SPY Levels & Game Plan

Wednesday, December 3, 2025

Note: the above screenshot was captured after 12/3/2025, as there was no pre-market screenshot taken. But the levels for the day are plotted in the above image for your reference. See the "After the Closing bell" screenshot below which is zoomed in so you can see the three levels that came into play throughout the regular session.

12:56 AM Eastern - I was not able to get the levels and a Game Plan put together for yesterday, Tuesday, December 2. Being six hours ahead of the Eastern time zone has made a few things challenging. Leading up to the market open yesterday, I was nowhere around the screens and unable to post anything. So, for today, Wednesday, December 3, I’m running the numbers and identifying levels before I head out for the day. It is currently about 6:45 AM Central European Standard time, where I am. So that makes it about 12:45 AM Eastern as I write this. Yes, there are many hours before the opening bell today, but I’m running with what I have available at the moment. Like yesterday, I will be away from the screens and unable to trade today. The levels for today should be good for the typical support and resistance we’re accustomed to using our base hit strategy.

Price stayed mostly flat on the day yesterday. The bulls have been doing a good job keep price above that trendline we talked about on Monday. See screenshot below to get an idea of where that trendline is for today. The more time price stays above the trendline, the better chance the bulls have to break above other resistance areas to go higher. They need to break above 683.70 to put price in a better position to climb some more.

If price gets back down to the trendline and starts closing below it, the bears could be able to pull price down more. There is a zone below the trendline that could help catch price – if everything is acting normal at the time. Speaking of of market behavior, be aware of some data releases today. I believe the PMI data releases is scheduled for 11:00 AM Eastern. That has the potential to move things around. Trade well today.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

First Base Hit was a short at 681.12 at 9:46 AM. The window of opportunity opened right under the level (after the 9:45 AM candle closed) and going short quickly gave at least a 4-point Base Hit. No Recycle trade on the long side at 681.12 when price got on top of it, because not enough time had elapsed, per the rules. The next trade was short at 681.90 at 10:03 AM. There was no Recycle trade on the long side at 681.90 because of a near miss at 10:57 AM. When price did retest the level, they bounced, but it would not have been traded, per the rules. The third and last Base Hit was on the short side up at 683.99.

Per the rules, a total of 12 ES points for the day.

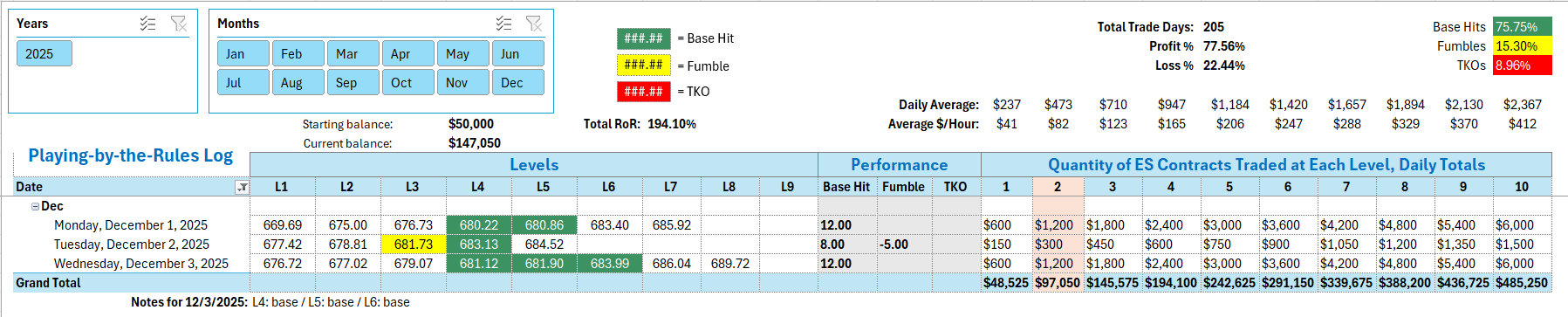

Tracking log to-date for 2025: