SPY Levels & Game Plan

Thursday, December 18, 2025

9:17 AM Eastern - The trendline is in the spotlight now. Notice the zone between 673.50 and 672.95. That is where the trendline is for today. It also happens to be in the same area that served as an important axis many times in the last couple months. Remember the 673 to 674 area where the SPY topped out and then fell from on October 10? Once price gapped above that area on October 24, the bulls and bears have been fighting that area and trying to establish dominance above or below. Interesting that price was pulled down back below that area on a day when the trendline lined up with the same axis area. This price action over the past couple months is creating the ingredients for a longer term rollover. Look at the weekly and monthly charts of the SPY. They need to get at least one or two weekly closes above 690 and then a monthly close above that area before the possibility of a rollover is off the table.

For the short term, what’s going on for today? Well, we have levels spread relatively far apart. With a move like we had yesterday, where the bears pulled price down below the trendline, closed the day below it, and then now in the premarket the next day, the bulls are trying their best to recover lost ground, price is poised to open above the bull axis level today – which is 674.30. If price stays above that level., the bulls can climb some more out of this interim reset. We can’t discount the fact that price did close decisively below the trendline yesterday. Either that was just a test and the bulls can recover, or it is a clue of more downside coming. Don’t forget that on the monthly chart, timing is ripe for a pull back. The monthly candle for November indicates indecision, and if more profit-taking occurs, the monthly perspective could be signaling more downside.

Looking at the midrange timeframes, it’s clear that even with the premarket push by the bulls to recover lost ground right now, price is still below the range they’ve been in for the past three weeks. This could make it difficult for the bulls to fight back into it. Getting above the range means they’re trying to break out into new highs again. Anything is possible, but the most probable thing is to expect more swings and increased volatility before the next leg in the market materializes.

If price gets pulled down below 671.40 today, that is better news for the bears. 671.40 is the bear axis for today. That level is below the trendline (the zone between 673.50 and 672.95), so candle closes of significance below the bear axis for today would probably be pointing to lower prices in the near term.

There were data releases that occurred during the premarket, and they got price to move. But there are no more data releases of significance scheduled for the rest of the day. There are some cyclical events happening soon, as well as the futures expiration, which is tomorrow. Unusual market activity is more likely, so be careful today and trade well.

After the closing bell...

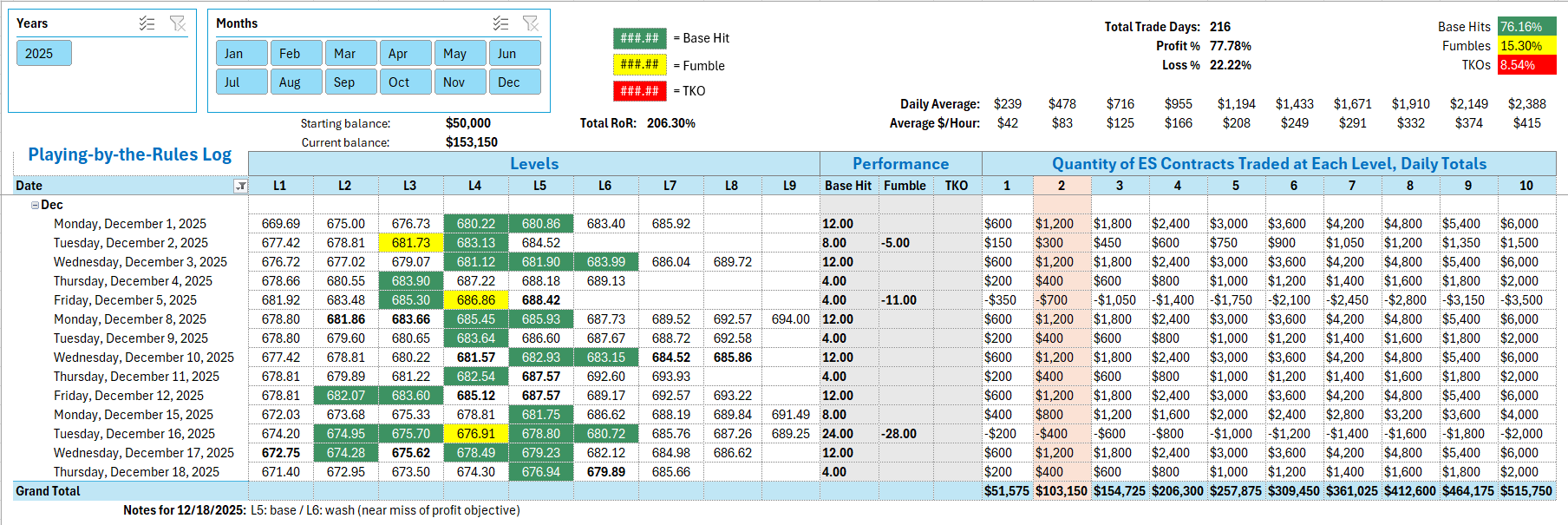

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

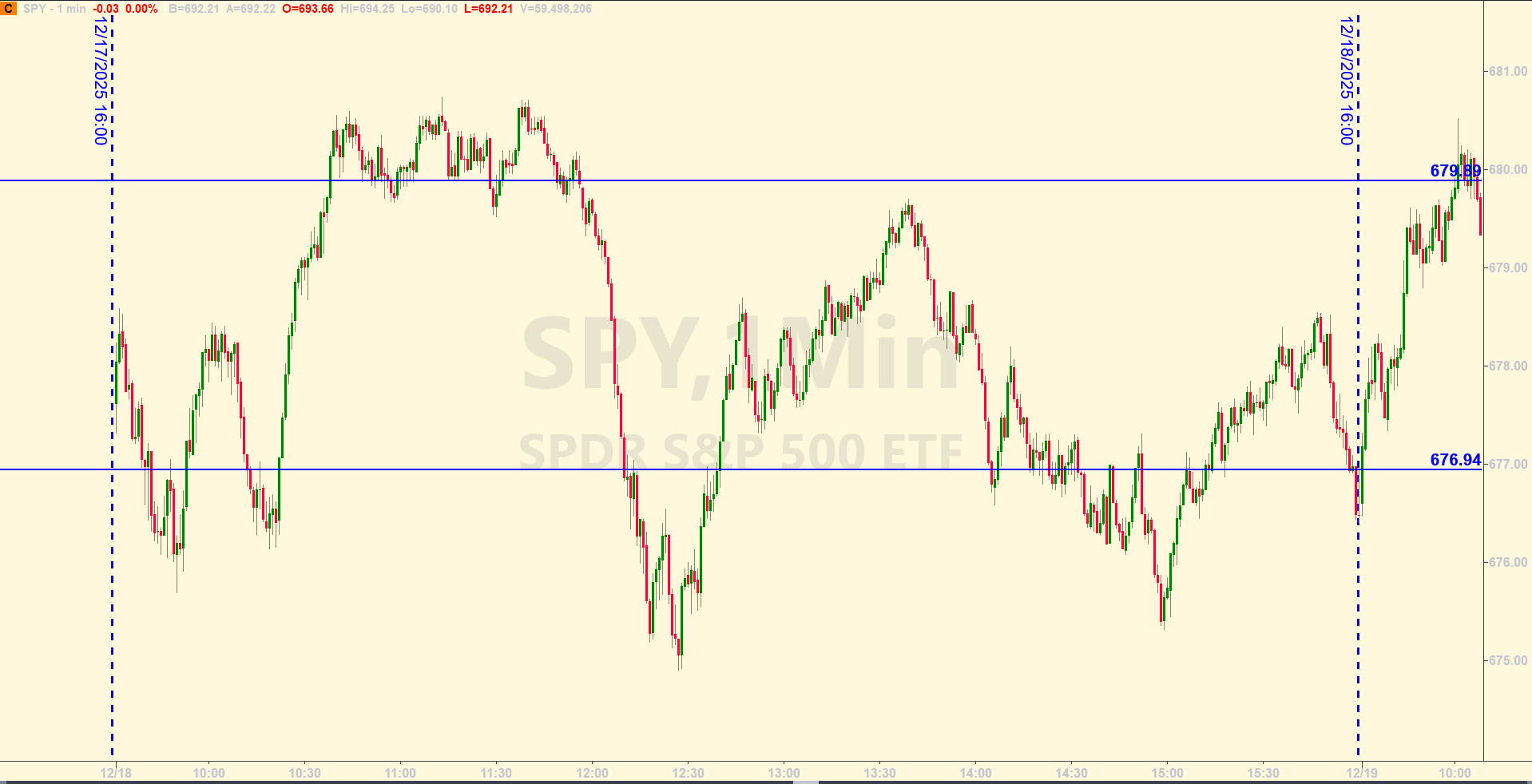

First Base Hit was the short at 676.94 at 9:48 AM. A Recycle Trade at that level on the long side could have been attempted at 10:12 AM, but being precise about it and sticking to the rules, it was one minute shy of being the right time for that window of opportunity open. So no Recycle Trade at 676.94. The short at 679.89 at 10:38 AM was closed out at breakeven because of a Near Miss of the profit objective when price dipped into the money at 11:30 AM. Jumping out at a wash was the plan. No other trades per the rules when price interacted again with 676.94.

Per the rules, a total of 4ES points for the day.

Tracking log to-date for 2025: