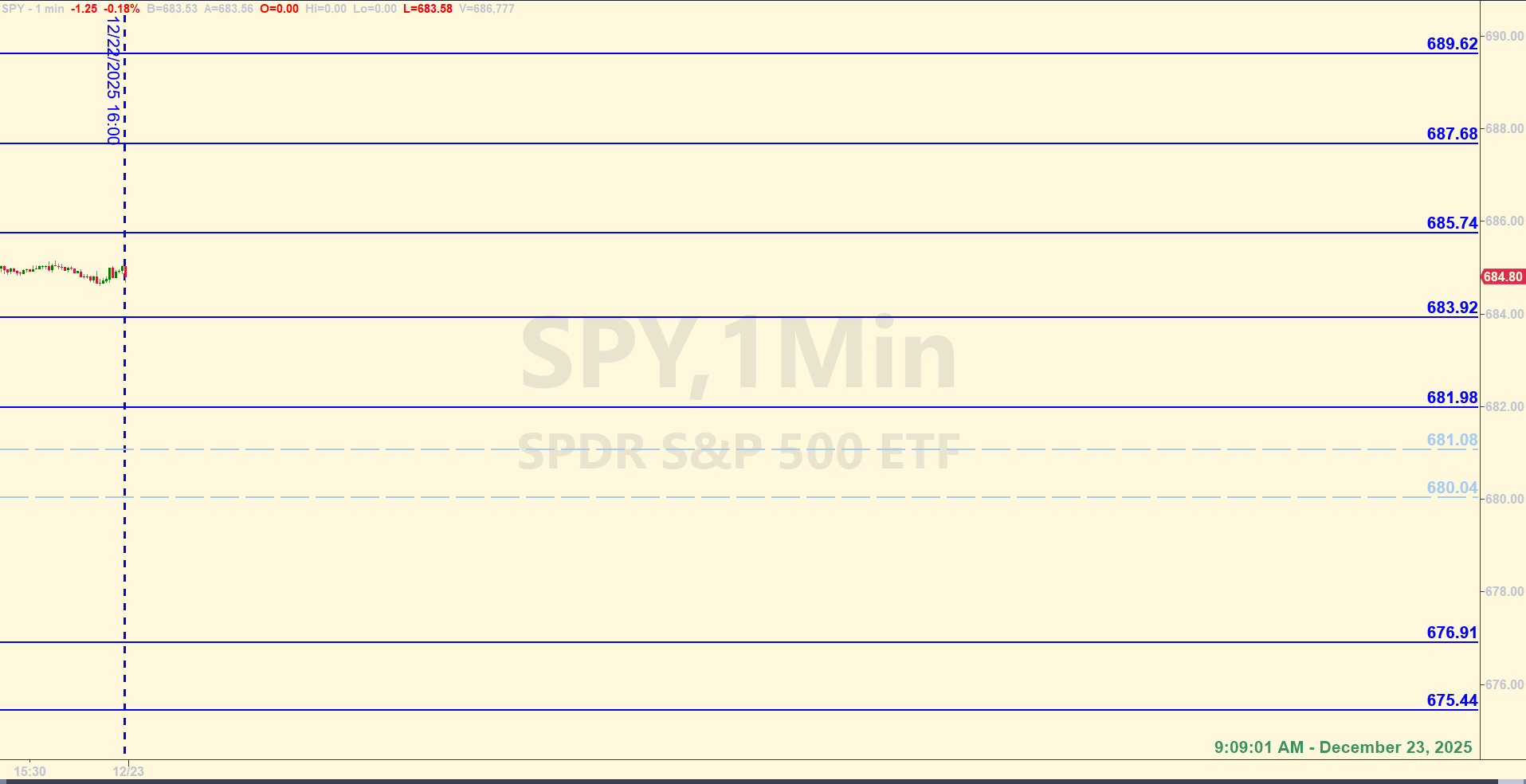

SPY Levels & Game Plan

Tuesday, December 23, 2025

9:09 AM Eastern - The only level that price hit yesterday was the bottom of the zone at 685.20. That resulted in a pull back. It was slow, but eventually, they provided a good base hit – more than a handful of points overall. But the SPY couldn’t get any deeper into the zone during the regular session. However, in the overnight session, price finally did get up into the middle of that same zone we identified yesterday morning before the opening bell – and that is where price pulled back from. So, we have a little bit of a pull back going on, but the SPY is still in bull territory. Price would need to get down below the zone at 681.08 to 680.04, and start closing hourly candles below that area before we could say that the bulls might be struggling. Even if that happens, it could just be a test by the bulls to see if those areas of support can hold.

Because it’s a holiday week, price action is still likely to be slow. It’s good to be aware of all possibilities though. So we have levels of probable support and resistance above and below current price, in case they start moving it around today. The more likely scenario is that today and tomorrow will be slow with not a lot of price movement. If things look relatively normal if/when price gets to the levels we have on the board for today, they are all valid for base hit trades. As always, understand what’s going on in the big picture before trading against the levels. Trade well today.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

At the close of the first 15 minute candle during the regular session - which is 9:45 in the Eastern time zone - price was a tick or so above 685.74. So the strategy says go long at the level if price comes back into it. And they did, seconds later. That continued momentum gave you a Base Hit quickly. Then price got under the level but didn't make it down to the next level lower, which was 683.92. They found support above that and started to climb. That's bullish behavior. And you can look at the initial reaction at 685.74 during the 10 minutes between 9:45 AM and 9:55 AM as a short trade that played out as designed. Yes, you went long there and grabbed a quick scalp trade. But the bigger picture is telling you that the bulls are probably gaining strength and they might be able to bust through the level on the second or third try. But we're going to say you went short at 685.74 because from a purely technical perspective, there wasn't a short trade taken at the level yet, per the rules. A short there resulted in a 6.5 point Fumble and a Base Hit worth of points on the reversal.

The next trade was a short at 687.68. Nothing happened - no Base Hit nor Fumble signal - and the clock was running out. Closing out the position at the market at the 10-minute mark before the closing bell was the plan. So, at 3:50 PM Eastern. That took another 3 points away from the bag to wrap up the trading day.

Per the rules, a total of -1.5 ES points for the day.

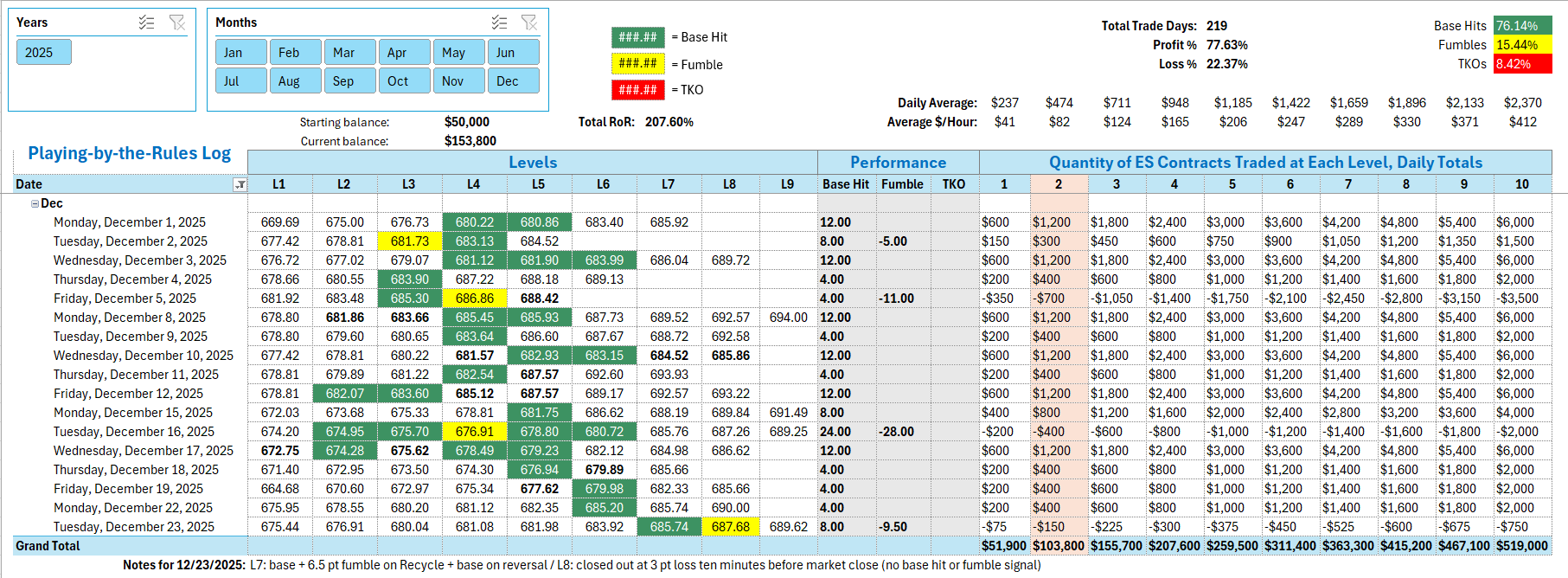

Tracking log to-date for 2025: