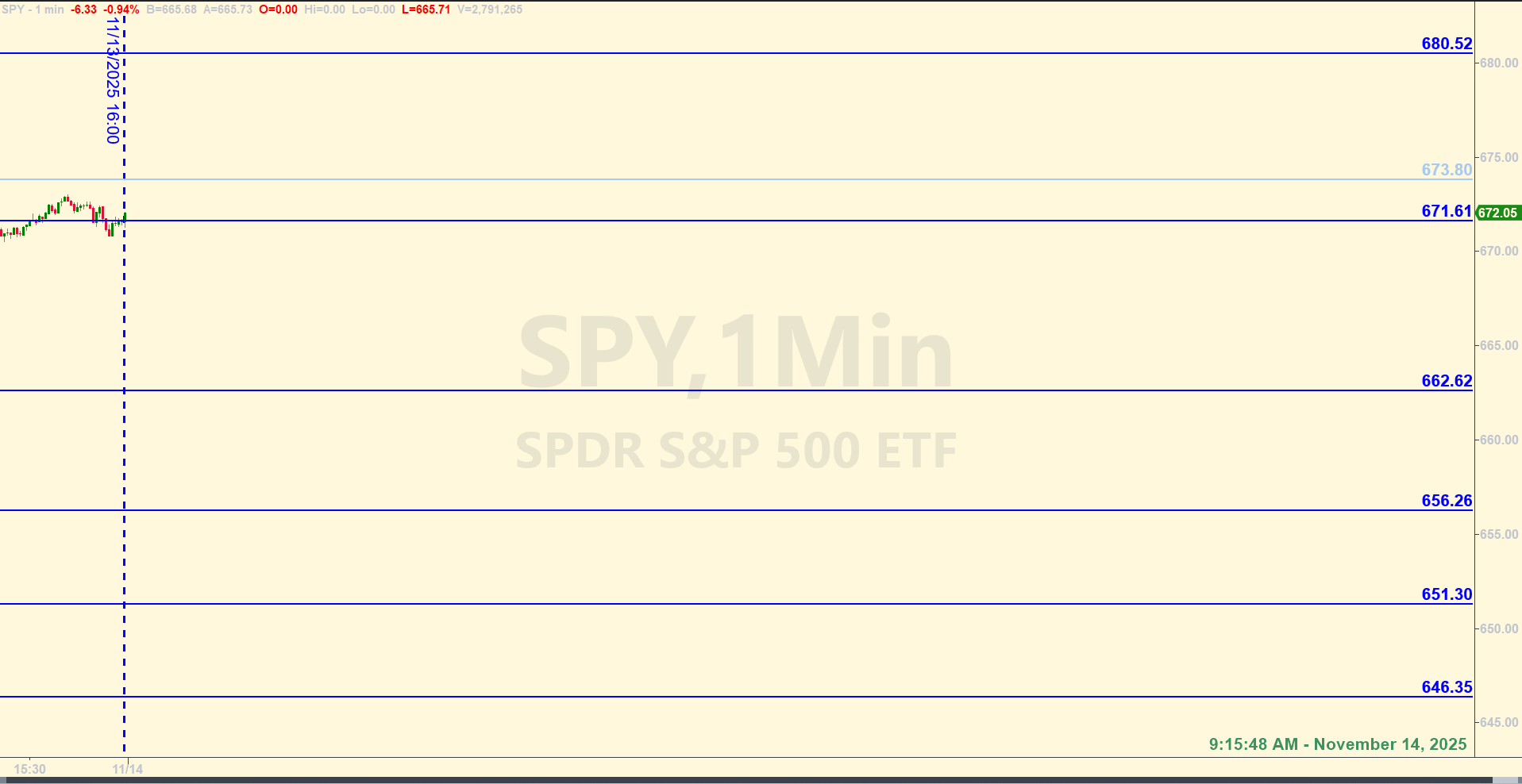

SPY Levels & Game Plan

Friday, November 14, 2025

9:15 AM – Yesterday’s drop put all the shorter timeframes under their 50-period moving averages. The daily chart and above were still in bull territory as of yesterday’s close. But so far in the premarket, price is poised to open under the daily 50-period MA. There is no guarantee that price will stay down there, but there is probably some significance to where price is approaching today’s open – and why it’s down there.

It wasn’t that long ago when we were talking about the doji candle on the weekly chart that was possibly pointing to a pull back. And also the timing on the monthly chart that suggested that the month of November was lining up for some possible weakness. This isn’t to say that price will keep falling today, but there is a very good chance of increased volatility while the bulls and bears get things sorted out. Larger than usual swings are possible today.

It’s about 40 minutes before the opening bell as I write this and price is trying to bounce in front of some support areas. The bulls would like to see price above 668 at the close today. In the meantime, though, they’ll likely be fighting increased bearish momentum. You remember when the SPY broke above 674 and that took the bearish consolidation off the table for the time being? The bulls enjoyed making new highs for a few days, but when price got pulled back down below 674 last week, it sent the bulls teetering. So it’s not too surprising that they lost about 100 S&P points in a short period of time when price got back under and started establishing closes under 674.

There are some levels of potential targets that should act as support if price continues to fall. Again, volatility is likely to be notched up today. Price can spike levels a lot, so if you choose to put money at risk today, the levels may need more wiggle room. Pay attention to the big picture and other indicators that could help validate the levels before trading against them.

If the bulls can get going again, they’ll need to get good closes above the 673.80 – 674.00 area to have a better chance of climbing out of this dip. The axis level for today is 673.80. It might seem like a long way off from there they are now, but anything can happen. If price gets up there, it will be necessary for the bulls to get above and stay above to keep climbing. Be careful and trade well today.

After the closing bell...

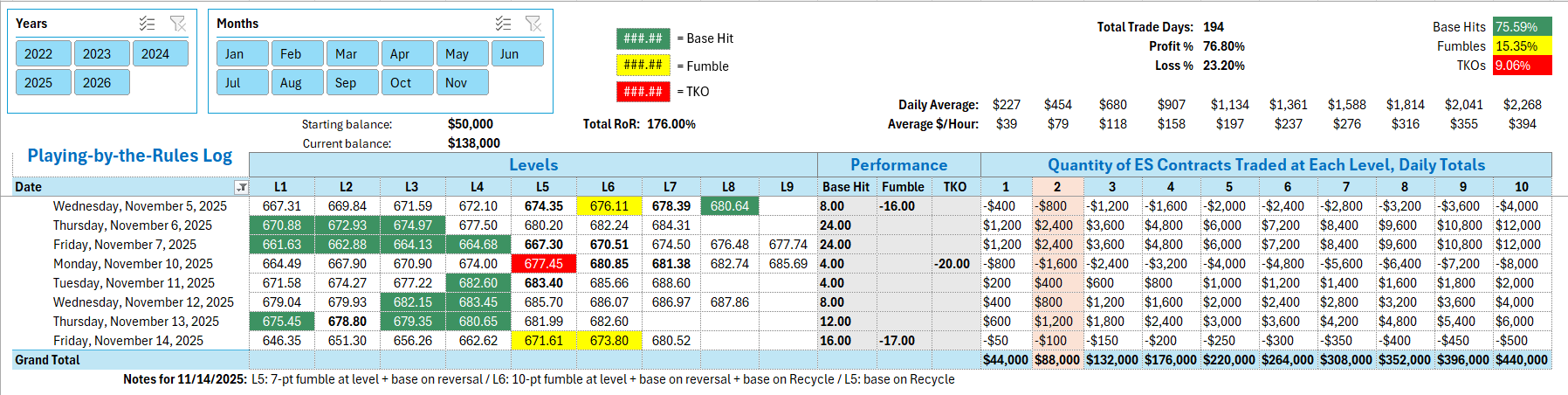

Trading by the Ticks & Trades Rules, here is where you would have landed for the day:

Going short at the first level hit, 671.61 resulted in a 7 point Fumble and then a 4 point Base Hit on the reversal. Next level hit was 673.80 and going short there resulted in another Fumble, giving back 10 points and then regaining some of that with 4 points on the reversal. The Recycle trade at 671.61 provided another Base Hit. And also another Recycle trade at 673.80 gave back an additional 4 points.

Per the rules, a net total of -1 ES points for the day.

Tracking log to-date for 2025: