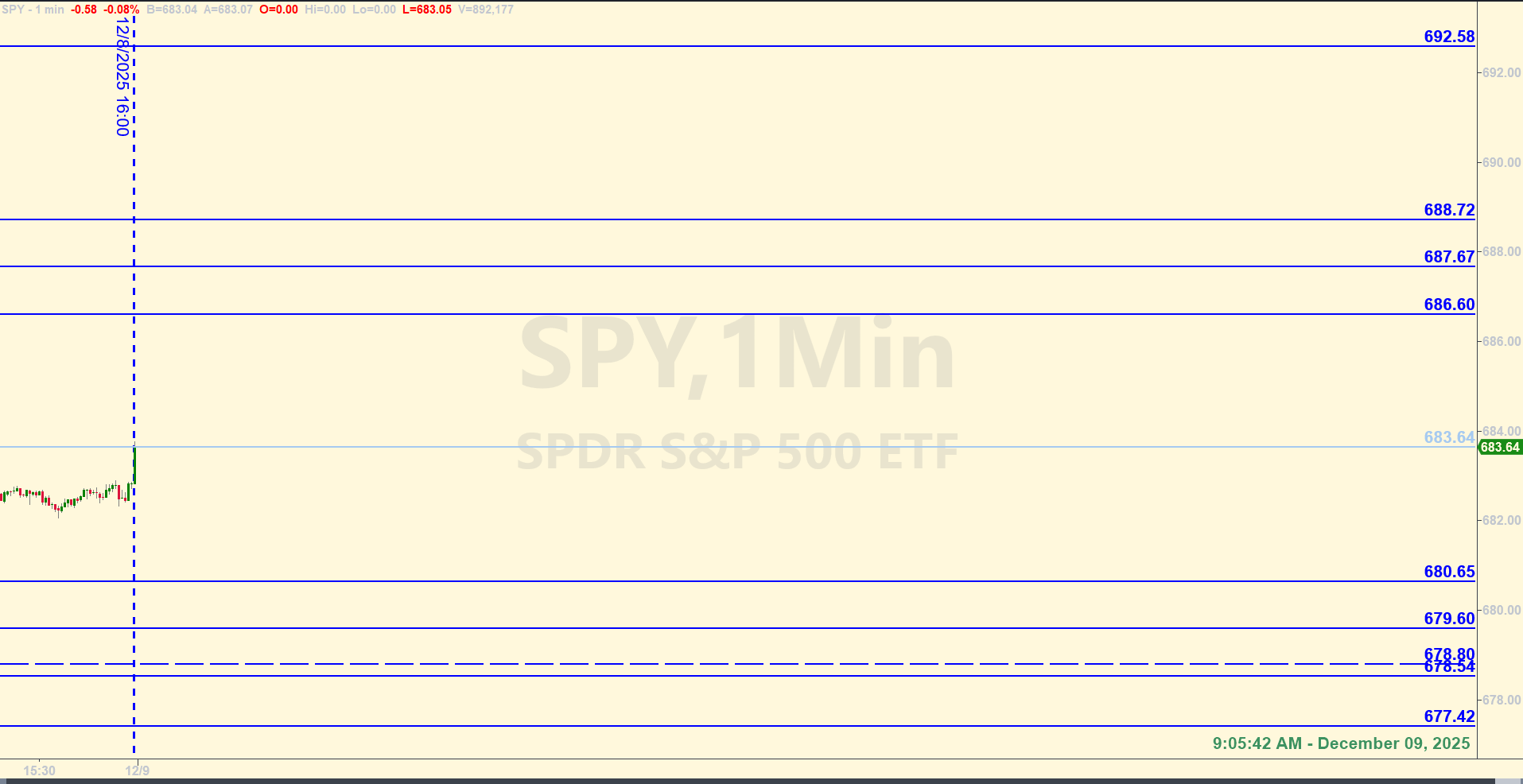

SPY Levels & Game Plan

Tuesday, December 9, 2025

9:05 AM Eastern - We talked about the reversal signal on Friday, along with decent timing for a pull back. And that’s what they did yesterday. Nothing too drastic, but overall a down day. The question for today is, will the bears be able to keep the downward momentum going, or is that the best they could do. At the close yesterday, price was pulled up to and closed within pennies of a level we had on the board from the morning, at 683.66. And all of the overnight and premarket session hasn’t seen price deviate much from that general area.

So we’ll use that level around yesterday’s close as the morning axis level. If price can stay above 683.64 and get some good closes above it, the bulls should have an easier time pushing price up into some of the resistance areas we’ve identified.

If price stays below and starts closing below 683.64, the bears could still have the upper hand. This level at 683.64 could be a tradeable level, if other signals and indicators are present when price interacts with it. Otherwise, it’s probably safer to use it as a gauge of potential near term bullish or bearish behavior for the morning.

There is a cluster of levels starting at 680.65 and below – including a zone between 678.80 and 678.54 – that are relatively close together. The reason I’m including all these levels on the board for today is that today is the day before an important FOMC announcement day, and generally, things can be slow on the Tuesday before FOMC days. If the market is acting “normal”, all the levels are fair game – assuming price interacts with the levels pursuant to the Ticks & Trades rules. But if for some reason, price gets whippy and is moving fast – volatility has picked up for some reason – then it’s probably a good idea to sit back and not trade every level that gets hit. It’s not probable that volatility will pick up, but I want to mention that when levels are relatively close together like this. Trade well today.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

All those levels on the board from the morning, and only one was hit - the axis level at 683.64. It worked for one good Base Hit on the long side right after the first 15-minute candle closed. That bounce produced at least a 4 ES point trade. And they bounced off that level several times, but the first hit is the best hit, so one official Base Hit trade for the day.

Per the rules, a total of 4 ES points for the day.

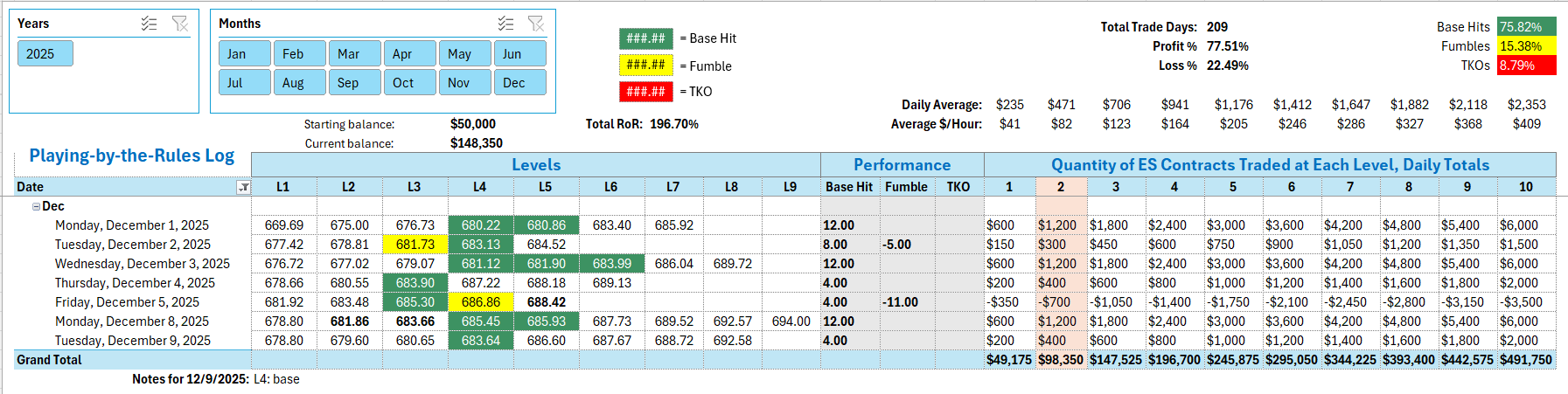

Tracking log to-date for 2025: