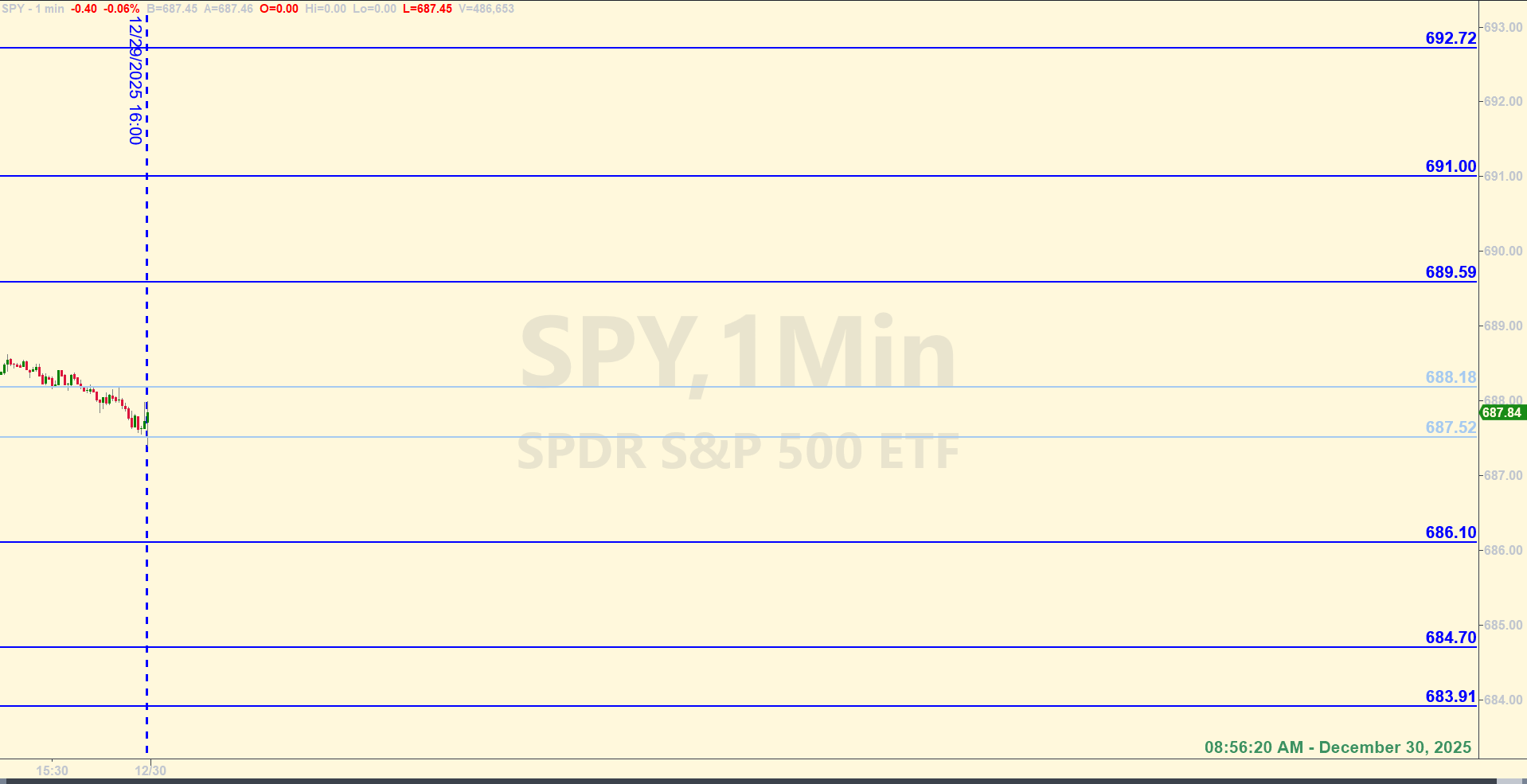

SPY Levels & Game Plan

Tuesday, December 30, 2025

8:56 AM - The story is the same as yesterday. The trendline area is where price stayed most of the day on Monday – they were above and below it with no real conviction either way. And all night in the overnight session, the futures kept things flat around that same trendline area. For today, we’re expanding that are to include a bull and a bear axis.

If price gets above 688.18 and closes hourly above it, it’s a sign the bulls are trying to climb out of this little pull back. If price gets below 687.52 and closes hourly below it, it probably means the bears aren’t finished with the downside. Getting below this trendline isn’t necessarily a bad thing for the bulls in the short term. The important line in the sand in the big picture is down around 661.00 or so. That’s not even on the board for today. While price is showing a little weakness on some of the shorter timeframes, the big picture is still bullish.

Being a shortened trading week because of the New Years holiday, the overall market is likely to be quiet. But as we said yesterday, be aware of sudden moves when volume is light. That kind of thing can happen with news events, data releases, and anything that looks like a black swan. For today, there are FOMC meeting minutes being published at 2:00 PM Eastern. So, be aware of your surroundings leading up to 2:00 PM. Trade well today.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

At the close of the 9:45 AM candle, price was under the bear axis of 687.52, but they reversed it and drove price higher, through 687.52 and up to the bull axis at 688.18. Your short position that was triggered in the E-minis when the SPY hit 687.52 at 9:49 AM was added to with the same number of contracts when price hit 688.18. That averaged-in position handed over a quick Base Hit as price fell. You pulled the profit while price was under 687.52 so there was no Recycle Trade on the long side. Also, the timing wasn't lined up exactly right when price came back down. No more trades at both those levels already hit.

Per the rules, a total of 8 ES points for the day.

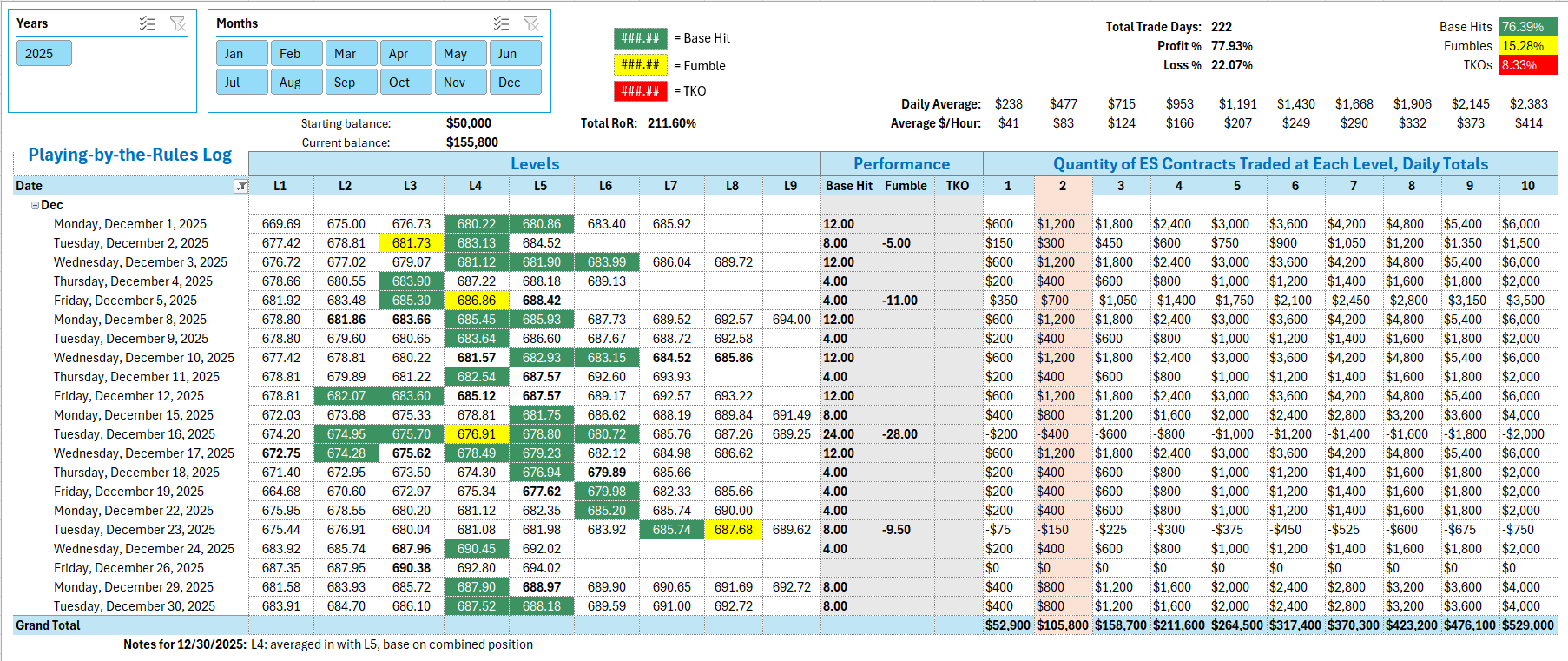

Tracking log to-date for 2025: