SPY Levels & Game Plan

Wednesday, January 7, 2026

9:19 AM - The SPY hit a new high yesterday. They stalled out right above 692 though and stayed in that general area in the post market. Then in the overnight and premarket session, price dipped and the bulls are currently trying to get back above 692. So this is a sideways move in the mid-term picture. This is typically a bullish sign – a good up day and then holding at the highs after the close. If price stays up around 692 without pulling down much, they have a better chance to build up strength to make another attempt at breaking the highs from yesterday and grinding higher.

Therefore 692.57 is our bull axis for today. Getting above and closing candles of significance above 692.57 can mean the bulls have what it takes to push higher. Don’t forget, ES 7,000 isn’t too far away now. It’s still a possible target. There are no levels on the board for today above 692.57 until 695.72. That may look like a long ways above current price, but there are no potential resistance levels I’m comfortable with including above current price for today. There is also a trendline above 692.57 that runs from about 692.84 to 693.15 for today. That is a safety net for a short position from 692.57. Getting above and closing above the trendline area is bullish. Unless we see signals of a potential bear retaliation which could pull price down, the bulls have the ball and the buy-the-breakout traders want to see price climb higher.

The bear case would be stronger if price gets pulled down to 689.98 and that level doesn’t hold. There would likely be a bull/bear battle down there first – if the bears are able to get more selling going, and that means the level could be a tradeable opportunity. But as the bear axis level for today, 689.98 is also a reference level to gauge the strength and intentionality of the bears. The other levels on the board below the bear axis are typical levels of potential support and should provide tradable bounces if price in the SPY approaches the levels per the rules of the Ticks & Trades futures trading strategy. There is a PMI data release at 10:00 AM Eastern. As always, it’s good to be aware of where you’re at leading up to news items like this – especially if price is at a pivotal point, which it is right now. Either the bulls break out and try to climb into new highs, or this is yet another test by the bears before they start selling again and pull price back down into their targets on the low end.

After the closing bell...

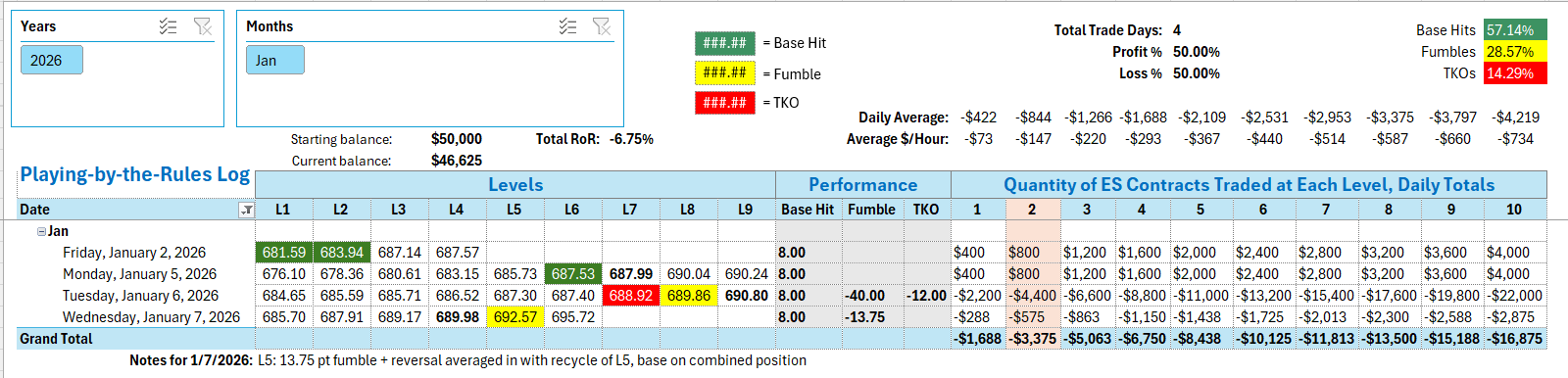

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

The overall reaction at 692.57 from about 9:42 AM to 10:00 AM was that of an overhead resistance area. Price hit resistance and fell from that area. But strictly speaking, right at the close of the 9:45 AM candle, price was above 692.57 so buying ES contracts the next time the level was hit from above was the plan. That long position yielded a 13.75 point Fumble. The reversal of that position after the Fumble was still in play when price came back into the level, which was prime for a Recycle trade. So averaging again on the short side at 692.57 gave you a Base Hit on the combined position as price fell from that level.

Per the rules, a total of -5.75 ES points for the day.

Tracking log to-date for 2026: