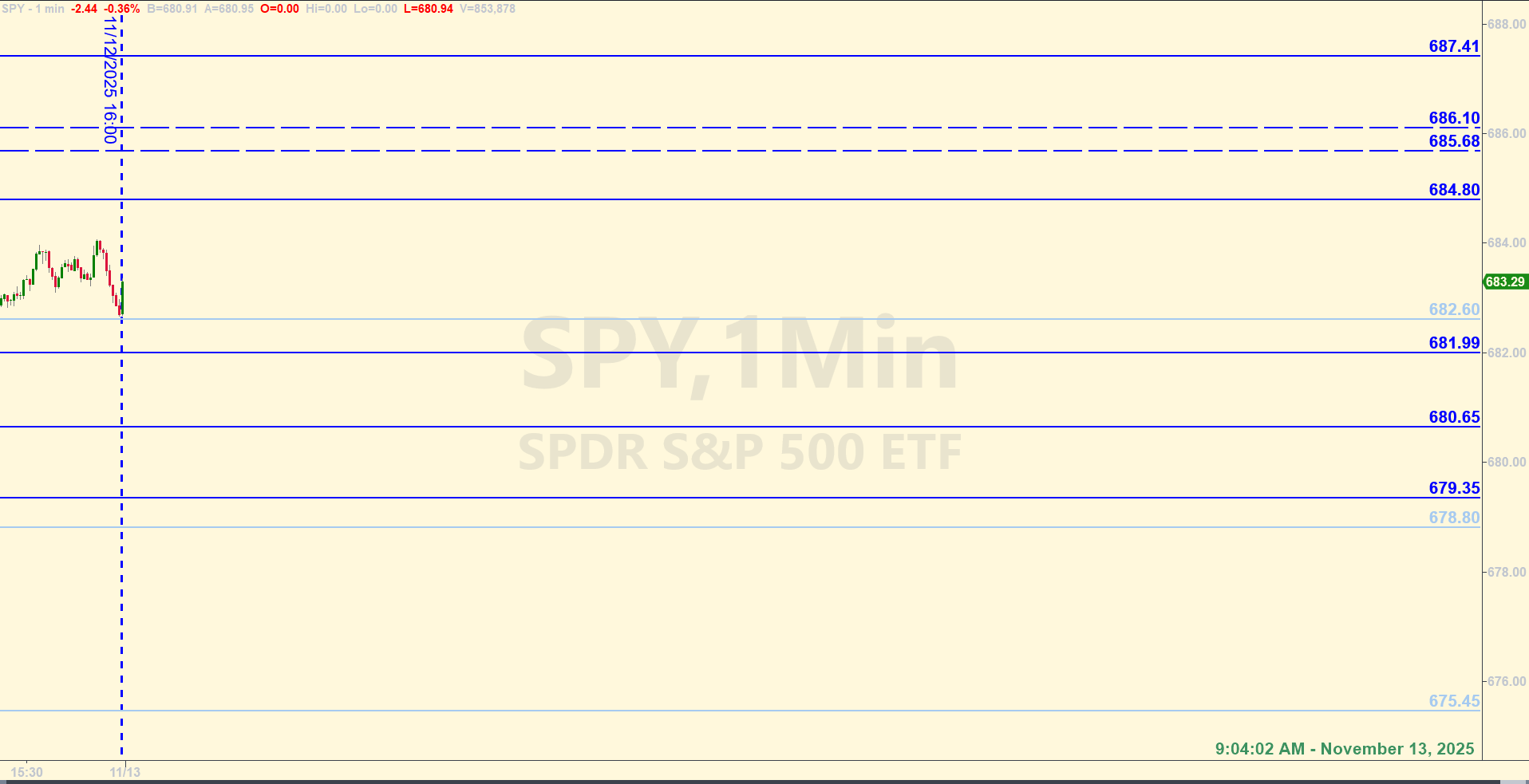

SPY Levels & Game Plan

Thursday, November 13, 2025

9:04 AM – All day yesterday during the regular session, price messed around with both the bull and bear axis levels we had on the board for the day. Price stayed mostly within the range of those levels, not extending very far outside the extremes of the range. And the after-hours price action doesn’t look much different. So far, as of about 8:30 AM, price is below the bear axis of 682.15 from yesterday.

What can we deduce about what price is doing right now? Considering that the upper part of the range came from a trendline that the bulls can’t seem to sustain closes above, this current pullback could become more pronounced. Price is also below the 75% retracement that they spent a couple days to get on top of. That’s around 682.60. One day on top, but now they’re back underneath. The bulls will need to get price back above 682.60 and close hourly candles above it to regain lost ground and hope to climb again. Then there’s the trendline they’ll need to contend with, which is around 683.80 to 684.15 today.

The levels in the lighter blue color in the list above and in the screenshot below are retracement levels from the October 29 high to the November 7 low. Price is climbing out of that move from high to low, and could bounce again from the retracement levels below current price (678.80 is the 61.8%, and 675.45 is the 50%). But those levels can also serve as axis points where if price gets below and closes below, the feel of the market could change. Therefore, the axis levels in the light blue color should serve as reference levels. Trading against them is fine if there are other reasons present in real time to validate their importance as support and/or resistance. Again, in the big picture, price needs to close hourly and daily candles above the trendline – between 683.80 to 684.15 for today – to keep the rally going. They are basically in the middle of stuff again and can go any direction. No data releases of significance scheduled for today. Trade well, and I hope to have time to compile a Recap Video for the last several trading days later today.

After the closing bell...

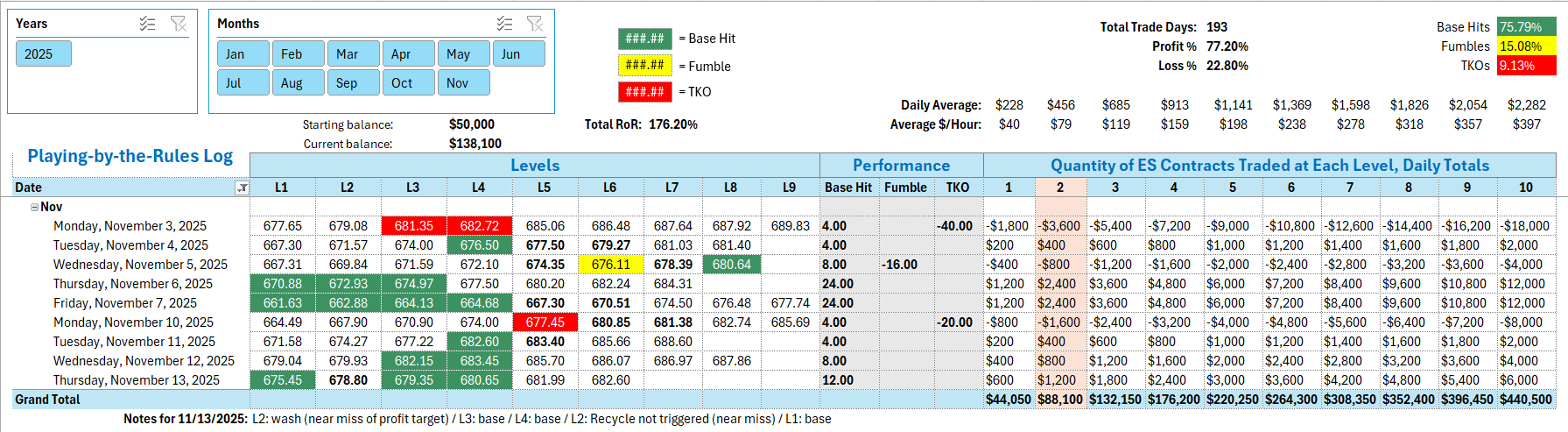

Trading by the Ticks & Trades Rules, here is where you would have landed for the day:

A short at 678.80 would have been aborted at breakeven for a wash because of a Near Miss of the profit objective - although it's clear that the level and the one above it at 679.35 were important early after the open. But jumping out at a wash at the 678.80 level was the conservative thing to do and that's why it's one of the Ticks & Trades rules. The next trade was a Base Hit at 679.35 on the short side - the first official trade that netted a profit. The second profitable trade was a Base Hit at 680.65 on the short side. The Recycle at 678.80 on the long side was aborted because of a Near Miss. Price came within 10 cents of the operating level (see FAQs for more information on what the Operating Level is) before bouncing enough for a Base Hit. Last trade was a long at 675.45. Solid bounce there for the last official Base Hit trade of the day.

Per the rules, a total of 12 ES points for the day.

Tracking Log to-date for 2025: