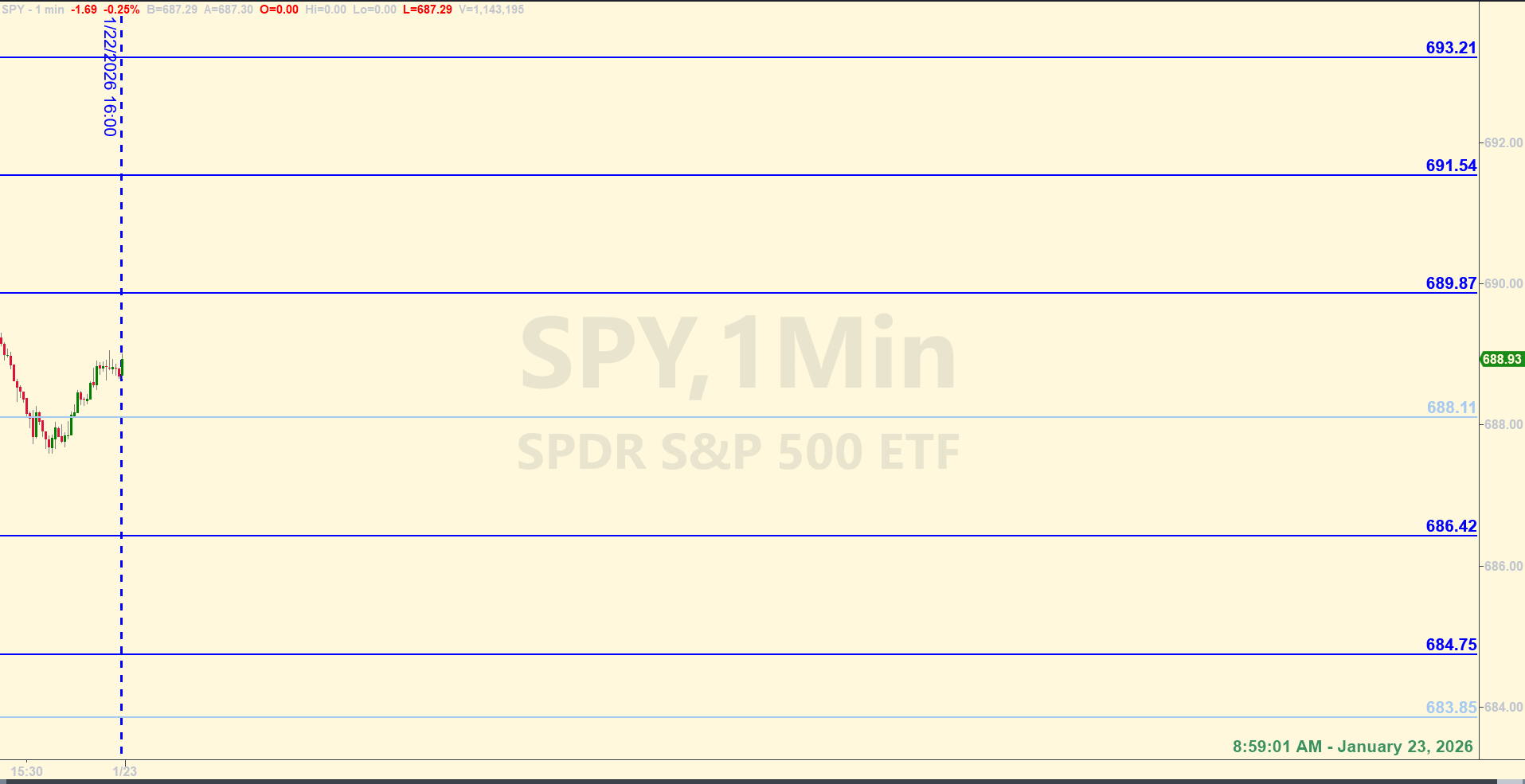

SPY Levels & Game Plan

Friday, January 23, 2026

8:59 am Eastern - Nothing has been gained in the overnight and premarket session so far. Right now, with about 40 minutes until the opening bell, price is under where they closed yesterday. The level at 688.11 is an area they're fighting. This is our axis level for today. Staying above 688.11 and establishing hourly closes above it could mean the bulls will try to break above yesterday's high. Doing that opens the door to higher targets. Yesterday's high was 691.13, and while that might present some interim overhead resistance if price gets up there, we have a level above that, at 691.54 that could work for a more precise short trade, if the SPY gets price up there the right way. Consolidating too long under yesterday's high could mean the bulls are building up energy to push higher - and possibly bust through 691.54.

If price stays below 688.11 on hourly closes, it could mean lower prices in the near term. They would need to get a little farther down and get below 686.42 - which would put price below an interim trendline - for the bears to start selling more. There are other levels below, like 684.75 which could provide a bounce, but the real line in the sand for the bulls to defend is 683.85. If price gets down there and 683.85 doesn't hold, the bears are probably going to try for a more meaningful pullback from that area. I'm not sure I would be willing to trade against 683.85 on the long side without additional confirmation of it being decent support. Looking for clues in real time if price approaches that level is the plan. As it stands right now, price is still in the middle of stuff and they could go either direction.

There are more data releases this morning. At 9:45 am Eastern, we have a PMI news item. And also at 10:00 am there could be more movement added to the market with the Michigan Consumer Expectation / Sentiment Index data release. It could be nothing, but it doesn't hurt to be aware of that one. It has caused price to whip around before. And there is still looming tariff hearing news. Depending on how that goes - or if it goes - it could affect price. So keep an eye on geopolitical events, just in case. In a "normal" market, the levels are expected to provide base hit trades most of the time. When market activity isn't so normal, price can do anything. With that in mind, be careful and trade well today.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

Trade number one was entered on the short side as price came up into 688.11 within a minute of the 9:45 am (Eastern) candle close. That was your first Base Hit. Second Base Hit was the short position taken at 689.87 at 10:26 am. That was a quick and clean trade. There was a Recycle trade at 689.87 on the other side for a long position, when price came back down at hit the operating level of 689.87 at 11:29 am, but that trade was aborted at breakeven for a wash. There was a 4-point bounce in the E-minis, but it may not have reached the ask price, and since I'm not sure (as I didn't take that Recycle trade myself) we're not counting that bounce at 689.87 on the long side as an official trade. It did take a few minutes, but support was established and price did bounce higher for what's it's worth. I consider it good confirmation to see behavior like this that the levels work even at times when adhering strictly to the rules makes you miss a trade every now and then. The main reason for the rules is to enforce discipline and keep us out of trouble for when the market does things not congruent with the design of our trades. The last Base Hit for the day was the Recycle back down at 688.11 at 12:53 pm.

Per the rules, a total of 12 ES points for the day.

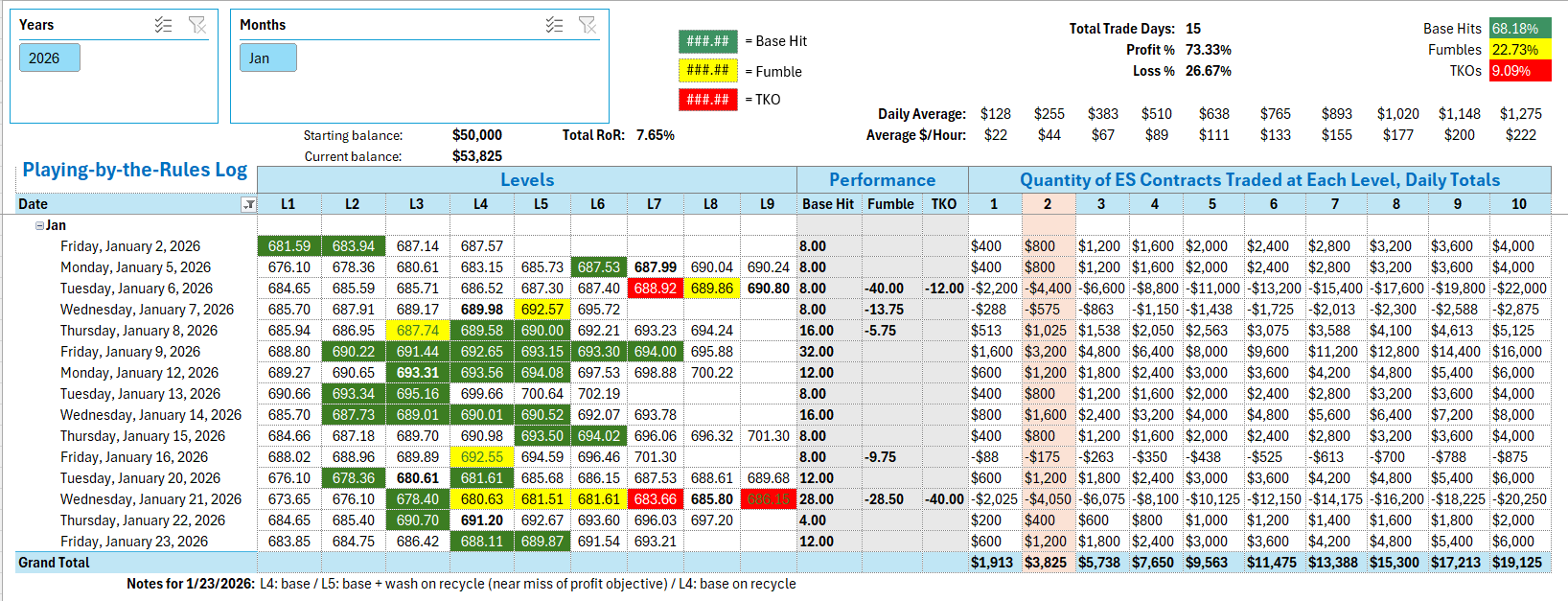

Tracking log to-date for 2026: