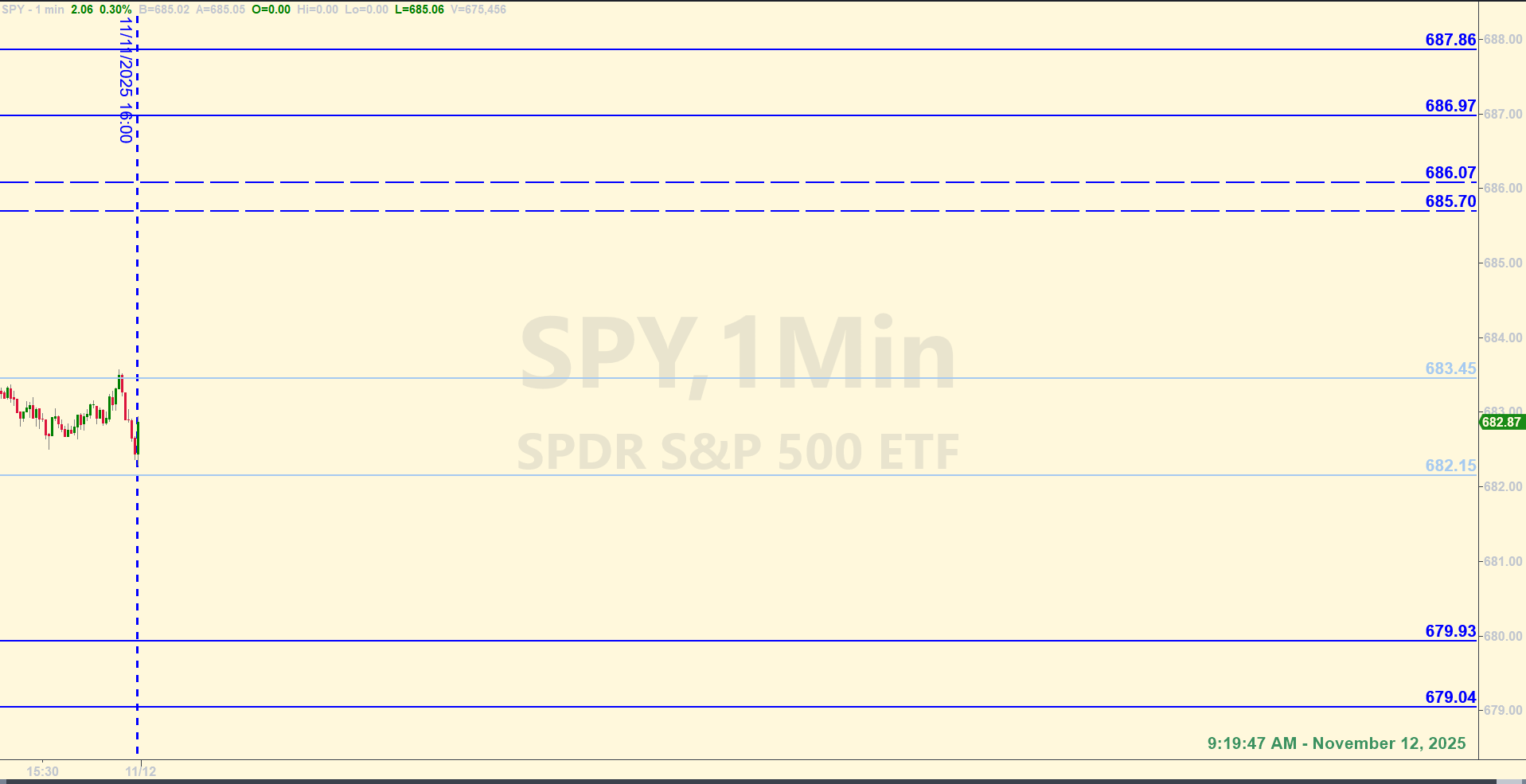

SPY Levels & Game Plan

Wednesday, November 12, 2025

9:19 AM – Once price got above the zone we had on the board for yesterday, they gapped up in the premarket and went straight to the next level we had on the board, 685.66, where they stalled out. It’s the same area they’re currently fighting to get above as of 8:45 AM this morning. It’s been interesting lately how often levels identified before the opening bell on one day, come into play and are relevant and still tradeable areas the following day in the premarket.

So this morning, the bulls have successfully gotten price above at least two important areas – one is a major retracement level from the October 29 high to the November 7 low. And another important area is a trendline that price rode under a lot of the day yesterday. For today, that trendline equates to about 683.45 and is the bull axis. Staying above that area is better for the bulls. Although for the bulls to keep climbing, they’ll need to establish closes above the zone at 685.70 to 686.07. There is room for them to run a little if they establish closes above 686.07.

The bear axis for this morning is 682.15. If we see closes of intermediate and longer time frames below 682.15, the bears may have a better chance at pulling price down more. Like most axis levels, I’d want to see more reasons why price might react there before trading against them. They are useful as gauges to help determine whether the current market is mostly bullish or mostly bearish. From where we sit currently, there is nothing bearish about the SPY. That’s not to say price can’t pull back at any point to test support areas, but until or unless price gets below important levels and establish multiple significant closes below those areas, the bulls will stay in charge.

After the closing bell...

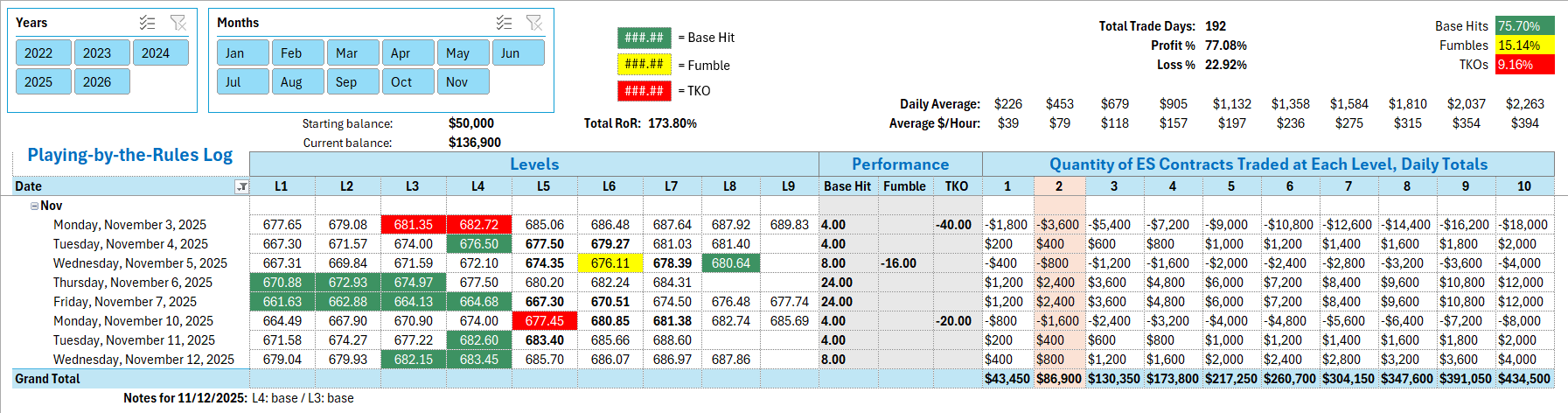

Trading by the Ticks & Trades Rules, here is where you would have landed for the day:

First trade was on the long side with the bounce at 683.45 at 9:47 AM Eastern. Price got under the level and tested it from the underside at 10:30 AM. That was not traded on the short side as a Recycle Trade because there wasn't enough time from when price got under the level and when the other side was tested. Next official Base Hit trade was at 682.15 on the long side. At 10:37 AM, they hit the level and a minute later they bounced more than enough for a 4-point Base Hit. No Recycle Trade at 682.15 after price got under it and tested it on the other side - because of the same reason as the other level. It's clear to see how both levels were important all day.

Per the rules, a total of 8 ES points for the day.

Tracking Log to-date for 2025: