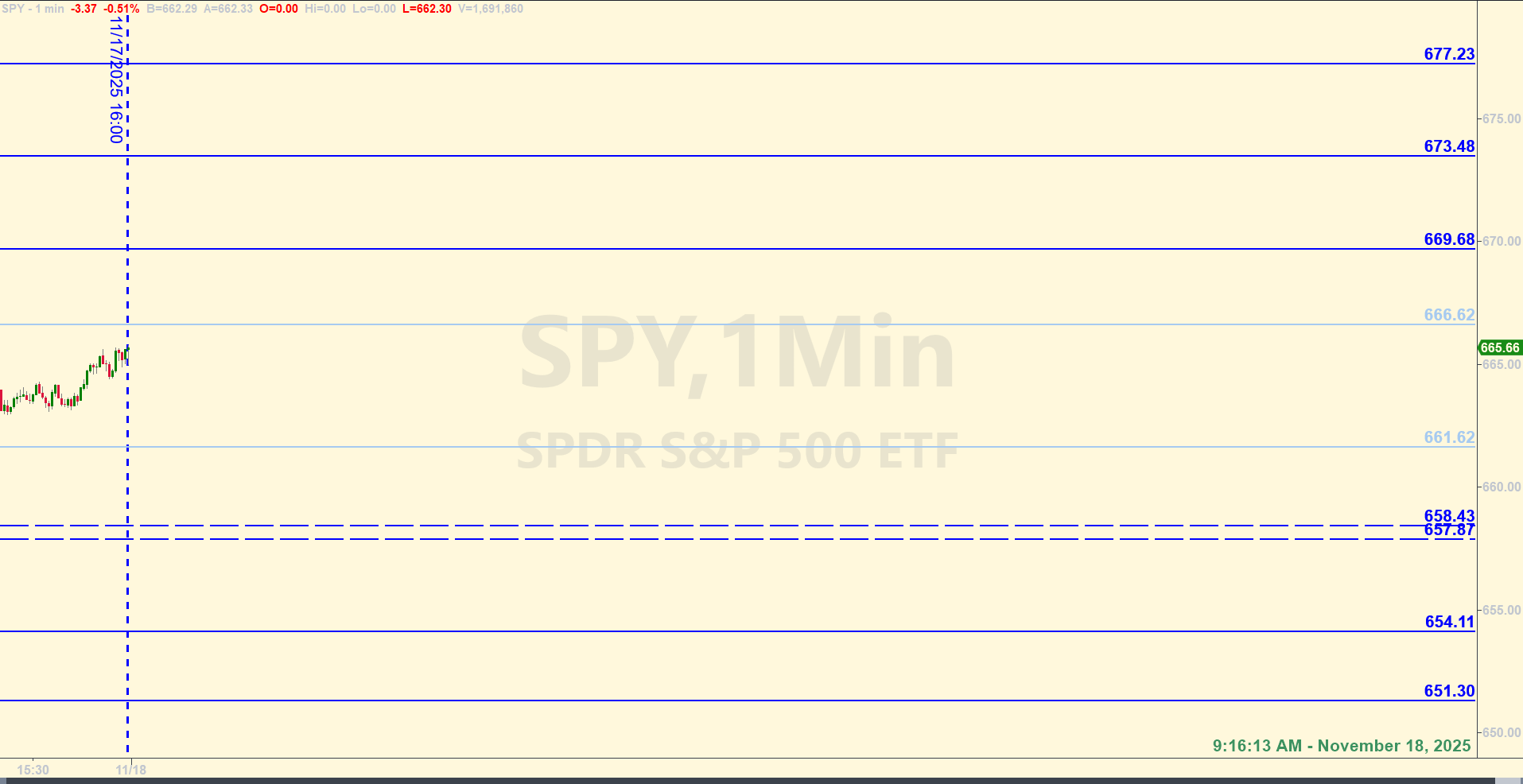

SPY Levels & Game Plan

Tuesday, November 18, 2025

9:16 AM – During the overnight and premarket sessions, price has continued to drop. With less than 30 minutes before the open for today – Tuesday, 11/18 – price is at a pivotal area. SPY 661.62 is the bear axis for today. If this level doesn’t hold and price gets under it and we see hourly candles close under it, the bears will likely have the upper hand at that point. There are still support areas under this level, but in the big picture, the bulls will need to defend 661.62 to keep price from falling further.

If they can get price above 666.62, the bulls may have a better chance of pulling out of this reset. But price has gotten under and closed under important areas on most of the intermediate and shorter timeframes. That is generally a bearish sign. Wile the weekly chart is still bullish, it will be easier for price to get pulled down farther now. The daily close from yesterday was under the daily 50-period MA, and they’re lower still this morning in the premarket. The bulls have their work cut out if they want to pull out of this dip. It’s possible, but the more weakness we see in the shorter timeframes, the greater the chance that weakness will morph into the longer timeframes. At the moment, that’s the possibility we have in front of us.

We’re still in the wider-than-usual swings mode where volatility is increased and levels can be spiked before reactions occur – if they occur. Understanding the big picture is key. And giving the levels more wiggle room can help. Look for additional reasons that validate the level’s importance as price approaches them in real time. Trade well today.

After the closing bell...

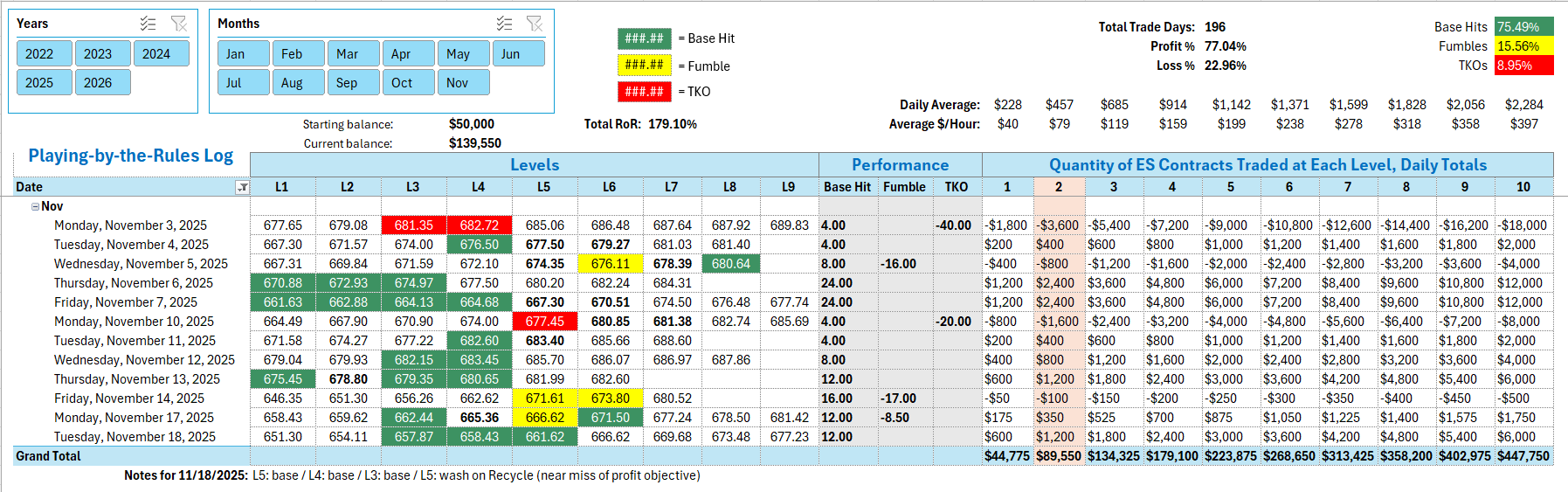

Trading by the Ticks & Trades Rules, here is where you would have landed for the day:

First Base Hit of 4 ES points was when SPY hit 661.62 at 9:46 AM. They bounced price there before getting under the level for a couple hours. Next trade was a Base Hit at 658.43 for clean 4 points. Third Base Hit was at the bottom of the zone at 657.87 - another 4 ES points after a few minutes. The Recycle trade on the short side of 661.62 was a Wash because of a Near Miss of the profit objective of 4 points.

Per the rules, a net total of 12 ES points for the day.

Tracking log to-date for 2025: