SPY Levels & Game Plan

Friday, November 21, 2025

8:58 AM - It was a fake out. In yesterday’s Game Plan, we discussed the possibility of the Wednesday night rally being a fake out, where the bears would come out and finish the job and negate the overnight rally. Didn’t think they’d do it in just one day, though. This is the “sit on the sidelines and wait for the dust to settle” kind of thing we talked about yesterday morning. The levels typically work to provide profitable trades, but it's trader's choice whether you want to put money at risk in a volatile market. Today should be no different.

We do have levels of potential support and resistance for today, per usual. And for what it’s worth, all the levels from yesterday that were hit provided support as price fell. Each had enough reaction for successful base hits, if you chose to trade against them. It is sometimes difficult to step in front of a speeding train, even if you have confidence of the importance of a support level. The safer thing to do, of course, is to wait on the sidelines until the market starts acting normal again. Today has the potential for increased volatility again.

If price stays below the zone at 657.82 to 658.43, the bears will likely have an easier time keeping price deflated. If price can get above 663.73 and establish closes of significance up there, the bulls might be able to pull price up some more. The other levels would benefit from extra validation in real time if you choose to trade against them. You certainly would need to give the levels more wiggle room, and not expect precision when volatility is increased like this. And adjust position size accordingly to minimize risk.

There are important data releases at 9:45 and 10:00 AM Eastern today. Couple that with where the SPY is right now, with respect to timing and all of the above, the data releases this morning have the potential to move price. Maybe a lot. So be careful out there today, and trade well.

After the closing bell...

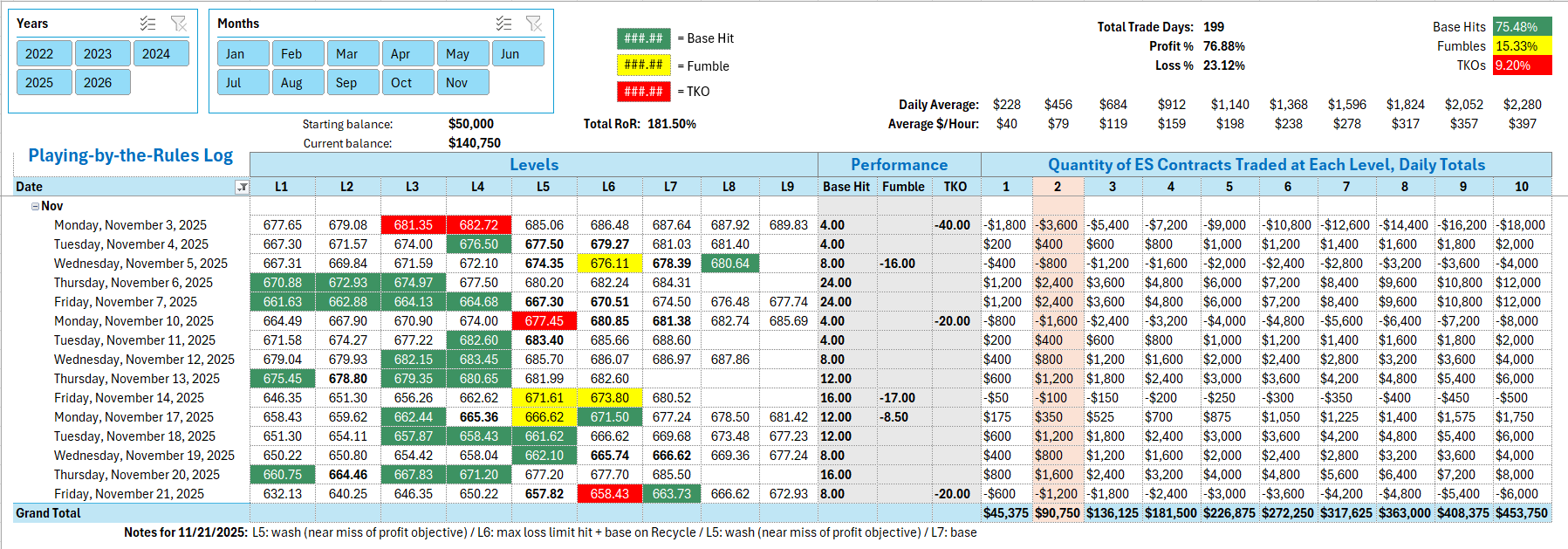

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

The first level hit was the bottom of the zone at 657.82. That trade was a Wash, when you jumped out at breakeven when they got close to a Base Hit before shooting back up. The level at 658.53 incurred a Max Loss Limit, which is 20 ES points. Taking the Recycle trade at 658.43 gave you a Base Hit to regain a few points. The Recycle of 657.82 was another Wash - a Near Miss of the 4-point Base Hit before quickly returning to the entry. The level at 663.73 did provide a good reaction and at least a Base Hit. When the market is likely to be volatile - as it was today - the levels need more wiggle room. And often times, there are bigger-than-base-hit moves at the levels when they work as designed.

Per the rules, a total of -12 ES points for the day.

Tracking log to-date for 2025: