SPY Levels & Game Plan

Tuesday, January 20, 2026

9:17 AM - The news is all about Trump, Greenland, and tariffs and this has affected price in the premarket. The futures have pulled price down below the cluster of trendlines that have informed many trades over the past few weeks. Now that price is down relatively low from where they've been lately, what can we say about today's potential price action? Volatility will be up - that's almost a given. So the levels we've identified may need more wiggle room if you choose to trade against them.

Right now, at about 9:00 AM Eastern as I write this, price has been bouncing between two levels that we'll call the bear and bull axis levels. The bear axis is 680.61 and the bull axis is 681.61. This whole area between the levels is like a big fat level where the bulls would like to stay on top of if they can, and the bears would like to keep pulling price down below this area. Price is currently in the middle of this one dollar spread. By the time the market opens, there will likely be many traders jockeying for position, trying to take advantage of the pre-market skittishness, depending on how they view the most likely next big move.

The way I see it is in the big picture - like on the monthly and weekly charts, price has plenty of room to pull back for a reset. Even on the daily chart right now, before the open, price is above the 50-period moving average. There's nothing bearish about the big picture, but a reset would not be out of the ordinary. If that's going to happen, they have to start from somewhere. If we get hourly closes below the bear axis of 680.61, that should make it easier for price to get pulled down into the levels of support lower down. Again, there will likely be some bigger-than-usual swings today, so we need to be careful.

As always, it's important to understand what the longer timeframes are telling you as price approaches the levels. Hourly closes will be important - as well as where they close the day today. With the likelihood of there being big swings today, adjust position size as necessary to reduce risk. Or just don't trade at levels if you don't see other good reasons on other timeframes that the level will be important in real time. Trade well today!

After the closing bell...

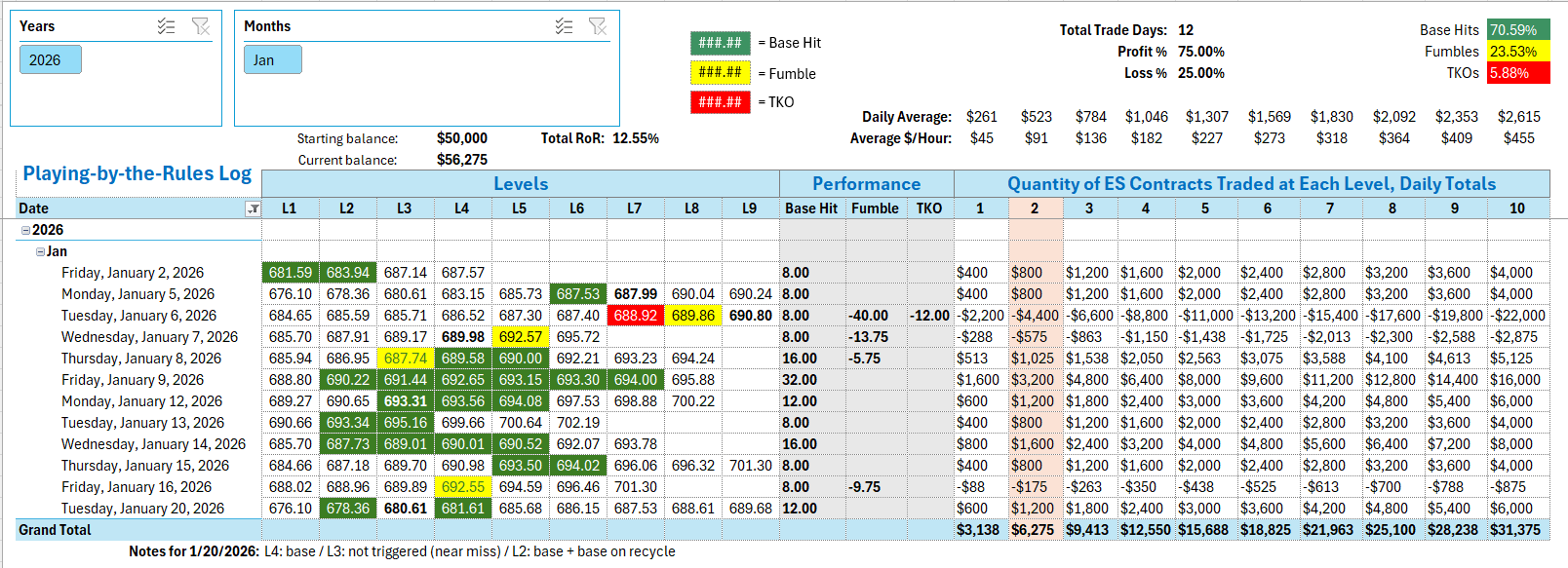

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

After about a 100 S&P point drop in the premarket, and even with the likelihood of increased volatility for the say, the levels still worked well today. The first Base Hit was at 10:01 AM when the SPY came down into 681.61. All interactions at that level prior to 9:45 AM were essentially noise. The rule is to wait until the close of the first 15 minute candle. The long trade against 681.61 worked as designed as price bounced. Later, when price came down into 680.61 at around 12:47 PM, the level was missed by pennies before bouncing enough for a Base Hit. Technically, that's a Near Miss and you wouldn't attempt a long trade if price came down and hit the level later. So we won't count the reaction at 680.61 as an official trade for today. It's good to notice though, how well the level worked for a bounce and if you did give the levels more wiggle room as suggested in the Game Plan from the morning. It would have been easy to pull points off that level if you chose to trade it. The next level hit was 678.36, and even in front of what looked like a falling knife, the level still provided support. The bounce there was the second Base Hit. Then after price got under 678.36 for the right length of time, the Recycle Trade of that same level, this time on the short side, was triggered at 2:42 PM when price retested the level. That was your third and final Base Hit for the day. Not too bad for a day with "unusual" market activity.

Per the rules, a total of 12 ES points for the day.

Tracking log to-date for 2026: