SPY Levels & Game Plan

Monday, January 5, 2026

Take note of the levels for today – see list above – and keep refreshing this page. I’ll put the Game Plan together and try to have this page updated before 9:30 AM….

We didn’t have levels or a Game Plan for Friday, which was the first official trading day of 2026, but it’s good to see what the SPY did at the close of last week and the month of December.

The big picture (monthly chart) gave us another candle that signifies indecision. The timing is good for the month of January to pull back, based on signals from the last two months, and of course, the timing component of where price is now – how log it’s taken them to get to where they are now. Zooming into the weekly and daily charts, we can see more clearly that price in the SPY is still “in the middle of stuff”. They are going sideways in a large range in the big picture. Above one important trendline and below another interim trendline. So for the near term, price can be pulled in both directions with more-or-less equal ease.

On the shorter, intra-day timeframes (one-hour and shorter), we can see the bulls trying to negate a bearish consolidation pattern that started developing last Friday, December 2. If the bulls can get hourly closes above 685.73, which is the axis area for today, then they are likely targeting the next zone higher up. The two zones are identified by the dark blue font levels in the list above and the same blue dashed levels in the screenshot below.

The bear axis is 680.61. Hourly closes below and price could fall into the support areas identified by the levels below, starting at 678.36. The level at 683.15 is Friday’s close and may produce a bounce if price comes into it the right way. Keep an eye on moving averages on all timeframes as price interacts with the levels. Since they are in the middle of stuff, there could be a lot of convergences with the levels and moving averages today, which could make for good trading opportunities. There is a PMI data release at 10:00 AM Eastern. Be aware of that. Trade well today.

After the closing bell...

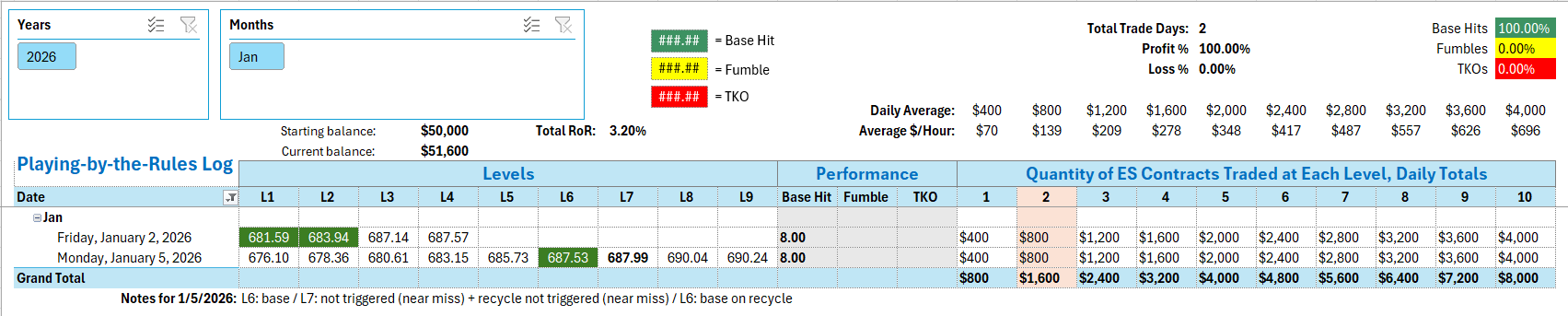

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

Price hit the first zone - the axis area - and stayed above for most of the day. That was bullish behavior overall. The first official trade was a short at 687.53. During that trade, price got up near the 687.00 level, which was the top of the zone, but didn't tag it before reacting strongly. That was a near miss. So the conservative thing to do was not trust the level for a short trade if price got up there again. They did, but no trade was entered, per the rules. The Recycle trade at 687.99 was not triggered because of the Near Miss at 1:09 PM. But the Recycle of 687.53 worked as designed giving you two Base Hits for the day.

Per the rules, a total of 8 ES points for the day.

Tracking log to-date for 2026: