SPY Levels & Game Plan

Monday, November 24, 2025

9:12 AM - This is the week of the Thanksgiving holiday in the US, and the market will be closed on Thursday. And there will be an early close on Friday. Volume is likely to dry up by mid-week. Also, after this week, the month of November will be complete, as far as the market is concerned. So, where would the institutions and professionals like the month to close? For starters, it will help the bull case if November’s close is above 652. Better yet, if they can get the close above 664, that would look good for the bulls. We still have the timing component to be aware of – that November marks the eighth month of the bull rally, and a pullback in this timeframe is normal.

The big picture question is: is that all the pullback we’re going to see? We won’t know until or unless we see more weakness on the larger timeframes. As of right now, the daily chart is below its 50-period moving average, and has been for the past week, so that’s not exactly strong. The shorter timeframes are almost all bearish in tone.

With this week being a short week, and price back in the middle of stuff, anything can happen. But markets tend to slow down around major holidays. So, we’ll see. The bull axis for today is 663. Price has been hanging around that level in the premarket. The bulls need hourly closes above 663 to be in a better position to climb.

If price gets below and starts closing hourly candles below 658.40, the bears might have an easier time pulling price down into the support levels below current price. The plan for today is base hits at the levels, if everything else looks good in real time as price approaches them. I would want more confirmation and on other indicators and on other timeframes before trading against the bear axis at 658.40. For now, I’m considering that level a reference level. It may work to trade against, but be aware of your surroundings first. No major data releases scheduled for today. Trade well.

After the closing bell...

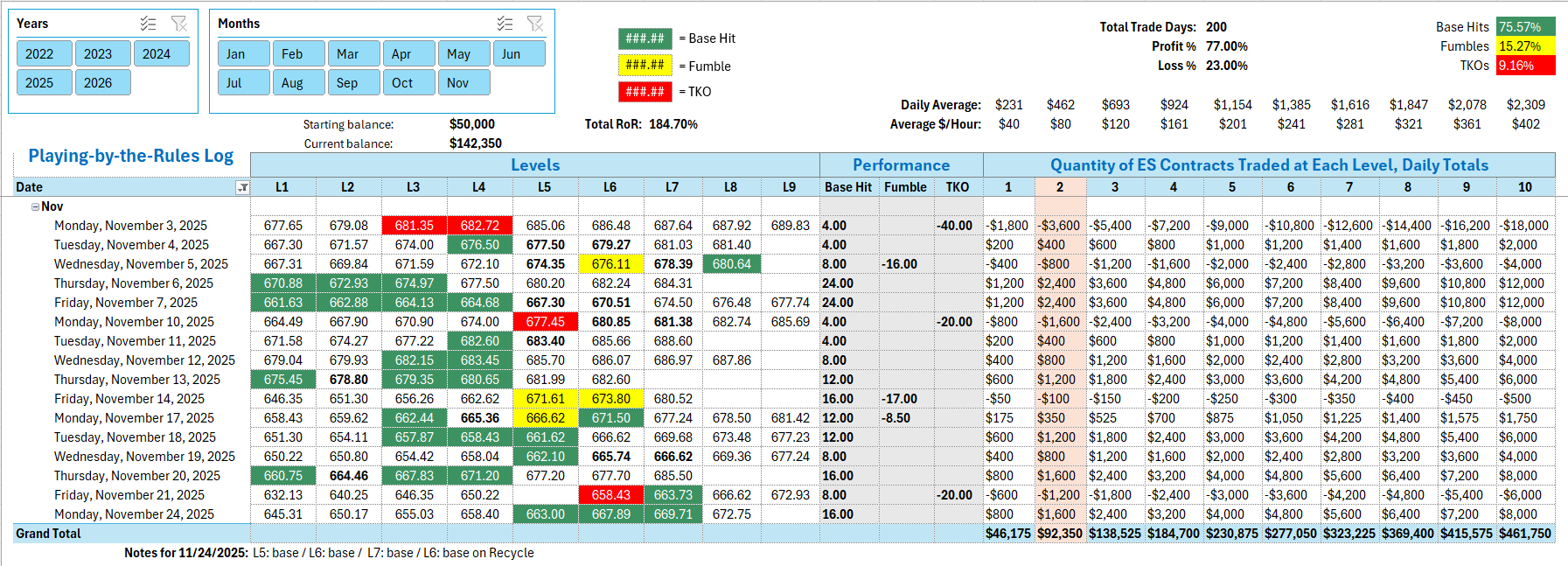

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

After the close of the first 15-minute candle, price was under 663. Going short there yielded the first Base Hit of the day. The second trade was a short at 667.89 at around 11:09 AM Est. Base Hit number two. Third trade was a short at 669.71 for Base Hit number three, and finally a Recycle trade at 667.89 on the long side when price came back down to test it at 2:54 PM Est.

Per the rules, a total of 16 ES points for the day.

Tracking log to-date for 2025: