SPY Levels & Game Plan

Monday, December 1, 2025

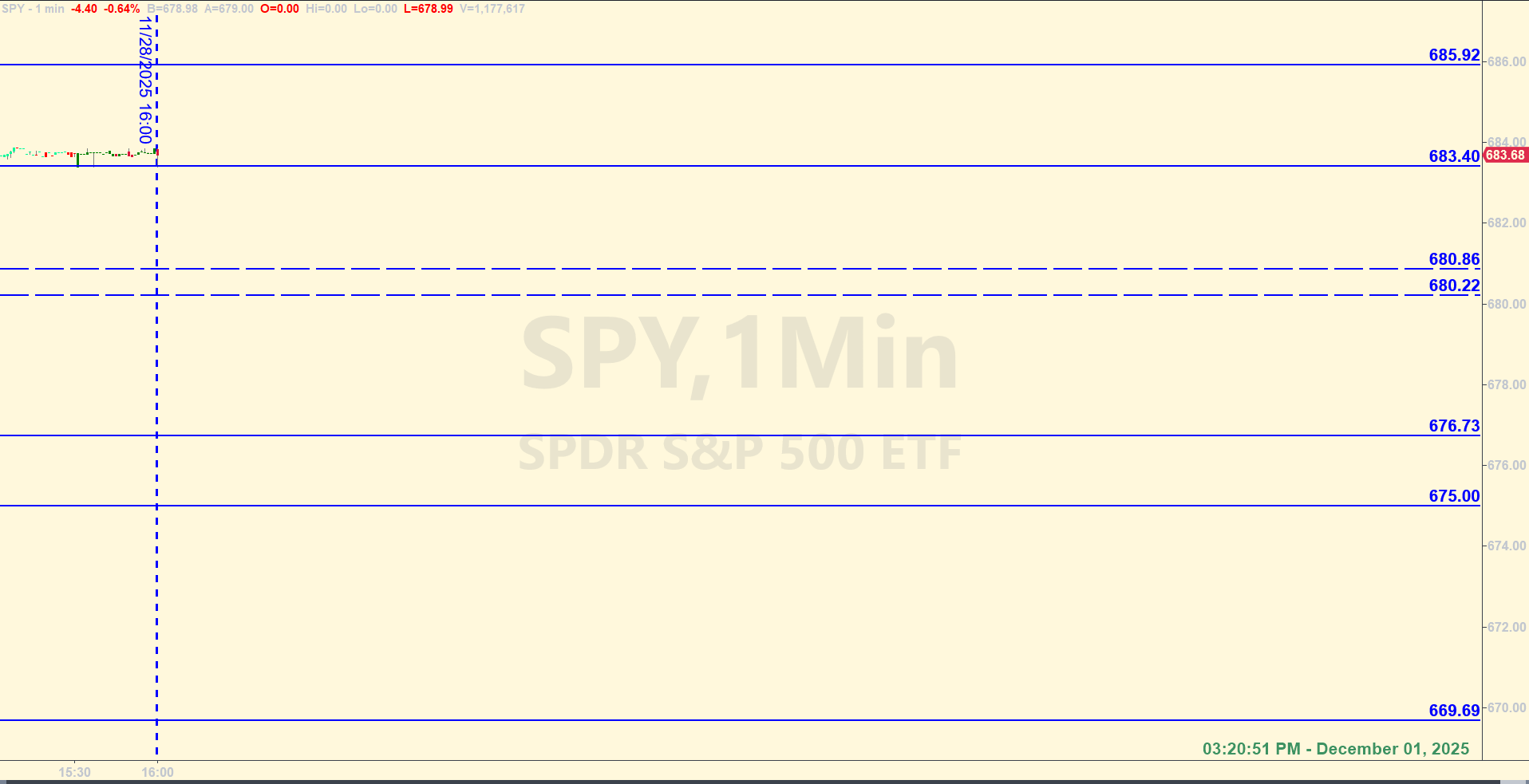

9:20 AM (Eastern) - The market opens in a few minutes. I’m running late – been traveling all day until about 30 minutes ago. I’m in the Central European Standard time zone currently, so that is reflected in the screenshot of the Daily Levels for today.

The levels are straightforward for today. Base hits are the plan. There is a zone between 680.22 up to 680.86 that could provide overhead resistance if price gets back up there.

Refresh this page until about 9:45 AM Eastern – 15 minutes after the opening bell. I’ll see if I can provide a better game plan. I need to study the market some more…

9:35 AM: Ok, so the big picture has the month of November closing with what could be argued is a reversal signal for the month. The timing is good too. At the beginning of November we talked about possible weakness during the month of November. Now that it has happened, we can step back and look at what the month and interim weeks provided. It’s way too early to know, but price action in December will probably be affected by the timing part of where price is and the indecision in November, indicated by the interesting tail candle we were left with after the month closed. That’s usually a sign that lower prices are coming.

Stepping back to the weekly chart, we can see that they fought hard to get above an important trendline and closed last Friday, 11/28 above it. But it’s possible that was a one day / one week wonder and the whole thing is a fake out. Currently, as of 9:44 AM on the first trading day of December, price is back down to that trendline area and fighting it. For the record, that trendline area is around 679.30 to 679.50. The bulls need to stay above that area, as well as the zone up in the mid-680 area for them to have a chance to keep price elevated.

Getting much below the trendline – call it below 679.00 and closing hourly candles and then daily candles below that important area means the bears are probably going to try to pull price down more. Lots of time left for both the bulls and bears to try to establish dominance.

After the closing bell...

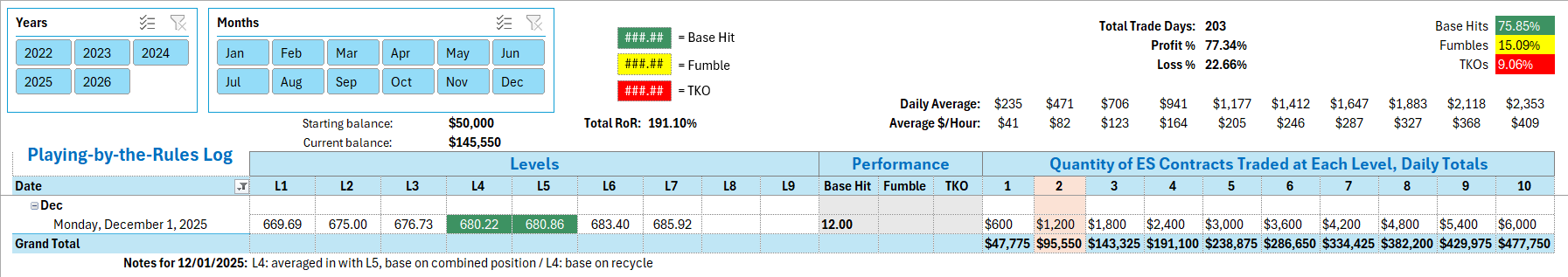

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

After the close of the first 15-minute candle, you went short in the E-minis when the SPY hit 680.22 and added to the position with the same number of contracts when the SPY hit 680.86. Letting the trade develop per the rules gave you a Base Hit on that averaged-in position. That was the first 8 ES points. The Recycle T 680.86 wasn't triggered because not enough time elapsed after price got above the level before the retest. A Recycle trade on the long side of 680.22 yielded a Base Hit. No more trades at these levels after this - both long and short sides had been satisfied.

Per the rules, a total of 12 ES points for the day.

Tracking log to-date for 2025: