SPY Levels & Game Plan

Wednesday, December 17, 2025

9:11 AM Eastern - We talked about what would likely happen if we got closes under 678.80 yesterday – that the SPY was probably targeting the trendline, which was in a zone starting down at 674.95. That’s exactly what they did. Bounced off the top of that zone, and the bulls defended that area well enough that the trendline itself wasn’t tagged. The whole area was support as foretold yesterday before the opening bell.

Yesterday’s daily candle ended up being a doji candle, which is a sign of a possible trend change. Also, on some smaller timeframes, there were clues that price was likely to rebound from where they closed on Tuesday. So it’s not a surprise that in the premarket, price has been doing just that – trying to climb out of this current pullback.

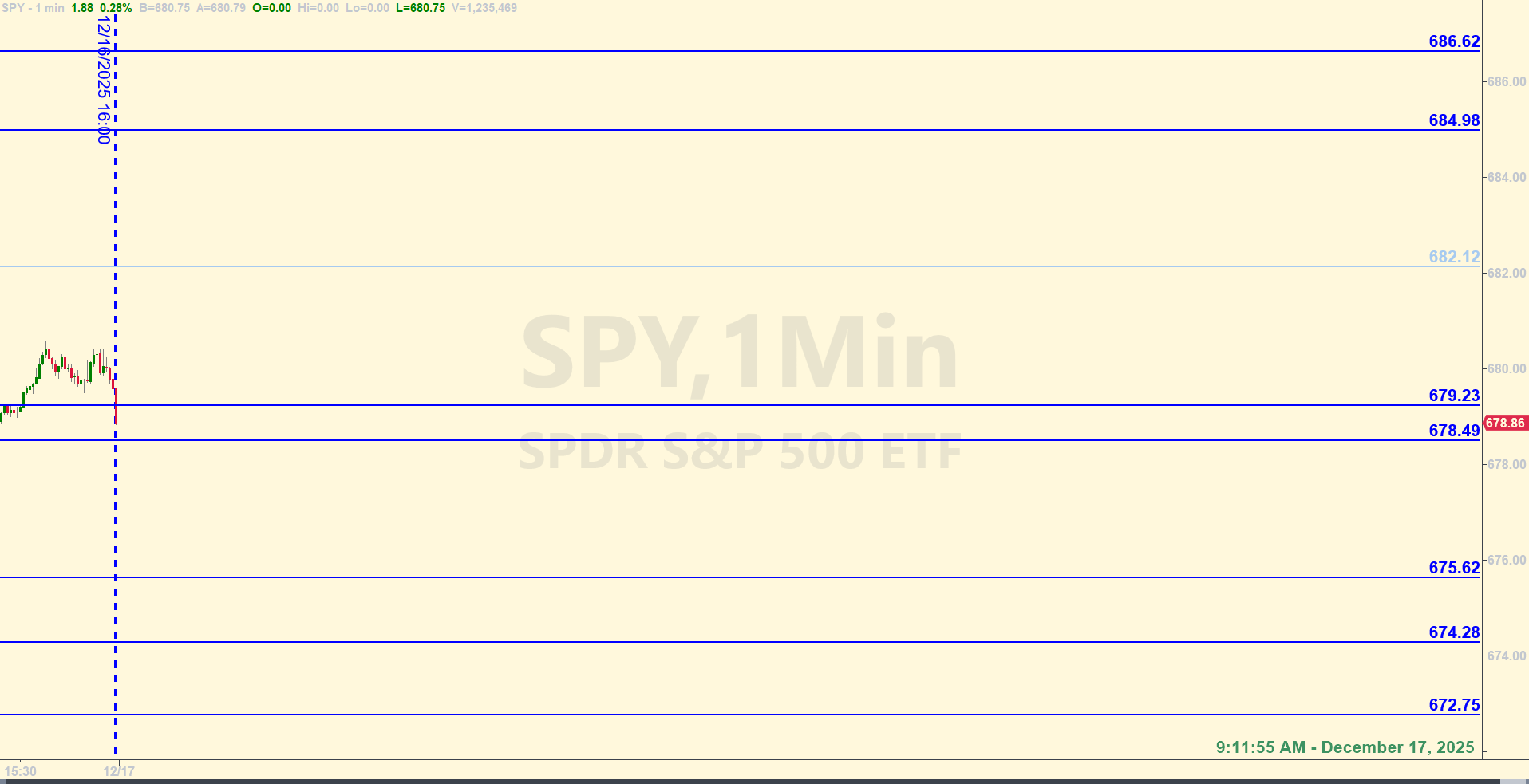

A couple things to consider: one is that price is still below the range that they’ve been consolidating in for the past three weeks. This means that getting back into it may present a challenge for the bulls. The axis level for today is 682.12. Establishing closes above 682.12 puts the bulls in a better position to climb. There are some areas of overhead resistance up there so the bears might not make it easy for the bulls to break through. It’s possible though. Don’t forget that ES 7,000 is still a target for the futures, and this Friday, the 19th is the expiration of December contract. Interesting things are likely to happen this week and next.

Also, notice a pair of levels that are relatively close together. They are 679.23 and 678.49. Typically, this could be a zone because of the close proximity of the levels, but I believe that each of these levels has it’s own importance and can be treated independently if you’re willing to trade against them. Base hits are the plan.

If price gets back down to the trendline, it’s showtime for the bulls again. That would be in the 674.00 to 673.50 area for today. Getting below and closing candles of significance below the trendline is likely a sign that the bears are in control for the time being and have targets somewhere lower. No data releases of significance scheduled for today. Stay alert and trade well.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

An easier day than yesterday. First official trade after the 15-minute window opened was a long at 678.49. After a dip under the level, they shot up to the next level, handing over a Base Hit on the way up. The next trade was a short at 679.23. Base Hit number two. The long trade at 675.62 was aborted at a wash because of a Near Miss of the profit objective. No Recycle trade at the level on the short side because not enough time had elapsed - but you can see how the level acted as resistance as it was supposed and kept pushing price down. Third a final Base Hit was at 674.28 for a solid long trade. The level at 672.75 was a no-trade because of the 20-20 Consolidation rule, which took effect after price consolidated a certain way above the level.

Per the rules, a total of 12 ES points for the day.

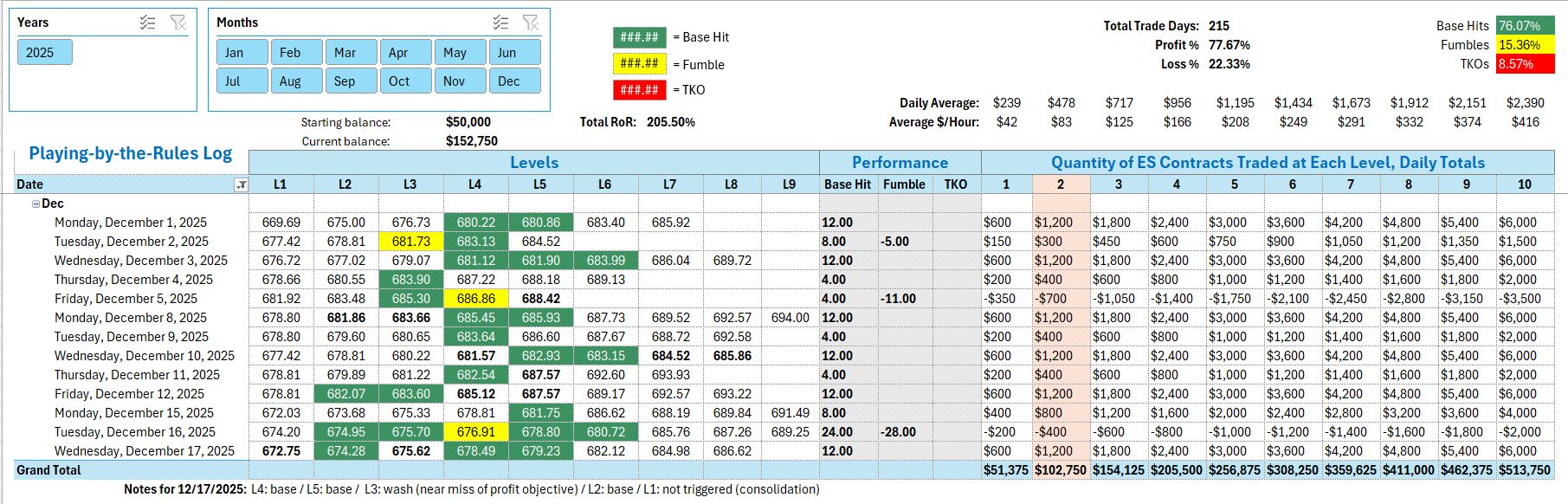

Tracking log to-date for 2025: