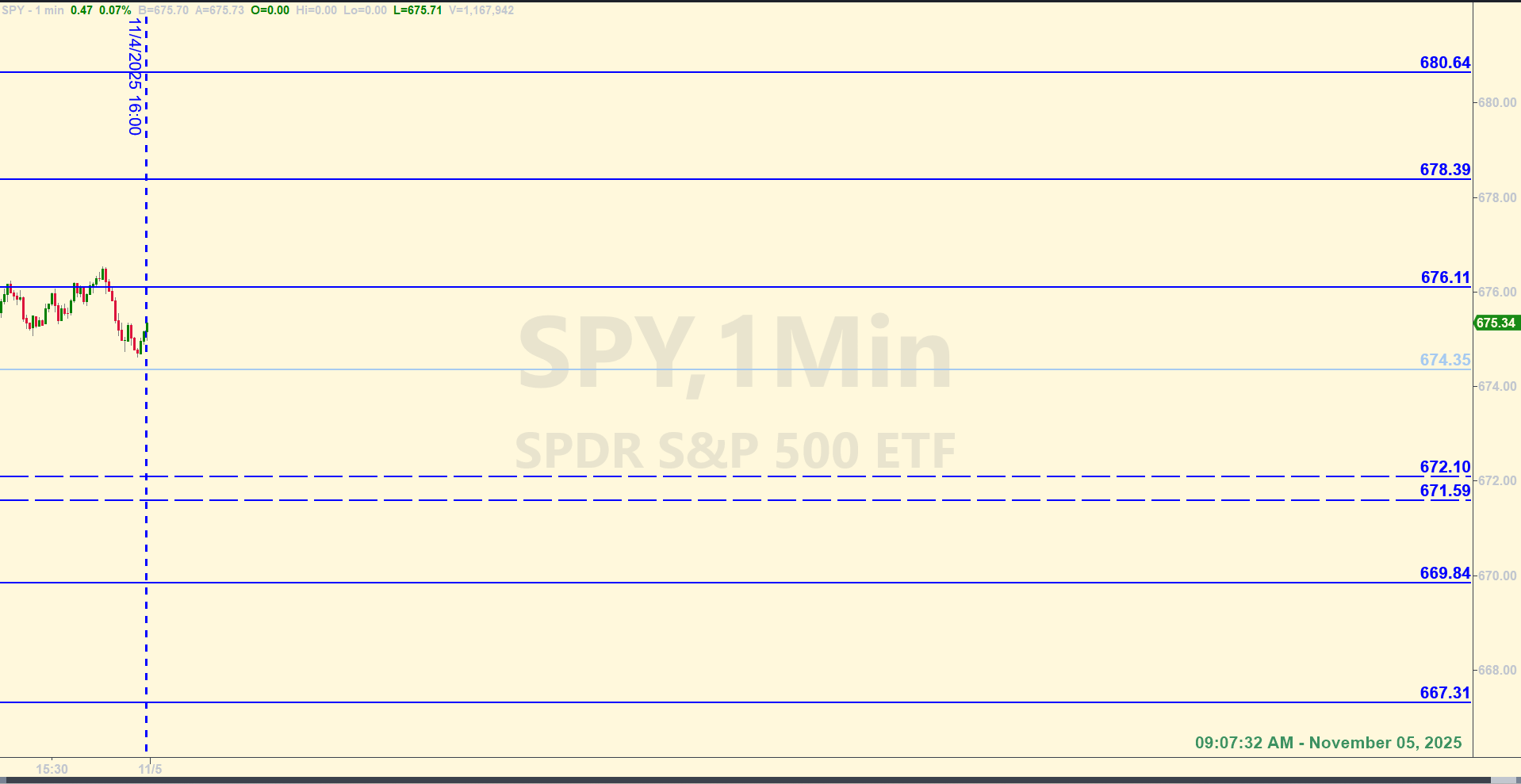

SPY Levels & Game Plan

Wednesday, November 5, 2025

9:07 AM – As proof of the importance of SPY 674.00, price has been fighting it all night. They went down to around 672.30 before getting back up to (and currently above) 674. As we discussed in yesterday’s Recap Video, what they do with 674 will likely set the tone for the rest of the week.

As of 8:50 AM Eastern as I write this, price is climbing back out of the 674 area. On the 1-hour and 30-minute charts from yesterday, price is poised to begin the climb out of the bottom of a bullish consolidation pattern that developed all of yesterday. If that plays out, price has the potential to get up to and possibly above 680. That the bull case for today.

For the bear case, price would need to get below 674.50 and start closing candles below that level for the bull pattern to become less important. Hourly closes below 674 and the bears probably have plans to pull price down more. The axis level for today is 674.35. You can say that above 674.50 is better for the bulls, but 674.35 is their main line in the sand. Staying above this axis level keeps the bullish consolidation intact. Hourly closes below 674.35 and the bears can move price down easier.

With the big picture in mind, as well as the axis level for the day – and what price does with it – you can use the other levels as entry points for ES futures trades. Base hits are the plan, but keep in mind that if price does start moving a lot out of the bullish consolidation, the target for today is 680 and above. If the bullish consolidation fails, price can still react at the levels – and the zone between 672.10 to 671.59, but energy can be released in the opposite direction. In other words, there is the potential for the bears to come out and try pulling price down if the bulls can’t maintain closes above the bottom of their consolidation pattern – which is 674.50.

At 10:00 AM Eastern, there is another PMI data release. Something to be aware of – especially if price happens to be near one of our levels at that time. These kind of data/news releases have the potential to kickstart price movements in one direction or another. Keep an eye on longer time frame charts and know your surroundings. Trade well today.

After the closing bell...

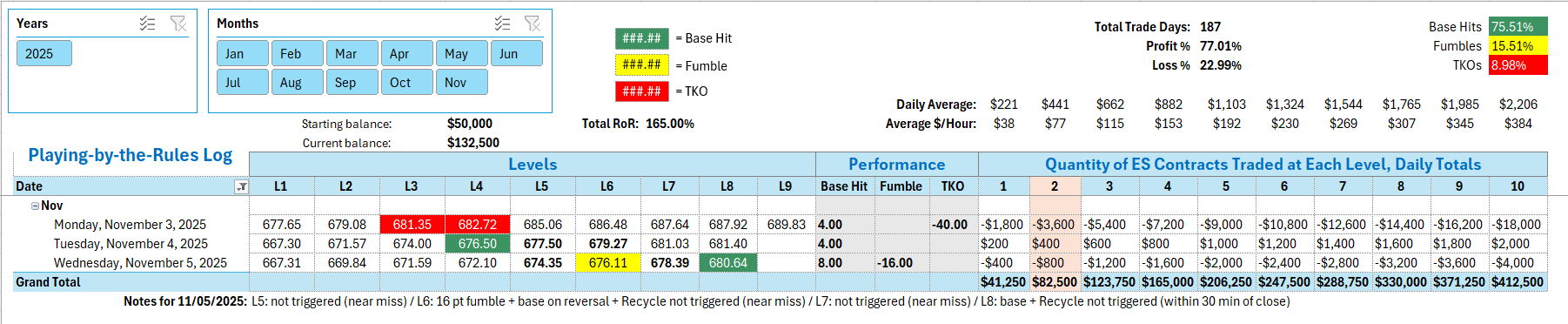

Trading by the Ticks & Trades Rules, here is where you would have landed for the day:

Near Miss at 674.35 - missed the operating level by one penny before price rocketed off it. A 16-point Fumble at 676.11, plus a Base Hit on the reversal. Recycle Trade at 676.11 not entered because of another Near Miss (by only pennies, before bouncing). 678.39 not triggered because of yet another Near Miss. When price finally did hit 678.39, there was almost a Base Hit reaction in the other direction, but playing by the rules, the level would not have been traded against on the short side. One solid Base Hit at 680.64. No Recycle Trade back at 678.39 on the long side because of the time of day - outside our window of opportunity.

Per the rules, net -8 ES points for the day.

Tracking Log to-date for 2025: