SPY Levels & Game Plan

Tuesday, January 6, 2026

Take note of the levels for today – see list above – and keep refreshing this page. The Game Plan should be ready to publish around the opening bell…

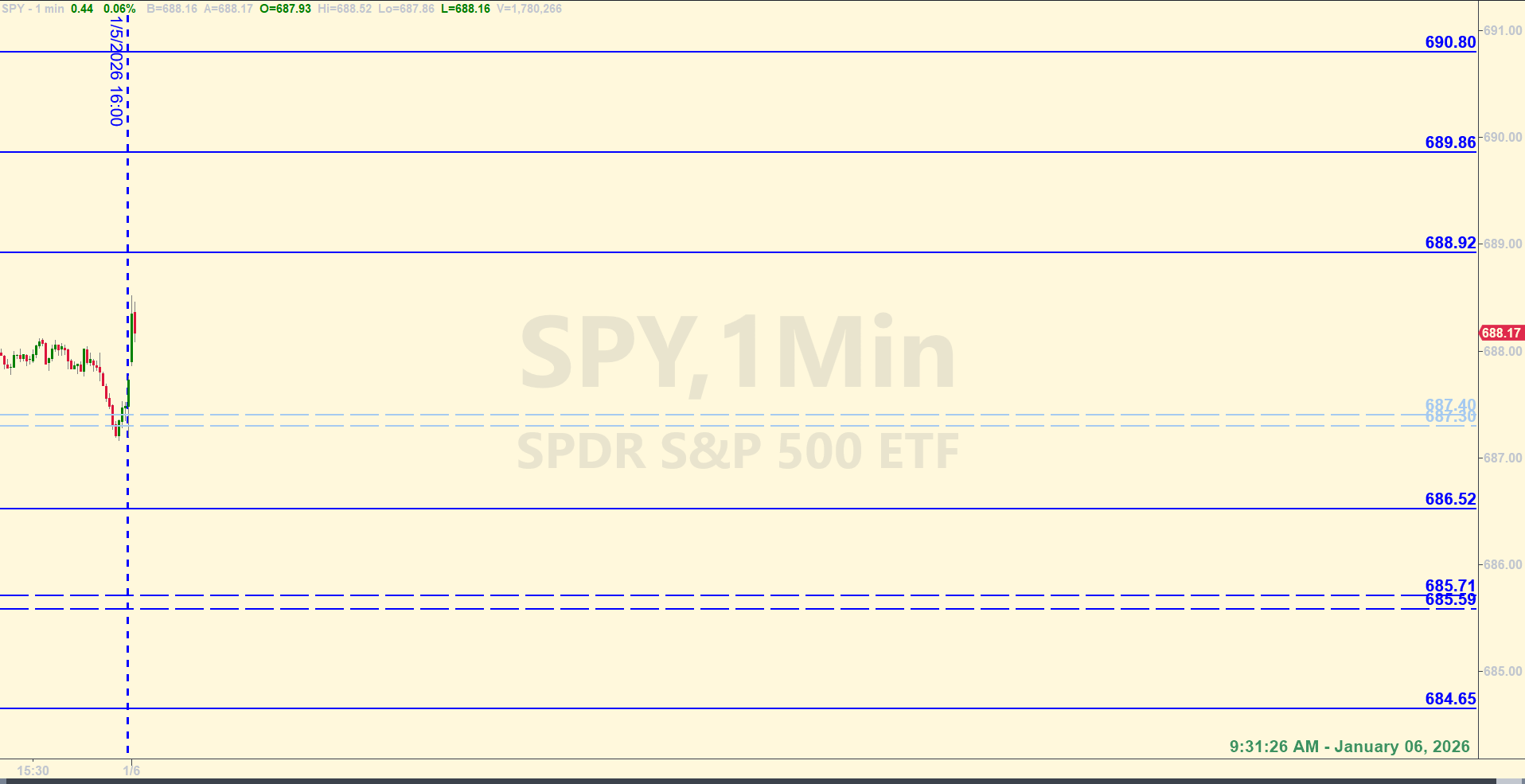

The trendline that the bulls and bears have been fighting is around the axis zone between 687.40 and 687.30 for today. This isn’t necessarily a tradeable area today as it’s likely that once either the bulls or the bears establish dominance above or below (respectively) the trendline, price will continue to move in that direction. In other words, while the zone may work to trade against, it’s just not clear how long the battle around that area will continue. Using the zone as a gauge for longer-term bullish or bearish behavior is the purpose of the axis zone for today.

The other levels – and zone farther down at 685.71 to 685.59 – are probably more tradeable. As always, it’s good to be aware of what the other indicators are telling you before trading against any of the Daily Levels.

Staying above and closing hourly candles above the axis zone (light blue dashed levels in the screenshot below) is the bull case. Getting below and closing hourly candles below the axis zone is better for the bear case. The other levels on the board today that are probable places for support and resistance are relatively close together. In a “normal” market, that’s not a problem. But if something happens that gets price to move around a lot, the levels can be spiked more aggressively. There is one data release at 9:45 AM Eastern that may have the potential to stir things up in the SPY / ES. So be aware of that. Otherwise the levels are designed for base hits.

The level at 686.52 could provide more than a base hit, unless they want to go down to the zone below that first. The whole overall area at and below 686.52 s a longer-term support area, where the bulls – if they can keep control – can drive price up for a few hours. Something to keep in mind. Getting below 686.40 or so and closing hourly below that area probably means the bull consolidation pattern is off the table for the time being. Trade well today.

After the closing bell...

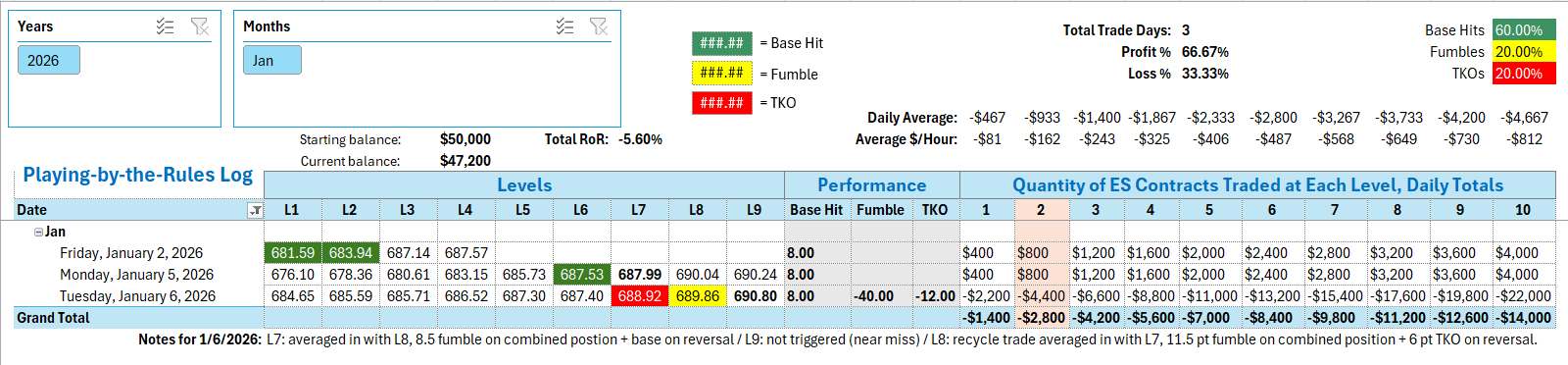

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

Right out of the gate, price in the SPY started climbing. They opened above the axis zone as defined in the morning Game Plan. And the bulls liked a 9:45 AM PMI data release and price climbed past the first level at 688.92. You can see how the levels on the board did provide some reaction when price came into them - especially 690.80. But unfortunately, sticking to the process and trading precisely per the rules essentially made almost every trade got on the wrong side of the levels. Going short at 689.86 at 9:47 meant you averaged in with the same number of ES contracts when SPY came up and hit 689.876. That level alone would have worked well as a standalone trade, but since it was now part of the the level below it, waiting for a Base Hit or Fumble was the plan. An 8.5 point Fumble came first and the position was reversed. The reversal handed over a Base Hit as price continued higher. When price got to 690.80, there was a Near Miss before price finally hit the level, thereby taking that short trade off the table. So no short trade up at 690.80 unfortunately. The Recycle trade at 689.86 on the long side was averaged in with 688.92 and produced another Fumble - this time for 11.5 ES points. The reversal didn't work, and the trade was finally closed out as a TKO with an additional 6 point loss on that combined position. A lot of points given back to the market today, and putting the start of 2026 a few percentage points under water for our rate-of-return metric.

Per the rules, a total of -44 ES points for the day.

Tracking log to-date for 2026: