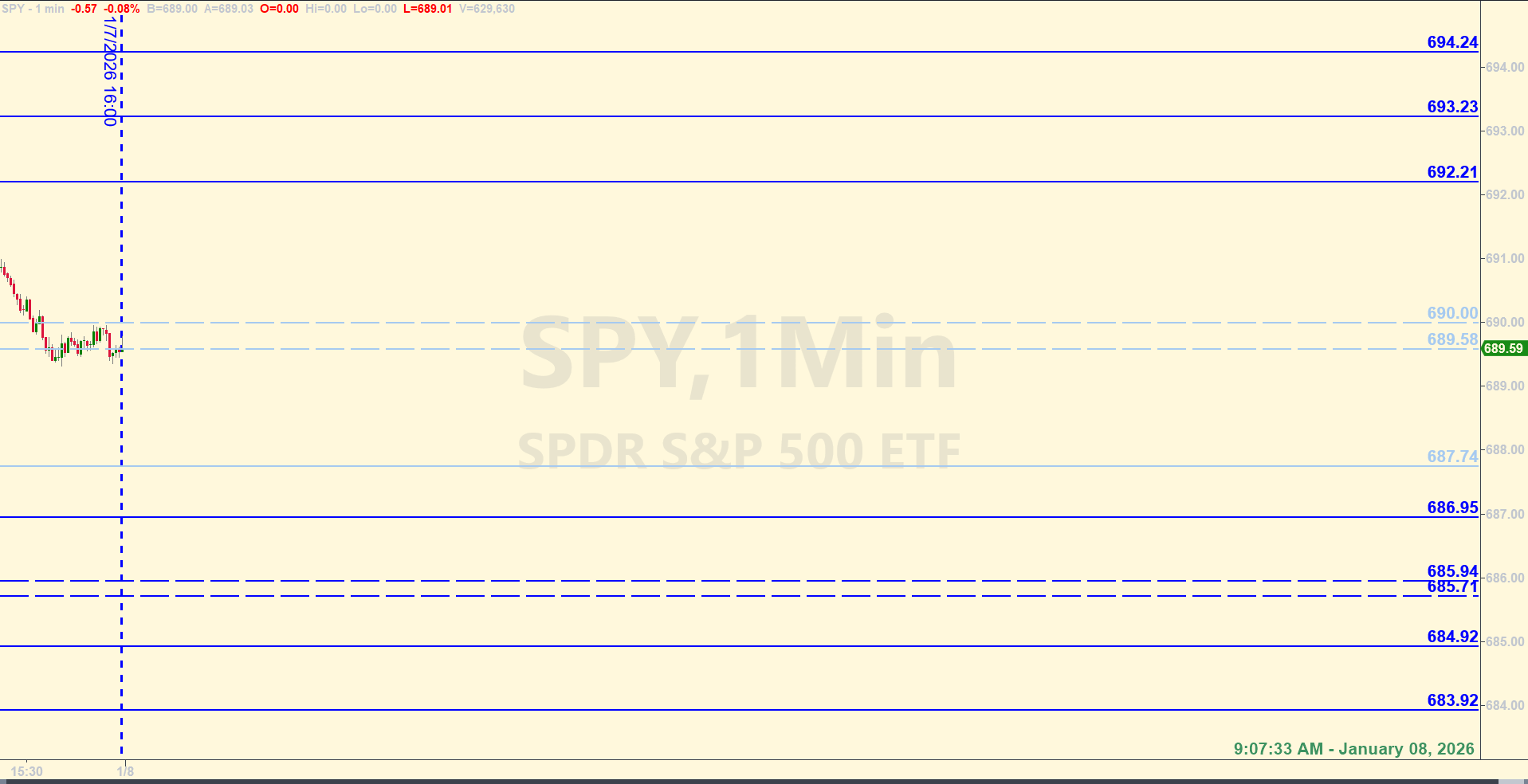

SPY Levels & Game Plan

Thursday, January 8, 2026

9:07 AM - Yesterday morning we said that the bulls would be in good shape if they could keep price above 692 and especially a trendline area above that level (which was identified with precise levels) and continue to close hourly above that area. It would keep the door open to test new highs. But if price got under 692 and if we saw signals developed that would indicate the bears wanted a reversal, then price would probably fall. The exact wording was, “Getting above and closing above the trendline area is bullish. Unless we see signals of a potential bear retaliation which could pull price down, the bulls have the ball and the buy-the-breakout traders want to see price climb higher.”

So what happened yesterday? Price started to dip below 692 and we got several reversal signals – on the 1, 2, 3, and 4-hour charts respectively. And the timing was good at that point for price to pull back too. That is exactly what happened. Now the question for today is whether or not this pullback will continue.

The bull axis is a zone between 689.58 and 690.00. If the bulls can establish closes above this area on a continued basis, it should make it easier to get price to climb out of this interim pullback. At about 30 minutes before the opening bell, as I write this, price is at a good place where that exact thing can happen. They’re kind of at a pivotal point in the premarket. We’ll probably see some back and forth early on as the bulls and bears battle it out. Bouncing from where they’re at now – or slightly lower, like say, the bear axis at 687.74 – would be in line with what the bulls want price to do. But the bears probably won’t just hand it over to the bulls without a fight.

If price gets below the bear axis, which is 687.74 and establishes closes of significance below it, the ball would be in the bear’s court. It should become easier for them to drive price down more from there. There are a lot of levels on the board for today, but we need to look at the zones as big fat levels. They are general areas from which price may react from if approached the right way. As such, the levels for today are designed for base hits. Unless longer-term signals develop in real time as the regular session gets under way (like we had yesterday on the 1, 2, 3, and 4-hour charts around mid-day), the conservative approach is to be satisfied with base hit trades at the levels. They’re more likely to work in a “normal” market. If and when price moves around a lot because of increased volatility and volume, the levels would require more wiggle room. And optionally, it’s not necessary to trade every single level, if current market behavior is giving you clues that negate the level’s importance. No data releases of significance scheduled for today. Trade well.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

The first Base Hit was a clean bounce off 687.74 as soon as the window of opportunity was open. Your second Base Hit was the short that started at the bottom of the zone at 689.58. The position was doubled when price hit 690.00. That averaged in position handed over the next two Base Hits. Now, the zones were to be treated a one big fat level, per the Game Plan from the morning, so attempting a Recycle trade on the lower part of the zone at 689.58 at about 1:06 PM wouldn't have been advisable - understanding the big picture included seeing the the entire zone could hold price as resistance. Getting back under the zone was exactly what the bears wanted to do. But if you did attempt a Recycle trade on the long side at 689.58 meant you gave 5.75 pts back on the Fumble as price got out of the money, and then a Base Hit's worth of points as price continued to fall.

Per the rules, a total of -5.75 ES points for the day.

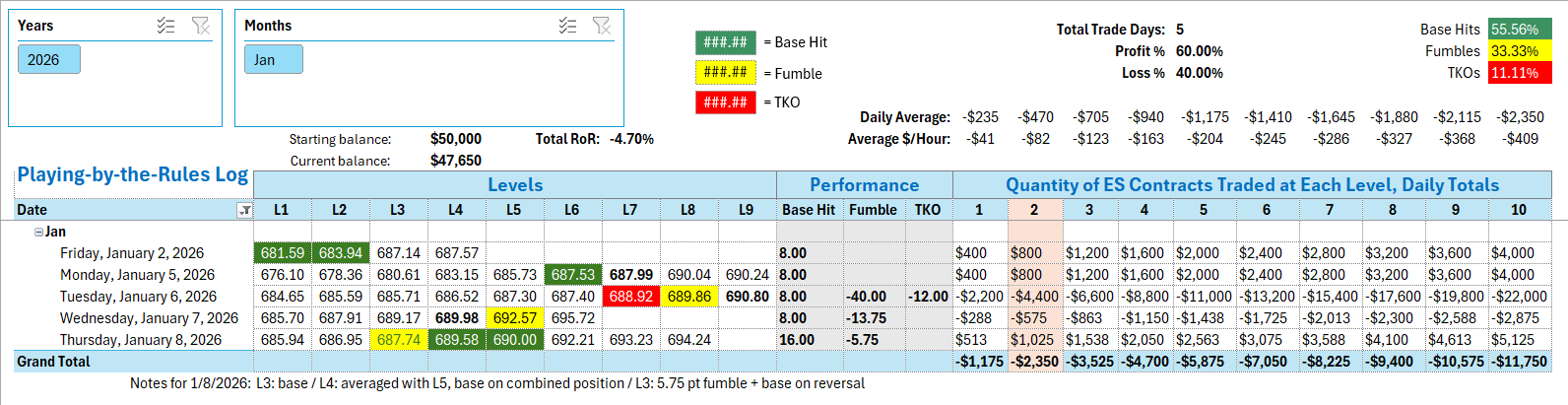

Tracking log to-date for 2026: