SPY Levels & Game Plan

Monday, December 15, 2025

9:07 AM Eastern - The December ES contract expires this Friday, the 19th, and volume is picking up in the March contract. We’re going to start trading the March contract this week. Notice that the March contract has already gotten closer to 7,000 than the December contract. That’s still a target for the E-minis.

Meanwhile, the SPY/ES continue to go sideways near the former highs – in the big picture, at least. On Friday the 12th, the day closed bearish, near the bottom of a range that price has been constrained in. But so far in the premarket, they’re trying to rebound and currently, price is around the 50% retracement of Friday’s move. This puts puts today’s open likely back in the middle of the range.

It’s kind of a coin flip which direction they might pick in the morning session. But if you look at the IWM, they closed last week with a more decisive signal with their daily candle on Friday. Like the SPY, the premarket activity in the IWM has pushed price back up to around 50% of their down move on Friday. But with the IWM, it would be more probable that they’ll get some more downward pressure today. And if the IWM is moving down, the SPY is likely to follow. Something to keep an eye on.

If price in the SPY gets below and starts closing below 681.75, the bears are likely gaining traction and trying to pull price down into the support areas farther below. Trading against this axis level of 681.75 is ok if everything else lines up accordingly.

Above current price are areas of probable overhead resistance. Considering that price is in the middle of a sideways consolidation in the big picture, and has retraced itself back to an important area in the premarket, anything can happen. Hence, the coin flip analogy. Levels are good for base hit trades in the E-minis if price comes into them the right way – that is, pursuant to the Ticks & Trades trading rules. On Friday, following the rules would have kept you out of trouble on one level that didn’t work, and gave you base hits on other levels that were on the board before the opening bell.

No data releases or news items on the schedule for today. Tomorrow looks to be much more active in that department. Trade well today.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

One level was hit and the trades were straightforward. Price came down into 681.75 at 10:01 AM Eastern. A quick bounce and Base Hit number one in the bag. Price got under the level and about 35 minutes later, it's back up at the level from the underside. You went short for a Recycle Trade at 681.75 when price hit it from underneath for the first time at 10:45 AM. A reaction and Base Number two. No more trades for the day because no other levels were hit and 681.75 had been traded on both sides.

Per the rules, a total of 8 ES points for the day.

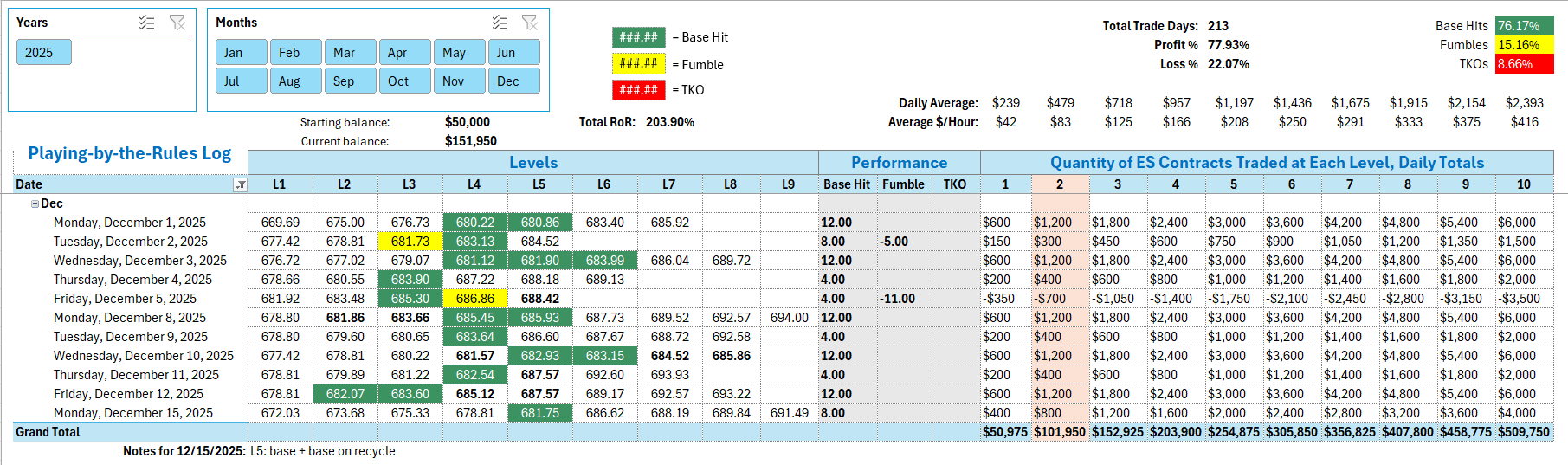

Tracking log to-date for 2025: