SPY Levels & Game Plan

Tuesday, December 16, 2025

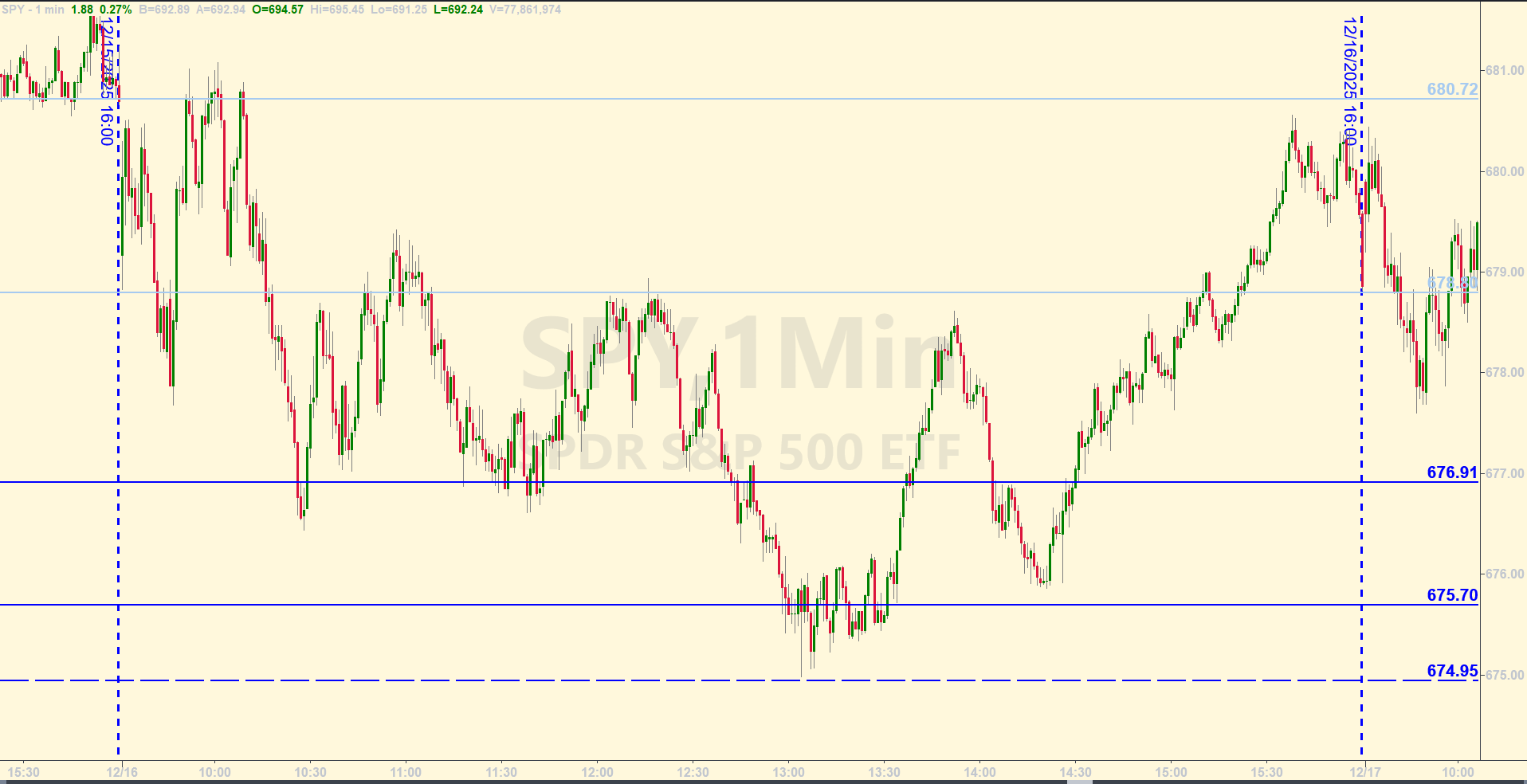

9:12 AM Eastern - The IWM pulled back as expected yesterday and that probably helped the bears in the SPY get price back down to the bottom of the range they’ve been in. Now price is poised to open today at the bottom of the range – which is the area between 680.72 and 678.80. Those two levels are our bull and bear axis levels respectively. It’s showtime for the bulls. If they can defend this area and start closing 15-min, 30-min, and hourly candles above 680.72, they have the potential to climb into the levels of overhead resistance. If they can’t defend this area and start closing below 678.80, then they’re probably on a mission to test the trendline which is coming back into play the lower price gets.

For today, that trendline is between the zone at the bottom of the board between 674.95 and 674.20. It would be normal market behavior for there to be a bull/bear battle down there. And there are other levels slightly above that trendline area that could provide support too. It’s an important area. If price gets down there and stays down there for awhile, the market could be signaling that this sideways consolidation is nearing an end and a possible rollover is coming. Still too early to know for sure, but getting under the zone today would be one of the clues.

There have already been some data releases during the premarket that moved price around. We still have PMI data coming out at 9:45 AM Eastern and that news has the potential to move price some more. Be aware of your surroundings leading up to 9:45 AM. Trade well today.

After the closing bell...

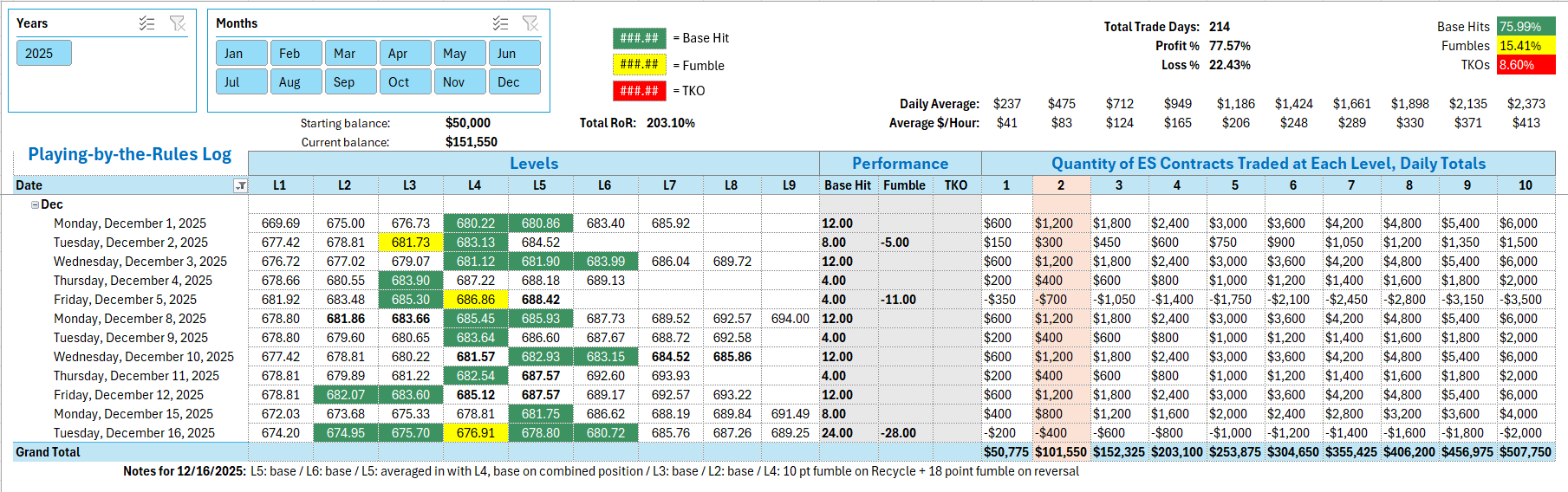

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

First the overall picture for the day: Price could not get above the bull axis of 680.72, and when they fell and got under the bear axis at 678.80 and started closing under it, it's no surprise that the tone of the market for the day was mostly bearish. And price was indeed pulled down by the bears and the top of the zone was tested almost precisely. Those were things to look out for as spelled out in the Game Plan from the morning. From a micro perspective, how did the levels work as traded according to the Ticks & Trades strategy?

At the close of the 9:45 AM EST candle, price was under 678.80. Going short in the ES with the SPY hit that level a minute later was the plan. Base Hit number one. The bulls defended it will and price shot up to the the bull axis at 680.72. Going short there gave you Base Hit number two. Price is back down to 678.80 after a not-quite-a-Near Miss, but close when price reacted sharply away from that general area at 10:05 AM. So when price was falling into 678.80 again, it was trader's choice whether to trade against it. You could have made the case that that level provided a good bounce in the 9:42 to 9:48 AM timeframe and therefore had been satisfied on the long side. But technically, price didn't get close enough at 10:05 to count as a official Near Miss. So if you did go long at the level when they fell into it at 10:16 AM, you would have been out of the money quickly. By the time price hit the next level down at 676.91, the unrealized loss had not reached the max loss limit, so the plan was to buy again at 676.91. That gave an averaged-in position across those two levels. It didn't take long for support to be established and a Base Hit bagged on that combined position.

You didn't trigger a Recycle Trade at 678.80 when price bounced back up there because of a Near Miss that occurred at 10:33 AM. So next trade was a long at 675.70 for a clean Base Hit. And another one at the top of the zone at the 674.95 level. The operating level was 675.00 for that trade, so scooping up that long position was clean and picture perfect. The Recycle Trade on the short side of 676.91 resulted in a 10 point Fumble plus another 18 point Fumble on the Reversal. A lot of back and forth and some points given back to the market. Rate of return for the year is still over 200%.

Per the rules, a total of -4 ES points for the day.

Tracking log to-date for 2025: