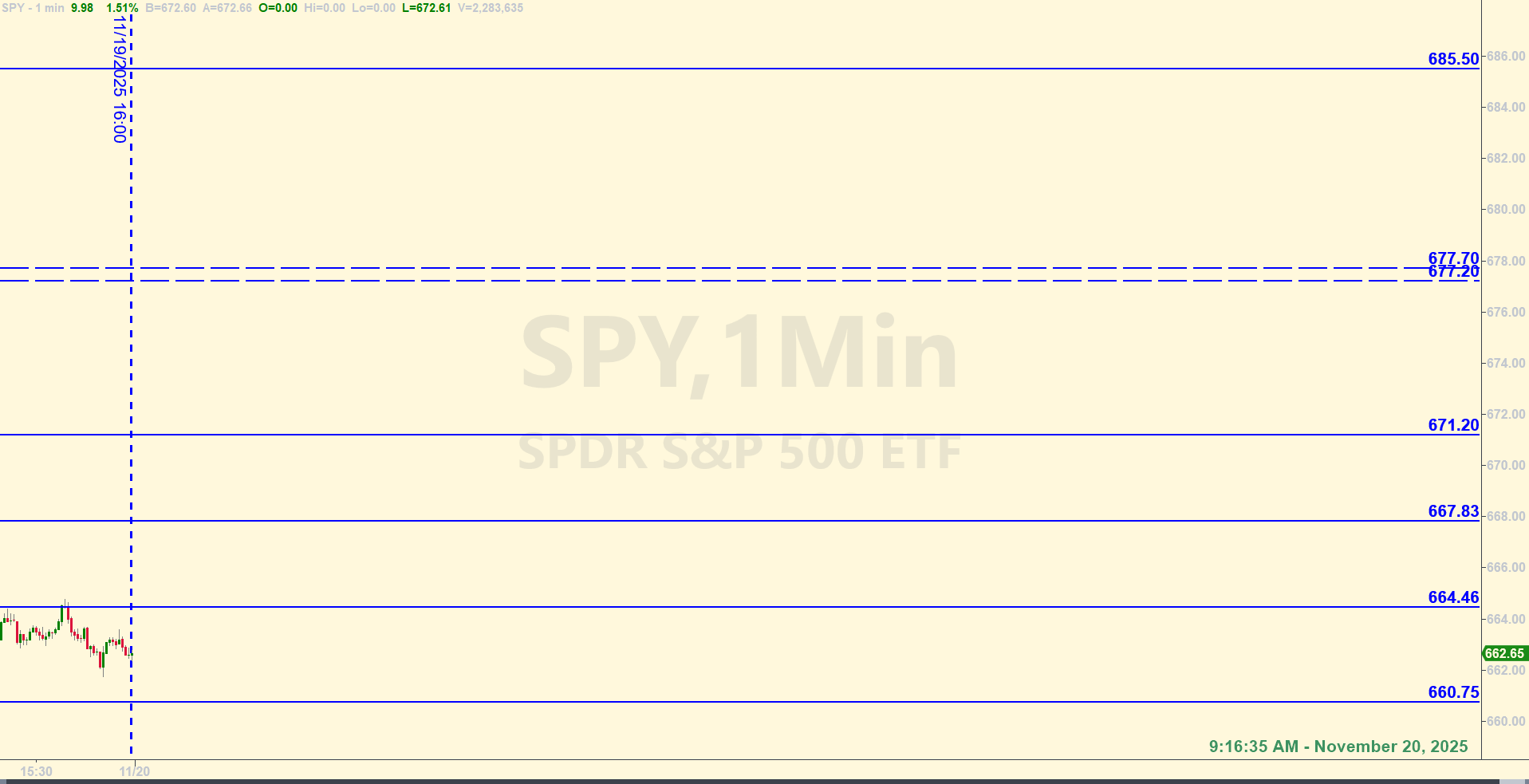

SPY Levels & Game Plan

Thursday, November 20, 2025

9:16 AM – Guess what they did in the Globex session overnight? While everyone was sleeping, the bulls managed to get price above all the trendlines and overhead resistance areas above where they closed yesterday. Remember the reversal signal we identified on the 4-hour chart yesterday morning? It was a signal, plus timing. Well, it looks as if that is playing out. Either this rally is legitimate and the bulls can keep climbing – if they get above the 673 – 674 area, or it’s a fake out. If the latter, watch out below. Not sure what’s happening right now, but for the bulls to get above all those areas overnight is not insignificant.

Right now, price is knocking on the 673 to 674 area, which as you know was important before. Above 674, and the bulls were in the right territory to climb. Below 674, and the bears had the ball. Now they’re back at the same place. We don’t have 673 or 674 on the board as official levels to trade against, but you should be aware of that area as an axis area. The zone above between 677.20 to 677.70 is the next area I’m comfortable with including as possible overhead resistance to trade against.

Same thing with the levels below price. There may other levels where price will meet support or resistance, but in case unusual things happen today, the levels we’re using for today are relatively far apart. It’s safer that way. It would be good, however to be aware of what price is doing in real time on larger timeframe charts. There could be some opportunities that present themselves depending on timing and reactions with other indicators. A lot of data releases at 8:30 AM this morning that helped lift price. But don’t discount that this whole rally could be a fake out in the big picture. The week and month are not over yet. If anything in the market seems out of character during the regular session, there is no shame in sitting on the sidelines and waiting for the dust to settle. It should go without saying that we have the ingredients for possible increased volatility today and tomorrow. It seems that something is in the air. Be careful and trade well today.

After the closing bell...

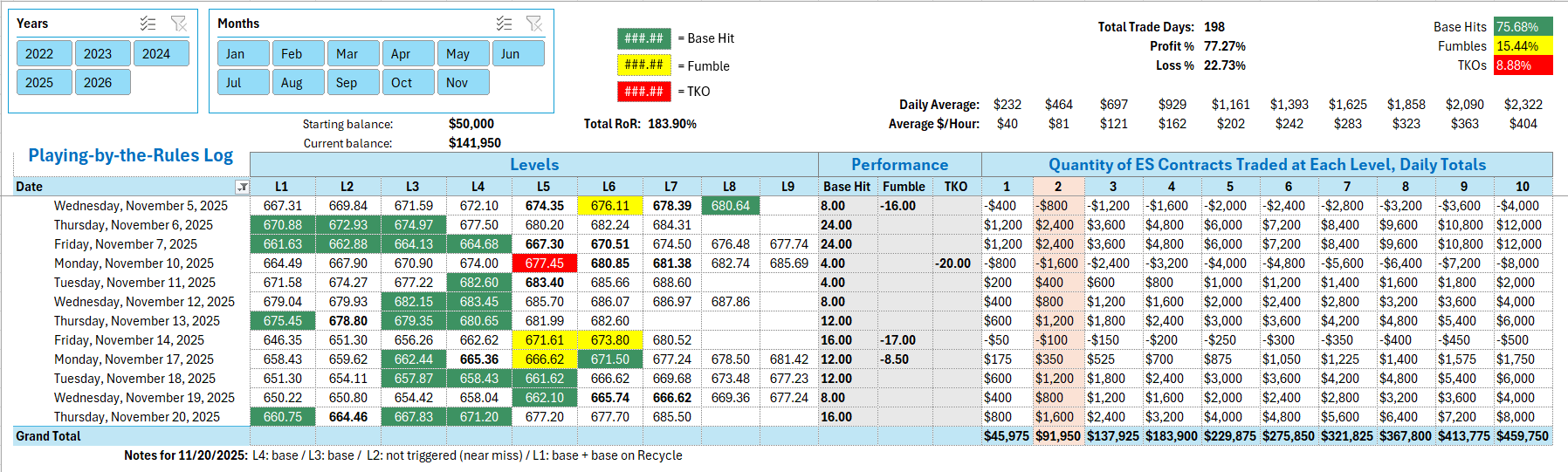

Trading by the Ticks & Trades Rules, here is where you would have landed for the day:

Big move today. Even with over 200 S&P points during the regular session, three of our Daily Levels gave solid trades while price was falling. Three of them were counter-trend trades. The first Base Hit was a long at 671.20. The second Base Hit was a long at 667.83. The level at 664.46 was not triggered because of a Near Miss of the operating level before bouncing enough for a 4 point Base Hit. Third profitable Base Hit trade was a long at 660.75.

Look at how price bounced at each of these levels more than enough for 4 ES point trades - even in the moment it may have looked like the bottom was dropping out of the market. That's the beauty of these high-probability levels of support and resistance. While you might not have been able to ride the whole day down on a short position (the outlook this morning as spelled out in the Game Plan was that the bulls had a chance to keep the rally going - but that it could be a fake out in the big picture). So not knowing the most probable general direction of the day was not all that important when you know you have a good chance a Base Hits at the levels - no matter which way the market is trending. The final Base Hit trade was a Recycle trade at 660.75 on the short side when price tested the level from underneath.

Per the rules, a total of 16 ES points for the day.

Tracking log to-date for 2025: