SPY Levels & Game Plan

Friday, November 7, 2025

9:06 AM – Our Game Plan for yesterday predicted price action fairly well. The clues were present ahead of time, and the market respected them. The bears defied that bullish consolidation on the hourly chart from Tuesday and were able to pull price down below 674 and get a solid daily close below it. It wasn’t very long ago that all the major timeframe charts were bullish. Now price is getting under some key areas and looking more bearish – on most of the smaller timeframes.

Yesterday, we brought attention to the weekly doji candle from last week and how that tentative reversal signal appears to be playing out. Also, recall that in a recent Recap Video, we talked about the timing on the monthly chart. It’s only the first week of November and a lot can happen between now and the end of the month. But for now, the bulls are showing some weakness as they let price get below key areas on the shorter timeframes.

If that behavior bleeds into the longer timeframes, a rollover can start to take shape. In the big picture for now, we could be looking at a garden-variety reset. In that case, the question is: where is the destination on the downside that the bulls will defend? For now, if we take what the market is giving us, we don’t have anything conclusive – some increased strength by the bears, demonstrated by getting price below 674 – but we’ll need to see more on the downside before making the bear case in the big picture.

The bear axis for today is 670.51. If price stays below that level, the bears are likely to be favored, and we’ll continue to see weakness. If price can get back above and close above 674.50 – which is the bull axis for today – then the bulls will likely have the strength at that point to climb. Both these axis levels are tradeable only if price approaches them correctly. Like, by the rules. Consolidating and going sideways under 674.50 for awhile, as an example, could be a clue that the bulls are building strength to bust through and go higher. So that kind of price interaction with the bull axis would go against a rule and therefore it would not be tradeable.

The zone between 664.68 and 664.13 isn’t necessarily “stronger” than the other levels around it. It’s just a zone of less-than-precise levels. So the whole are can be treated as one big level, if you’d like. For today, bigger than usual swings can happen, so being aware of where price is in relation to other indicators is key. Like moving averages across different timeframes, directional timing of price, specific candle signals, etc. And it could be good to give the levels more wiggle room to let them play out. And of course, it’s never a bad idea to decide to not trade against a level if you don’t see any other good reasons why price should react there. A 10:00 AM Eastern data release could be a catalyst to move price around. Be careful and trade well today.

After the closing bell...

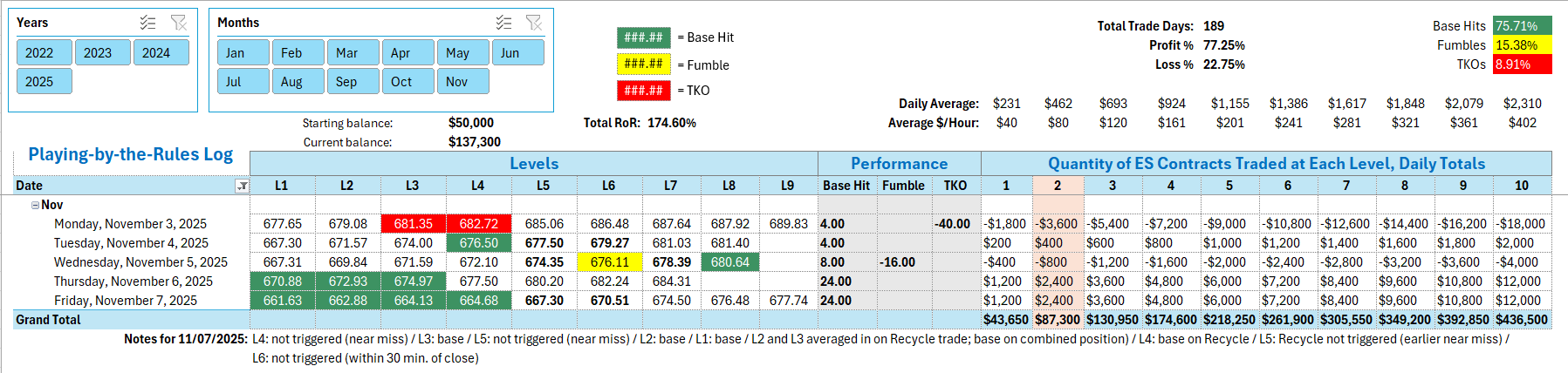

Trading by the Ticks & Trades Rules, here is where you would have landed for the day:

After our window opened after the first 15 minutes of the regular session (after 9:45 AM Eastern), the first trade would have been a long position taken in the ES when the SPY came back down into 664.68 at 9:51 AM. It did not trigger because of a Near Miss. The level at 664.13 was the first official base hit when price bounced there. When price came up into 667.30, it was another Near Miss. No trade entered. We're not trading 664.68 and 664.13 again on the long side - they've already been traded on that side for the day. So down to 662.88 and there was the the second Base Hit trade with the bounce there. Also at 661.63 with a third Base Hit. On the way back up, per the rules going short at 662.88 and 664.13 was valid. Both levels would have been averaged in and a Base Hit on the combined position for that trade. That was Base Hit numbers 4 and 5. Another Recycle Trade at 664.68 on the way up. There was a reaction enough to give a Base Hit on the short side there - at about 1:13 PM. That was the sixth and final Base Hit trade for the day. When price got up to 667.30 again, there was no new attempt at a short trade, per the rules (the first hit is the best hit). And then up at 670.51 was a no-trade because the level was hit just a few minutes before the closing bell, and we don't enter trades within the last 30-minutes of the closing bell using the Ticks & Trades strategy.

Per the rules, a total of 24 ES points for the day.

Tracking Log to-date for 2025: