SPY Levels & Game Plan

Monday, November 10, 2025

9:16 AM – After dipping into our lowest level on the board on Friday, which was 661.63, and then climbing out of that support area, the bulls have managed to push price up and above Friday’s bull axis, which was 674.50. They gapped above that important area in the premarket session this morning. And price has stalled out (so far) right at the highest level we had on the board for Friday, at 677.74. Interesting how these levels work as targets and destinations long after the regular session is over. By the way, the levels for both Thursday and Friday last week produced several good trades. Recap videos of those days coming soon…

So, this means before the opening bell today, price is above that important 674 area. The question I have is whether last Thursday and Friday’s dip below 674 was the test of that breakout area that we’ve been saying could happen, and now the bulls are free to climb back up to the former highs… or will this attempted rally not hold, and price get back down below 674 and the bears come out again. Both scenarios are possible.

Today’s bear axis is down at 670.90. That is near Friday’s close. If the bears can get closes of longer timeframe candles below 670.90, then that’s not good for the bulls – at least for today. And of course, if price is down in the 670.90 area, that means they already got below 674, and there would likely be overall weakness in the market at that point.

They’ll need to get price above some overhead resistance areas before they can run. Notice on the hourly chart at this exact point in time, that we have the 50-period and 100-period moving averages converging at about SPY 677.63. That area is right above a level we have on the board for today at 677.45. This whole area is the first place the bulls will need to fight to get above and start closing candles above to go higher. If they succeed, the next area of overhead resistance is a zone at 680.85 to 681.38. There could be other interim areas of resistance, but nothing I’m willing to put on the board to trade against.

If price gets up to 682.74, I’d want to see more reasons in real time on other longer time frame charts before trusting that level for a reaction. There is an open gap above that level which is at 683.37 that could resist price, so that could be a safety net if you’re in a short position at the 682.74 level. No data releases of significance on the schedule for today. Increased volatility and larger-than-usual swings are possible again today. Be careful and trade well.

After the closing bell...

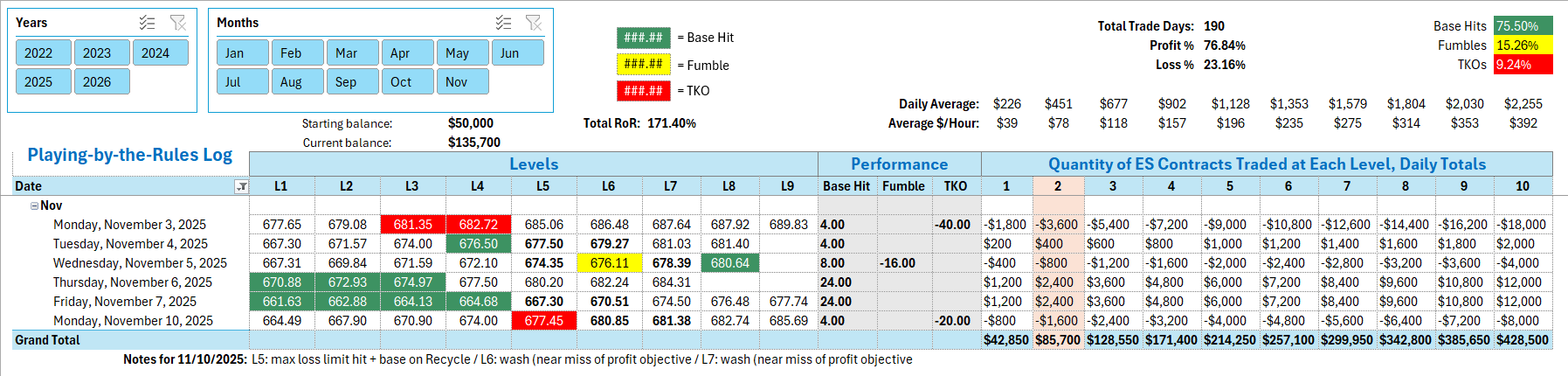

Trading by the Ticks & Trades Rules, here is where you would have landed for the day:

At 10:51 AM, a long trade was entered at 677.45. The level didn't hold and there wasn't enough initial support for the trade to work. The max loss limit was hit and the position closed out. The Recycle of that trade - on the short side, at about 12:05 PM, worked as designed for a counter-trend scalp. A four-point Base Hit, per the rules. The next level hit was the bottom of the zone at 680.85. That short trade would have been closed at breakeven for a Wash because of a Near Miss of the 4-point profit objective. The next trade was a short at 681.38 - the top of the zone, at 1:53 PM was also a Wash. The profit objective was missed by a few pennies before reverting back to the entry point within three minutes.

Per the rules, a total of -16 ES points for the day.

Tracking Log to-date for 2025: