SPY Levels & Game Plan

Thursday, January 15, 2026

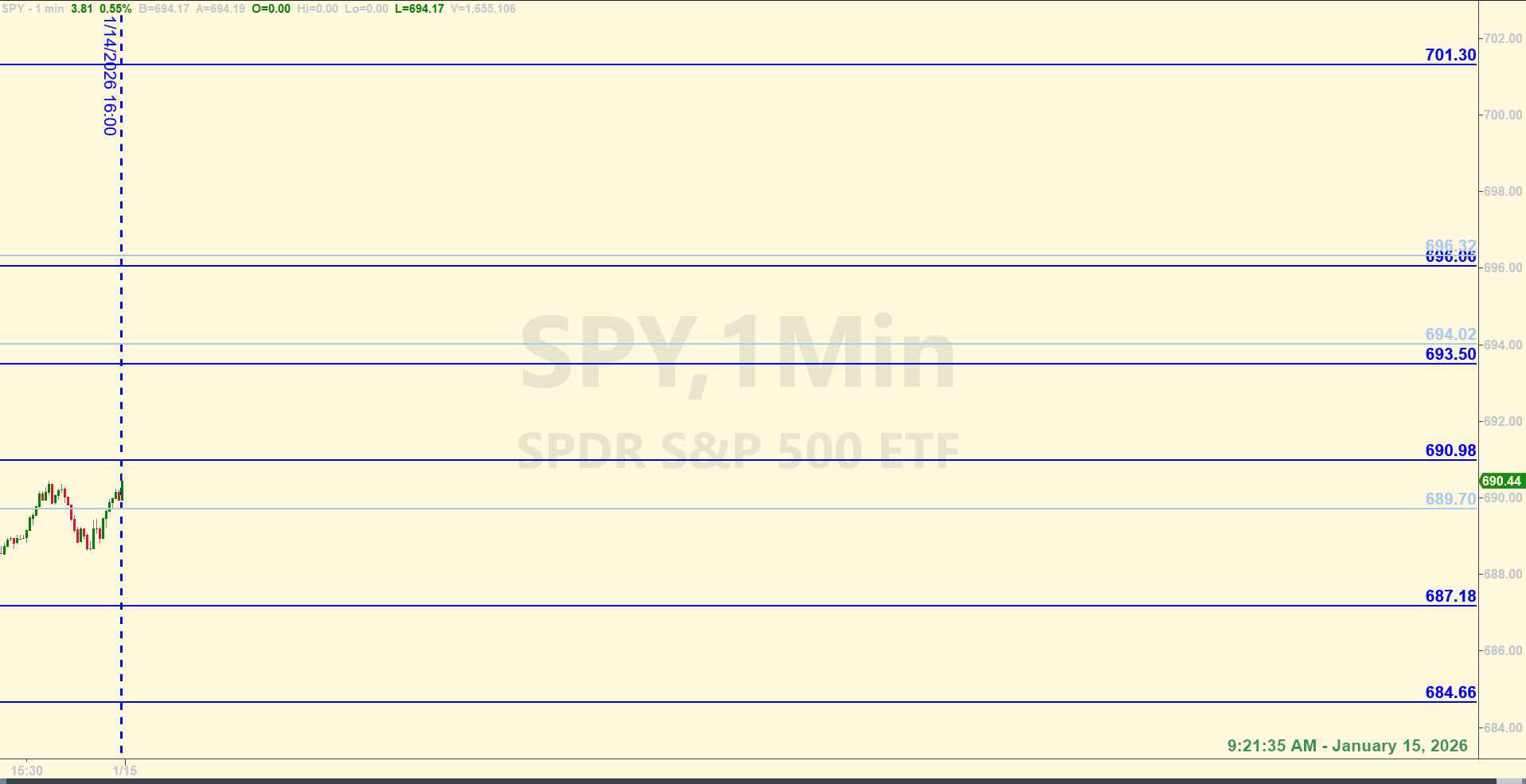

9:21 AM - We got the back and forth yesterday that we speculated about. Down over 50 points before finding support around a trendline area - which was right above an important level we had on the board for the day (685.70) and climbing most of the way back up. This morning, they are once again at the important 694.00 area trying to get above. The bulls likely have a target higher up above the all time highs they made earlier this week. Don't forget that the cash index, the SPX is getting really close to 7,000.

Pretty decent swings in the SPY this week so far. Price came within about 40 cents of 685.70 yesterday before rallying. That was the money spot where I was planning to go long yesterday, but didn't get on board. The bulls front-ran it. So that's bullish behavior. Price got above yesterday's bull axis of 693.78 in the premarket this morning. It will be important to see if they can stay above.

For today, the are two bull axis levels. The first is 694.02. Getting above and closing above this level opens the door to the next levels of probable resistance starting at 696.06. Notice the other level right above that at 696.32 in the light blue color. That is the second bull axis level. Getting above and closing 10, 15, 30-min, and even more importantly, hourly candles above 696.32 means the bulls should have an easier time breaking out to new highs. They've made a lot of attempts to break out and establish a new leg higher, but each time, it's more of a spike the highs and then pull back for a few days. Either price will break out, or break down. And eventually one or the other direction will become the next longer-term leg in the SPY. I would probably use 696.32 as more of a gauge or safety net if I were in a short position against 696.06. Not sure I would trade the exact level of 696.32 unless I saw more compelling reasons in real time that it would offer additional resistance.

If there is a pullback today and the bears gain some momentum, they'll need to get below 689.70 and close below it on significant candles to change the tone of the market for today. 689.70 is the bear axis for today. There are no other data releases of importance scheduled for today, but the pending tariff hearing could present some news. If, for whatever reason, price starts to fall fast, the levels below price may work as support to catch price - perhaps enough for base hit scalp trades. But it would be advisable to be aware of other market indicators in real time that could help validate each level's importance in real time before jumping in front of a potential out of control train. I'm not suggesting anything out of the ordinary will happen, but it's always good to keep that possibility in the back of your mind. Trade well today.

After the closing bell...

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

A lot of levels on the board from the morning, but only two where hit. Your first trade was a long position entered at the market at the close of the 9:45 AM candle. That resulted in a quick Base Hit. The second trade was a long at 693.50 at 9:52 AM. A good bounce there for the second Base Hit. Although both of these levels continued to get tagged as the SPY interacted with the levels at various times during the rest of the regular trading session, no other trades were taken while following the Ticks & Trades strategy.

Per the rules, a total of 8 ES points for the day.

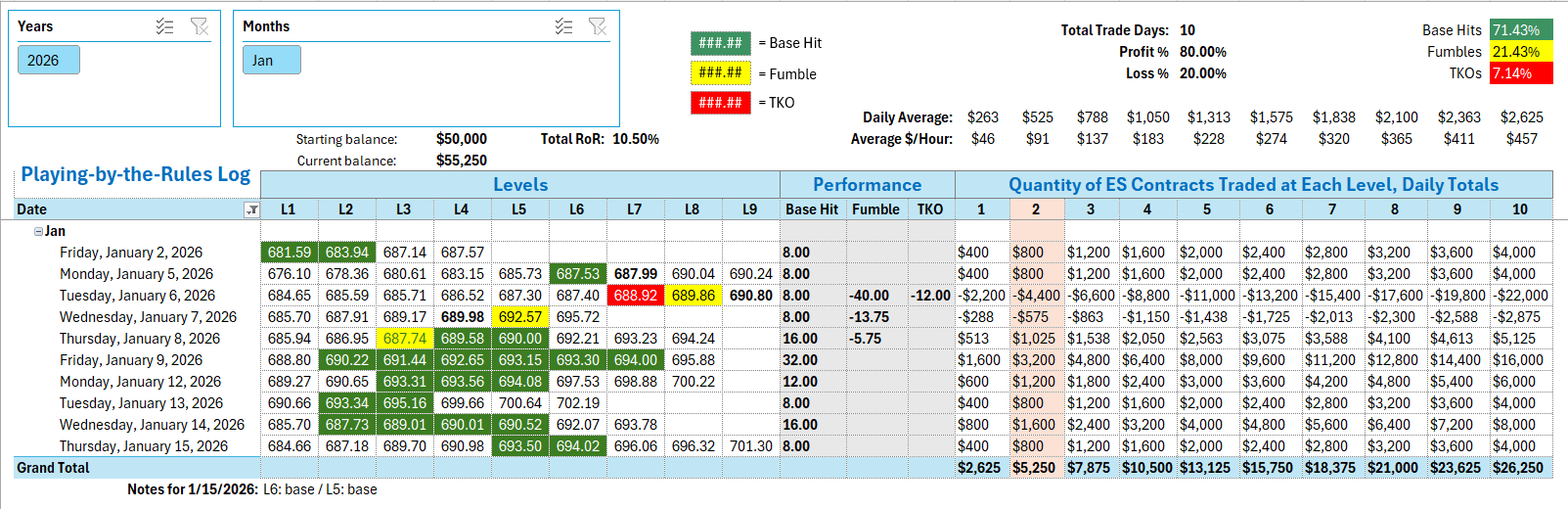

By the way, If you've been studying these Recaps and Tracking Log and following its progression, you would have noticed the metrics had a fresh start at the beginning of 2026. The first official trading day of 2026 was Friday January 2. I want to bring your attention to something regarding the first couple weeks in 2026 trading with the Ticks & Trades strategy.

First, let's say you deposited $50,000 in a one-year CD on January 2. And let's say you got a good rate in today's market at 5% APY This means when you cash out after 12 months, your $50,000 will be worth $52,500. That's a gain of $2,500 over 12 months. You didn't have to do anything - just let the money sit there.

But what if you could find an hour or so each morning to trade the futures using a systematic approach and put a little effort into making that $50,000 grow into something more substantial. Would you do it if you stood to pull double the CD rate? Like, 10% or more? What about deep into the double or triple digit returns... what if you could more than double that $50,000 in one year by working an hour or two per day?

That's the kind of thing I think about when I'm trading and I get a couple days in the red. I know that over time, my money will grow way beyond what I could expect to get by investing it in anything else. Since you've been following these Daily Recap posts, you know that the first couple trading days using this futures trading approach had already put the return above 3%. Only two days, after starting with a $50,000 futures trading account and trading 2 ES contracts at each of the Daily Levels and you're already above 3%. The next couple days made the rate of return dip below 0%. Down to almost a negative 7%. It's the ebb and flow of the strategy. But there are way more up days than down days, and that's the thing to remember.

So now, only two weeks into the new year, on January 15, the rate of return has poked up above 10%. There's no guarantee that tomorrow, January 16, will be another up day and keep pushing the rate of return higher. We could have a down day tomorrow. But whatever happens, do you think that by the end of the year, the gains pulled from the market using this futures trading strategy will be more than what that 12-month CD would have gotten you?

I just find it good to keep reminding myself after days where the strategy doesn't work out as intended, that those days are the minority. Most days will be like today - two relatively easy Base Hit trades. With a two-ES contract position, that's a gross of $800 for the day. And over time that daily average will work out to be around $400 or more. If you can afford to trade more contracts, and scale up, your daily average will be higher. It all comes down to small scalp trades that have a high probability of working. You don't need to try for massive 50 point homerun futures trade to make your account grow. The Base Hits will add up over time.

Feel free to go back as far as you need to on these Recap blog pages and the Ticks & Trades YouTube Recap Videos to verify the work. I think you'll find the data to be compelling.

Tracking log to-date for 2026: