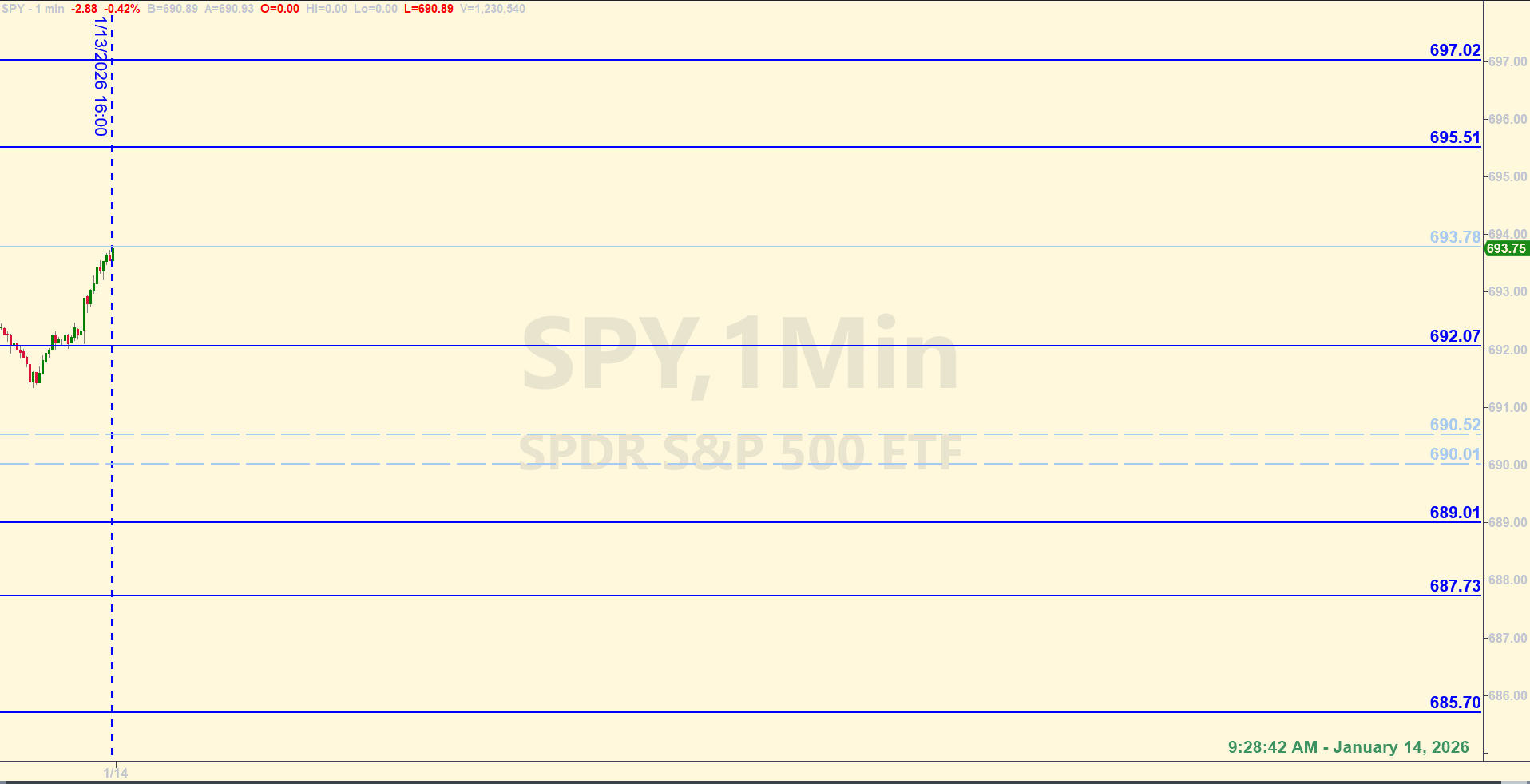

SPY Levels & Game Plan

Wednesday, January 14, 2026

9:28 AM - Quick recap of yesterday's activity: the signals we talked about that pointed to a pull back did come to fruition. The bulls couldn't stay above 695.16, let alone close an hour above it, so the reversal signal on the hourly chart from Monday played out. Price fell into support lower down. Where was support? At the bear axis level for the day at 693.34. Price bounced between both axis levels before finally giving in to the bears and getting under the bear axis. That put 690.66 in view. They finally hit that level and reacted there in the premarket this morning.

Notice the zone for today between 690.52 and 690.01. That whole area is the bear axis. Price will need to stay above for there to be any kind of rally out of this pull back. Under the zone and the bears are likely targeting the lower support areas.

The bull axis is 693.78. They'll need to get price above that level and close hourly above it to be in a better position to climb. There is likely going to be more back and forth today. There are still interesting things going on. Be aware of the big picture and understand your surroundings before trading against the levels for today. Trade well.

After the closing bell...

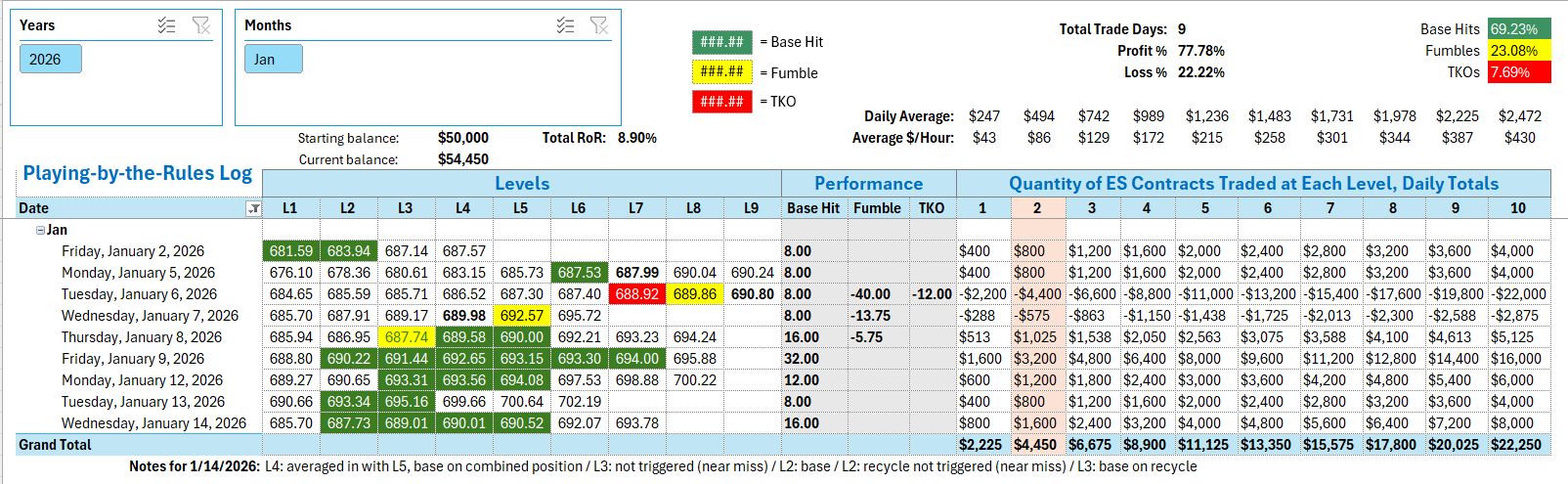

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

Another good day trading against the levels. You got your first Base Hits by shorting the zone - first by selling, say, two ES contracts when the SPY hit 690.01 (or more specifically, the operating level which factors in a 5-cent buffer toward price), then sold two more ES contracts when price hit the top of the zone (the operating level based off 690.52). The resulting pull back handed over the first two Base Hits. There was no long trade at 689.01 when the SPY came down and hit the level at 9:59 AM because of the near miss that happened at 9:47 AM. The next trade was a clean bounce on the long side at 687.73. Base hit number three. No Recycle trade at 689.01 at 10:12 AM because there needed to be more time for the retest before attempting a Recycle Trade. When price got back up to the zone, no mores shorts there. It had already been shorted, so you waited to see what else would develop, while following the strategy. The next trade came came when price retested 689.01 from below. The Recycle Trade there netted you your fourth Base Hit of the day.

Per the rules, a total of 16 ES points for the day.

Tracking log to-date for 2026: