SPY Levels & Game Plan

Wednesday, January 21, 2026

9:17 am Eastern - There's a good chance of increased volatility today. Welcome to Wacky Wednesday. On the board yesterday was a level at 676.10. It was not hit during the regular session, but at about 7:00 AM Eastern this morning in the premarket, price got down there and bounced. The level is still important. They've been riding this level since then and the bulls want to stay on top of it. It will be our first gauge of market sentiment. If price stays above 676.10 and we see hourly closes above this level, that puts the bulls in a better position to try to climb out of this pull back.

Below that level is 676.65. It may work for a base hit trade in the E-minis, if the SPY comes into that level correctly, but it's kind of in the middle of space. In a fast-moving market (which is very possible today) I would want additional confirmation on larger timeframes before trusting that level. The level at 671.50 is an axis level too. While there could be some back and forth in this area if the bulls show initial weakness, getting below 671.50 and closing hourly candles below probably won't be good for the bulls in the short term. There's a lot of empty space down there for the bears to run if they want to.

If there are wide swings today, be careful trading against levels that are relatively close together. The chance for fast rallies and sharp drops are always increased at times like this. Between last Friday's close of the SPY and Tuesday's open, the futures pulled the S&P down about 140 points. In the big picture, that's a substantial one-day drop. There will be bulls buying like crazy, thinking things are on sale (which wouldn't be wrong - at least in the interim picture). That would drive price up - possibly creating a solid grind higher. But there are plenty of bears who probably want to keep the downward momentum going because there are targets on the downside that they're eyeing. Both these potentialities are the ingredients for increased volatility and big swings. We'll probably have some good clues after today's close about which direction the next leg of the market will be.

As of 9:15 AM Eastern, as I write this, the bulls are working hard to bring price back up. They're already above 678.40 (a level on the board for today which they did react at briefly before continuing higher), and they're approaching an important resistance area where the cluster of levels are starting at 680.63 and including the small zone above between 681.51 and 681.61. The bottom line for today: be careful and be judicious in which levels you choose to trade against. Understanding other clues and signals which are more present on larger timeframes - is key. Trade well today.

After the closing bell...

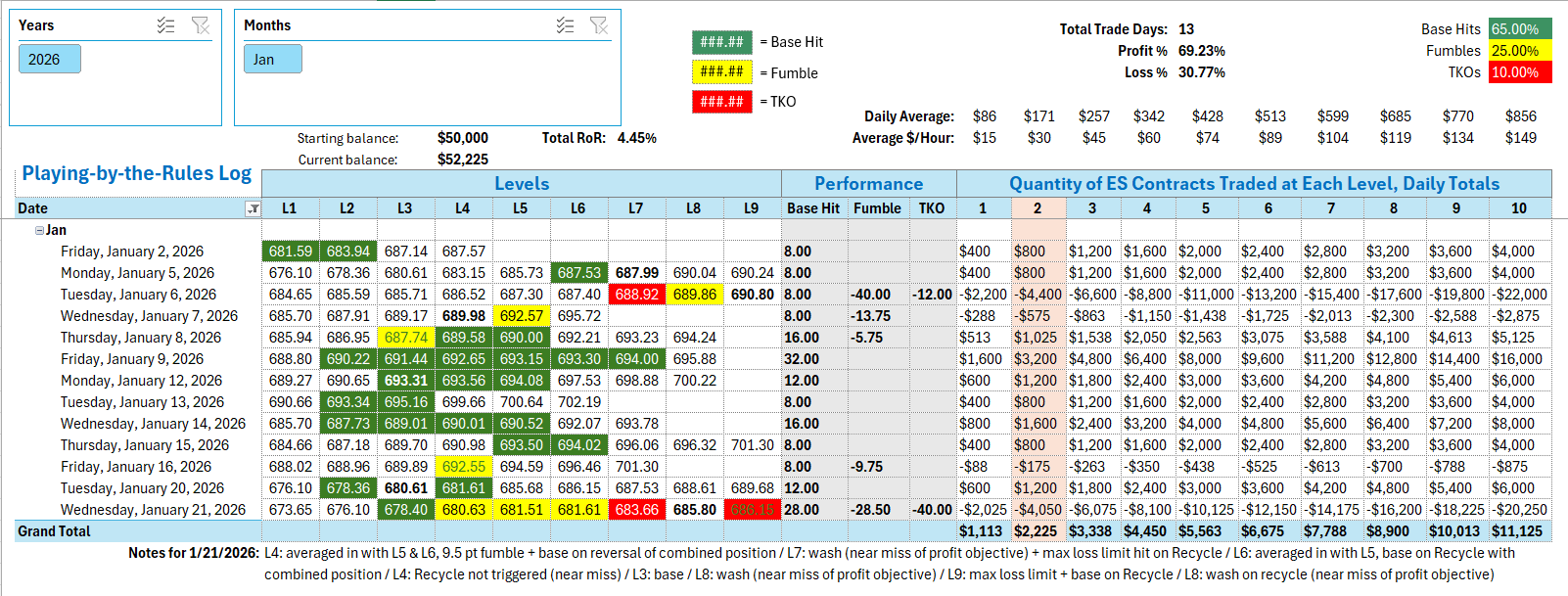

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

It was indeed Wacky Wednesday. In hindsight, probably a good day to sit on the sidelines and not get into any trades. We had a good idea of the risk going into the day per the Game Plan that was spelled out before the opening bell. Regardless, if you traded every level with the same approach as always, a not insignificant amount of points were given pack to the market today. There was a quick spike of 680.63 at 9:40 am, which is still within the 15-minute off-limits timeframe. But that was the reaction there, and going short there again when the level was hit at 9:48 am was somewhat of a gamble. That short position would have been averaged in across the next two level higher up - the zone at levels 681.51 and 681.61. That combined position turned into a 9.5 point Fumble and a Base Hit's worth of points on the Reversal.

By the time price bounced off the top of the 681.51 - 681.61 zone at about 10:11 am, it was becoming clear that the bulls had the ball - at least for the time being. In fact, while the right amount of time had not elapsed since price got on the other side of the zone and came back for the retest at 10:11 am, I jumped on board on the long side anyway, and was able to wash out some of the loss I incurred with the short trades earlier.

The level at 683.66 got an almost-Near Miss at 10:17 am, when price reacted away sharply. That was a good clue that the level shouldn't be trusted. But I'm keeping this tracking log as accurate as possible by recording every single trade by the same standard. That reaction at 10:17 am was technically not a Near Miss, so the level was shorted, per the rules. It almost gave a Base Hit before quickly continuing upward, so this trade ended up being a wash by closing out at break even. On the way down, the Recycle trade at 683.66 didn't hold at all and resulted in a max loss limit. That's 20 points given back to the market.

Price was going back down again (roller coaster market - Wacky Wednesday, whatever you want to call it) and came into the zone starting at 681.61. A long position across both levels of the resulted in a Base Hit. The Recycle at 680.63 was not triggered on the long side because of a Near Miss a minute before the level was actually hit. Sticking to the rules kept you out of trouble on that one because price kept falling. It went down to 678.40 and that was finally the money spot. We're counting just a 4-point Base Hit, but you can see price found the low of the day there and climbed a lot from that area.

The next trade was a short up at the zone starting at 685.80 (all the other levels had already been traded on both sides). The trade at 685.80 ended up being a wash because of a Near Miss of the profit objective. Then the top of the zone at 686.15 didn't provide the right resistance to push price down quick enough and that trade resulted in another max loss limit. But on the Recycle of that same level, a Base Hit was bagged. When the bottom of the zone was hit, the time was 3:27 pm, close to the cut off, but technically ok to enter a new trade. That long trade was aborted at breakeven for a wash because of a Near Miss of the profit objective. Pretty much a mess of a day.

Per the rules, a total of -40.5 ES points for the day.

Tracking log to-date for 2026: