SPY Levels & Game Plan

Wednesday, November 19, 2025

9:14 AM – The SPY is at an interesting place right now. The axis level for today is 662.10, and price has been hanging around that level in the premarket. It’s an important place that if the bulls can’t defend it, price can fall. They’re already below areas of support, including several trendlines, and the daily 50-period MA. This means that if the bulls try to rally, they’ll have a lot of overhead resistance to fight through. It probably won’t be easy.

There are, however, a couple signs from yesterday of a potential trend change – at least in the interim – that indicate that the SPY could get a bounce. The 4-hour chart, in particular, left us with at least two signs that price could bounce from where they currently are. But if they try to do that, they’ll quickly hit resistance. So, it makes where price is right now a very interesting place. Swings have been wide and volatile lately, and today is likely to be no exception.

The level at 658.04 will be another line in the sand for the bulls if they get down there again today. There will likely be a bull/bear battle there because the bulls know they need to defend it. If price gets below and we get hourly closes below 658.04, that puts the ball in the bears court. If price is down there, they’re already below the axis level of 662.10, so volatility could pick up. Price needs to stay above 662.10 for the bulls to maintain a modicum of confidence.

But don’t forget that not far above current price is where strong overhead resistance is waiting. So, today could get interesting – if not today, then by the end of this week. Be prepared for the possibility of increased volatility. Notice the two zones on the board for today. They are wider than usual. It may be prudent to adjust position size to reduce risk when trading at the levels and zones. Also, at 2:00 PM Eastern today, FOMC meeting minutes report will be released. That has the potential of moving price around. Be aware of your surroundings leading up to 2:00 PM. Once again, be careful today, and trade well.

After the closing bell...

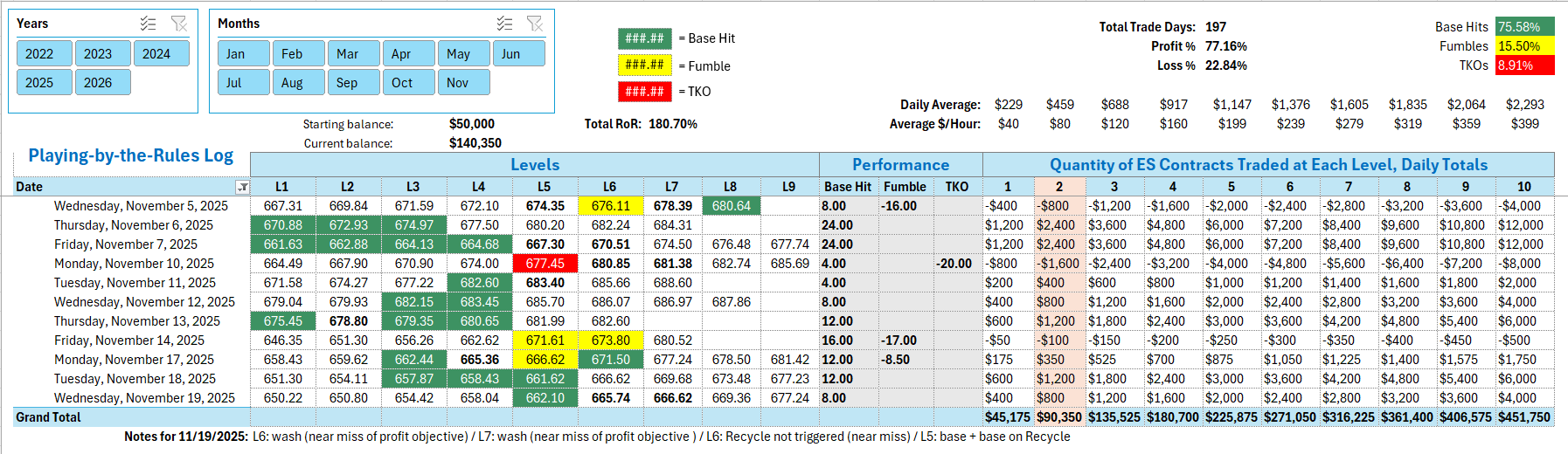

Trading by the Ticks & Trades Rules, here is where you would have landed for the day:

The whole zone between 665.74 and 666.62 proved to be very good overhead resistance when price got up there right after 1:00 AM Eastern. Following the rules though meant you jumped out at a wash on the short trade at 665.74. This was because of a Near Miss of the profit objective. And the same thing happened at 666.62. So while the whole area worked if you gave the levels more wiggle room, if we're being precise and following the rules exactly, both trades at those levels left you with zero points. The Recycle at 665.74 was not triggered because of a Near Miss of the operating level. A long trade at 662.10 at 11:07 AM gave a Base hit and another Base Hit on the Recycle trade at the same level from the other side at 1:05 PM.

Per the rules, a total of 8 ES points for the day.

Tracking log to-date for 2025: