SPY Levels & Game Plan

Monday, December 8, 2025

9:15 AM Eastern - We could have an interesting week ahead of us. There is the FOMC announcement on Wednesday, December 10, and it comes at a time when there are several signals that price could be topping out in the near future. It’s not a guarantee, but a good possibility. I’m not just talking about the SPY. The ES isn’t too far from 7,000, other markets are showing signs that profit-taking is happening. In the big picture, the month of December could be an interesting ride.

By the way, I was still in Europe on Friday, and was not able to make it back to my computer before the market opened that day. So, there was no Game Plan posted for that day. For the most part, though, the schematic from Thursday was still in play. Price stayed above the trendline and as we said in Thursday’s Game Plan, the SPY had room to run. That’s what they did on Friday. Friday also gave us a reversal signal on the Daily chart. And the timing is right for a pullback after the bull run for the past two weeks.

For today, we have an area between 685.93 and 685.45 that can act as our axis zone. If the bulls can keep price above and continue closing above 685.93, they have the potential to keep grinding sideways to higher. If price gets below the lower part of that axis zone, the bears might be able to pull price down more. There are levels of resistance above current price and levels of support below current price. Battles for control of both directions is likely – especially considering that much of the market is waiting on the Fed announcement on Wednesday. It’ll be interesting to see where price is leading up to 2:00 PM Eastern on Wednesday this week.

As such, the levels today are designed for base hits. Be aware of what the larger timeframes are saying. Trade well today.

After the closing bell...

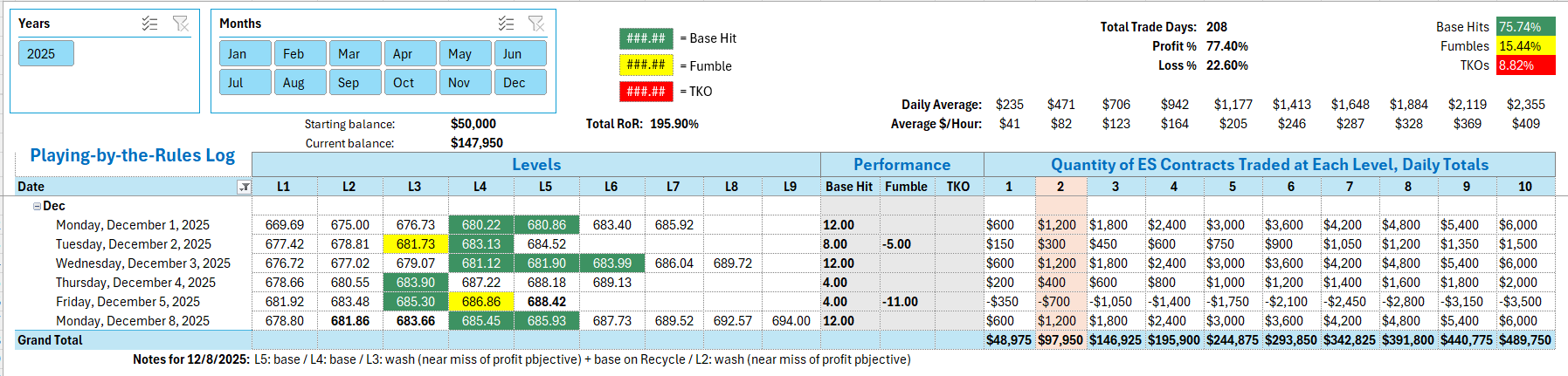

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

The first two trades were quick. At the close of the first 15 minute candle, price was a penny under 685.93. Going short at the market at that exact moment handed you the first base hit. As soon as you closed out that scalp trade for 4 ES points, you jumped into a long trade at 685.45 at 9:49 AM Eastern. The bounce there gave you Base Hit number two. No more trades at those levels, per the rules. When price came down into 683.66 the long position taken in the ES against that level was aborted at a wash because of a Near Miss of the profit objective. The Recycle of that level on the short side resulted in a Base Hit. Then when price got to 681.86, it was another wash. They did pull away from that area after a few minutes, but the first quick Near Miss of the profit objective meant you bailed out of that trade to be safe.

Per the rules, a total of 12 ES points for the day.

Tracking log to-date for 2025: