SPY Levels & Game Plan

Tuesday, November 25, 2025

9:20 AM - If price stays below 669.70, the bears could have an easier time pulling price down some more into support. The bulls will need to get price above 673.50 to be more in the clear to try to climb out of the pull back we’re currently in. There are levels of overhead resistance above 673.50 they’ll need to contend with before having the space to run. Right now, price is still in the middle of stuff. Considering this is a holiday week, where volume is likely to dry up starting tomorrow, it’s more likely nothing crazy will happen. But don’t get complacent. The market has a habit of doing the thing when you least expect it.

The 8:30 AM EST data releases shimmied price around, but nothing too drastic. Price is still under the bear axis of 669.70 with about 10 minutes before the opening bell. As always, it’s good to be aware of the big picture – look at larger timeframes, to see how the levels may interact with moving averages and retracements, etc. on those larger timeframes before choosing to trade against the levels. Bull/bear battles are more likely when you have multiple reasons around a level that would give one or both sides of the tape to defend their positions. Trade well today.

After the closing bell...

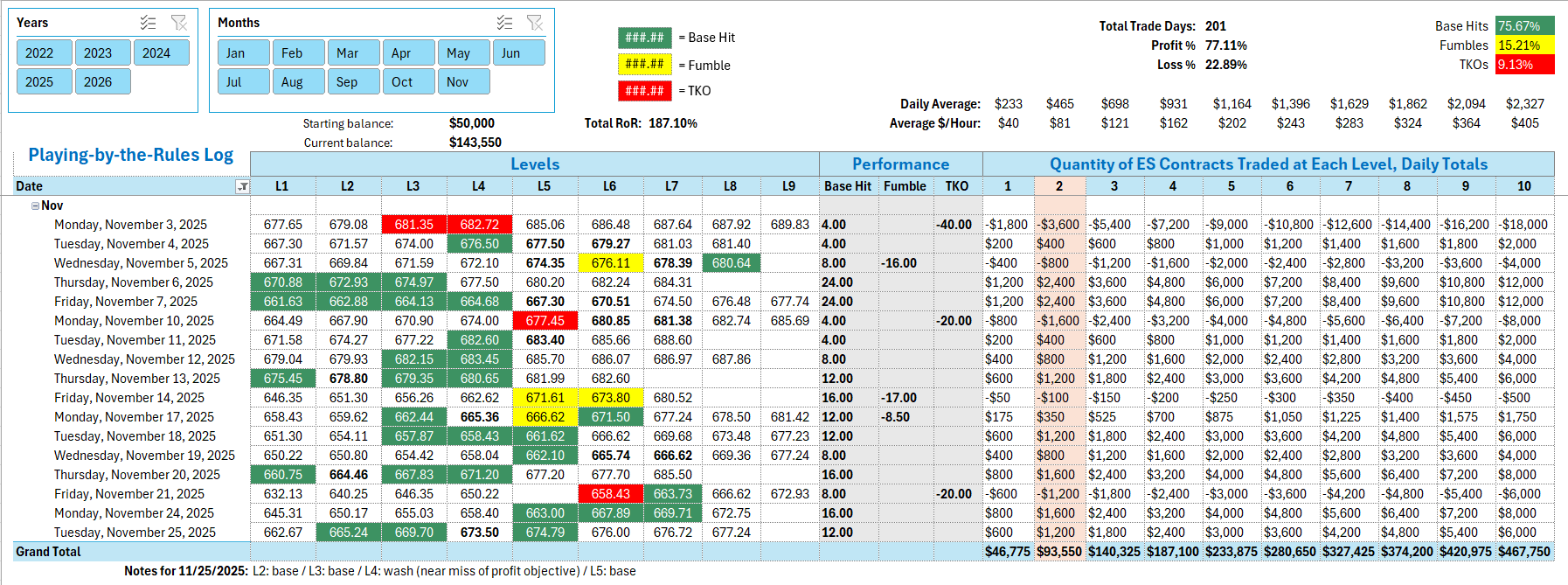

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

First Base Hit was a long trade at 665.24, where price bounced cleanly. Second Base Hit trade was at 669.70 on the short side. The short entry at 673.50 was aborted and closed out at a Wash because of a Near Miss of the profit objective. The last Base Hit trade was a short at 674.79.

Per the rules, a total of 12 ES points for the day.

Tracking log to-date for 2025: