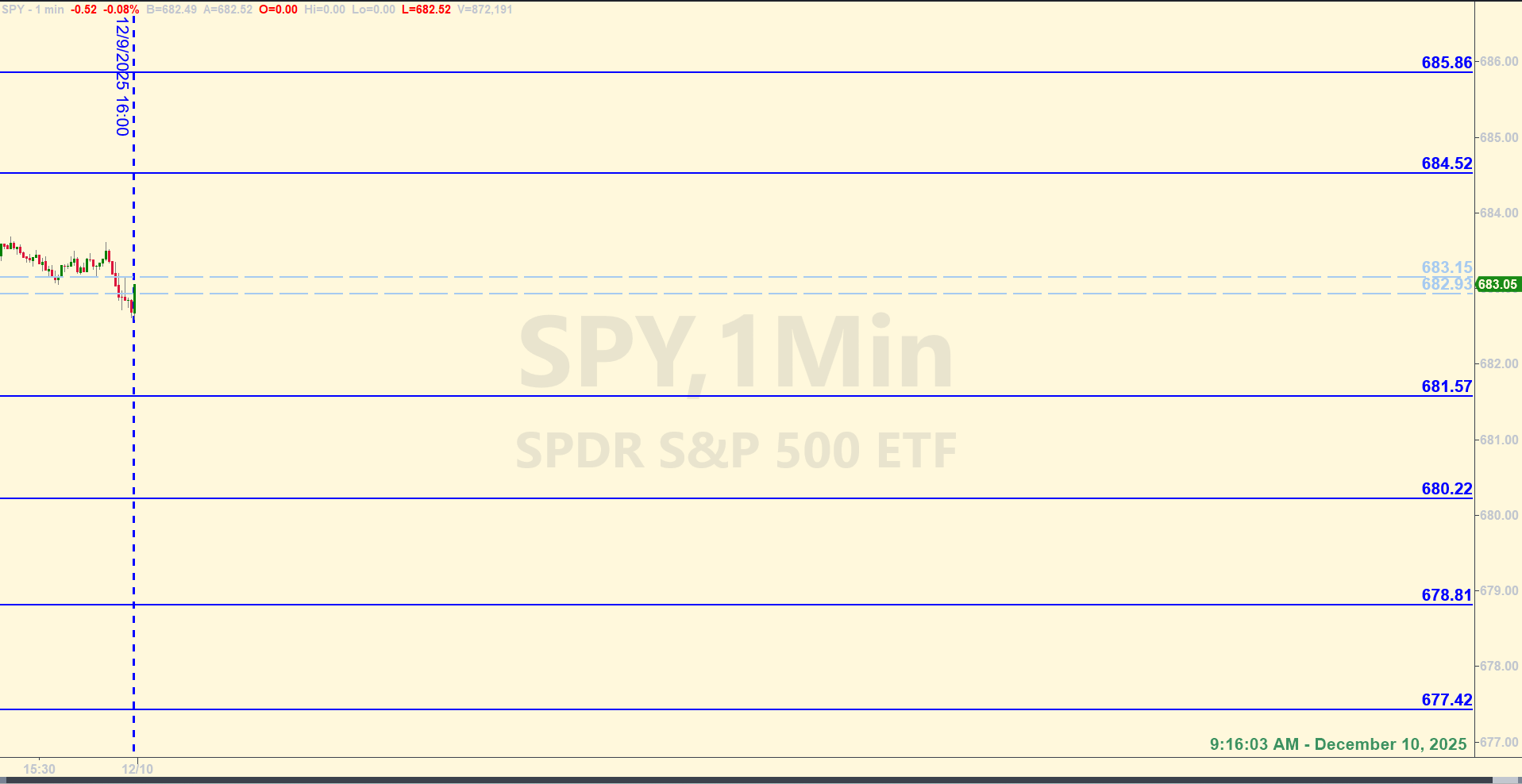

SPY Levels & Game Plan

Wednesday, December 10, 2025

9:16 AM Eastern - Tuesday’s price action was flat on the day. The bulls tried to push price up, but they couldn’t sustain it and closed near where they opened for the day. This resulted in price getting under some moving averages on the shorter timeframes, and basically giving a somewhat bearish sentiment to price action – at least for the shorter timeframes. Typically, there isn’t much movement on FOMC days leading up to 2:00 PM. After then, the gates could – and probably will – be thrown wide open. According to the rules that I try to trade by, no trades should entered after 1:00 PM today, just to play it safe.

The levels for today are straightforward. Typical and usual areas of probable support and resistance. There is a zone between 683.15 and 682.93 that is the axis area for the day. Anything can happen at 2:00 PM and later, but for the morning, at least, if price stays below this zone, the bearish sentiment is likely to remain. If the bulls can get price above the zone and close 15-min, 30-min, and hourly candles above it before 2:00 PM, that might be sign that price is trying to bounce from that area.

In the big picture though, things are going sideways. There will likely be a direction picked after the Fed decision today and that could set the tone of the market for the near future. I don’t like predicting longer-term price action, but it wouldn’t be out of the question for there to be a bigger pull back coming. Something that could take a week or two to start developing. And maybe today could be the start of a bigger long term move. Just food for thought. Look at the monthly chart of the SPY and you can make the case that some trend change signals are present. We’ll likely know within the next couple weeks to a month or so if this turns out to be true.

Trade well today, and remember that there is no shame in sitting on the sidelines and being an observer if the market starts acting out of character.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

Price was under the axis zone at the close of the first 15-minute candle. Triggering a short at the bottom of the zone at 682.93 and adding to the position by selling the same number of contracts when SPY hit the top of the zone at 683.15 - that was the plan. You pulled a Base Hit on the combined position, your first 8 ES points. And, in case you're wondering, the bounce at 681.57 at 9:37 AM Eastern was not a trade per the rules, because that level was hit within the first 15 minutes after the opening bell. Later, when 681,57 was tested again around 10:40 AM, it was a Near Miss. So trading that level on the long side was off the table at that point. They did bounce there again at 11:03, but we're not trading it after the first hit. You still have 8 ES points. The third and final trade was a Recycle of the top of the zone at 683.15 when price came back down from the top, after getting above the level for the right amount of time. When price tested the bottom of the zone at 682.93, it was a Near Miss, taking that level off the table for the rest of the trading session. After this third trade, no other levels were hit before 1:00 PM, which is the cut-off for trading on FOMC days. You can observe that the levels still provided reactions that would have bagged many points - but we leave the market alone leading up to FOMC announcements.

Per the rules, a total of 12 ES points for the day.

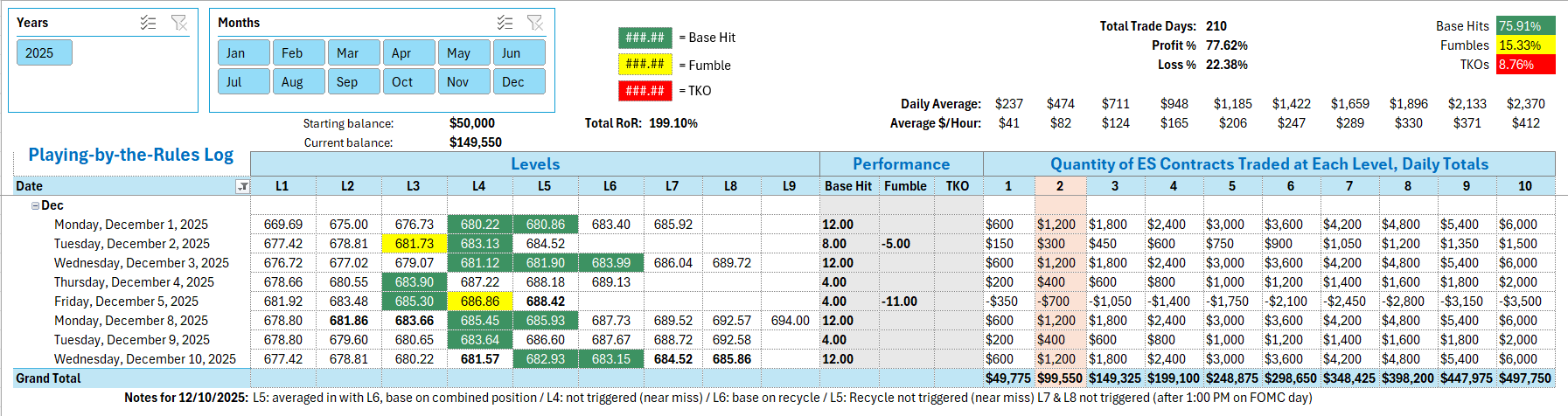

Tracking log to-date for 2025: