SPY Levels & Game Plan

Tuesday, November 11, 2025

9:23 AM – While the bulls were strong yesterday, they couldn’t get price to test an important retracement level yesterday or in the overnight session. That level is at 682.60. They have stalled out under that level so far. Either they are hanging out under it to build up enough energy to bust through it to go higher later, or they’ll meet enough resistance in the general area where price is now and pull back. That level is therefore our axis level for the morning. Closes above 682.60 is good for the bull case. Closes under 682.60 is better for the bear case.

Above that level is a gap that is left open from last week at 683.40. This creates a zone. The whole thing may be tradeable if price approaches it the right way, but the more they go sideways under the zone – or within the zone – the more likely they are gearing up to go higher. I would not necessarily want to trade against the levels of that zone unless I saw other compelling reasons in real time that would validate their importance. For now, they are reference levels.

On the 30-minute chart from yesterday, we got a few signals of a possible trend change, and sure enough, so far in the premarket, price has pulled back a little from where they closed yesterday. If the reversal signs hold, the bears could be able to pull price down to test the lower support levels. Getting above and closing 30-minute and hourly candles above 682.60 and 683.40 takes the reversal setup off the table.

The other levels are designed for base hit trades. No data releases of significance scheduled for today.

After the closing bell...

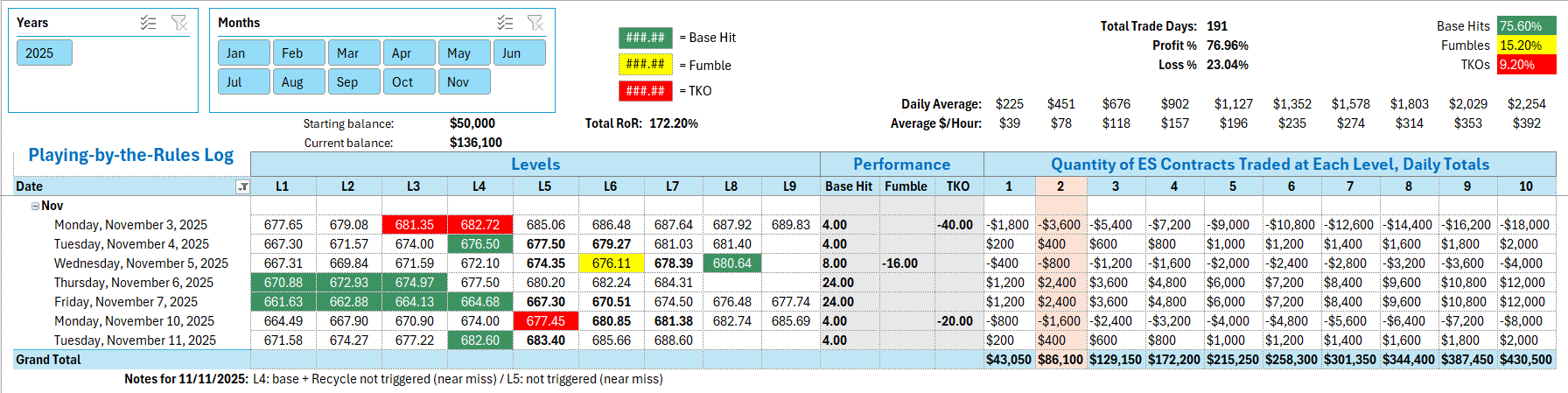

Trading by the Ticks & Trades Rules, here is where you would have landed for the day:

No levels hit until 1:02 PM when price came up into the bottom of the zone at 682.60. That level gave a Base Hit before continuing higher. The top of the zone at 683.40 was not triggered for another short trade because of a Near Miss. There would have been a Recycle Trade on the long side of 682.60, but price missed hitting it by one penny before bouncing.

Per the rules, a total of 4 ES points for the day.

Tracking Log to-date for 2025: