SPY Levels & Game Plan

Monday, November 17, 2025

9:16 AM – By the end of last week, price got pulled under the 50-period moving averages on all but the longer timeframes. The daily chart is the next timeframe to be in possible jeopardy. All this means now is that bearish sentiment that has started in the shorter timeframes is morphing into the larger timeframes. We can’t say that the big picture is bearish until there are weekly closes below its 50-period MA, and that’s a long way below current price. But it is entirely possible for price to pull back a lot and the big picture still remain bullish. Don’t forget the timing thing we talked about from the monthly perspective – that there was a good chance November could show some weakness in the SPY. The result of all has created a choppy market. Today and this week is likely to be no exception.

The axis level for today is 671.50. If we see closes above that level and above 672.00, then the bulls could run a little before hitting resistance. The next official level higher up for today is at 677.24, but below that is a trendline that the bulls could have trouble getting through. Hourly closes above 673.00 could mean the bulls are gearing up to move higher. The axis level could be tradeable if other indicators validate its importance in real time.

If price stays below the axis level for today, the bears should have an easier time pulling price down more. Similar to the space above the axis point, the area below 671.50, down to the next level at 666.62 likely contains some support areas, but none that I’m comfortable using as official tradable levels for today. With the likelihood of wide swings and choppiness still high, any of the levels for today should be treated with caution. I’d want to see multiple reasons on larger timeframes that the areas could provide support and/or resistance before trading against them. Allowing more wiggle room at the levels is a good idea. No data releases of significance scheduled for today. Trade well.

After the closing bell...

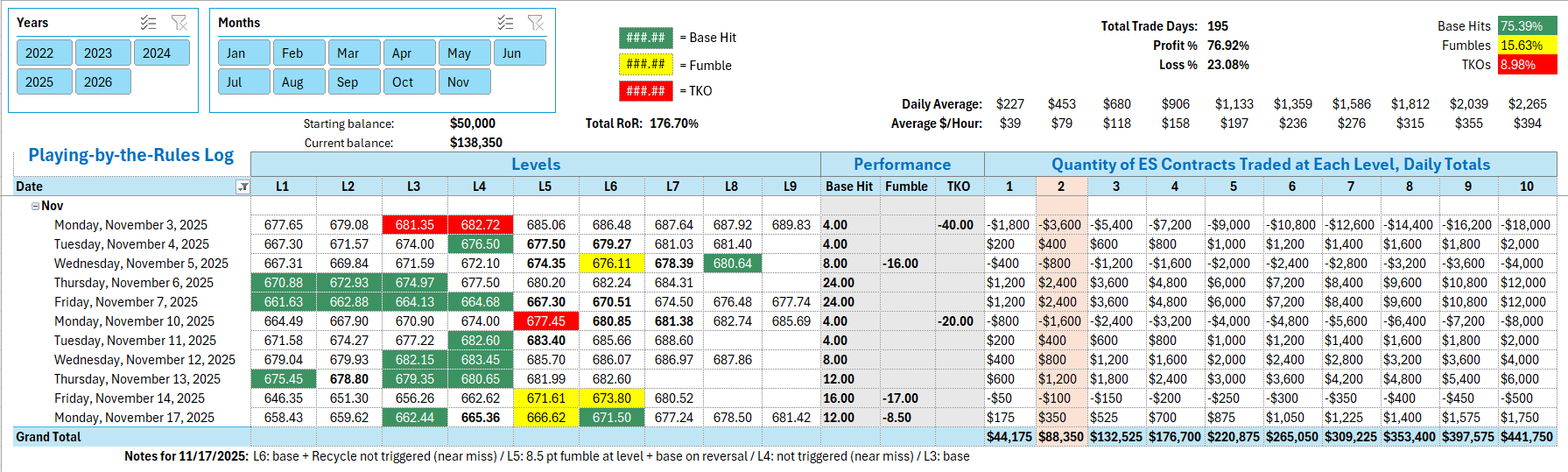

Trading by the Ticks & Trades Rules, here is where you would have landed for the day:

First trade after the 15-minute window opened was a long at 671.50 at 10:05 AM. That was the first official Base Hit for the day for 4 ES points. The Recycle of 671.50 was not triggered because of a Near Miss. Going long at 666.62 resulted in an 8.5 point Fumble, plus a recovery of 4 points on the Reversal. No entry at 665.36 in the meantime because of a Near Miss. Last official trade was a long at 662.44 at 3:02 PM. No Recycle at 665.36 because of the time of day (within 30 minutes of closing bell).

Per the rules, a net total of 3.5 ES points for the day.

Tracking log to-date for 2025: