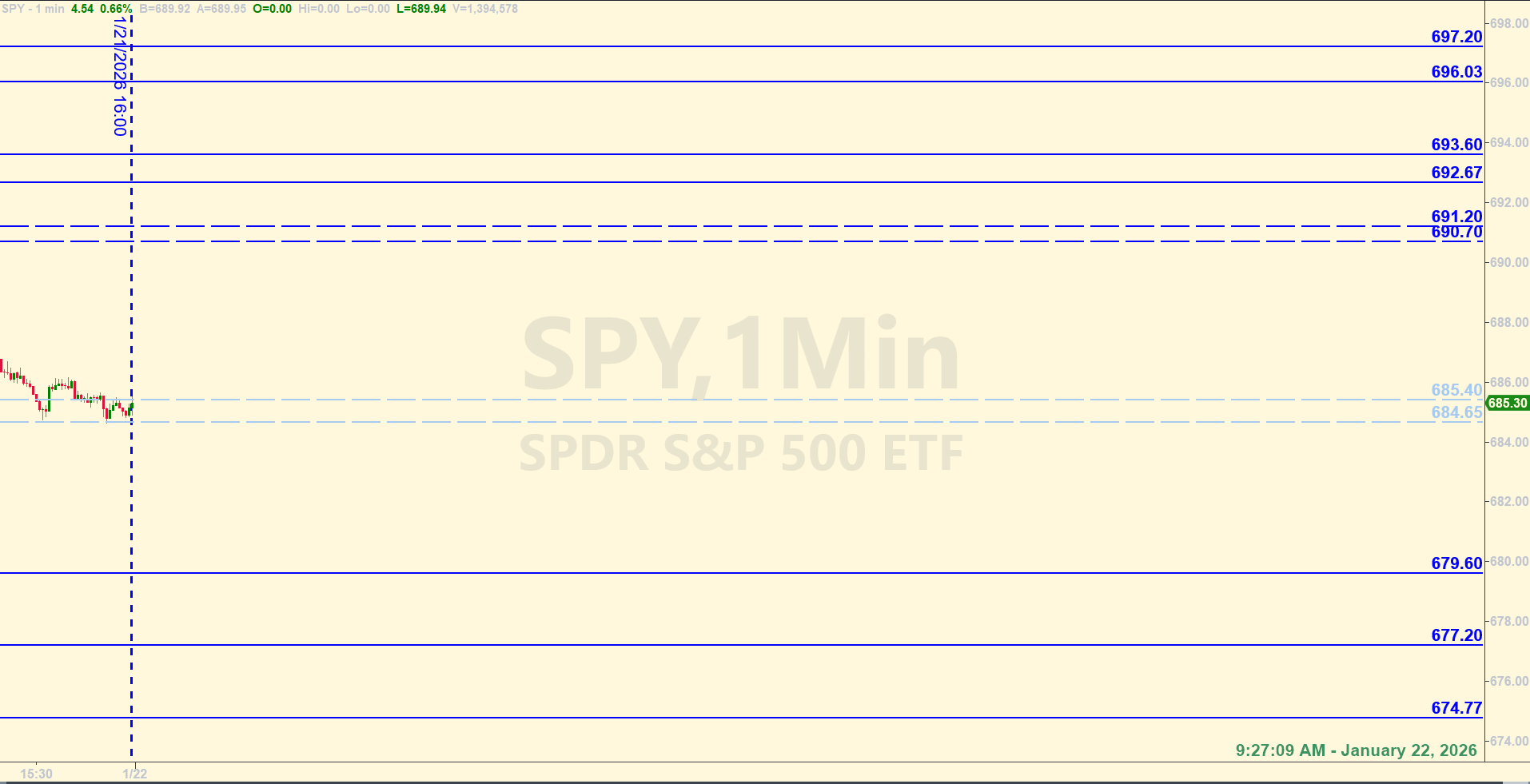

SPY Levels & Game Plan

Thursday, January 22, 2026

9:27 am Eastern - The bulls are doing a good job making up for lost ground. In the premarket, price is up almost 50 S&P points from where they closed yesterday. Wider than usual swings and increased volatility is still a good possibility today. One thing that is interesting is that while the SPY was whipping around and staying in the middle of stuff, a couple other indexes I track used yesterday to break into new highs - specifically the IWM and the DJT. Both of those markets have a way of leading the SPY in the mid to long term, so that's something to keep in the back of our minds. Are these clues that the SPY might follow suit and break through all the overhead resistance it has to deal with right now, and make it above its former highs? It's certainly a possibility. I wouldn't say that yesterday's action in the SPY left us with any better indication of where its next leg in the market will be. They're still in the middle of stuff.

In fact, right now in the premarket, price is hovering under a trendline that for today, starts at 689.86 and slopes up to about 690.59 by the end of the regular session. That area could provide enough resistance after the open to where price falls from that trendline area for awhile, without reaching the official zone we have on the board that starts at 690.70 and goes up to 691.20. From what I see, that zone could be decent resistance if price comes up into without pulling back a lot first - like from the trendline they're at now - or if price consolidates under the zone and the bulls can use that to build up energy to bust through to the levels of probable resistance higher up.

When volume and volatility is increased, the levels can be spiked by a lot, as you know. And there are a number of levels from the zone on up that are relatively close together. It would be prudent to be very aware of the relationship between price and the other indicators we use on larger timeframe charts before blindly trusting each level. Remember how yesterday, there was a precise tag of 680.63 (which was a level on the board for the day) and a good pull back - enough for a Base Hit, at least - but the level was hit at like, 9:39 am. Yes, that was before our 15-minute window was opened, and per the rules, we would have still attempted a short at the level if price came up there again. But yesterday's price action was already ripe for volatility, so getting that initial test of the level at 9:39 am and then quickly pulling back up to it was like the market telling you, "I'm going to bust through this time - or try to". So the point is, today could be like that too. Give the levels more wiggle room. And look for other signals in real time that could help you validate a level or zone's importance before trading against it.

The zone down at 685.40 to 684.65 is the axis area for today. If the bears manage to pull price down to the area, the zone itself could be sufficient support for a bounce and a trade. But if price gets under the zone and starts closing hourly candles under it, the bears could have the upper hand again at that point. Other than the moving averages, trendlines and other overhead resistance areas above current price that the bulls need to fight through if they want to get to the former highs again, the big picture is still bullish. The month isn't over for another week, and we may get a long-term signal or two about likely next big moves in the SPY. But for now, price is still very much in the middle of stuff.

Be aware of some more data releases this morning. There were already some job numbers GDP data that came out at 8:30 am, that didn't seem to do much to price. But there are 9:45 am CPI data releases to be aware of. Trade well today. And be careful.

After the closing bell...

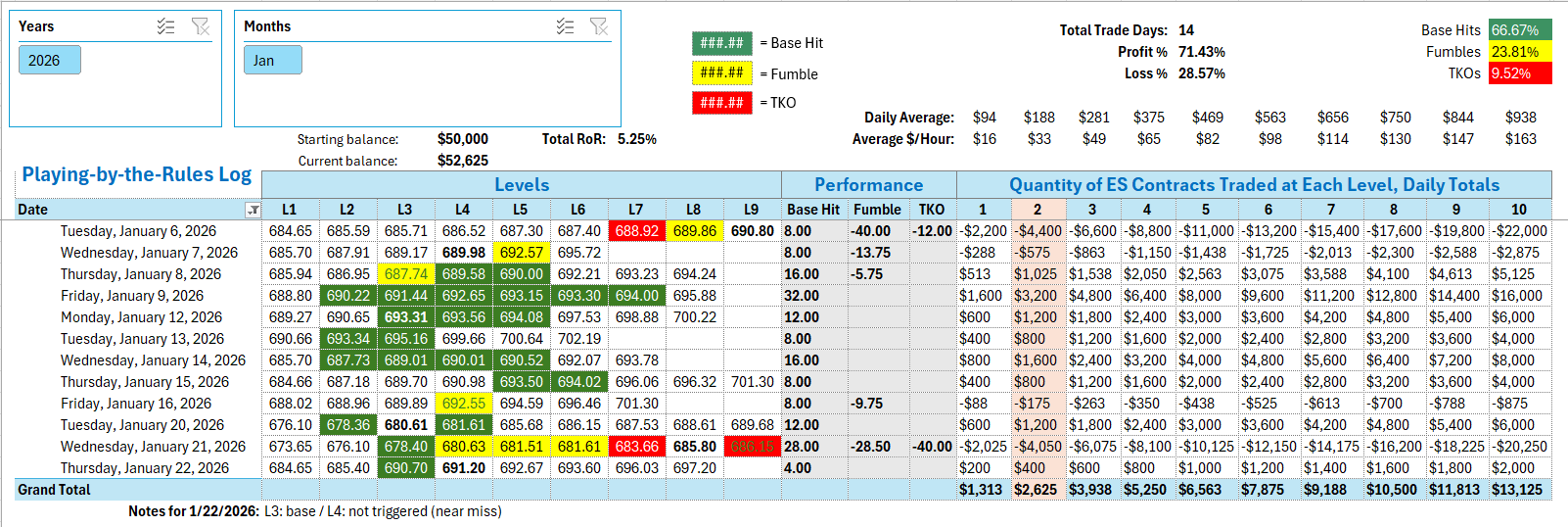

Trading by the Ticks & Trades Strategy, here is where you would have landed for the day:

The operating level for the bottom of the zone up at 690.70 was 690.65. That's with the 5-cent buffer applied. Price went right up to the bottom of the zone shortly after the open and got to a high of 690.67 during the 9:42 am 1-minute candle. And price fell sharply from there for over 30 points before finding support. So the level was important and worked. But per the rules, you didn't short against the level at 9:42 am because we were still in the 15-minute window of letting the market settle in. That means you missed the bog reaction, but the next time price got up to the same level, there was an almost Near Miss at 11:53 am when price reacted away from the level - coming a few cents short of it. And the SPY didn't quite hit the operating level at 12:12 pm, but the ES did. I know, because I got pulled into that trade on the short side. The E-minis pushed a little higher and I had a limit order on the screen. That was worth a Base Hit in a few minutes. I'm counting this as an official Base Hit trade for today because if I could pull some points at that area, you could have too. Also, I pulled a few points when price started to find a low around 687.75. That wasn't an official level on the board from this morning, but there were several indicators in real time that there was a chance of good support there. I took that chance and pulled about 5 points. Moving on to the next official level for today that came into play, and that was the top of the zone at 691.20. Price came up shy of the operating level before pulling back down, but the whole zone worked as resistance - and that was the expectation. With the levels published this morning, you could have pulled at least one Base Hit. We're putting down one Base Hit for the record. Hopefully, you'll agree to its veracity.

Per the rules, a total of 4 ES points for the day.

Tracking log to-date for 2026: