SPY Levels & Game Plan

Monday, December 29, 2025

9:25 AM - We’re back in business today after the Christmas holiday, but this week is likely to be another low-volume trading week. The market is closed on Thursday for the New Years Day holiday. Like last week, I’ll publish levels and Game Plans through Wednesday, December 31, and pick back up on the following Monday, January 5, 2026.

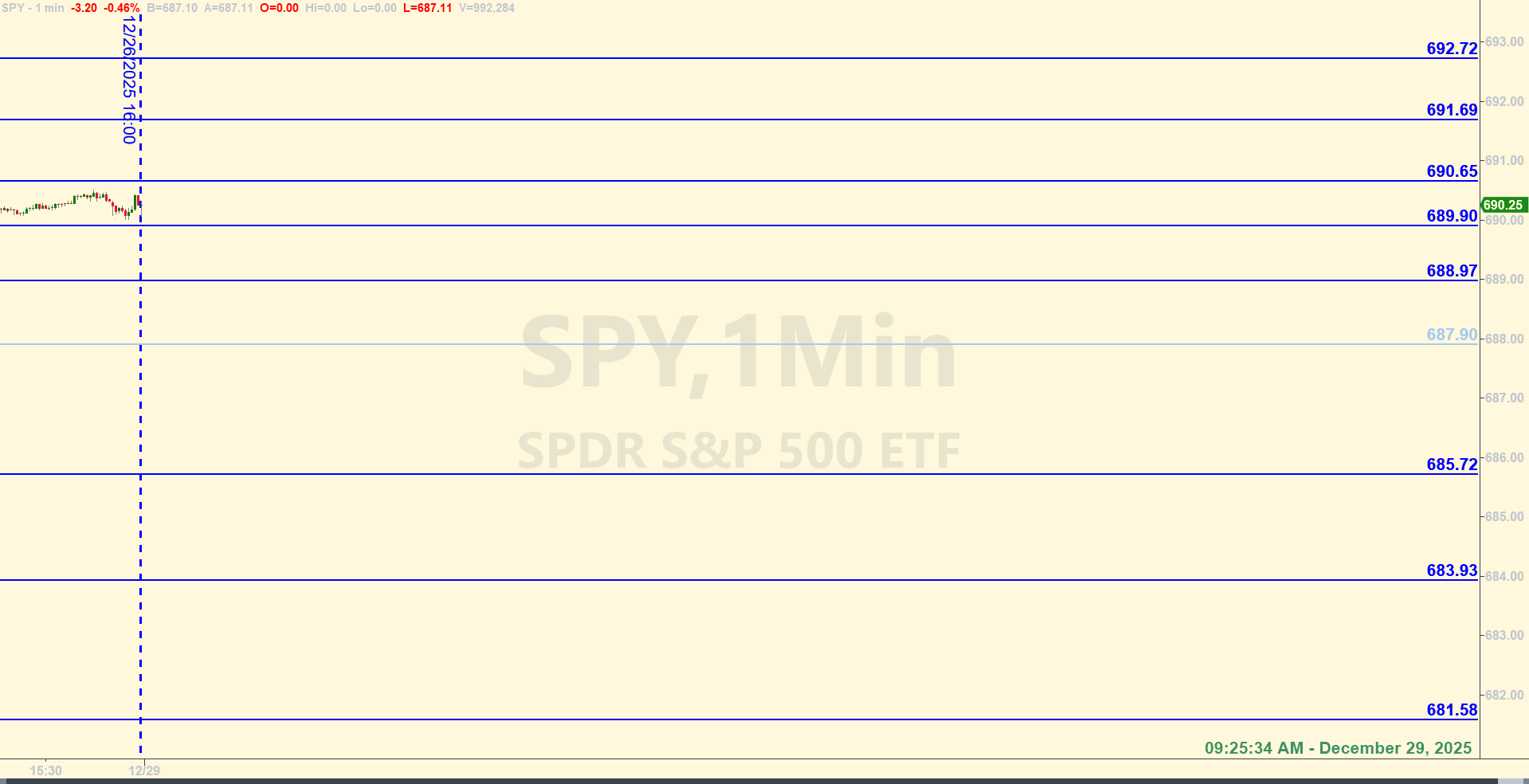

What we’re looking at now is a pull back from the all-time the SPY made on Friday. In the afterhours session, price has been pulled down to a trendline area, which is around 687.90. That is a place where the bulls will defend and price will rebound from – or the bears gain some strength by establishing closes under 687.90, and that will likely bring lower prices today. So we’ll use 687.90 as our axis level for today.

Getting below and closing below 687.90 opens the door to support down at 685.72. The other levels are typical for today – designed for base hits. Market activity might slow down over the next few days. And when volume is light, either price basically goes nowhere, or sometimes a news event can spook the market and price moves a lot. There aren’t any scheduled data releases for today, although tomorrow, Tuesday, December 30, there are FOMC meeting minutes on the docket for 2:00 PM Eastern. That may have some kind of bearing on where price goes.

The end of the 2025 currently looks like price could end in the neighborhood of the all time highs, but it’s not over yet. Keep an eye out for potential signals on longer timeframes that could point to a trend change. For example, the 3-hour chart ended on Friday with a bullish flag pattern which had the potential to break out above the former all-time highs today and this week. But it failed. Now price is below the low of the big up candle that started the pattern. That low happens to be around the axis level for today. So getting 3-hour candle closes below the axis level could indicate lower prices on the horizon, as we talked about earlier. Trade well today.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

Price got above the axis level of 687.90 quickly after the open and ran right up to the level at 688.97. That level was great overhead resistance and was the high of the day, but the trade was not entered because the level was hit within the first 15 minutes of the regular session. Then price fell back into 687.90, triggering a long trade at 9:46 AM. That handed over a quick Base Hit. Price got under that level and the Recycle trade was entered on the short side at 10:26 AM. You bagged your second Base Hit on the trade in about 25 minutes. No other trades were entered after this point in time because no other levels were hit, and 687.90 had been traded on both sides already. The retest of the axis level at 1:39 PM did not trigger another short trade, but you can see that the level was still important at that time.

Per the rules, a total of 8 ES points for the day.

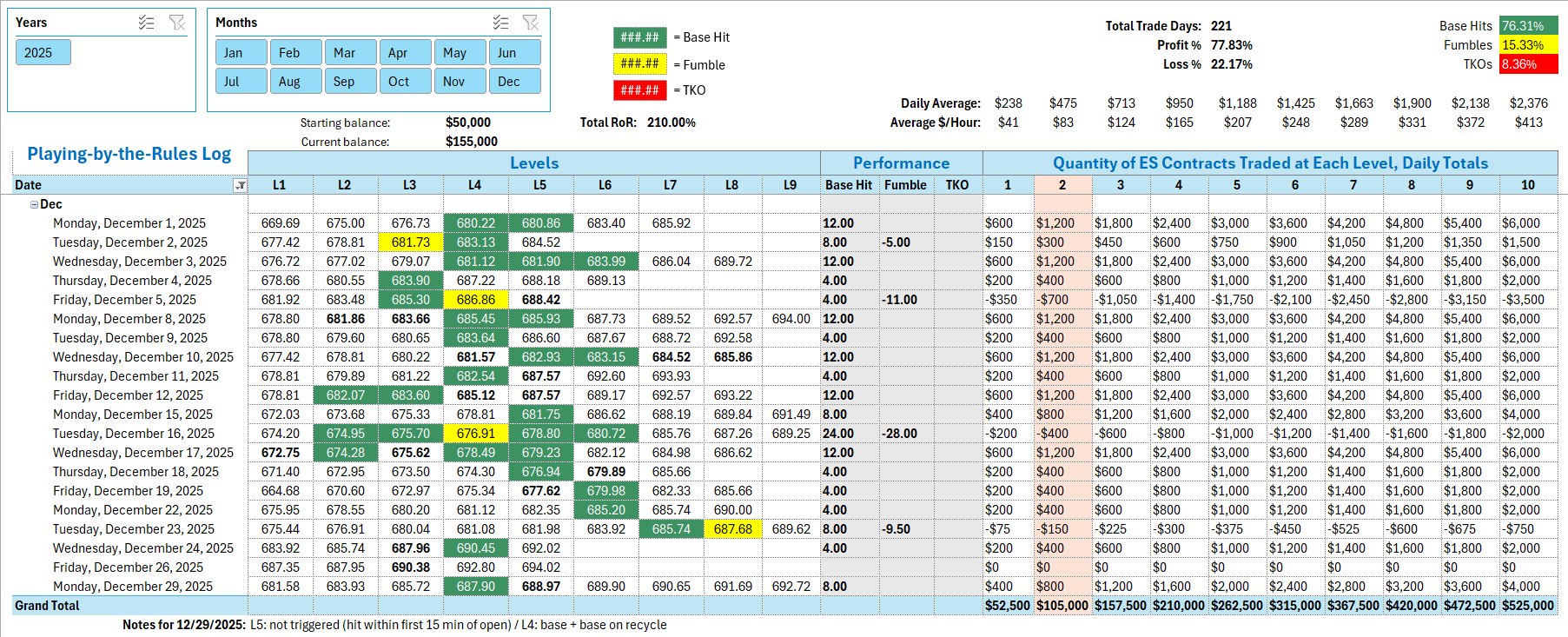

Tracking log to-date for 2025: