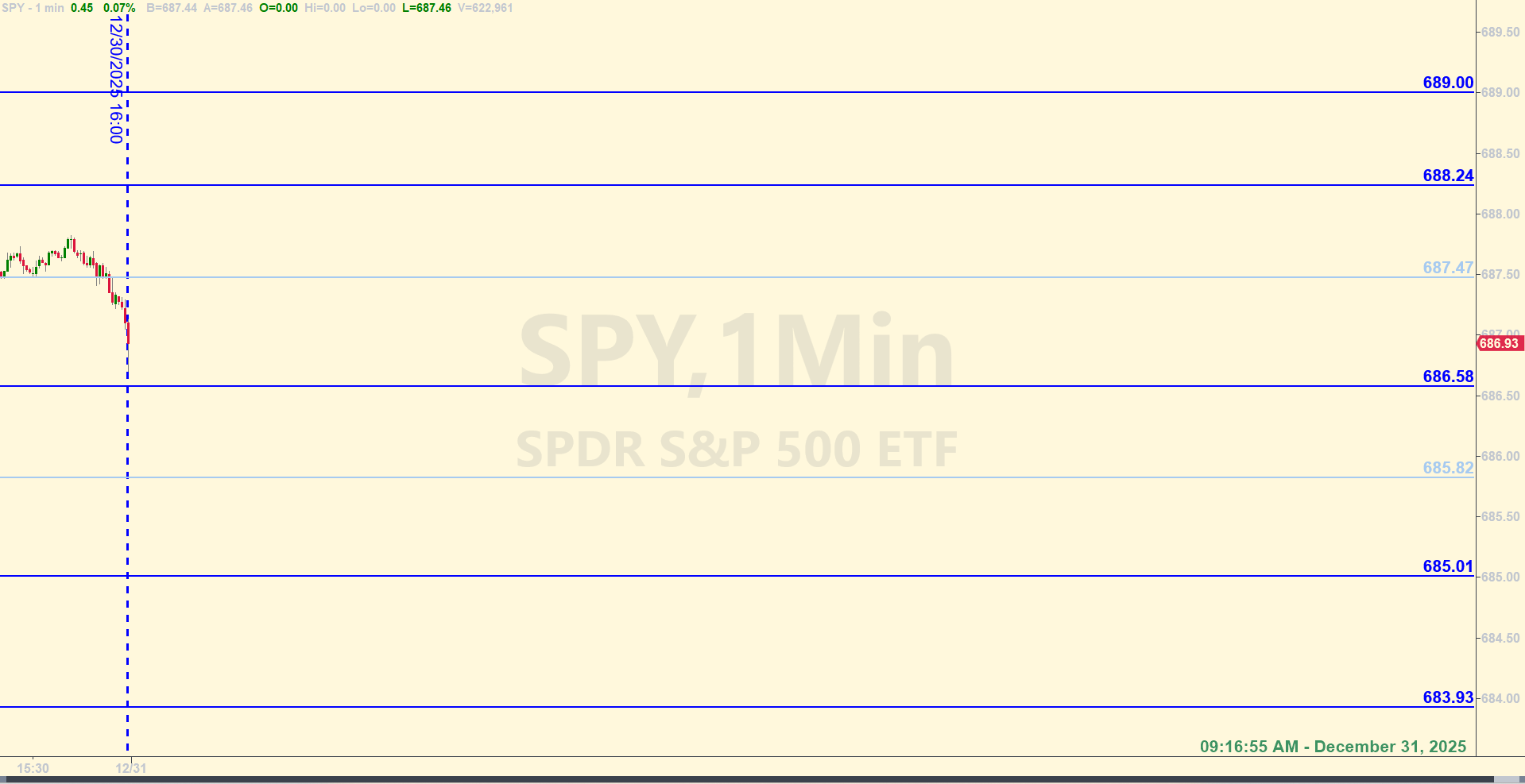

SPY Levels & Game Plan

Wednesday, December 31, 2025

9:16 AM - They hung around the trendline all day yesterday and didn’t really go anywhere. It wasn’t until after the closing bell that price started to test some of the support levels below the bear axis from yesterday. Now they’re back at the trendline again in the premarket this morning.

Closes above 687.47 and the bulls can still grind out of this pull back. It’s the same story as yesterday. Volume is likely to be low on this day-before-a-major-holiday trading session. It’ll be interesting to see where the close the SPY on the last day of 2025, which is today.

An out-of-left-field kind of thing is probably not as likely, but stay aware of unusual market behavior when volume is low. The level at 685.82 is the bear axis for today. Getting below and staying below that during the regular session and we’ll probably see continued weakness. Overall the big picture is bullish. Right now, price is in the middle of stuff. The SPY can’t seem to get into new high territory and stay there, so overall, we could be in the middle of a slow motion roll over in the big picture. But anything can happen. The levels for today are otherwise typical – designed for base hits. Trade well today.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

The close of the 9:45 candle was about 10 pennies on top of 685.77, so you went long at the level for a bounce higher. That gave you your first Base Hit within a few minutes. Price didn't make it to 686.58 (even with the 5-cent buffer applied), so no short position taken up there. And you didn't trade at the level when it was hit the first time just a few minutes after the opening bell because it was within that first 15 minute thing - and that's one of the rules. Next official Base Hit trade was a long at 685.01. When 685.01 was hit from the under side after price was under that level for the right amount of time, a short was entered there. The trade was closed out at breakeven after a Near Miss of the profit objective. And when price got close to 683.98 and bounced at 2:35 PM (classic Near Miss), you canceled that trigger activation, so a long trade was not entered when price hit the level right at 3:00 PM. So no other trades taken for the day - and sticking to the rules kept you out of trouble when you didn't trade 683.98 on the long side at 3:00 PM.

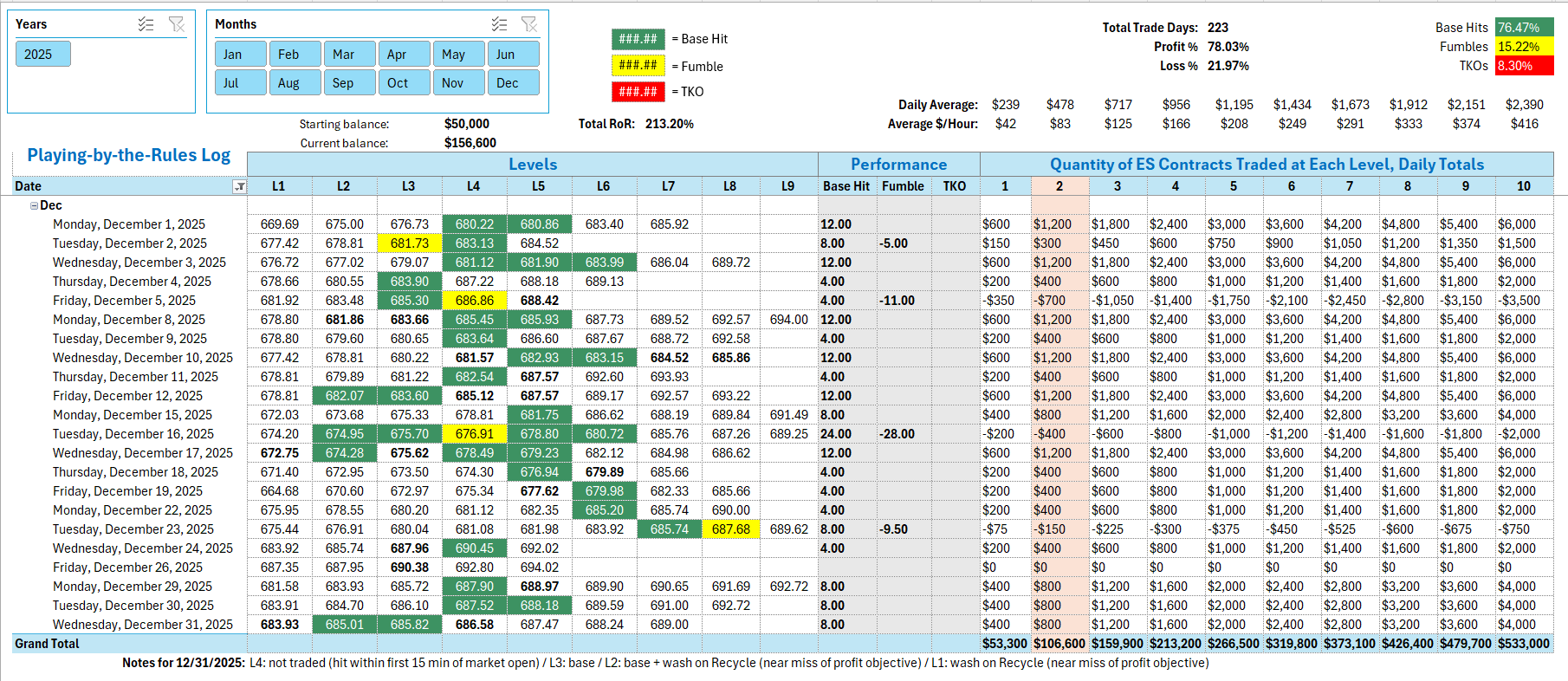

Last trading day of 2025. The year with a 213% rate of return. Nice.

Quick reminder: on the Tracking Log, the rate of return ("Total RoR" metric) assumes a $50,000 starting balance at the beginning of the year, and two (2) ES contracts traded at each level, per the Ticks & Trades rules.

Per the rules, a total of 8 ES points for the day.

Tracking log to-date for 2025: