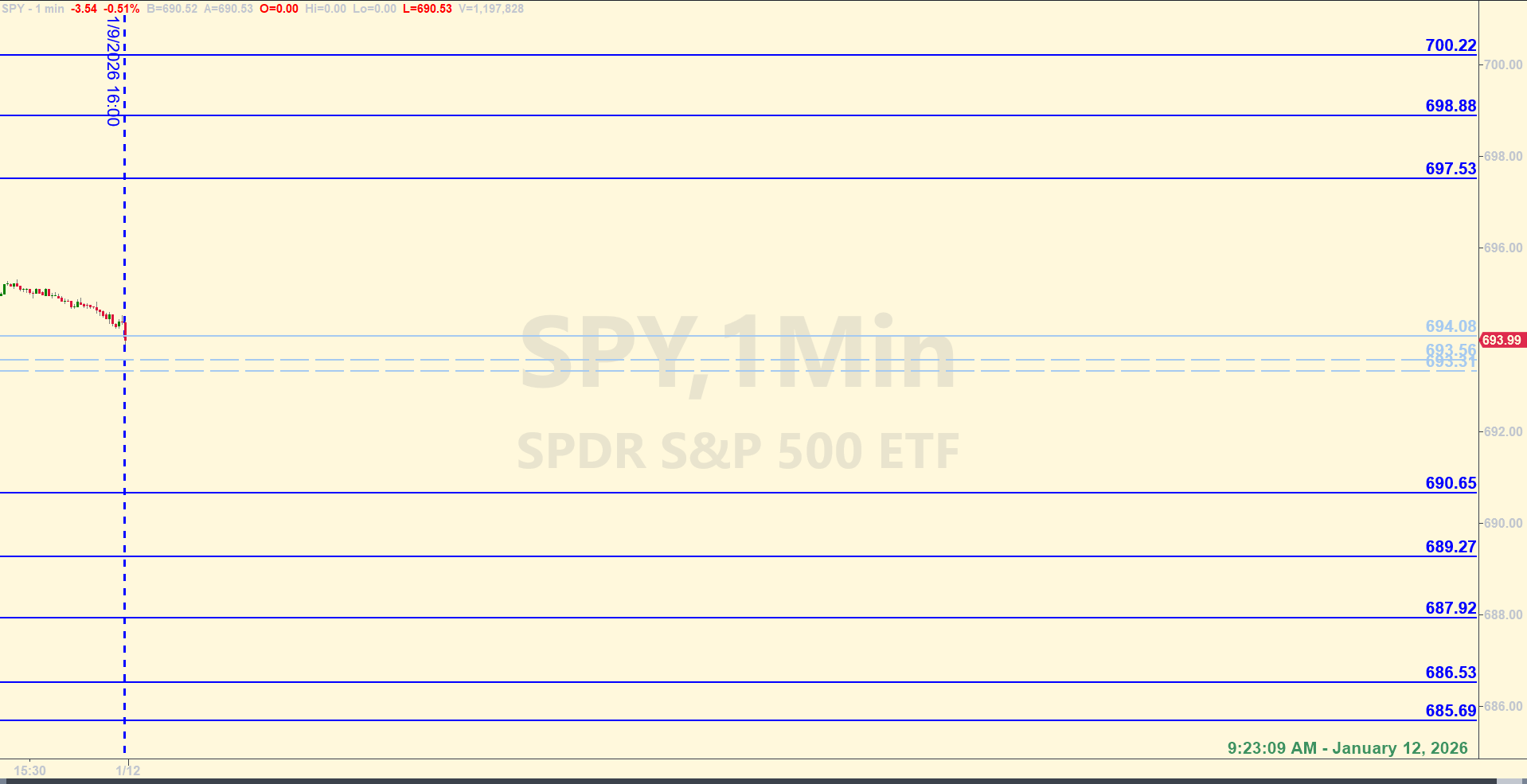

SPY Levels & Game Plan

Monday, January 12, 2026

9:23 AM - The level at 694.00 from Friday turned out to be strong overhead resistance. After the closing bell and throughout the premarket session, the futures pulled price down a good amount – around a 50 S&P point drop so far. Right now, as of 9:04 AM EST as I write this, price is hovering under a level we have for today at 690.65. They’ve managed to climb out of the low of the overnight drop. There will likely be some bulls trying to regain lost ground today in the regular session. But at the same time, the drop during the Globex session isn’t insignificant. The bears may be able to maintain that momentum.

So the chance for increased volatility is higher than usual for today. Keep this in mind because some of the levels on the board for today are relatively close together – or will feel close together – if price is moving fast. No guarantees that there will be bigger-than-usual swings today, but it’s a possibility.

Price got below a trendline and is poised to open under it. That trendline runs from about 693.31 to 693.56 for today. those are the dashed light blue levels in the screenshot. And right above that area, at 694.08, is Friday’s close. That whole area is likely to be a bull/bear battle ground. Above 694.08 with hourly closes and the bulls could climb. Staying below the trendline area keeps the ball in the bear’s court. This whole area is the axis area for today.

There are a lot of data releases this week. Nothing significant scheduled for today, but starting tomorrow, Tuesday, 1/13, things could get interesting. Especially if there is a tariff ruling by the Supreme Court this week. Pay attention to the longer timeframes and look for convergences before trading against the levels today. That’s something you should always do, but in the event of increased volatility, usually one area in the SPY emerges to be the main support or resistance for the day – and understanding the big picture can help in determining the highest probability which level will be the money spot. Going for base hit trades per the Ticks & Trades rules in the E-minis as price reacts at the levels is always the conservative approach. Trade well today.

After the closing bell...

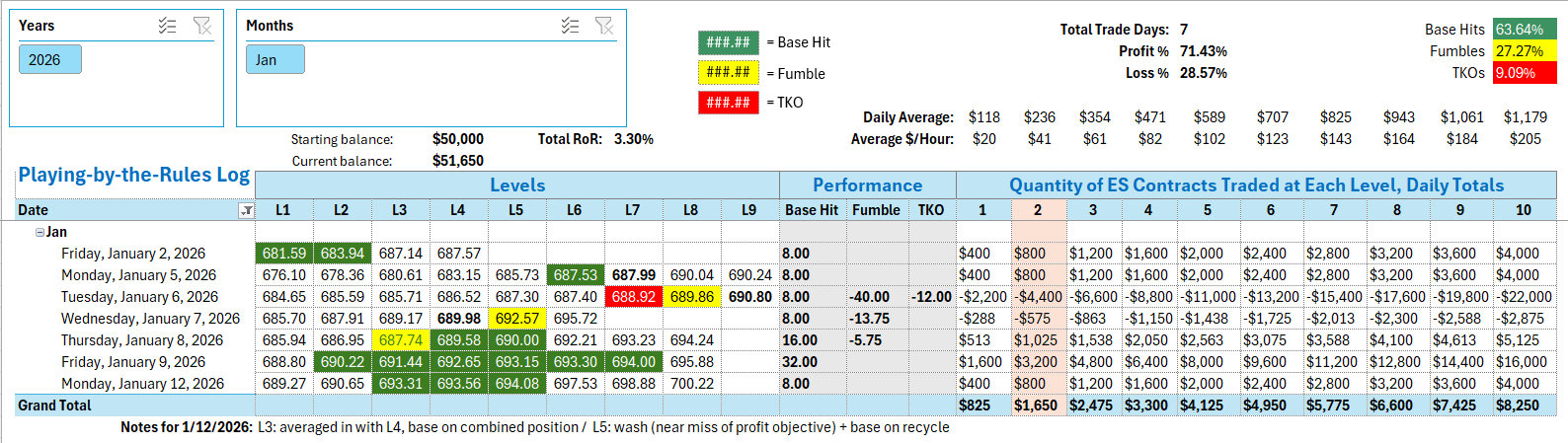

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

If we didn't have a rule that says to give the market 15 minutes to settle in before entering any new futures trades, we might have been able to buy at 690.65 and ride that long position as price launched from that level. It was an important level we talked about in the Game Plan from the morning. But we'll only count the trades you took per the Ticks & Trades strategy. The level at 693.31 - the bottom of the zone - was where you entered the first short position, then doubled the position size as price quickly went to the top of the zone at 693.56. The pull back gave you Base Hit numbers one and two. The short trade entered at level 694.08 was closed out at breakeven after a Near Miss of the profit objective. On the retest from above, the Recycle Trade at 694.08 launched price again, and that handed you your third and final official Base Hit trade of the day.

Per the rules, a total of 12 ES points for the day.

Tracking log to-date for 2026: