SPY Levels & Game Plan

Friday, December 12, 2025

9:09 AM Eastern - It appears that the Wednesday FOMC rally and subsequent erasure of those gains during Thursday’s premarket activity was not a fake out as we postulated yesterday. After finding support at one of our levels from yesterday (at 682.54), the bulls drove price higher and got above the axis level – which was Wednesday’s close – and after fighting to stay above, they finally got some good closes above it. This is bullish on its face, at least in the short to mid-term.

For today, we have price in the premarket still fighting to stay above yesterday’s axis level and currently, with about 30 minutes left until the opening bell, as I write this, the bulls are fighting Thursday’s close at 689.17. They’ll need to establish closes above 689.17 to keep the bullish behavior intact. We will use 689.17 as the bull axis for today. Staying above with 15-minute, 30-minute, and hourly candle closes is good for the bull case.

If the SPY can break into new highs, the only areas above 689.17 that I’m comfortable with including as tradable levels start with a zone up between 692.57 to 693.22. That could be a good place for a pullback, if price gets up there.

If price starts to fall and gets below 687.57, that could be a sign the bulls are taking a break. Candle closes below 687.57 will be our signal that the bears could be trying for a renewed pullback into the support areas below 687.57.

Both the axis levels can be traded for base hits, as bull/bear battles would be expected there. But as always, it’s better to trust the levels when price interacts with them in correct way – which is to say, pursuant to the Ticks & Trades rules. Adhering to that process is a more conservative approach than to just blindly trust each and every level for a base hit trade.

Almost halfway through the month of December. A lot can still happen this month. Next Friday, the 19th marks the end of the December ES contract as well as option expirations across the market. There are news items and data releases scheduled for next week. Things could get interesting as price approaches the all-time highs again in the SPY. Also, for what it’s worth, the ES is getting very close to 7,000. That’s a psychological number for many traders and algorithms and is a target. Trade well today and have a good weekend. We’ll be back with new Levels and and new Game Plan on Monday.

After the closing bell...

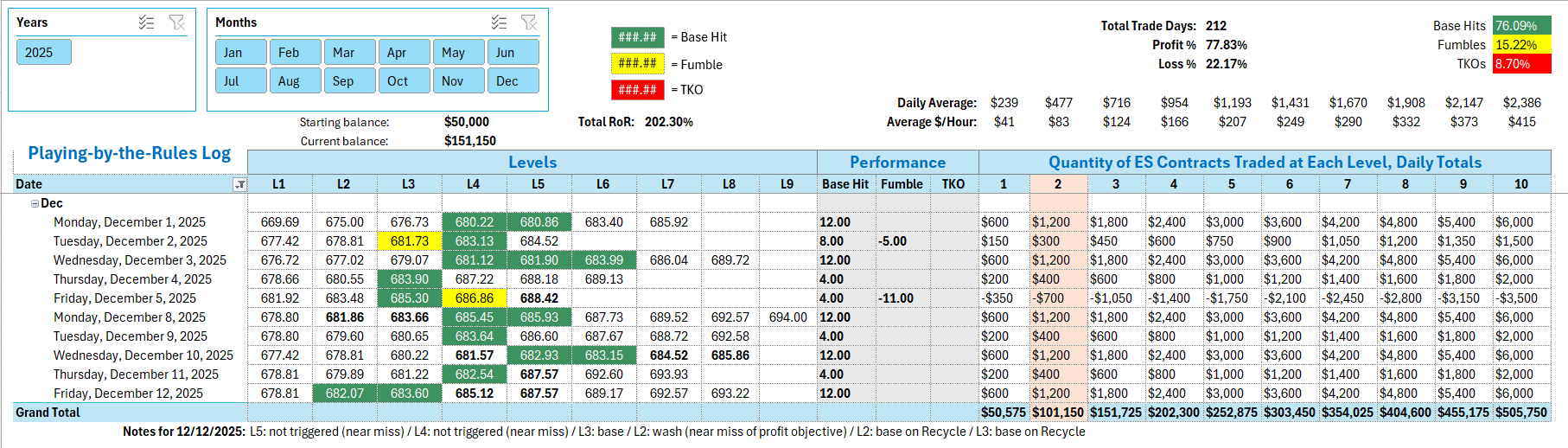

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

Interesting day, but good trades were possible if you played by the rules. Also by following the strategy to a "T", you stayed out of trouble on at least one trade. After the first 15-minute candle close, price came into 687.57, but that did not trigger a trade in the ES because there was a Near Miss of the operating level at 9:46 AM. So no trade at 687.57. Price came into 685.12 and the same thing happened - a Near Miss and no long trade triggered.

The first official Base Hit trade was a long at 683.69. A Recycle Trade at 685.12 was not entered either because not enough time elapsed - although you can see the level was resistance on the other side as price fell away from it. You went long at 682.07 and jumped out for a wash when price gave a Near Miss of the profit objective. Sticking to the process kept you from staying in that long position as price continued lower. The Recycle at 682.07 worked as designed for a short trade at 12:09 PM. The Recycle at 683.60 on the short side bagged another Base Hit. This gave you three Base Hits today. After that, the continued interaction with price at the levels were complete. No more trades, because they had been satisfied on both sides of the tape. And officially over 200% Rate of Return for the year as of today.

Per the rules, a total of 12 ES points for the day.

Tracking log to-date for 2025: