SPY Levels & Game Plan

Thursday, December 11, 2025

9:25 AM Eastern - About half of the gains from yesterday’s FOMC rally have been erased so far in the overnight/pre-market session. Was the whole thing a fake out? We should get some answers today.

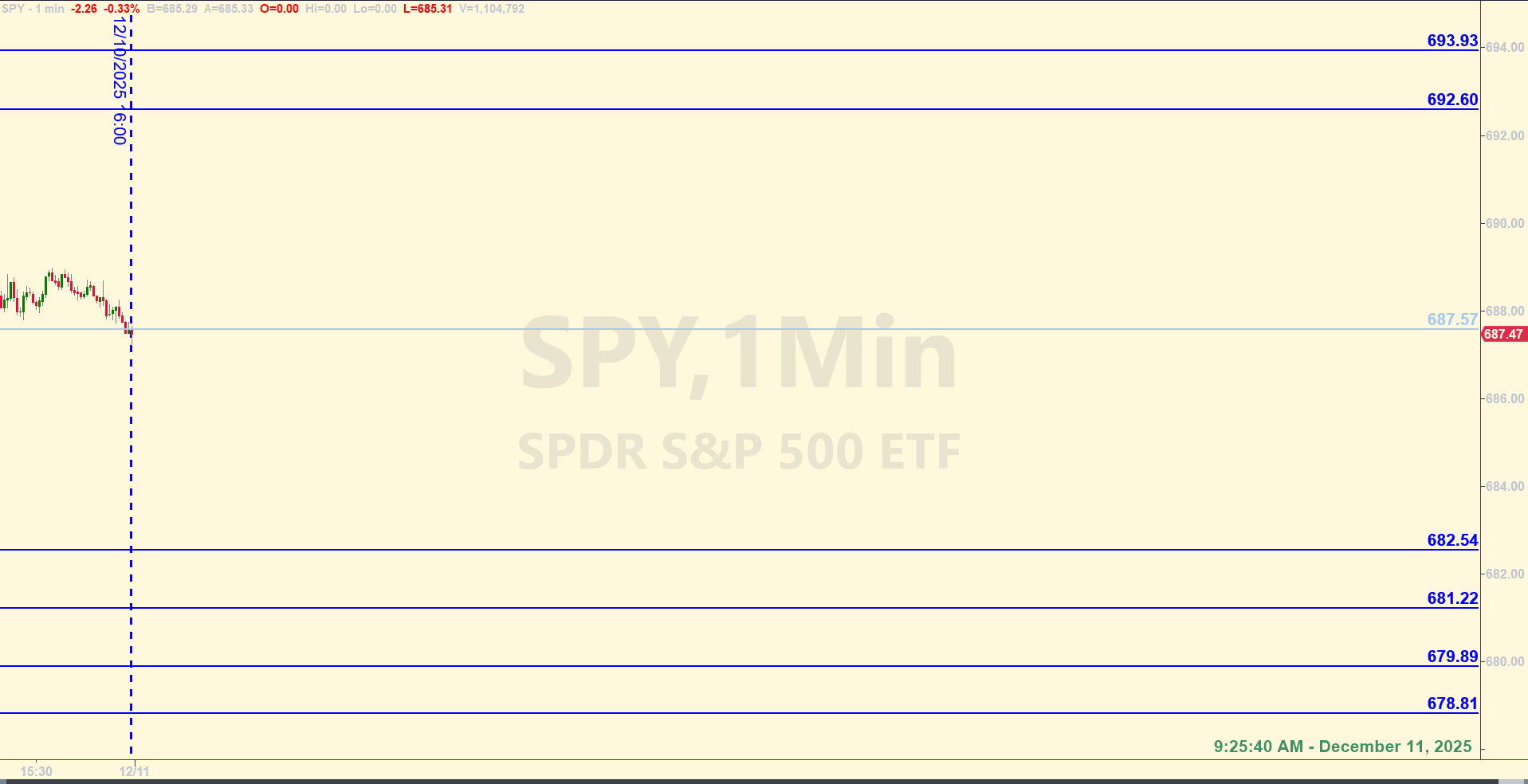

Certainly a bullish sentiment was the overall flavor of the SPY yesterday, but timing is getting ripe for the bears to come out. They need to get price below some key levels before we can say they are in control. Right now, price in the SPY is in the middle of stuff.

Notice that there are relatively large spaces with no identified levels above and below the axis level for today – which is yesterday’s close at 687.57. This is intentional. There may be some residual volatility before things settle down, and the levels on the board are the only ones I’m comfortable with trading against. If the bulls can get price back up and above 687.57, they are likely in better shape to push higher. Staying below like they are now, has the potential to draw out the bears. Again, price needs to get below some important levels – like the trendline, which is down near 675.00 – before the bears have the upper hand.

Let’s let the FOMC dust settle and see what happens. Meanwhile, the levels on the board today are designed for base hit trades in the E-minis, if price in the SPY approaches them the right way and the market is acting more or less normal. Trade well today!

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

First trade should be obvious. It was a classic Base Hit on the long side with the bounce off 682.54 at 9:56 AM Eastern. Later in the day, at 12:25 PM, price got up to the 687.57. That short trade would have been aborted at breakeven for a wash. This is because there was a Near Miss of the profit objective, which changes the flavor of the trade. When that happens, the odds are higher that the short won't hold and price will get above the level and stay above. So no points at 687.57. A Recycle Trade attempt at 687.57 at about 1:24 PM was not triggered because of a Near Miss of the operating level.

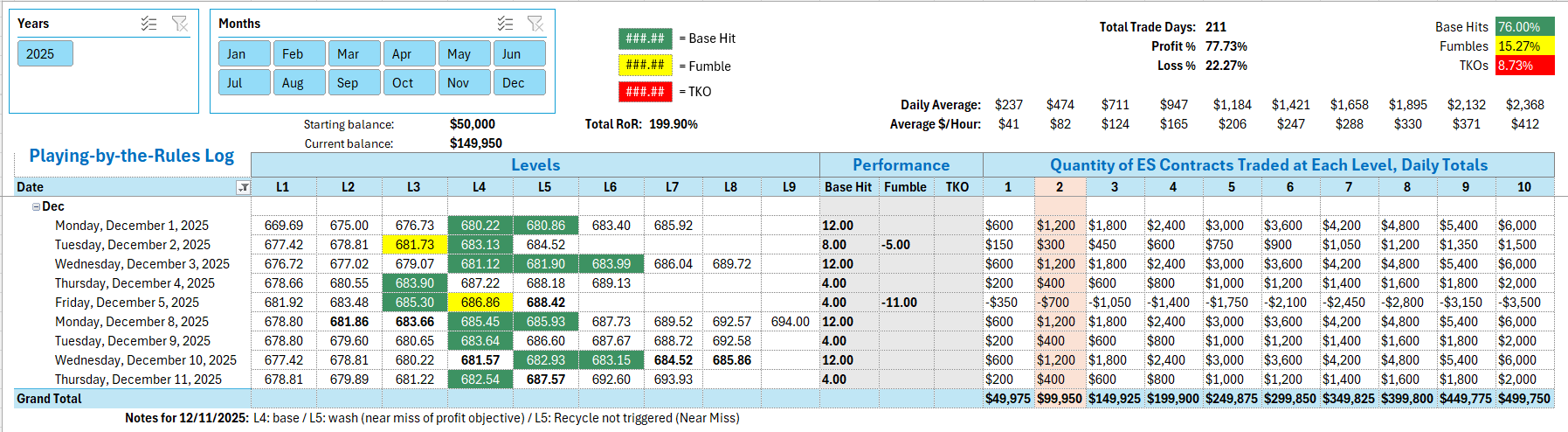

Also, notice in the Tracking Log where the Rate of Return is for 2025 so far. Looks like we're going to surpass 200% for the year. Nice!

Per the rules, a total of 4 ES points for the day.

Tracking log to-date for 2025: