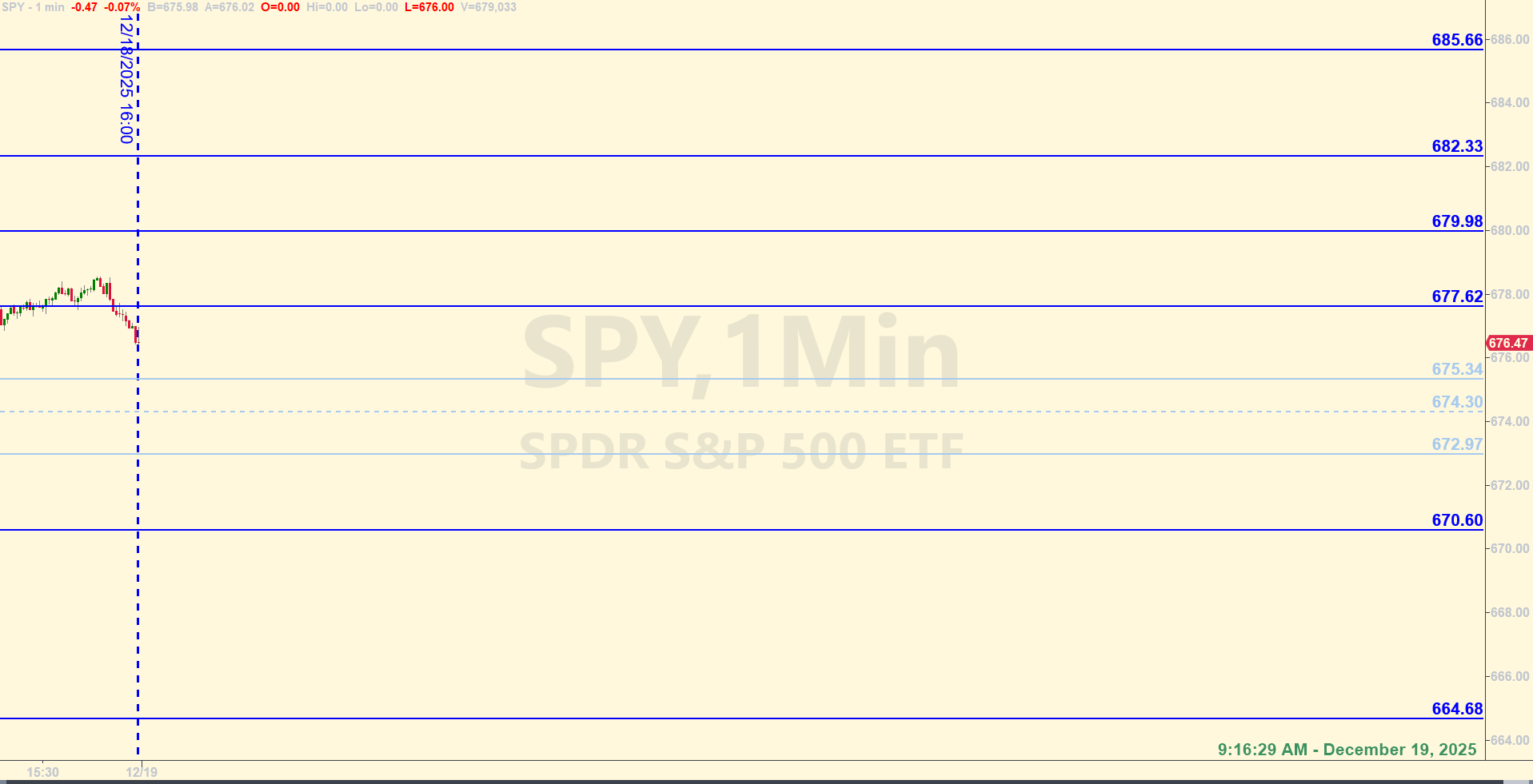

SPY Levels & Game Plan

Friday, December 19, 2025

9:16 AM Eastern - The battle above the trendline continues. For today, the trendline is sloping downward from about SPY 673.00 at the open and will be about 672.50 by the time the regular session closes today. While price didn’t get down to the trendline during the regular session yesterday, they did spike down into the top of our trendline zone from yesterday and hit the 674.30 level. That happened just a little while ago during the obligatory 8:00 AM Eastern shimmy.

So where does this leave us for today – the last official day of the December ES contract? For starters, the bulls still look weak. While they are above the trendline currently, price remained mostly flat since yesterday’s close. The more they hang out above the trendline, giving the occasional bearish signal, the more likely they are to test the trendline again. And there are no guarantees that it will continue to hold as support.

The bull axis for today is 675.34. If they can keep price above, and close candles consistently above 675.34, the bulls may be able to start another grind to pull out of this reset. In the screenshot below, notice the dotted line at a level at 674.30. That isn’t necessarily a tradable level for today, hence it not being included in the list above. Price spiked that in the premarket, as we just discussed. They may try to tag it again after the opening bell. It is a reference level to gauge the strength of the bulls. Better support is likely farther down, so trading against 674.30 could work, but it would be a coin flip and discretion should be taken.

The bear axis is 672.97. If price gets down there and shows signs of continued weakness, the bears could be in control at that point. Basically, getting under and closing candles of significance under the trendline will likely be be more confirmation that the bears have targets lower down. And 672.97 is the beginning of showtime for the bulls. They need to defend it to go higher, but they might not be able to do it. But don’t forget that we’re at an interesting point in time in terms of cyclical movements and timing. Unusual things in the market are more likely to happen at times like this, so be careful. Trade well today.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

Price opened above the bulls axis as explained the Game Plan from the morning and hit 677.62 right after the opening bell. They hung out in that area for a few minutes. But at the close of the first 15-minute candle, the bulls were already driving price up and they left 677.62 behind - so no trade there. A short position in the E-minis when the SPY hit 679.98 netted you the only Base Hit of the day. Once price got above the level at 679.98 and came back down into it later in the day, you didn't take the Recycle Trade because the interaction happened to near the closing bell. We don't enter new trades within the last 30 minutes of the regular session.

Per the rules, a total of 4 ES points for the day.

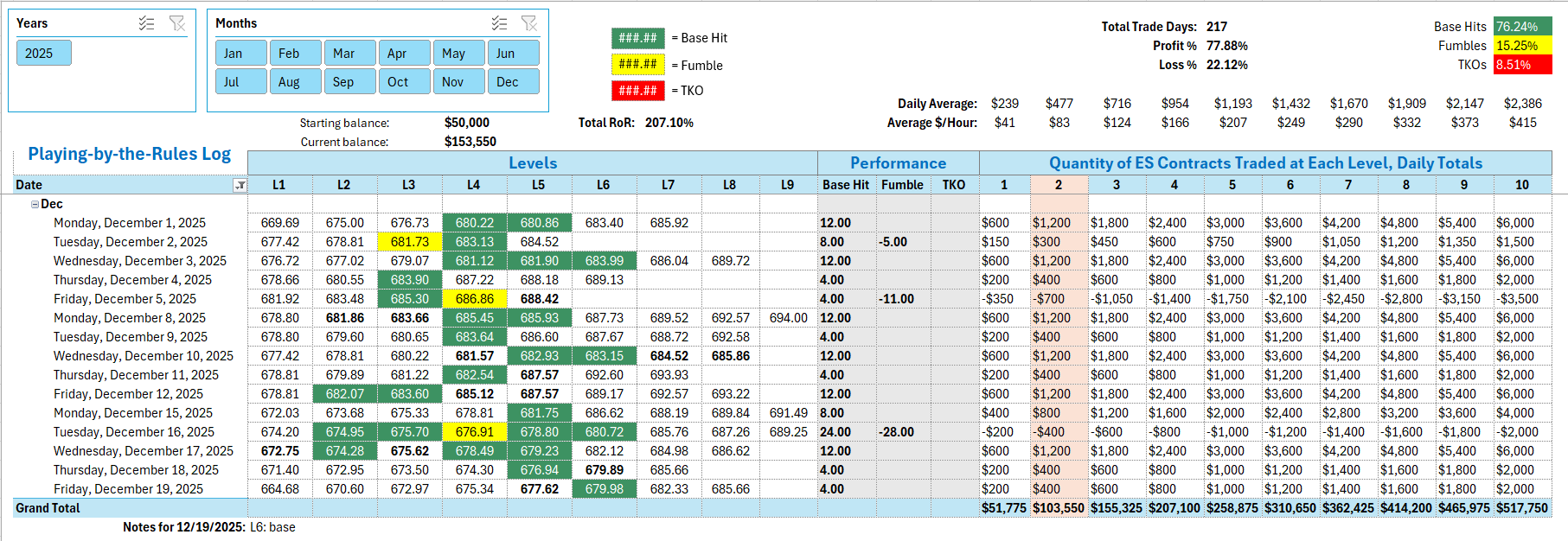

Tracking log to-date for 2025: